Limited Liability Companies Are Primarily Designed To:

The allure of entrepreneurship is often tempered by the specter of financial ruin should a business venture falter. This inherent risk has driven the development of business structures designed to protect personal assets. At the forefront of these protective shields stands the Limited Liability Company (LLC), a legal entity that has become ubiquitous in the modern business landscape.

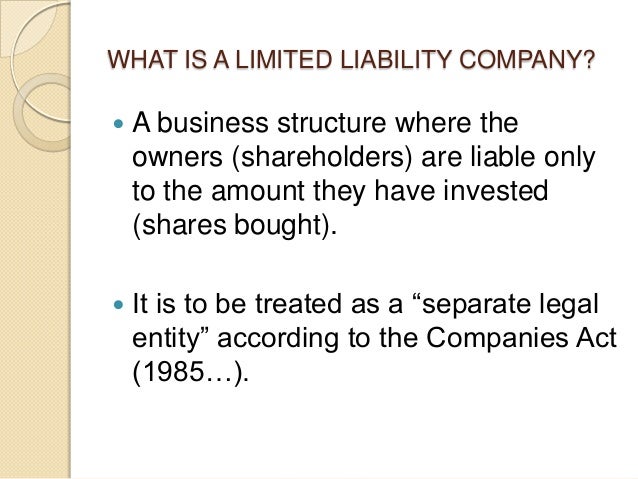

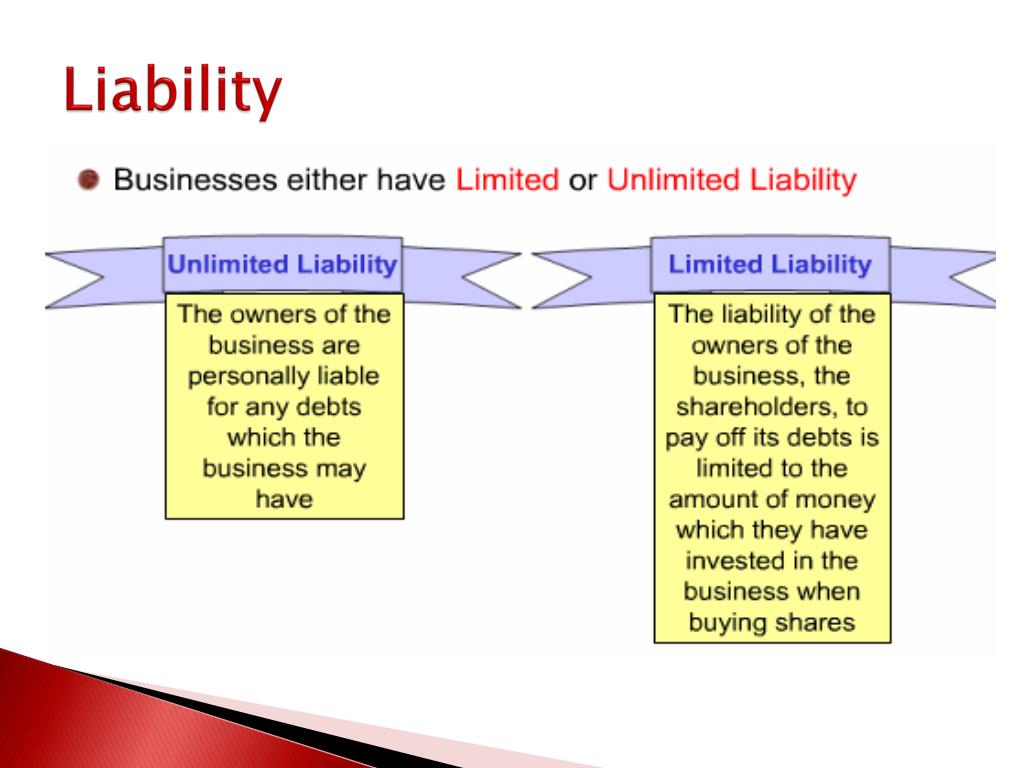

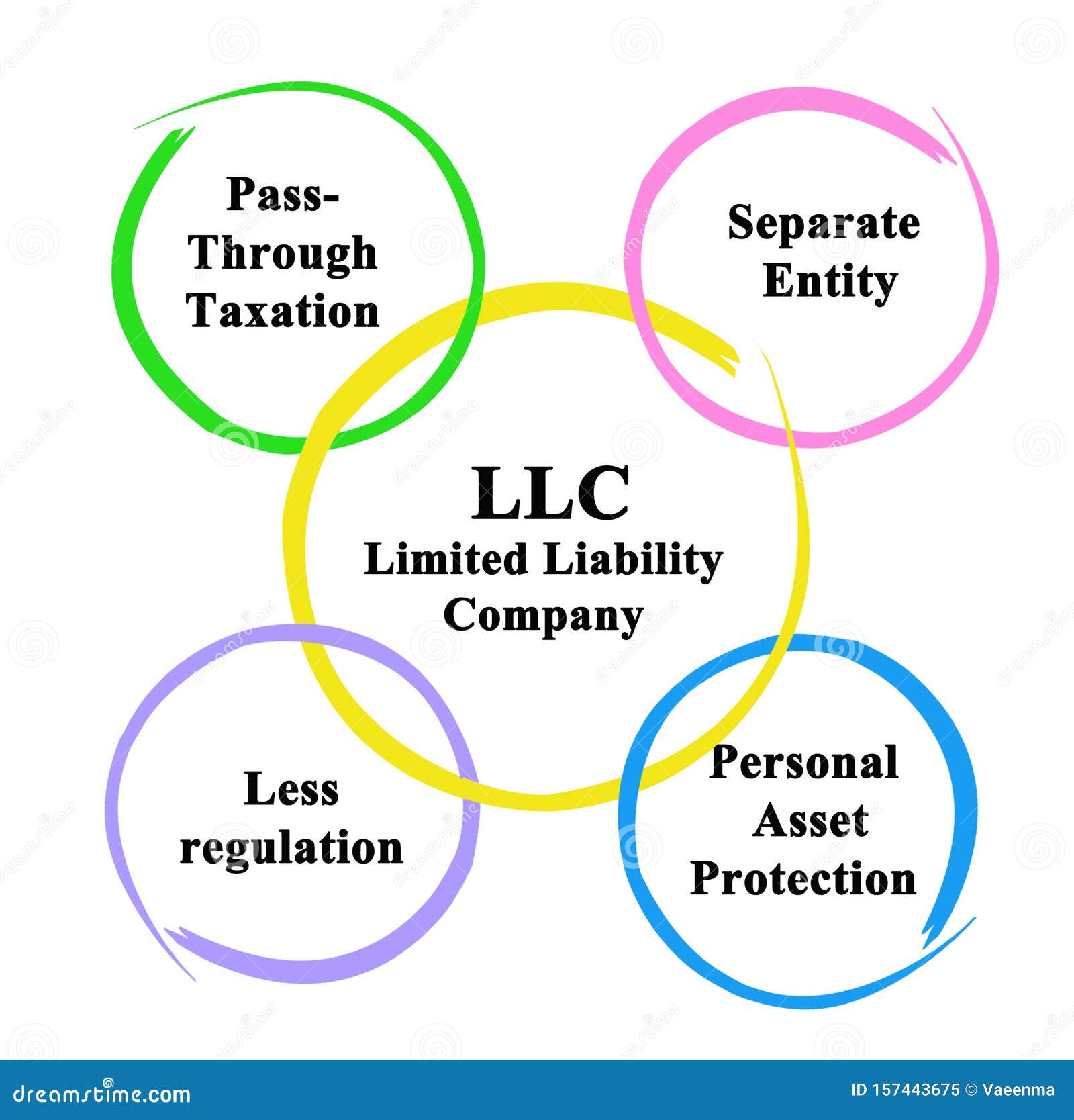

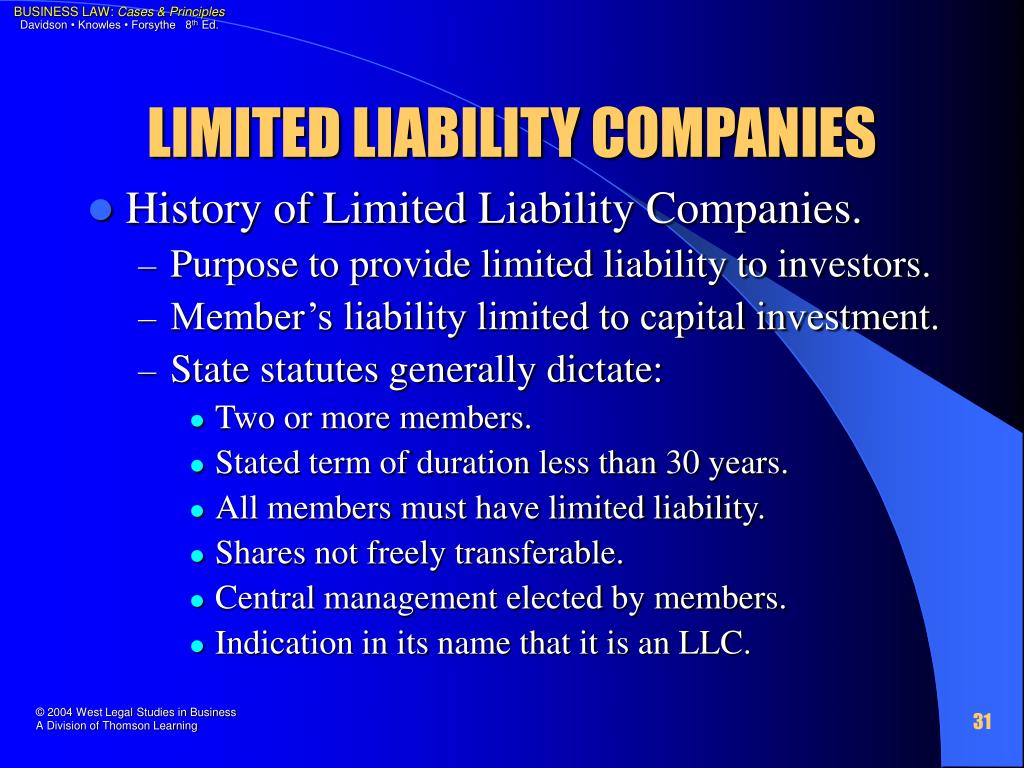

The core purpose of an LLC is to legally separate the business’s liabilities from the personal assets of its owners, known as members. This fundamental characteristic significantly mitigates the financial risk assumed by entrepreneurs, fostering a more dynamic and accessible business environment. Beyond liability protection, LLCs offer operational flexibility and potential tax advantages, making them a popular choice for startups, small businesses, and even larger enterprises seeking a streamlined organizational structure.

The Primary Purpose: Shielding Personal Assets

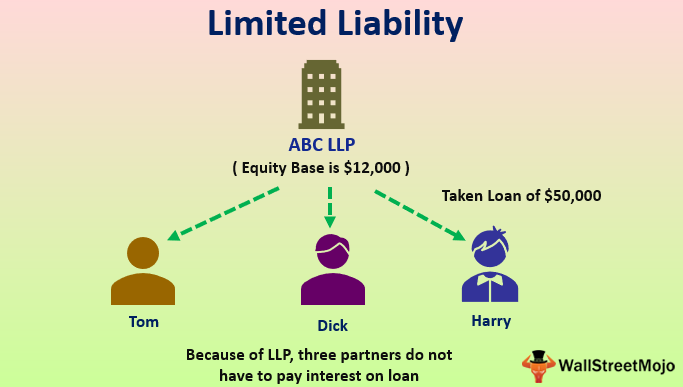

The principal aim of an LLC is to provide limited liability to its members. This means that the personal assets of the members, such as their homes, savings accounts, and other investments, are generally protected from business debts and lawsuits. This separation of personal and business liabilities is a cornerstone of LLC formation.

According to the Small Business Administration (SBA), the risk of personal liability is a major concern for entrepreneurs. By establishing an LLC, business owners can operate with greater confidence, knowing that their personal wealth is shielded from the potential fallout of business-related misfortunes.

Understanding Limited Liability

Limited liability is not absolute. There are instances where the "corporate veil" protecting members can be pierced. "Piercing the corporate veil" refers to a legal doctrine where a court disregards the limited liability status of an LLC, holding its members personally liable for the company's debts or actions.

This typically occurs when there's evidence of fraudulent activity, commingling of personal and business funds, or gross negligence on the part of the members. Maintaining a clear separation between personal and business finances is crucial to upholding the limited liability protection afforded by an LLC.

Operational Flexibility and Management Structure

Beyond liability protection, LLCs are favored for their operational flexibility. Unlike corporations, which often have rigid structural requirements, LLCs offer a more adaptable management framework. Members can choose to manage the LLC themselves (member-managed) or appoint a manager (manager-managed), providing flexibility in how the business is operated.

This flexibility extends to the allocation of profits and losses. Members can agree to distribute profits and losses in a manner that differs from their ownership percentages, as outlined in the LLC's operating agreement. The Internal Revenue Service (IRS) recognizes this flexibility, allowing for various profit-sharing arrangements that best suit the needs of the business and its members.

Member-Managed vs. Manager-Managed LLCs

In a member-managed LLC, all members actively participate in the daily operations and decision-making processes. This structure is common in smaller LLCs where members are closely involved in the business. Alternatively, in a manager-managed LLC, one or more designated managers are responsible for running the business.

These managers can be members or non-members, offering greater flexibility in delegation of responsibilities. This structure is often preferred in larger LLCs or when members wish to take a more passive role in the day-to-day operations.

Taxation Advantages

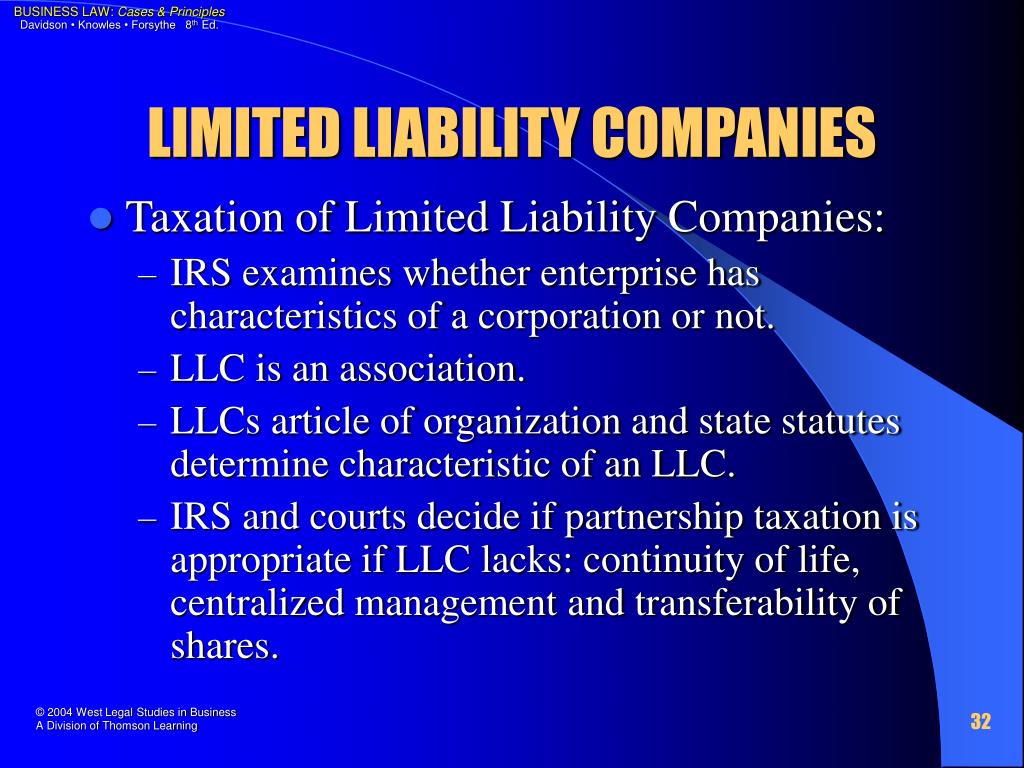

LLCs offer a range of taxation options, providing members with the ability to choose the tax structure that is most advantageous to their specific circumstances. By default, an LLC is treated as a pass-through entity for tax purposes. This means that the profits and losses of the LLC are passed through to the members' individual income tax returns, avoiding double taxation that can occur with corporations.

However, LLCs can also elect to be taxed as a corporation (either S corporation or C corporation) if it is more beneficial. This flexibility in taxation is a significant advantage for many business owners. The IRS provides detailed guidance on the various tax options available to LLCs, allowing businesses to make informed decisions about their tax strategy.

Pass-Through Taxation vs. Corporate Taxation

Pass-through taxation simplifies the tax process for many small businesses. The profits are taxed only once at the individual level, avoiding the corporate income tax. However, electing to be taxed as a corporation can offer benefits in certain situations, such as reducing self-employment taxes or facilitating the retention of earnings within the business.

The optimal tax structure for an LLC depends on several factors, including the business's profitability, the members' individual tax situations, and their long-term financial goals. Consulting with a tax professional is recommended to determine the most appropriate tax strategy for an LLC.

Criticisms and Limitations

While LLCs offer numerous advantages, they are not without their limitations. One potential drawback is the complexity of state laws governing LLCs. LLC regulations vary from state to state. This can create challenges for businesses operating in multiple jurisdictions.

Another criticism is that LLCs may not be as well-understood by lenders and investors as traditional corporations. This can sometimes make it more difficult to secure funding or attract investors. Despite these limitations, the overall benefits of LLCs, particularly the liability protection they provide, generally outweigh the drawbacks for many entrepreneurs.

The Future of LLCs

The LLC remains a cornerstone of modern business structure. The evolving business landscape suggests that LLCs will continue to adapt and evolve. As businesses increasingly operate across state lines and internationally, there may be a greater need for standardization of LLC laws to reduce complexity and facilitate cross-border operations.

Furthermore, as the gig economy expands and more individuals engage in freelance or contract work, the LLC structure may become even more prevalent as a means of protecting personal assets and managing business operations. The flexibility and adaptability of the LLC model ensure its continued relevance in the ever-changing world of entrepreneurship.

:max_bytes(150000):strip_icc()/Termslllccopy_v1-e155e47b90ec42d28579ede54f19ce05.jpg)