Line Of Credit For Bad Credit No Credit Check

The promise of easy access to credit is often a siren song, particularly for those with damaged or nonexistent credit histories. A new breed of financial products, marketed as "line of credit for bad credit no credit check," are flooding the market, offering hope to individuals shut out by traditional lenders.

However, these offerings raise significant concerns about predatory lending practices, hidden fees, and the potential for trapping vulnerable consumers in cycles of debt. Consumers must proceed with extreme caution and be aware of the potential pitfalls.

Understanding the Landscape

At its core, a line of credit is a pre-approved borrowing limit that allows individuals to draw funds as needed, repay, and borrow again. The catch with "no credit check" versions is that lenders forego traditional creditworthiness assessments, relying instead on alternative factors like income verification, bank account history, or even employment status.

This opens doors for individuals with low credit scores or thin credit files who might otherwise be denied access to credit. However, this accessibility comes at a significant cost.

The Allure of Easy Access

The appeal of these lines of credit is undeniable. For individuals facing unexpected expenses, urgent repairs, or simply needing a financial cushion, the promise of quick access to funds without the scrutiny of a credit check can be incredibly tempting.

Marketing often emphasizes the speed and simplicity of the application process, highlighting minimal paperwork and rapid approval times. This can be particularly attractive to those intimidated by the complexities of traditional lending.

The Dark Side: High Costs and Risks

The absence of a credit check is a major red flag indicating potentially exploitative terms. Lenders take on a higher risk by lending to individuals with questionable credit histories, and they mitigate this risk by charging exorbitant interest rates and fees.

Annual Percentage Rates (APRs) on these lines of credit can range from 36% to well over 300%, dwarfing the rates charged by credit cards or personal loans from traditional banks. This means borrowers can quickly find themselves owing far more than they initially borrowed.

Hidden fees are another common pitfall. These can include origination fees, maintenance fees, late payment fees, and even fees for simply accessing the line of credit.

The Regulatory Environment

The regulation of these "no credit check" lines of credit varies significantly by state and federal laws. Some states have usury laws that cap interest rates, providing some protection for consumers. However, many jurisdictions have loopholes or lack sufficient enforcement mechanisms.

The Consumer Financial Protection Bureau (CFPB) has been actively investigating predatory lending practices and has taken action against some companies offering these types of products. However, the sheer volume of lenders and the evolving nature of online lending make effective oversight a constant challenge.

Perspectives from Industry Experts

Consumer advocacy groups like the National Consumer Law Center (NCLC) are highly critical of these products, warning that they often trap vulnerable consumers in cycles of debt. They advocate for stronger regulations and increased consumer education to protect individuals from predatory lending practices.

“These products are often marketed as a quick fix, but they can quickly become a financial nightmare,” says Lauren Saunders, associate director at the NCLC. “Consumers need to be extremely wary of any lender offering a line of credit without a credit check.”

Some industry representatives argue that these lines of credit provide a valuable service to individuals who are underserved by traditional lenders. They contend that the higher interest rates are justified by the increased risk and that responsible lenders provide clear disclosures of fees and terms.

Alternatives to Consider

Before resorting to a "no credit check" line of credit, consumers should explore other options. Secured credit cards, which require a cash deposit as collateral, can be a good way to rebuild credit while having access to a line of credit.

Credit-builder loans, offered by some credit unions and community banks, are designed specifically to help individuals establish or improve their credit history. These loans typically require borrowers to make regular payments over a set period, with the proceeds released only after the loan is repaid.

Seeking help from a nonprofit credit counseling agency can also be beneficial. These agencies can provide personalized financial advice, help individuals create a budget, and negotiate with creditors to lower interest rates or create manageable repayment plans.

Looking Ahead

The market for "line of credit for bad credit no credit check" is likely to continue to grow as demand for alternative lending options increases. Increased scrutiny from regulators and consumer advocacy groups is essential to prevent predatory lending practices and protect vulnerable consumers.

Greater transparency in fees and terms, along with stronger enforcement of existing laws, are crucial to ensuring that these products are offered responsibly. Consumers must educate themselves about the risks involved and explore all available alternatives before resorting to these potentially dangerous financial products.

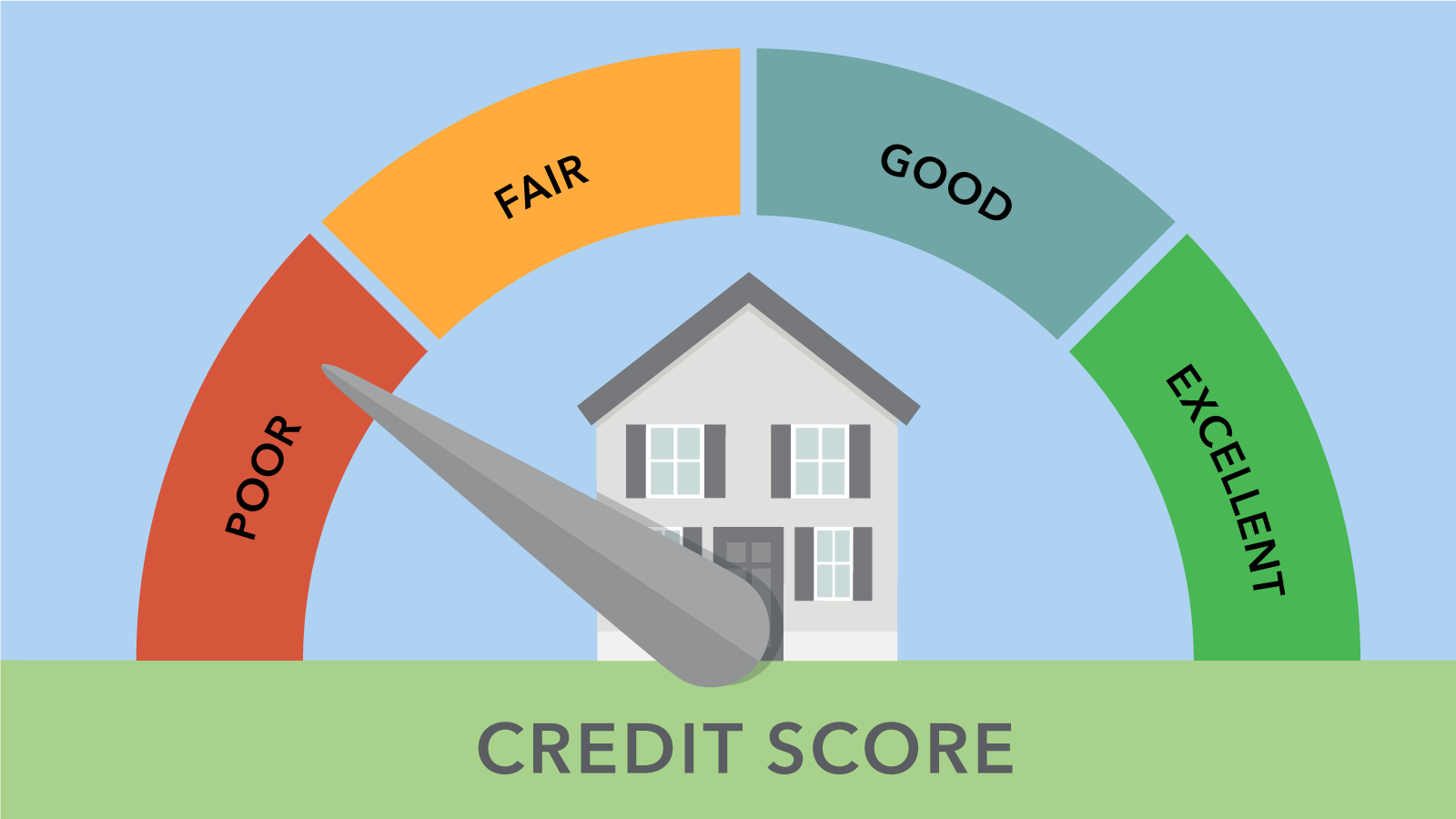

Ultimately, the best defense is a strong offense: proactively building and maintaining good credit through responsible financial habits. This involves paying bills on time, keeping credit card balances low, and regularly monitoring credit reports for errors.