Mara February 2025 Bitcoin Production Update

Mara Digital Holdings, Inc. reports a significant drop in Bitcoin production for February 2025, raising concerns among investors and analysts.

This downturn comes despite increased hash rate and operational adjustments, highlighting potential challenges in mining efficiency and network difficulty.

February Production Plunge

Mara produced 410 Bitcoins in February 2025, a notable decrease compared to the 505 Bitcoins mined in January 2025. This represents an approximate 19% decrease month-over-month.

The company attributes this decline primarily to increased network difficulty and operational factors at its various mining facilities.

Key Production Metrics

The company's deployed hash rate remained relatively stable at 27.8 EH/s. Total Bitcoin holdings are approximately 16,953 BTC as of February 29, 2025.

The average production in February was approximately 14.6 Bitcoins per day.

This is a decrease compared to January's average of 16.3 Bitcoins per day.

Operational Hurdles

Mara faced several operational challenges during the month. These affected its overall mining output, including increased maintenance downtime.

One of the key challenges was an electrical storm that resulted in outages in some of the mining facilities in Texas.

Furthermore, increased congestion on the Bitcoin network may have contributed to the lower production figures.

Facility Performance

The operational facilities experienced varying levels of performance. The Texas facilities were particularly affected by weather-related disruptions.

Mara is working to mitigate these issues and improve operational uptime across all its mining locations.

Diversification of mining locations remains a strategic priority for the company.

Financial Implications

The reduced Bitcoin production is expected to impact Mara's revenue for February.

Analysts are closely monitoring the situation to assess the long-term financial implications for the company's profitability.

Investors are keenly awaiting the Q1 2025 earnings report to gain a deeper understanding of Mara's financial performance.

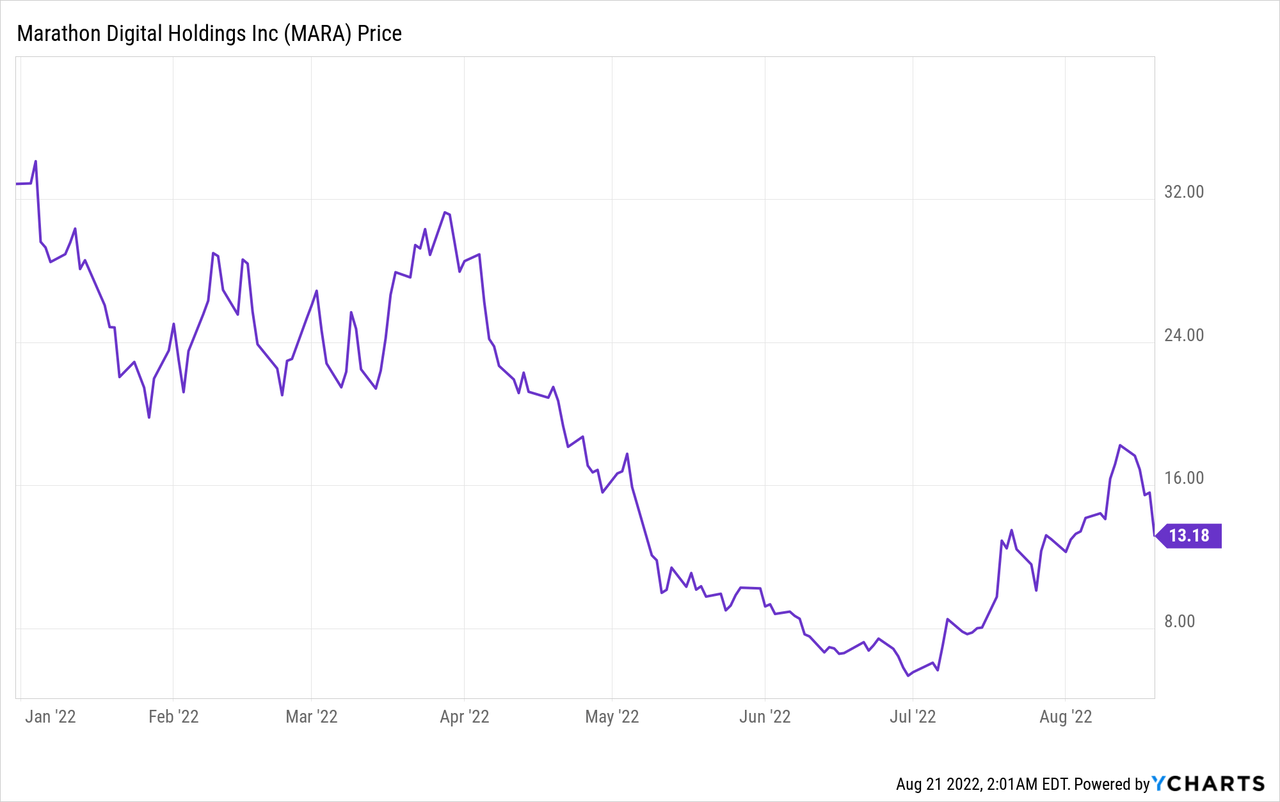

Market Reaction

News of the production decrease caused a slight dip in Mara's stock price. The stock is trading at $13.41 as of close of market today.

The market is expected to react further as more details about the challenges emerge.

Company is confident of recovery.

Strategic Adjustments

In response to the production shortfall, Mara is implementing several strategic adjustments.

These include optimizing mining pool allocations and accelerating the deployment of new, more efficient mining equipment.

The company is also exploring additional power purchase agreements to secure more cost-effective energy sources.

Future Outlook

Mara aims to increase its hashrate to 30 EH/s by the end of March. They are also working with suppliers to obtain efficient mining rigs.

Achieving this target is crucial for regaining production momentum and improving the company's competitive position.

Mara expects to increase its bitcoin production next quarter.

Next Steps

The company plans to release a comprehensive update on its operational improvements and strategic initiatives in the coming weeks.

This update will provide further insights into the factors affecting production and the company's plans to address these challenges.

Investors and analysts are encouraged to review this information carefully to assess Mara's long-term prospects.