Universal Life Insurance Offers Which Of These Features

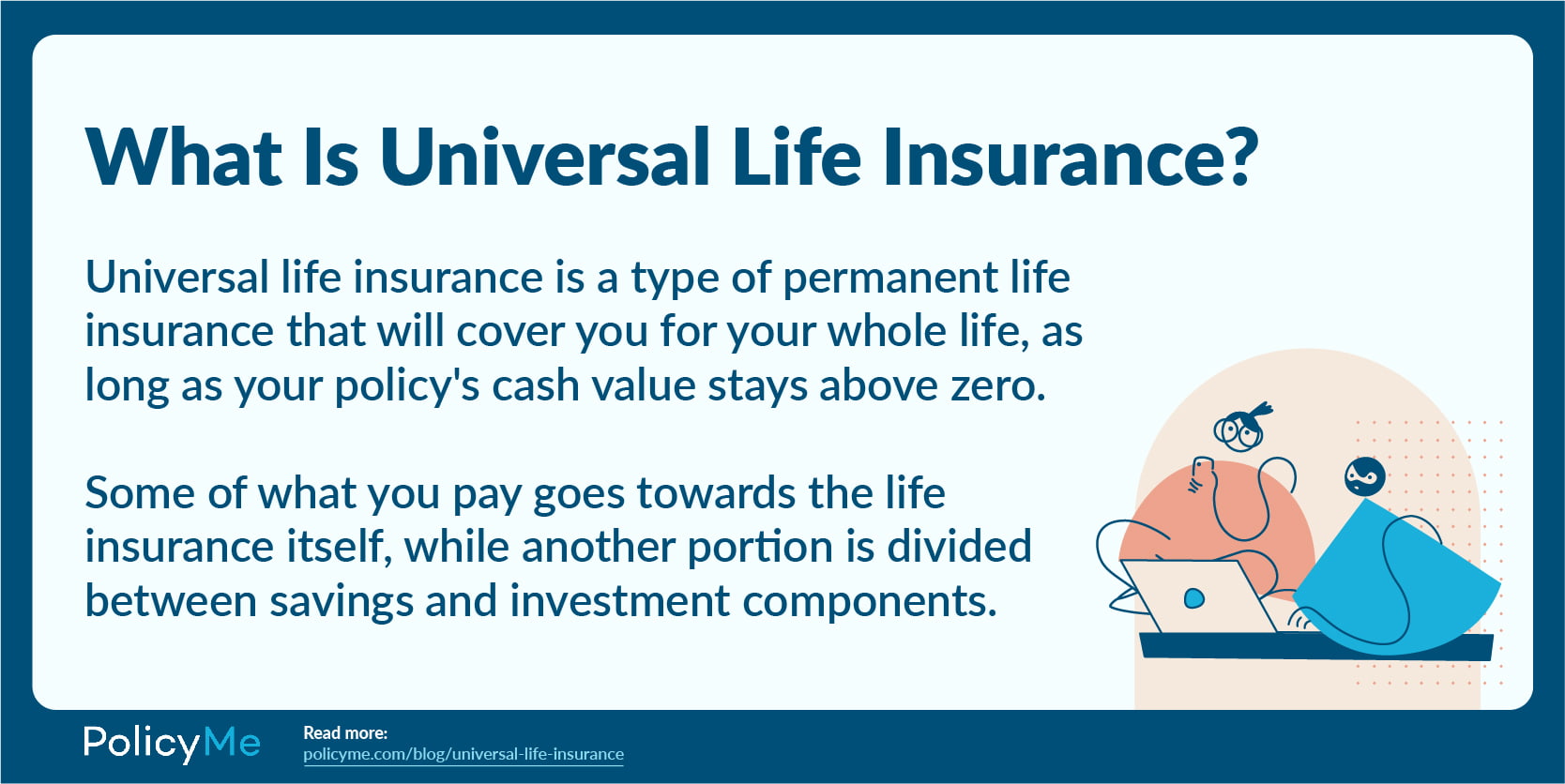

In an era marked by financial uncertainty, consumers are increasingly seeking insurance products that offer both security and flexibility. Universal Life Insurance (UL), a type of permanent life insurance, has emerged as a popular choice, but understanding its features is crucial before making a decision.

This article delves into the core attributes of Universal Life Insurance policies, examining the guarantees they provide, the flexibility they offer, and the potential risks they entail, drawing upon industry reports and expert opinions.

Understanding the Core Features of Universal Life Insurance

At its heart, Universal Life Insurance combines a death benefit with a cash value component. Premiums paid, after deducting policy expenses, contribute to this cash value, which grows on a tax-deferred basis.

One of the primary appeals of UL is its flexible premium structure. Policyholders can, within certain limits, adjust their premium payments and even the death benefit amount over time, offering adaptability to changing financial circumstances.

Guaranteed minimum interest rates are sometimes touted as a safeguard, but it's vital to scrutinize the fine print. These guarantees often apply only to a portion of the cash value or are subject to specific conditions.

Flexibility in Premium Payments and Death Benefit

The adjustable premium feature is a cornerstone of UL's appeal. Policyholders can increase or decrease payments, potentially even skipping them altogether, provided the cash value is sufficient to cover policy expenses and keep the policy in force.

However, this flexibility comes with responsibility. Consistently underfunding the policy can deplete the cash value, leading to policy lapse and loss of the death benefit.

Similarly, the death benefit can usually be increased or decreased, subject to insurability requirements. Increasing the death benefit may necessitate additional underwriting, including medical exams.

The Cash Value Component: Growth and Risks

The cash value within a Universal Life policy grows tax-deferred, meaning no taxes are paid on the earnings until they are withdrawn. This can be an attractive feature for long-term savings.

The rate of growth is tied to the insurer's declared interest rate, which can fluctuate depending on market conditions. Some UL policies offer a fixed interest rate, while others are tied to an index.

It's crucial to understand that the cash value is also subject to policy expenses, including administrative fees and mortality charges. These expenses can significantly impact the growth of the cash value, especially in the policy's early years.

Guaranteed Features and Their Limitations

Many Universal Life policies advertise guaranteed minimum interest rates. However, these guarantees often come with caveats. The guaranteed rate may be lower than the current rate, and it may only apply to a portion of the cash value.

Furthermore, the guarantees typically assume that premiums are paid as originally planned. Underfunding the policy can void or reduce the effectiveness of these guarantees.

Consumers should carefully review the policy documents to understand the specific terms and conditions of any guarantees.

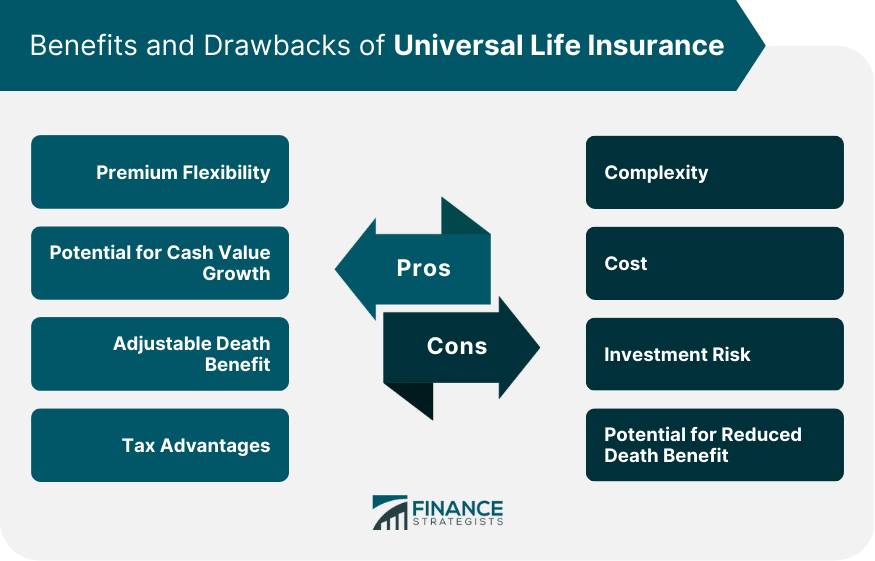

Potential Advantages and Disadvantages

Universal Life Insurance offers potential advantages, including flexibility and tax-deferred growth. However, it also presents risks, such as policy lapse and the impact of fees and expenses.

For those seeking a death benefit and a savings component with flexibility, UL can be a viable option. However, it's crucial to compare it with other financial products, such as term life insurance and investment accounts.

Consumers should consider their individual financial needs and risk tolerance before purchasing a Universal Life Insurance policy.

The Importance of Transparency and Disclosure

Transparency in policy fees and expenses is paramount. Consumers should ask their insurance agent for a detailed breakdown of all charges associated with the policy.

It's also crucial to understand how the cash value is calculated and how the interest rate is determined. Requesting illustrations showing different scenarios, including low and high interest rate environments, can be helpful.

"Consumers should not hesitate to seek independent financial advice before making a decision," according to The National Association of Insurance Commissioners (NAIC).

The Future of Universal Life Insurance

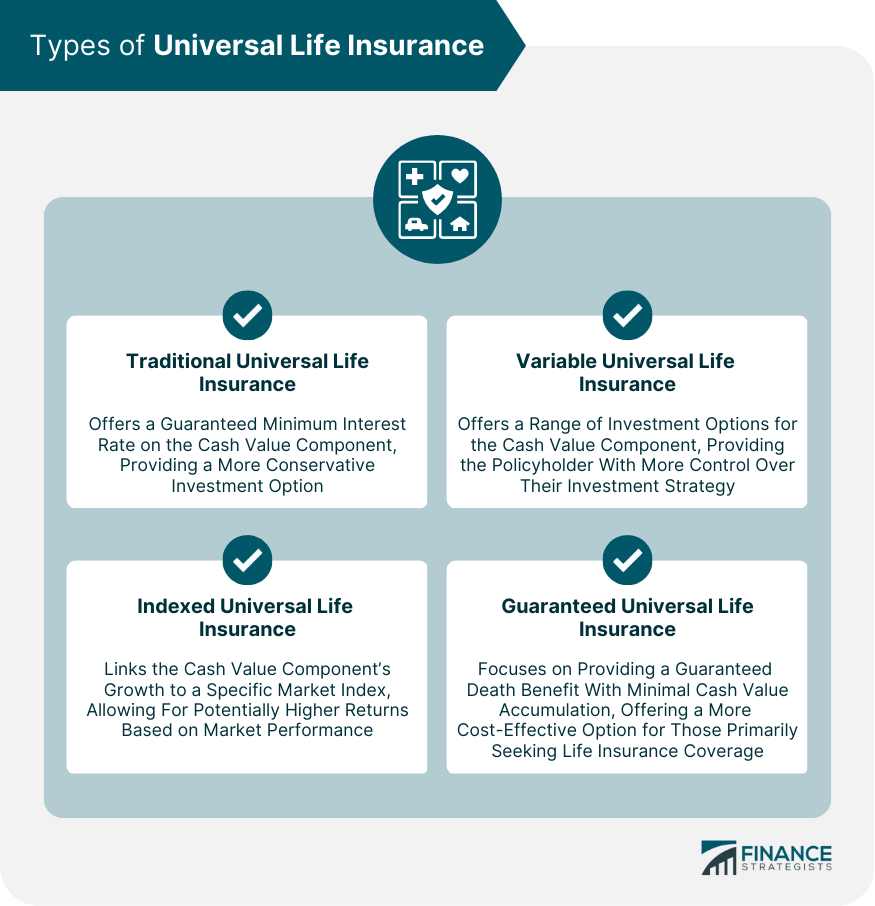

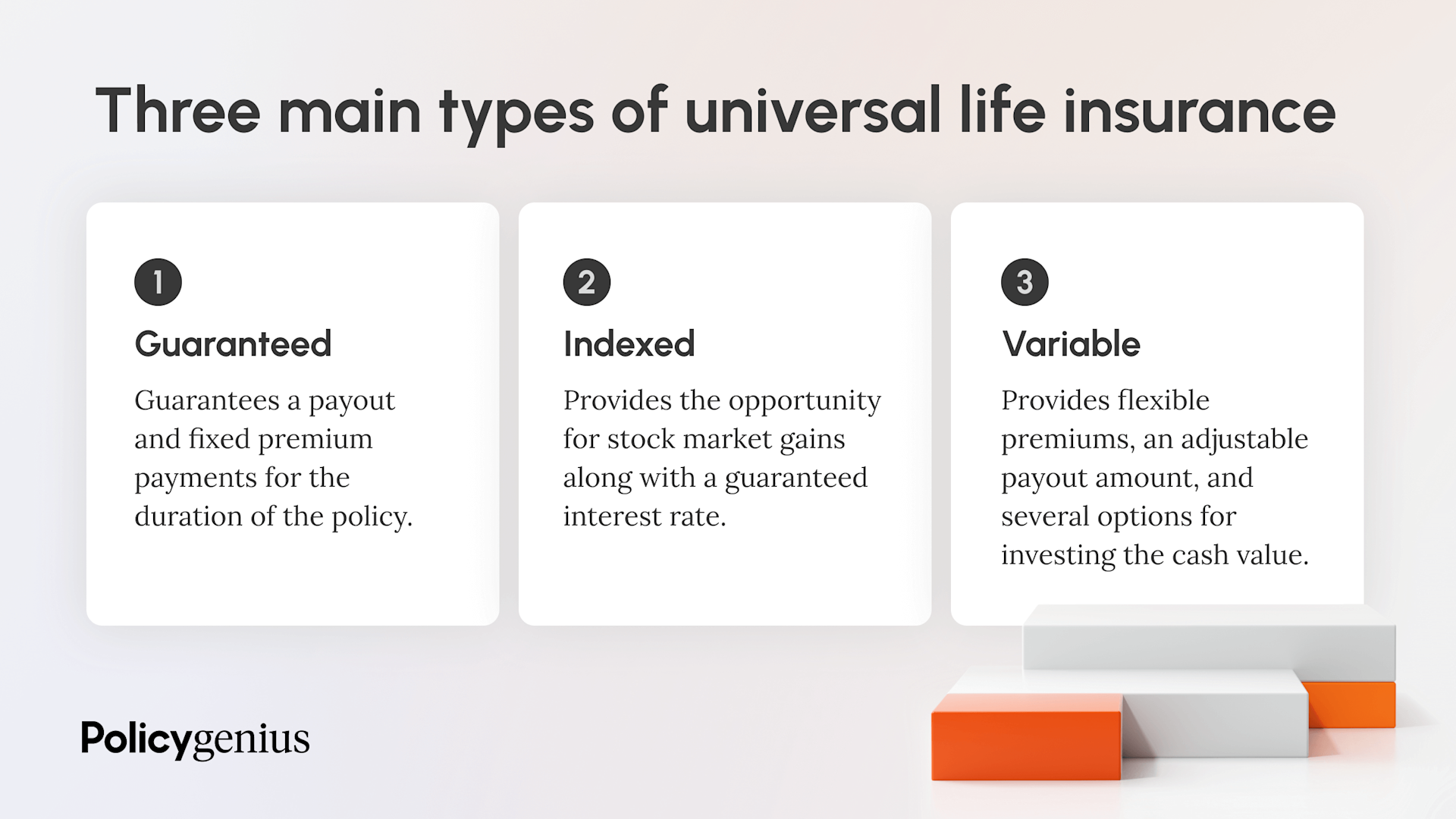

The Universal Life Insurance market continues to evolve, with insurers adapting their products to meet changing consumer needs and market conditions. Innovations such as indexed universal life (IUL) and variable universal life (VUL) offer different approaches to cash value growth.

Increased regulatory scrutiny is also likely, with a focus on ensuring transparency and protecting consumers. The Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA) play roles in overseeing certain aspects of UL policies, particularly those with investment components.

As the financial landscape becomes increasingly complex, understanding the features and risks of Universal Life Insurance is more critical than ever. A well-informed decision can provide both financial security and peace of mind.