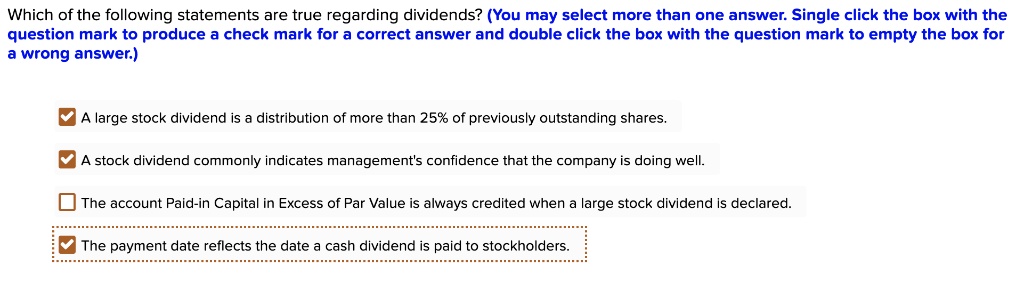

Which Of The Following Statements Are True Regarding Dividends

Dividends, a cornerstone of investment strategies and shareholder returns, are often the subject of both investor interest and considerable scrutiny. Understanding the nuances of dividend policies is crucial for making informed financial decisions. But navigating the complex landscape of dividend statements requires careful consideration and factual verification.

This article aims to clarify common misconceptions and present accurate information regarding dividend declarations, payments, and their implications for investors and companies alike. We will explore the factual basis behind various statements about dividends, drawing from reputable sources and established financial principles.

Key Considerations Regarding Dividend Statements

The Board's Prerogative

One fundamental aspect of dividends is the authority that resides within a company's board of directors. The board holds the sole power to declare dividends. This power is not mandated, meaning companies are not obligated to distribute dividends, even if they are profitable.

Dividends and Profitability

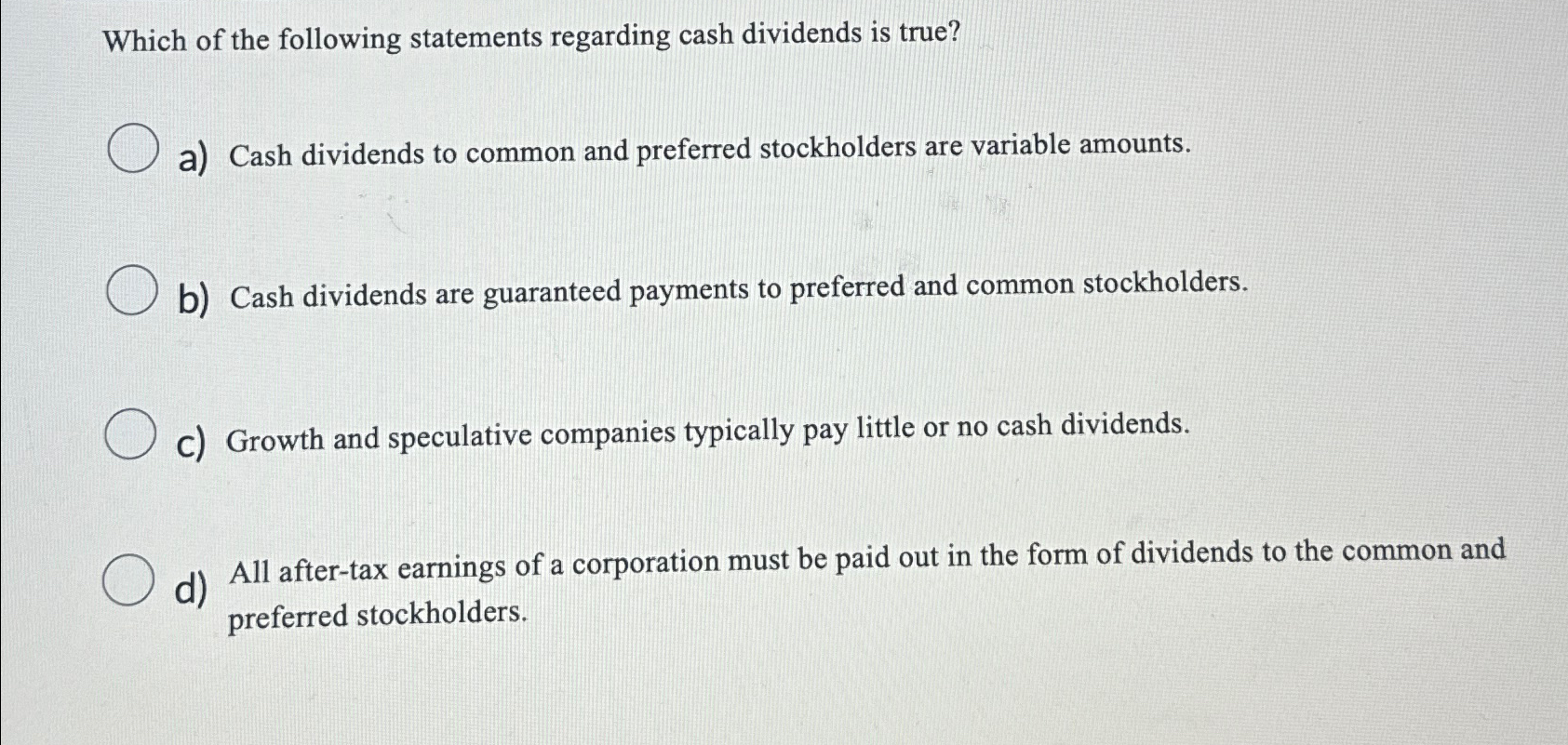

While often associated, profitability does not automatically guarantee a dividend payout. Many profitable companies, particularly those focused on growth, choose to reinvest their earnings into the business. Reinvestment may be viewed as a strategy to enhance future profitability and increase shareholder value in the long term.

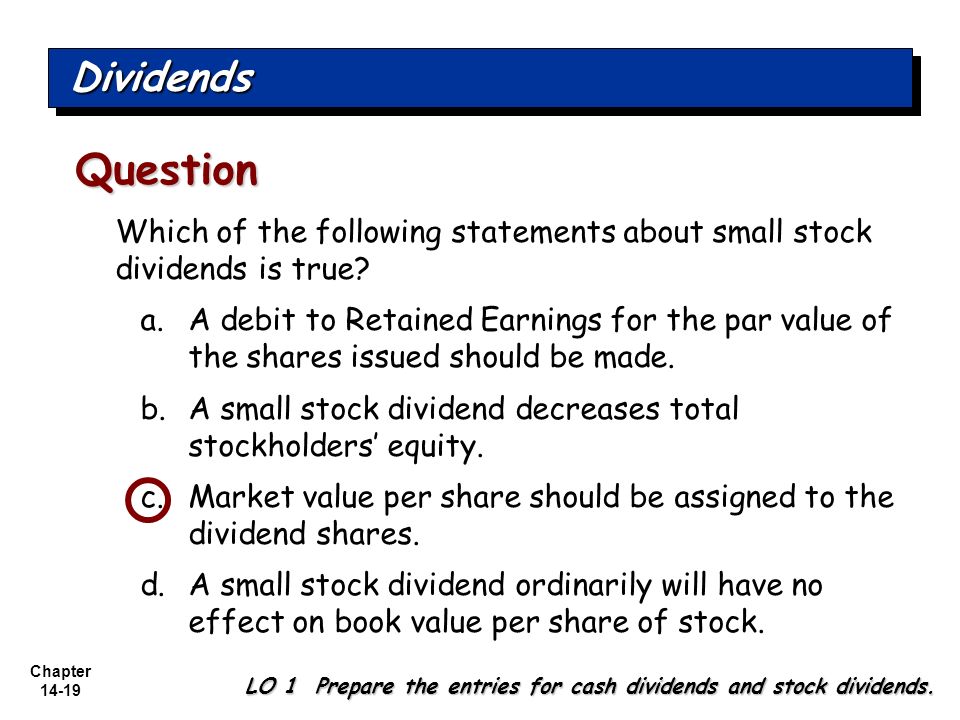

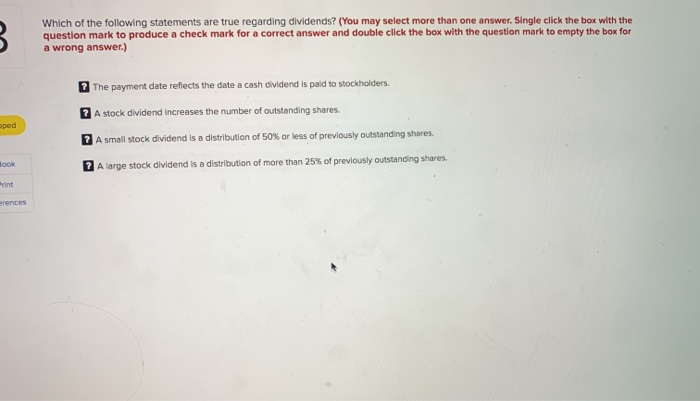

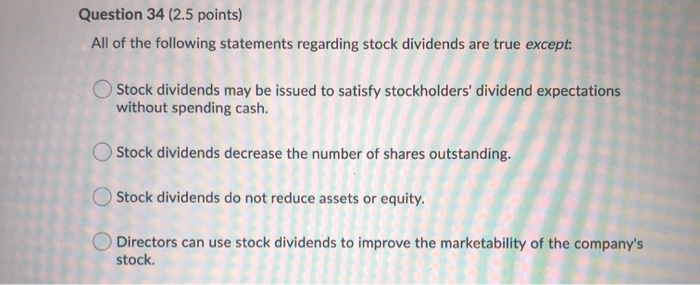

Types of Dividends

Dividends are not limited to cash payments; they can also take the form of stock dividends. A stock dividend involves distributing additional shares of the company's stock to existing shareholders. Cash and stock dividends have different implications for shareholders and the company's capital structure.

The Declaration Date

The declaration date is the date on which the company's board announces its intention to pay a dividend. This announcement specifies the dividend amount, the record date, and the payment date. The declaration date marks a crucial step in the dividend distribution process.

Record Date and Ex-Dividend Date

The record date determines which shareholders are eligible to receive the declared dividend. To be eligible, an investor must be a registered shareholder on the record date. The ex-dividend date, typically set one business day before the record date, is significant because it determines when a stock begins trading without the right to receive the upcoming dividend.

Payment Date

The payment date is the date on which the company actually disburses the dividend to eligible shareholders. Shareholders who owned the stock before the ex-dividend date and were registered on the record date will receive their dividend payment on this date.

Dividend Reinvestment Plans (DRIPs)

Dividend Reinvestment Plans (DRIPs) offer shareholders the option to automatically reinvest their dividends to purchase additional shares of the company's stock. DRIPs can be a cost-effective way to increase one's holdings in a company over time. They are often commission-free or offered at a reduced commission rate.

Dividends and Stock Price

In theory, the stock price should decrease by the amount of the dividend on the ex-dividend date. This adjustment reflects the fact that new buyers will not receive the upcoming dividend. However, market dynamics and other factors can influence the actual price movement, making it difficult to observe a direct correlation in every instance.

Dividend Taxation

Dividends are generally subject to taxation, although the specific tax rate can vary depending on the investor's income bracket and the type of dividend. Qualified dividends are often taxed at a lower rate than ordinary income, while non-qualified dividends are taxed at the ordinary income tax rate.

Dividend Aristocrats

Certain companies, often referred to as Dividend Aristocrats, have a long track record of consistently increasing their dividend payouts year after year. Achieving Dividend Aristocrat status is a signal of financial stability and commitment to shareholder returns. However, past performance is not indicative of future results.

Are Dividends Guaranteed?

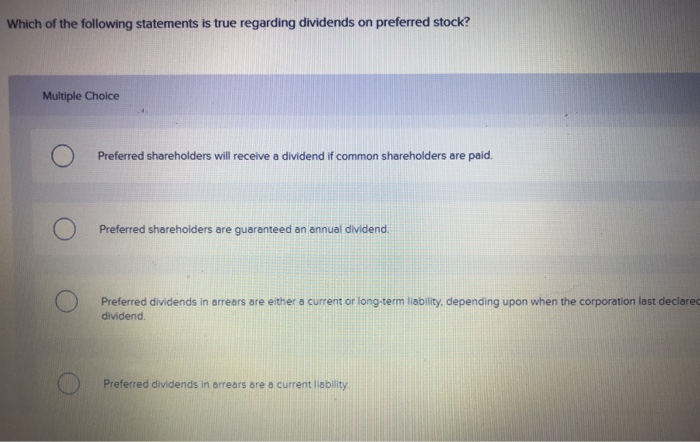

No, dividends are not guaranteed. Even companies with a history of consistent dividend payments can reduce, suspend, or eliminate dividends entirely if facing financial difficulties. The decision to pay dividends is subject to the board's discretion and the company's financial condition.

Understanding the Impact

The truth about statements regarding dividends lies in the context of the specific company, its financial health, and the prevailing economic conditions. Investors should conduct thorough due diligence and avoid relying solely on generalized statements.

By understanding the roles of the board of directors, the various dividend dates, and the tax implications, investors can make more informed decisions and potentially improve their investment outcomes. Knowledge is the key to navigating the dividend landscape effectively.

Consulting with a qualified financial advisor is always recommended to tailor investment strategies to individual circumstances and risk tolerance.