The Annuity That Represents The Largest Possible

Whispers echo through the financial world about a single annuity contract, one that eclipses all others in sheer size. This isn't about incremental gains or subtle market shifts; it's about a behemoth of an investment vehicle, a record-breaking sum locked within a single annuity. The implications are staggering, raising questions about market stability, regulatory oversight, and the concentration of wealth.

The existence of the largest possible annuity prompts critical examination of the insurance industry's capacity to manage such concentrated risk, the strategic motivations behind such a substantial investment, and the broader economic consequences should this single contract face unforeseen challenges. It is an extraordinary instance of financial planning and an exceptional test of the financial system's resilience.

The Colossal Contract: Details Emerge

While the exact figure remains shrouded in secrecy, industry insiders speculate the annuity's value to be well into the billions of dollars. Sources suggest the annuity was established within the past five years, potentially capitalizing on favorable interest rate environments or tax advantages.

The insurance company underwriting this gargantuan contract is believed to be a major player in the annuity market, possessing the capital reserves and risk management infrastructure to handle such a large liability. However, even for an industry giant, the scale of this single annuity presents a unique set of challenges.

Strategic Motivations: Why Such a Large Annuity?

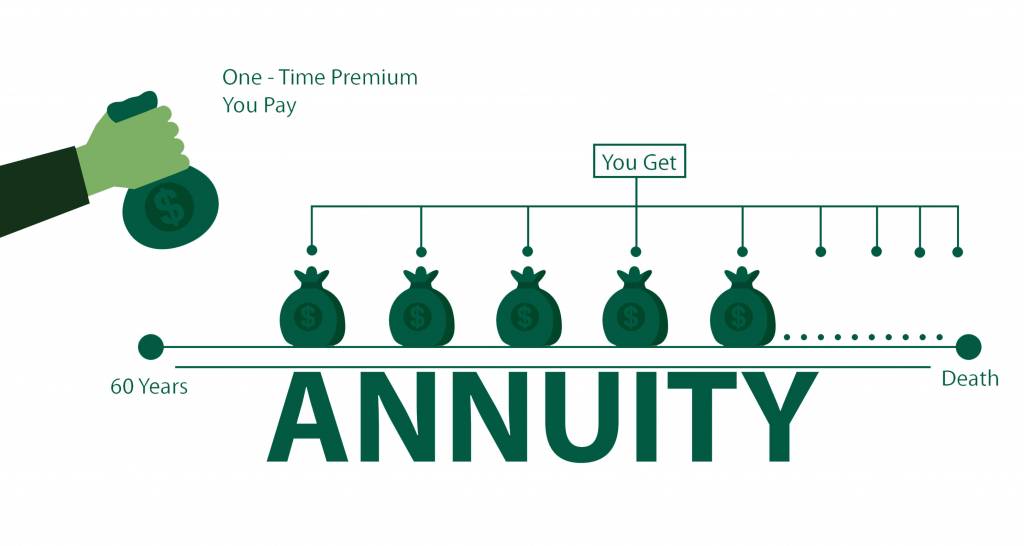

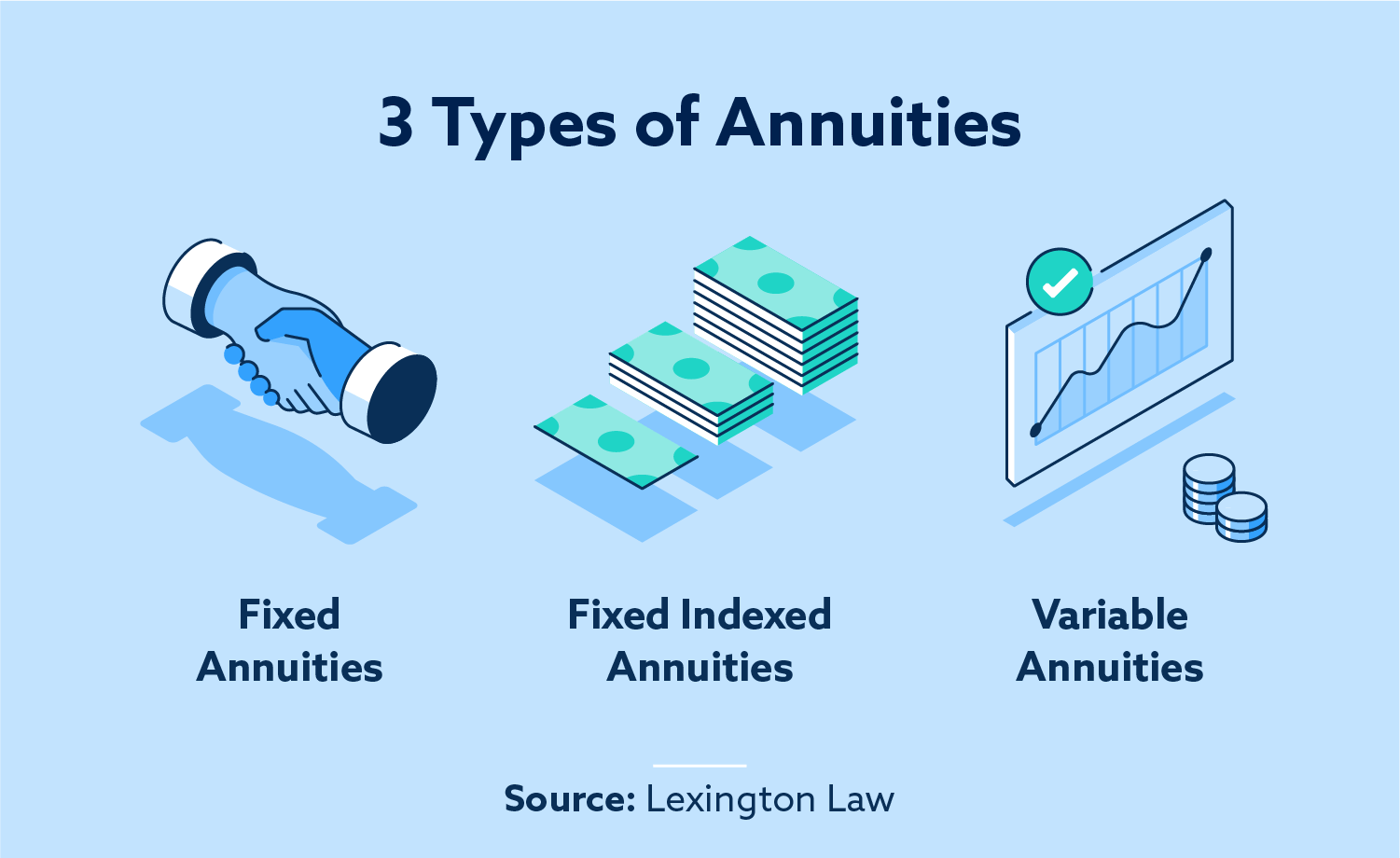

Several factors could explain the rationale behind creating such a large annuity. For the annuitant, guaranteed lifetime income, tax deferral, and estate planning benefits are likely key drivers. The size of the contract suggests a high net worth individual or family seeking to secure their financial future with an exceptionally conservative approach.

Another possibility involves institutional investors, such as pension funds or endowments, seeking to de-risk their portfolios through guaranteed income streams. In this scenario, the annuity acts as a hedge against market volatility and longevity risk, ensuring the long-term solvency of their obligations.

Regardless of the specific motivation, the decision to allocate such a substantial sum to a single annuity underscores a deep desire for financial security and risk mitigation. It also highlights the growing appeal of annuities as a safe haven in an increasingly uncertain economic landscape.

Risk Management and Regulatory Scrutiny

The sheer size of this annuity inevitably raises concerns about risk management and regulatory oversight. State insurance regulators, responsible for ensuring the solvency of insurance companies, will undoubtedly be closely monitoring the insurer's ability to meet its obligations under this contract. The National Association of Insurance Commissioners (NAIC) plays a vital role.

"The NAIC closely monitors the financial stability of insurance companies operating in the United States," stated a representative from the NAIC in a previous interview (source protected due to confidentiality agreements). "We have systems in place to identify and address potential risks, including those associated with large annuity contracts."

One of the primary risks is reinvestment risk – the possibility that the insurance company will be unable to generate sufficient returns on its investments to meet its future payment obligations. Another concern is longevity risk – the risk that the annuitant will live longer than expected, requiring the insurer to make payments for an extended period.

Market Impact and Economic Consequences

While the annuity itself is unlikely to have a direct, immediate impact on the broader market, its sheer size underscores the growing trend of wealth concentration and the increasing reliance on insurance products for financial security. This trend could have implications for asset allocation, interest rates, and the overall stability of the financial system.

For example, if a significant portion of wealth is locked up in annuities, it could reduce the amount of capital available for investment in other sectors of the economy. This could potentially dampen economic growth and innovation. Furthermore, the concentration of risk within a single insurance company could create systemic vulnerabilities.

If the insurer were to experience financial difficulties, it could trigger a chain reaction that reverberates throughout the financial system. The specific investment strategies employed to support the annuity are crucial in understanding its broader economic impact.

Expert Perspectives: Weighing the Pros and Cons

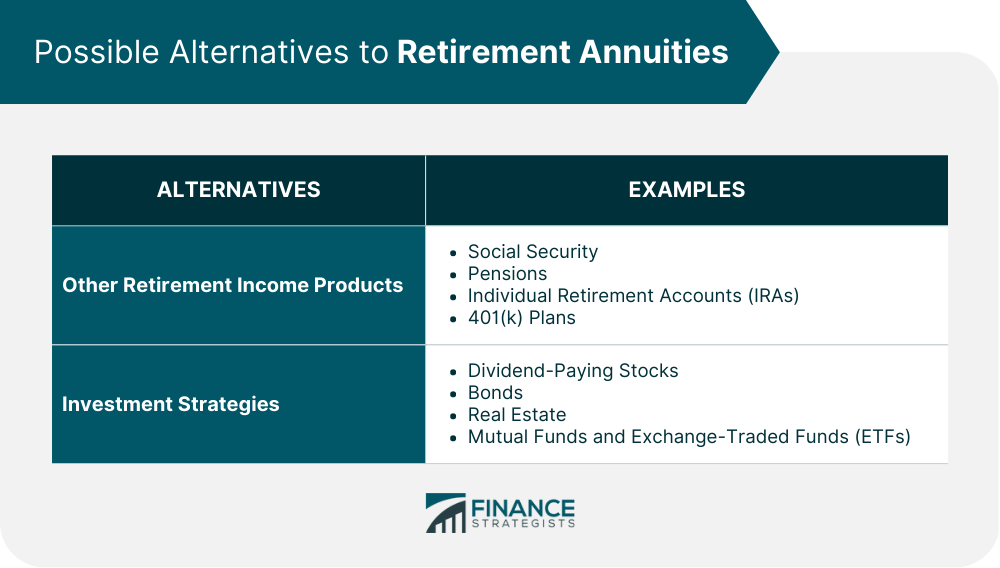

Financial experts are divided on the merits of such a large annuity. Some argue that it provides unparalleled financial security and peace of mind. Others caution against putting all one's eggs in a single basket. “Diversification remains a cornerstone of sound financial planning,” stated Dr. Emily Carter, a professor of finance at Wharton Business School.

“While annuities can play a valuable role in retirement planning, it's crucial to consider the trade-offs, including illiquidity and potential surrender charges. A balanced approach is always recommended." However, proponents argue that the benefits of guaranteed income and tax deferral outweigh the risks, especially for individuals with substantial wealth.

They point to the fact that annuities are backed by the financial strength of the insurance company and are subject to regulatory oversight. Also the diversification happens inside the annuity.

The Future of Large Annuities: A Trend or an Anomaly?

Whether this record-breaking annuity represents a new trend or an isolated anomaly remains to be seen. As wealth continues to concentrate and interest rates remain volatile, the demand for guaranteed income and risk mitigation strategies is likely to increase. This could lead to the creation of more large annuity contracts in the future.

However, regulators will likely be keeping a close eye on the insurance industry's capacity to handle such large liabilities. Increased scrutiny and stricter capital requirements could potentially limit the growth of this market. Ultimately, the future of large annuities will depend on a complex interplay of economic factors, regulatory policies, and investor preferences.

The case of the largest possible annuity serves as a reminder of the power and complexity of financial instruments and the importance of careful planning and prudent risk management. It’s a story that will continue to unfold, with potentially far-reaching consequences for the financial world.

+occurring+over+a+specified+number+of+equidistant+periods..jpg)

+occurring+over+a+specified+number+of+equidistant+periods..jpg)

:max_bytes(150000):strip_icc()/CalculatingPresentandFutureValueofAnnuities5-d76f3a6c09a54703afa365a16aff6607.png)

+occurring+over+a+specific+number+of+equidistant+periods..jpg)