Merrill Lynch Walmart 401k Loan Phone Number

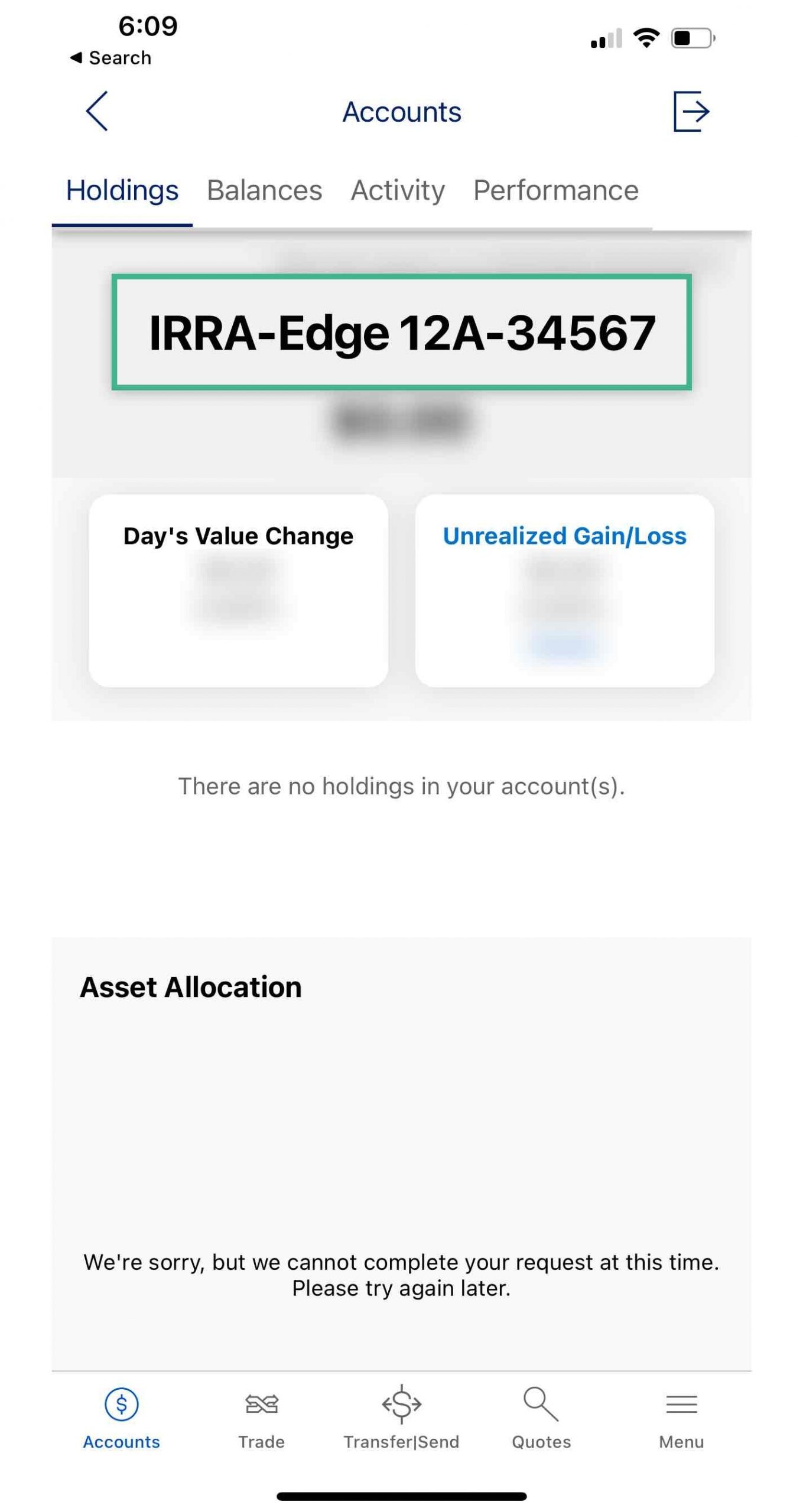

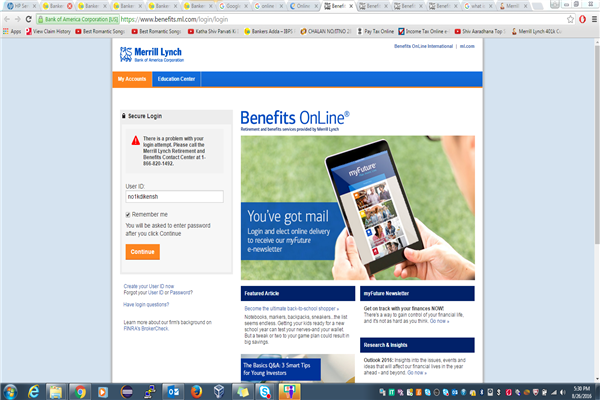

Confusion and frustration are mounting among Walmart employees attempting to access critical information regarding their Merrill Lynch 401(k) loan options. Many are reporting difficulties finding a direct and reliable phone number for assistance, leading to delays in managing their retirement funds and accessing much-needed loans.

The inability to easily contact a representative regarding 401(k) loans – vital for addressing unexpected expenses or financial hardships – has sparked concerns about the accessibility and responsiveness of the support system provided for Walmart employees' retirement savings.

The 401(k) Loan Support Vacuum

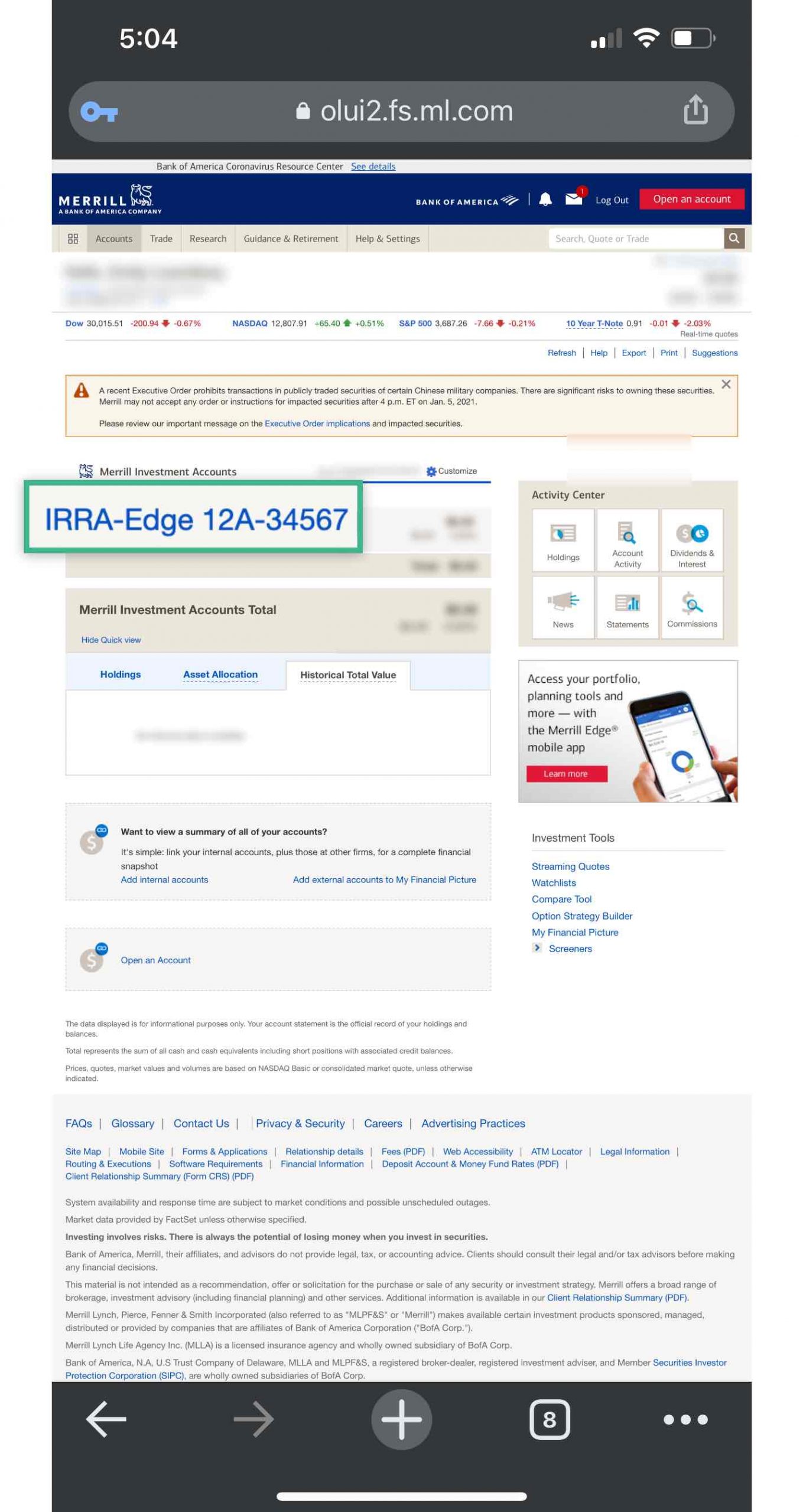

Walmart's 401(k) plan, managed by Merrill Lynch, aims to provide employees with a secure retirement savings vehicle. A key component of this plan is the ability to take out loans against their vested balance, offering a financial lifeline in times of need. However, anecdotal evidence and reports online suggest a significant disconnect when employees attempt to navigate the loan application process and require assistance.

The core issue revolves around the difficulty in locating a dedicated phone number for 401(k) loan inquiries. Employees report being routed through multiple automated systems, enduring long hold times, and ultimately struggling to connect with a knowledgeable representative who can address their specific loan-related questions.

"I spent hours trying to get through to someone who could help me understand my loan options," said one Walmart associate, speaking on condition of anonymity. "It was incredibly frustrating, especially when I needed the money urgently."

The Search for Clarity

Online forums and social media groups dedicated to Walmart employees are filled with similar complaints. Many share their experiences of failed attempts to reach a relevant contact, often leading to a reliance on outdated information or unverified advice from fellow colleagues. The lack of a clearly advertised and readily accessible Merrill Lynch Walmart 401(k) loan phone number exacerbates the problem.

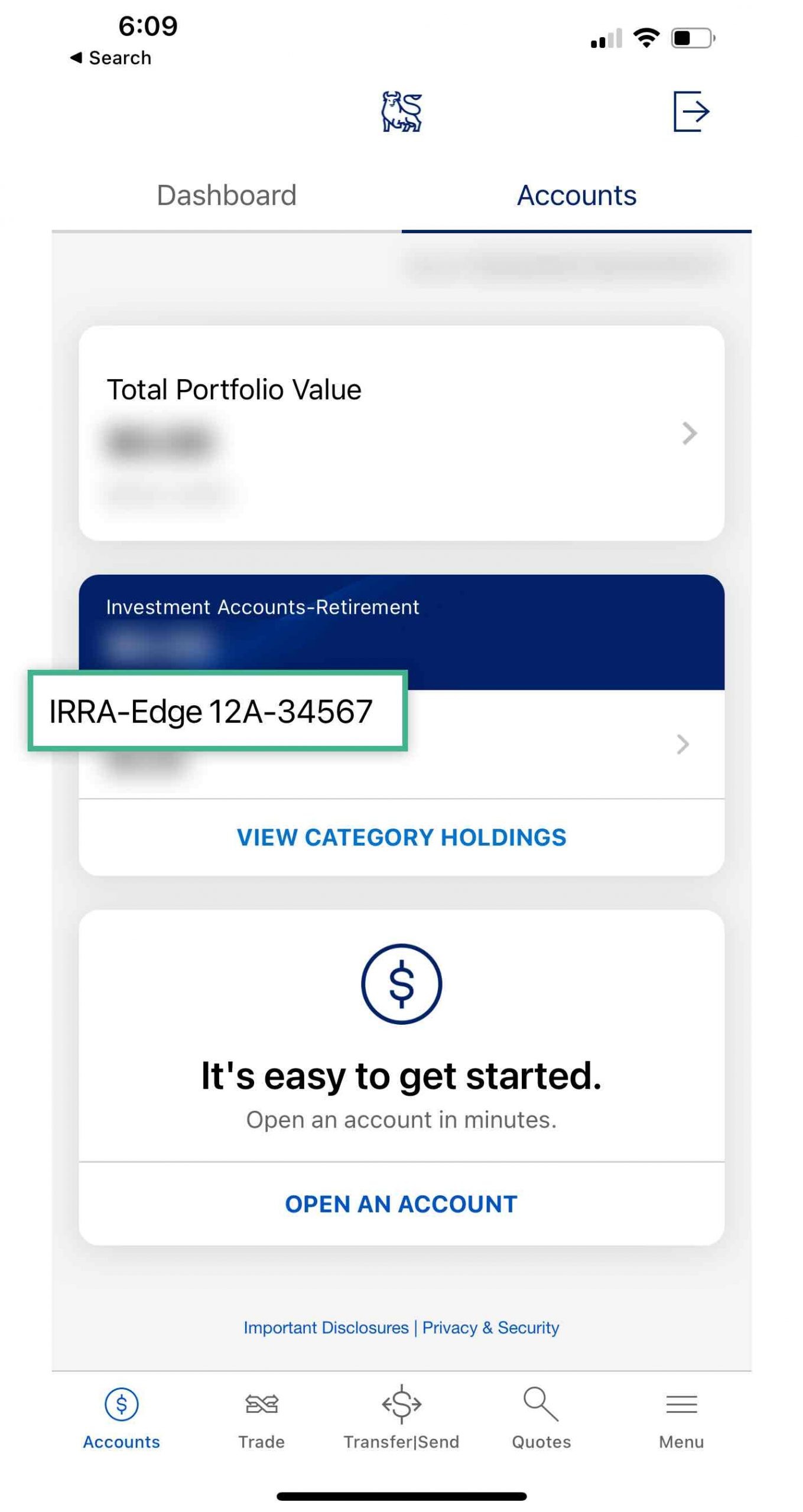

Attempts to contact Merrill Lynch directly through their general customer service lines can also prove fruitless. Representatives may lack the specific expertise regarding the nuances of the Walmart-specific 401(k) plan and its loan provisions.

Walmart’s official website offers limited information on 401(k) loans, often directing employees to a general benefits hotline. While helpful for broader benefits inquiries, this hotline may not provide the specialized assistance required for navigating the loan application and approval process.

Implications and Potential Solutions

The challenges in accessing 401(k) loan support have several potential implications. Firstly, employees may delay seeking necessary financial assistance due to the cumbersome process. This could lead to increased financial stress and potentially detrimental decisions.

Secondly, a lack of clarity on loan terms and conditions can result in misunderstandings and unexpected fees. This could negatively impact employees' retirement savings and erode their trust in the 401(k) plan.

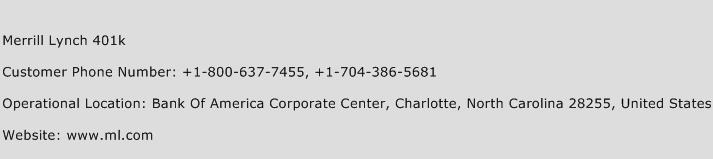

Potential solutions include Merrill Lynch and Walmart collaborating to establish a dedicated phone number specifically for 401(k) loan inquiries. This hotline should be staffed with representatives trained on the intricacies of the Walmart plan and equipped to handle loan-related questions efficiently.

Enhancing Communication and Transparency

Improved online resources, including FAQs and step-by-step guides, could also alleviate some of the burden on the phone support system. Proactive communication about loan eligibility, terms, and repayment options can empower employees to make informed decisions.

Regular training sessions for Walmart HR staff on 401(k) loan procedures can also equip them to provide initial guidance and direct employees to the appropriate resources. Increased transparency and accessibility are crucial for ensuring that Walmart employees can effectively manage their retirement savings and access loans when needed.

Looking Ahead

Addressing the communication gaps surrounding Merrill Lynch Walmart 401(k) loans requires a concerted effort from both Walmart and Merrill Lynch. Improving access to dedicated support, enhancing online resources, and promoting proactive communication are essential steps towards empowering employees to make informed financial decisions and secure their retirement futures.

The coming months will be crucial to observe whether these companies take corrective action to improve communication and support for their employees.