Metro 2 Compliance Credit Repair Software

The credit repair industry is undergoing a significant shift with the increased adoption of Metro 2 Compliance credit repair software. This software aims to streamline and standardize the often-complex process of disputing inaccurate information on credit reports, promising greater efficiency for credit repair businesses and, potentially, improved outcomes for consumers.

The rise of Metro 2 Compliance software highlights a growing need for automation and accuracy within the credit repair sector. Its adoption signifies a move towards greater transparency and standardization in handling consumer credit data. This development warrants careful examination for its potential benefits and challenges.

What is Metro 2 Compliance?

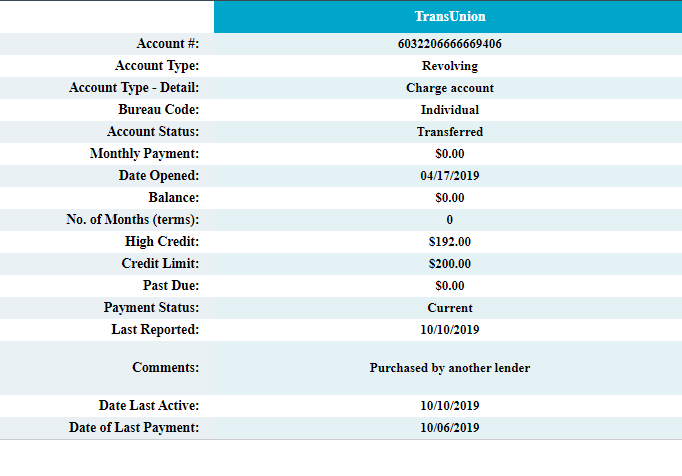

Metro 2 Compliance refers to adherence to the Metro 2 reporting format, a standardized data format used by credit bureaus (Experian, Equifax, and TransUnion) for reporting consumer credit information. Credit repair software designed with Metro 2 Compliance focuses on generating dispute letters and managing client data in a format compatible with these bureaus' systems. This compatibility theoretically speeds up the dispute resolution process.

The software generally includes features such as data import from credit reports, automated dispute letter generation, client management tools, and reporting functionalities. It aims to assist credit repair agencies in efficiently managing a large volume of cases while adhering to regulatory guidelines.

Who is Using It?

The primary users of Metro 2 Compliance credit repair software are credit repair organizations and agencies. These businesses leverage the software to improve operational efficiency and client outcomes. Some individual consumers with extensive knowledge of credit reporting laws also utilize these tools.

Several companies offer various Metro 2 Compliance credit repair software solutions, targeting different segments within the credit repair industry. Software vendors often provide training and support to help users navigate the complexities of credit reporting and dispute processes.

Key Features and Benefits

The touted benefits of Metro 2 Compliance credit repair software center around efficiency and accuracy. By automating dispute letter creation and data management, agencies can handle more cases with fewer errors.

Standardized data formats and reporting help to ensure that disputes are accurately submitted and processed by credit bureaus. This leads to a potentially faster resolution of inaccurate credit information. Many vendors claim improvements in client credit scores and quicker turnaround times.

The software typically offers features like automated credit report imports, dispute letter templates, and tracking tools. These features assist credit repair businesses in maintaining compliance with regulations like the Fair Credit Reporting Act (FCRA).

Potential Drawbacks and Concerns

While Metro 2 Compliance software offers numerous advantages, potential drawbacks exist. The effectiveness of the software depends on the accuracy of the initial credit data and the user's understanding of credit reporting laws.

Automating the dispute process does not guarantee a successful outcome. Credit bureaus may still require additional documentation or verification to validate disputes. Over-reliance on automation without proper human oversight could lead to ineffective or even harmful practices.

Moreover, the cost of Metro 2 Compliance software can be a barrier for smaller credit repair businesses. Training and ongoing maintenance also contribute to the overall expense. The software must be used ethically and in compliance with all relevant laws to avoid legal repercussions.

Impact on the Credit Repair Industry

The widespread adoption of Metro 2 Compliance software is reshaping the credit repair landscape. It is driving a shift towards more standardized and data-driven practices. This increasing reliance on technology has the potential to either greatly help or greatly hinder consumer credit.

Credit repair businesses that effectively leverage the software may gain a competitive advantage by offering faster and more reliable services. Conversely, those that fail to adapt to this technological change risk falling behind. There is the added potential for fraud.

The standardization facilitated by Metro 2 Compliance software may also lead to greater scrutiny from regulatory agencies. Agencies like the Federal Trade Commission (FTC) are likely to pay close attention to how credit repair businesses utilize this technology to ensure compliance with consumer protection laws.

Looking Ahead

The future of credit repair will likely involve further integration of technology and automation. Metro 2 Compliance software represents an important step in this evolution.

As technology advances, expect even more sophisticated tools that incorporate artificial intelligence and machine learning. These advancements will automate data analysis and personalize dispute strategies.

However, it is crucial to remember that technology is only a tool. The ultimate success of credit repair depends on ethical practices, consumer education, and a thorough understanding of credit reporting laws. Consumer advocates, like those at the National Consumer Law Center (NCLC), emphasize the importance of informed decision-making when seeking credit repair services and caution against unrealistic promises.

The impact of Metro 2 Compliance on the broader financial ecosystem should continue to be assessed. It's crucial to understand how the use of automated systems can benefit or harm consumers. Only continued and transparent evaluation can ensure that technology serves as a force for positive change in credit repair.