Managing Expenses For Small Business

Small business owners often juggle multiple roles, from marketing and sales to customer service and product development. A crucial, yet often overlooked, aspect of running a successful small business is effectively managing expenses. Poor expense management can quickly erode profits and threaten the very survival of a business, while strategic cost control can unlock growth opportunities.

This article explores practical strategies and resources available to small business owners to help them streamline their expense management, improve their financial health, and ultimately, achieve sustainable success. Effective expense management is not just about cutting costs, it's about making informed decisions that optimize resource allocation and drive profitability.

Understanding Your Expenses

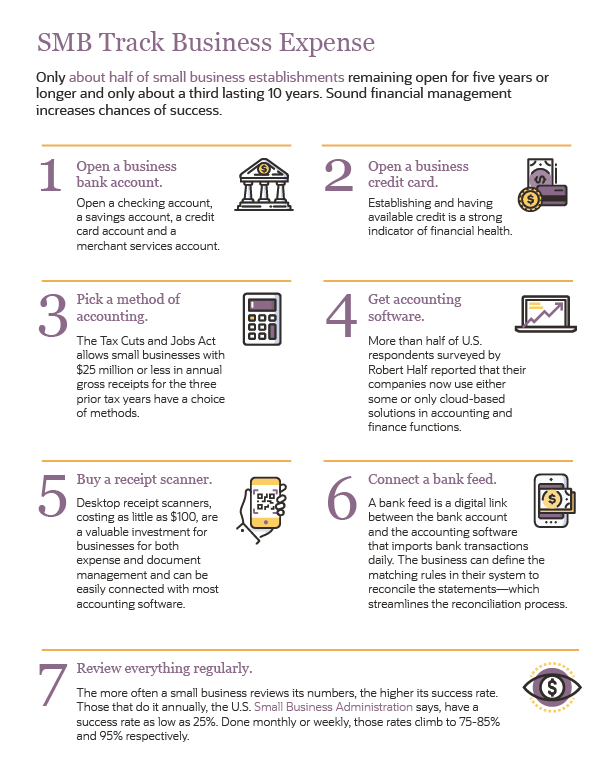

The first step in managing expenses is understanding exactly where your money is going. This requires meticulous tracking and categorization of all business expenditures. Common expense categories include rent, utilities, salaries, marketing, supplies, and professional fees.

Tools like accounting software (e.g., QuickBooks, Xero) can automate much of this process, providing real-time insights into spending patterns. According to a recent study by the Small Business Administration (SBA), businesses that actively track their expenses are significantly more likely to experience sustained profitability.

Creating a Budget

Once you have a clear picture of your expenses, the next step is to create a realistic budget. This budget should outline expected income and expenses for a specific period, typically a month or a year. A well-defined budget serves as a roadmap for financial decision-making.

Regularly compare your actual expenses against your budgeted amounts to identify areas where you're overspending or underspending. Adjust your budget as needed to reflect changing business conditions.

Strategies for Reducing Expenses

There are numerous ways to reduce expenses without compromising the quality of your products or services. Negotiating better rates with suppliers is a good starting point. Consider exploring alternative suppliers or vendors to secure more competitive pricing.

Another strategy is to reduce energy consumption by implementing energy-efficient practices in your workplace. The Environmental Protection Agency (EPA) offers resources and guidance on energy conservation for businesses. Remote work or hybrid models can significantly cut down on office-related costs, as well.

Furthermore, carefully evaluate your marketing spend to ensure you're getting the best return on investment. Digital marketing channels like social media and email marketing often offer more cost-effective alternatives to traditional advertising methods.

Leveraging Technology

Technology plays a crucial role in modern expense management. Cloud-based accounting software, as mentioned earlier, provides a centralized platform for tracking expenses, generating reports, and collaborating with your accountant. Expense tracking apps streamline the process of recording and categorizing receipts on the go.

Automation tools can help automate repetitive tasks like invoice processing and payments, freeing up valuable time for other business activities. Embracing technology can significantly improve efficiency and accuracy in expense management.

According to a report by Gartner, businesses that invest in digital expense management solutions see an average reduction of 15% in administrative costs.

Seeking Professional Advice

Managing expenses can be complex, especially for businesses with intricate financial structures. Consider seeking advice from a qualified accountant or financial advisor. These professionals can provide expert guidance on tax planning, budgeting, and financial forecasting.

The Service Corps of Retired Executives (SCORE) also offers free or low-cost mentorship and business counseling services to small business owners.

In conclusion, effective expense management is a vital component of small business success. By understanding your expenses, creating a budget, implementing cost-reduction strategies, leveraging technology, and seeking professional advice, you can optimize your financial health and achieve your business goals. Continuous monitoring and adaptation are key to staying on track and ensuring long-term sustainability.