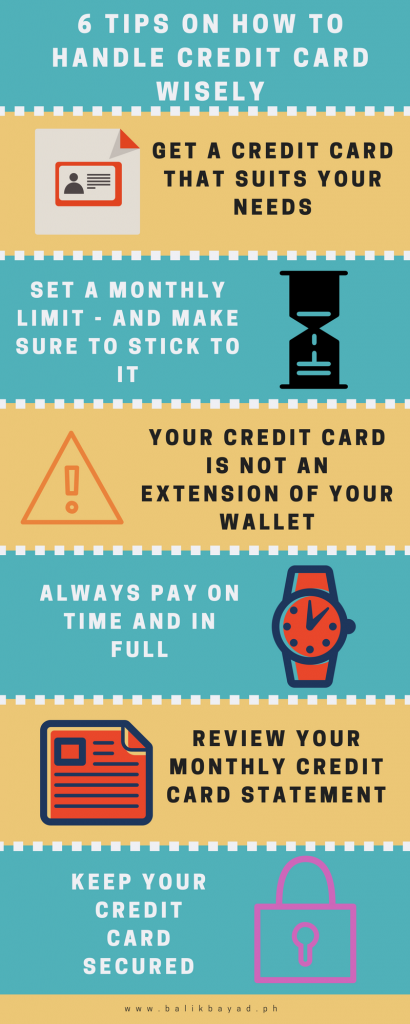

List At Least Two Tips For Using Credit Wisely

Credit card debt is soaring, and financial experts are sounding the alarm. Americans need to act now to protect their financial futures.

This article provides immediately actionable advice on responsible credit card usage to avoid crippling debt and maintain a healthy credit score.

Understanding the Credit Crisis

According to the Federal Reserve, total household debt reached a staggering $17.29 trillion in the first quarter of 2024. A significant portion of this is attributable to credit card balances, which have climbed to over $1 trillion, with interest rates at historic highs.

High inflation and stagnant wages are pushing many families to rely on credit cards for essential expenses. Missed payments and accumulating interest are creating a dangerous debt cycle that is difficult to escape.

Tip #1: Pay Your Balance In Full, Every Month

The single most effective way to use credit cards wisely is to pay the entire statement balance in full each month. This prevents interest charges from accruing, saving you significant money in the long run.

Consider setting up automatic payments from your checking account to ensure timely payments. Even paying a little more than the minimum can drastically reduce interest and payoff time.

Experian reports that individuals who pay their balance in full consistently have significantly higher credit scores. This demonstrates responsible credit management to lenders.

Tip #2: Maintain a Low Credit Utilization Ratio

Your credit utilization ratio (CUR) is the amount of credit you are using compared to your total available credit. Experts recommend keeping your CUR below 30%, and ideally below 10%.

For instance, if you have a credit card with a $10,000 limit, try to keep your balance below $3,000. High credit utilization can negatively impact your credit score.

According to TransUnion, individuals with CURs above 50% are considered high-risk borrowers. This leads to higher interest rates and difficulty obtaining loans.

Additional Considerations for Credit Card Usage

Be wary of introductory offers with low or 0% interest rates. These rates often expire, leading to dramatically higher interest rates on the remaining balance.

Avoid using credit cards for cash advances, as these typically come with high fees and interest rates. Consider exploring alternative funding sources if you need cash.

Regularly monitor your credit report for errors or fraudulent activity. You are entitled to a free credit report from each of the three major credit bureaus (Equifax, Experian, and TransUnion) annually.

Seeking Professional Help

If you are struggling with credit card debt, consider seeking help from a reputable credit counseling agency. These agencies can provide guidance on budgeting, debt management, and negotiating with creditors.

The National Foundation for Credit Counseling (NFCC) is a non-profit organization that offers free or low-cost credit counseling services. Be wary of for-profit debt relief companies that promise quick fixes but may charge exorbitant fees.

Remember that rebuilding credit takes time and discipline. Don't be discouraged by setbacks, and continue to practice responsible credit management habits.

The Road Ahead

Controlling credit card debt is crucial for financial stability. Implement these tips today to take control of your finances and build a secure future.

Stay informed about changes in interest rates and credit card policies. Proactive management is key to navigating the complex world of credit.

Take action now: Review your credit card statements, calculate your credit utilization ratio, and create a plan to pay down your debt. Your financial future depends on it.