Mondelez Q1 2025 Earnings Date April 2025

Imagine the scent of freshly baked Oreos wafting through the air, a comforting aroma that evokes childhood memories and simple joys. Now, picture the bustling headquarters of Mondelez International, a global snacking powerhouse, as they prepare to unveil their first quarter earnings for 2025 in April. The anticipation is palpable, not just for the executives crunching the numbers, but for investors, analysts, and snack enthusiasts worldwide eager to see how their favorite treats are performing.

At the heart of this excitement lies the upcoming Mondelez Q1 2025 earnings report, a critical indicator of the company's performance and strategic direction. This report will provide vital insights into Mondelez's revenue growth, profitability, and market share across its diverse portfolio of iconic brands, shaping investor confidence and influencing future business decisions.

A Sweet Legacy: The Mondelez Story

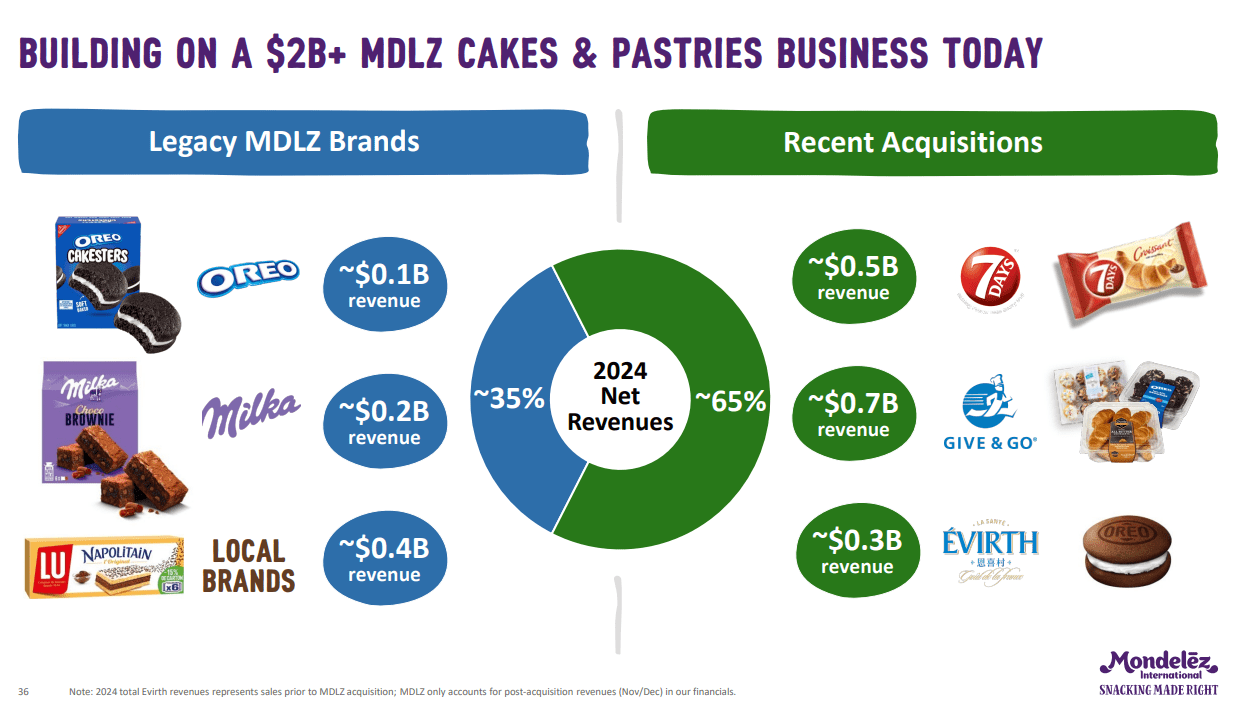

The story of Mondelez International is one of delicious evolution. Born from the Kraft Foods split in 2012, Mondelez inherited a treasure trove of beloved snack brands like Oreo, Cadbury, Toblerone, and Ritz.

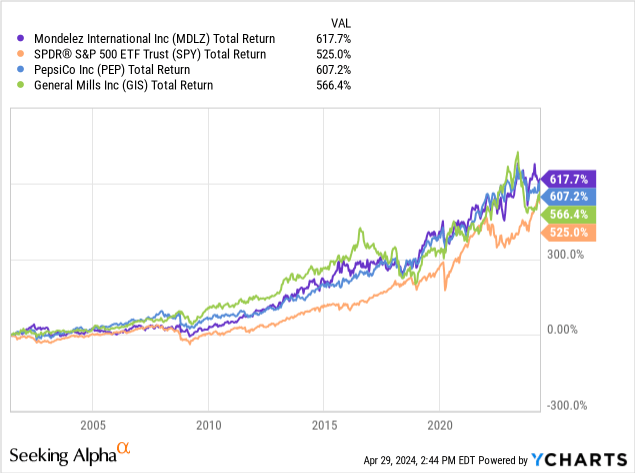

This portfolio provided a solid foundation for growth. Since its inception, the company has focused on expanding its global footprint and adapting to changing consumer preferences.

Mondelez has strategically invested in emerging markets and innovative product development, positioning itself as a leader in the global snacking landscape.

Navigating the Shifting Tides of Snacking

The snacking industry is anything but static. Consumer tastes are constantly evolving, influenced by health trends, convenience demands, and a desire for new and exciting flavors.

Mondelez faces challenges such as rising ingredient costs, increased competition from smaller brands, and the need to cater to diverse dietary needs.

To stay ahead, the company has been actively innovating with healthier options, plant-based alternatives, and convenient on-the-go formats.

What to Watch For in the Q1 2025 Report

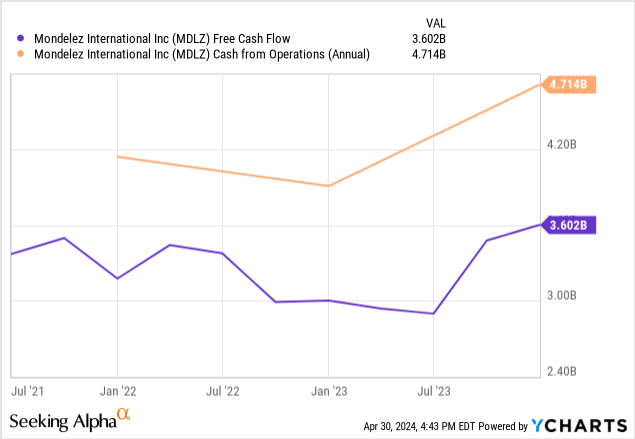

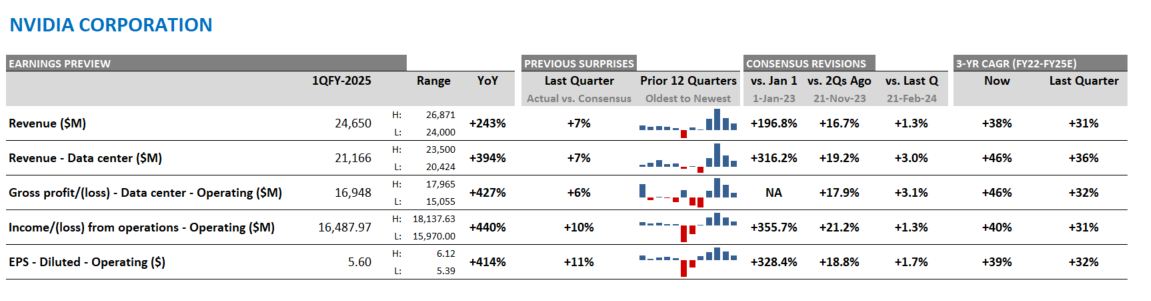

The upcoming earnings report will be scrutinized for several key metrics. Revenue growth, both organic and overall, will indicate the company's ability to expand its market share and adapt to changing consumer demand.

Profitability margins, including gross profit and operating income, will reveal how effectively Mondelez is managing costs and optimizing its operations.

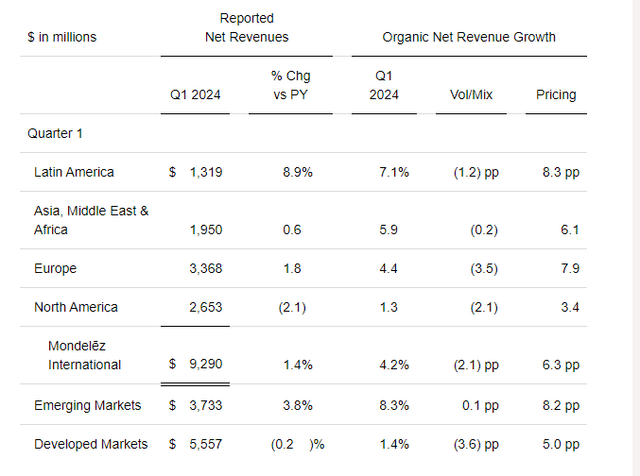

Analysts will also pay close attention to the performance of specific product categories and geographic regions. This will highlight areas of strength and potential areas for improvement.

Revenue Growth: The Top Line Story

Revenue growth is a primary indicator of a company's overall health. Investors will be keen to see if Mondelez can maintain its momentum in key markets and drive sales through innovation and marketing initiatives.

Organic revenue growth, which excludes the impact of acquisitions and currency fluctuations, will provide a clearer picture of the company's underlying performance.

A strong revenue performance would signal that Mondelez is effectively capturing consumer demand and capitalizing on growth opportunities.

Profitability: The Bottom Line Matters

While revenue is important, profitability is the ultimate measure of a company's success. Investors will analyze Mondelez's gross profit margin and operating income margin to assess its ability to generate profits from its sales.

Factors like raw material costs, manufacturing efficiency, and pricing strategies can significantly impact profitability.

Strong profit margins would indicate that Mondelez is managing its costs effectively and generating healthy returns for its shareholders.

Regional Performance: A Global Perspective

Mondelez operates in a diverse range of markets around the world. The Q1 report will provide insights into the company's performance in different geographic regions, such as North America, Europe, and Asia.

This regional breakdown will highlight areas of strength and potential challenges. It will show where Mondelez is experiencing strong growth and where it may need to adjust its strategies.

Emerging markets, in particular, are often a key area of focus, as they offer significant growth potential.

The Analyst's Eye: Expert Predictions

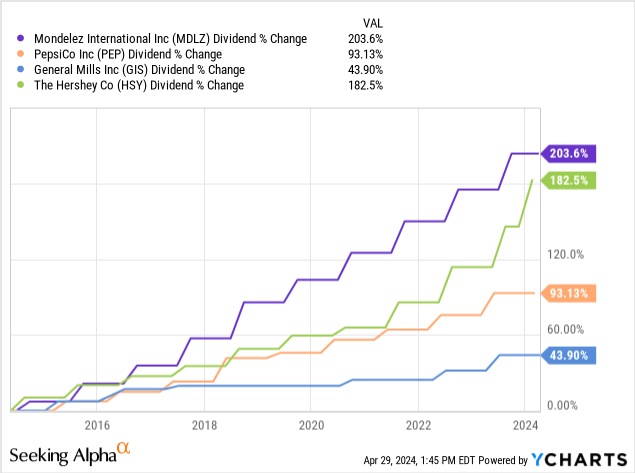

Ahead of the earnings release, financial analysts will be busy crunching their own numbers and making predictions about Mondelez's performance.

These analysts consider factors such as macroeconomic trends, industry dynamics, and the company's past performance to arrive at their estimates.

Their insights can influence investor sentiment and impact the company's stock price.

Analyst expectations for Mondelez's Q1 2025 earnings will be closely watched by investors. Meeting or exceeding these expectations can boost investor confidence, while falling short could lead to a decline in the stock price.

Beyond the Numbers: The Human Element

While the earnings report focuses on financial metrics, it's important to remember the human element behind the numbers. Mondelez employs thousands of people around the world, from factory workers to executives.

Their dedication and hard work are essential to the company's success. The company's performance also affects its relationships with suppliers, distributors, and retailers.

Ultimately, Mondelez's success depends on its ability to create value for all of its stakeholders, not just its shareholders.

Looking Ahead: Challenges and Opportunities

The future for Mondelez, like that of any global corporation, is paved with both challenges and opportunities. Adapting to evolving consumer preferences remains paramount. This means embracing innovation, exploring healthier options, and staying attuned to emerging trends.

Sustainable sourcing and environmental responsibility are also becoming increasingly important. Consumers are demanding more from the companies they support, expecting them to operate ethically and minimize their environmental impact.

By addressing these challenges and capitalizing on its strengths, Mondelez can continue to thrive in the ever-changing snacking landscape.

A Taste of the Future

As April 2025 approaches, the anticipation surrounding Mondelez's Q1 earnings continues to build. The report will offer a valuable snapshot of the company's performance and provide clues about its future direction.

Whether you're an investor, an analyst, or simply a fan of Oreo cookies, the Mondelez story is one worth following.

It's a story of delicious treats, global reach, and the constant pursuit of innovation in a dynamic and competitive market. The Mondelez Q1 2025 earnings are more than just numbers; they tell a story of a snacking empire navigating a complex world.