What Is The Difference Between Temporary Staffing Services And A Peo

Imagine navigating the complexities of hiring, payroll, and benefits, only to realize you're missing a crucial piece of the puzzle. Businesses often grapple with the choice between temporary staffing services and a Professional Employer Organization (PEO), each offering distinct solutions to workforce management. Understanding their differences is critical for optimizing efficiency and compliance.

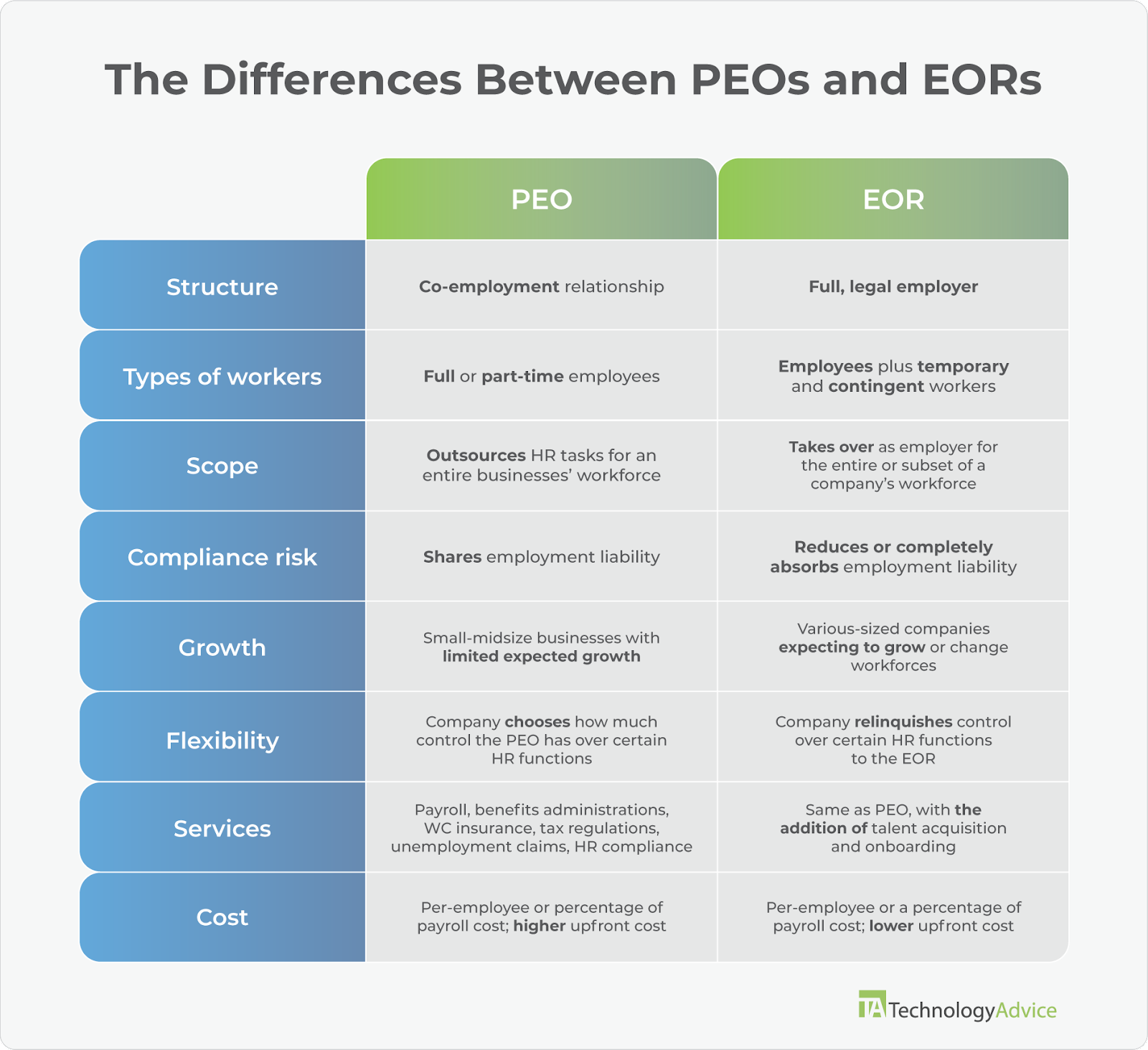

The core distinction lies in the scope of services and the legal relationship established. Think of temporary staffing as a short-term solution for filling immediate needs, while a PEO involves a co-employment partnership designed for long-term HR management. This article dissects the nuances between these two models, equipping businesses with the knowledge to make informed decisions.

Temporary Staffing Services: Filling Immediate Gaps

Temporary staffing agencies, like Manpower or Adecco, primarily focus on providing workers for short-term or project-based assignments. These agencies act as the employer of record, handling payroll and associated taxes for the temporary employees.

Businesses leverage temporary staffing to address fluctuating workloads, cover employee absences, or test potential candidates before offering permanent positions. According to the American Staffing Association (ASA), temporary staffing allows companies to quickly adjust their workforce size to meet changing market demands.

However, the employer retains significant control over the temporary employee's day-to-day activities and responsibilities. The relationship is transactional, focused on filling a specific need for a defined period.

Key Features of Temporary Staffing

Speed and Flexibility: Quick access to qualified workers for immediate needs. Limited Scope: Primarily focused on recruitment and payroll administration. Employer Control: The client company retains direct management oversight.

Cost-Effective for Short-Term Needs: Ideal for project-based work or seasonal fluctuations. No Co-Employment Relationship: The staffing agency is the sole employer of record. These features are beneficial for companies that need immediate access to talent with minimal long term commitment.

Professional Employer Organizations (PEOs): A Comprehensive HR Solution

PEOs, such as ADP TotalSource or TriNet, offer a more comprehensive suite of HR services through a co-employment arrangement. In this model, the PEO becomes a co-employer, sharing certain employer responsibilities and liabilities with the client company.

This co-employment relationship allows the PEO to leverage its size to negotiate better rates for employee benefits, such as health insurance and retirement plans. A 2023 study by the National Association of Professional Employer Organizations (NAPEO) found that businesses using PEOs often experience reduced employee turnover and increased profitability.

PEOs handle a wide range of HR functions, including payroll, benefits administration, compliance, risk management, and employee training. This enables businesses to focus on their core competencies while outsourcing complex HR tasks.

Key Features of PEOs

Co-Employment Relationship: Shared employer responsibilities and liabilities. Comprehensive HR Services: Wide range of services including payroll, benefits, compliance, and HR support.

Cost Savings on Benefits: Access to better rates on health insurance and other benefits. Reduced Administrative Burden: Frees up internal resources to focus on core business activities. Improved Compliance: Expertise in navigating complex labor laws and regulations.

Making the Right Choice

The decision between temporary staffing and a PEO hinges on a company's specific needs and goals. If the priority is filling short-term staffing gaps and maintaining complete control over employees, temporary staffing is likely the better choice.

However, if a business seeks a long-term partner to handle comprehensive HR functions, improve benefits, and reduce administrative burdens, a PEO may be the more strategic option. Consider the long-term benefits and costs when evaluating each solution.

Ultimately, carefully assessing workforce needs, growth plans, and risk tolerance will guide businesses toward the most effective and beneficial solution. Consulting with HR professionals and conducting thorough due diligence is crucial before making a final decision.