Credit Karma Refinance Student Loans

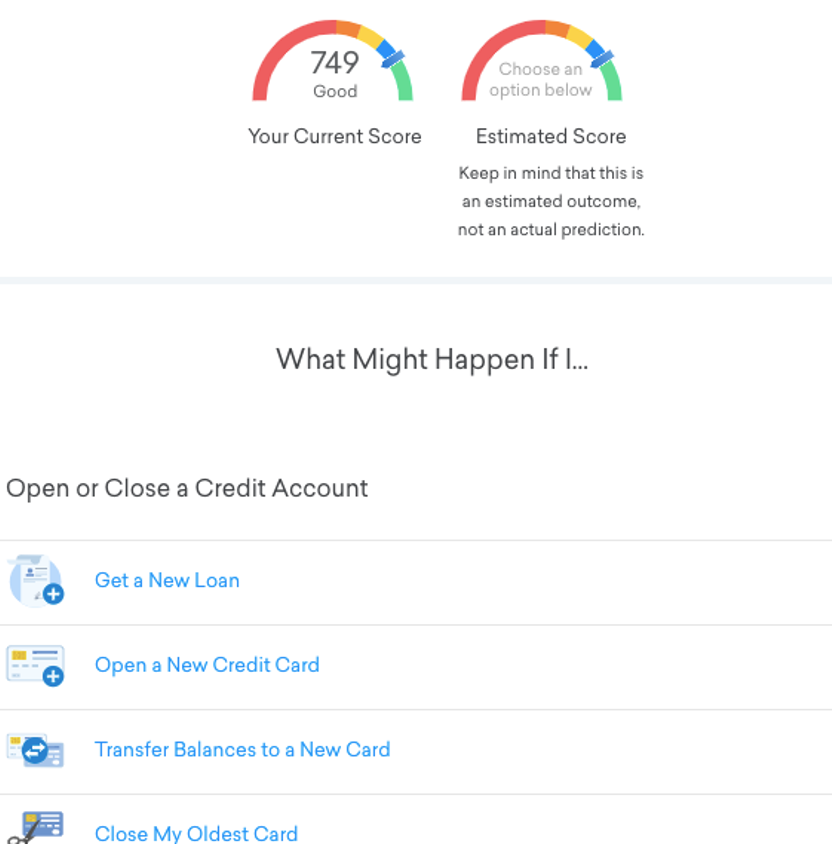

Credit Karma, a popular personal finance company known for its credit score monitoring and financial product recommendations, has expanded its services to include student loan refinancing. This move aims to provide borrowers with more options for managing their student debt and potentially securing lower interest rates.

The expansion into student loan refinancing marks a significant step for Credit Karma, positioning it as a more comprehensive financial platform. The initiative allows users to compare personalized refinance offers from various lenders directly through the Credit Karma platform, streamlining the often complex process of finding the best refinancing options.

Key Details of the Credit Karma Student Loan Refinance Platform

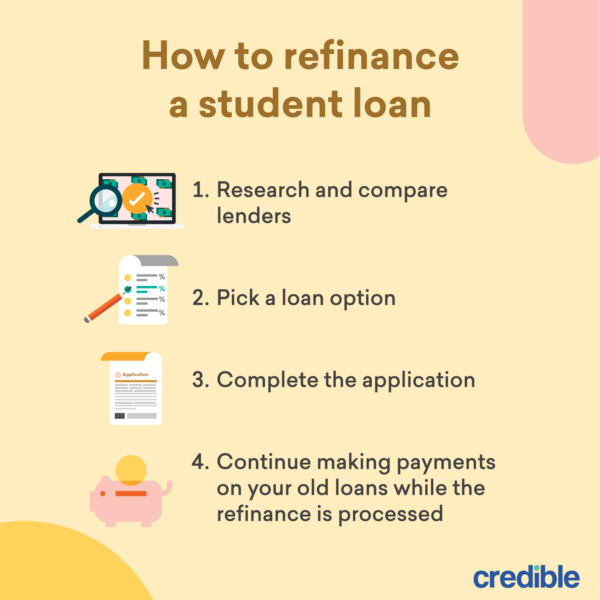

The Credit Karma student loan refinance platform operates as a marketplace, partnering with multiple lenders to present users with a range of refinancing options.

Users can input their loan information, income details, and credit history to receive customized rate quotes from participating lenders. This eliminates the need to individually apply to multiple lenders, saving time and potentially avoiding multiple credit inquiries.

The service is free for Credit Karma users, with the company receiving a commission from lenders when a user successfully refinances their loan through the platform.

Who is Involved?

The primary players are Credit Karma, the student loan borrowers, and the participating lending institutions. Credit Karma acts as the intermediary, connecting borrowers with lenders.

The lenders include a variety of banks, credit unions, and online lending platforms, each with its own eligibility criteria and interest rates.

What is Offered?

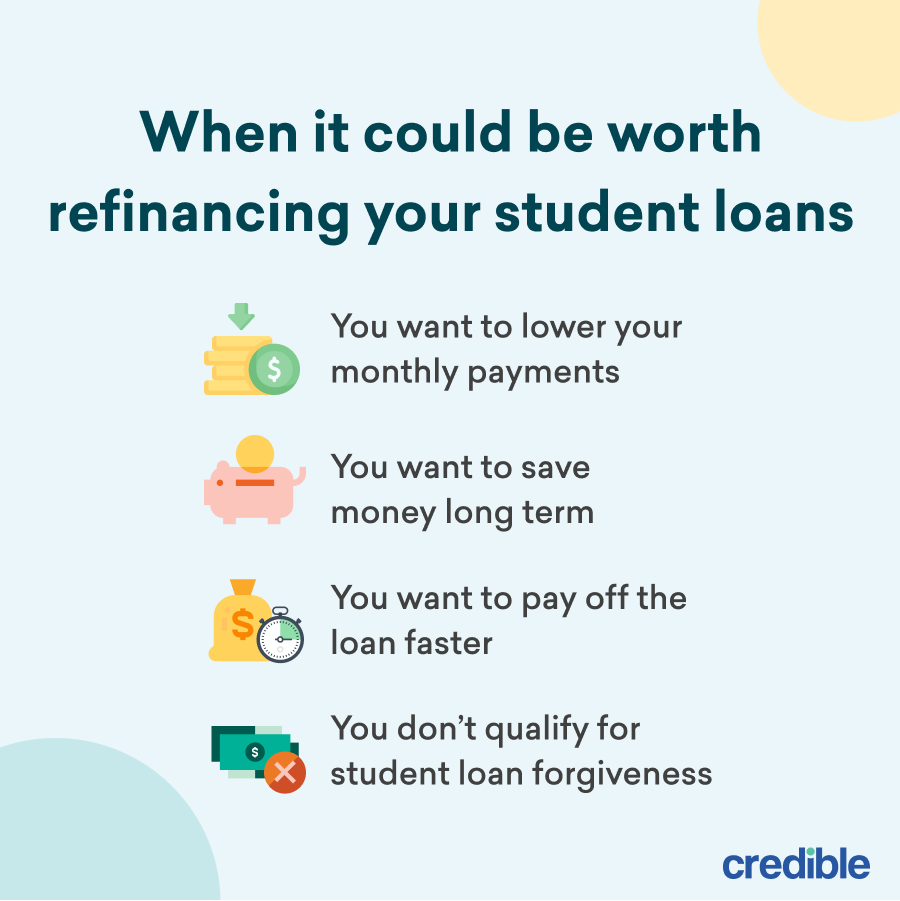

The platform offers a comparison of student loan refinance rates and terms from different lenders. This helps borrowers find potentially lower interest rates, which can reduce their monthly payments and overall repayment amount.

Borrowers can also explore different loan terms to find a repayment schedule that aligns with their financial goals.

Why is this Important?

Student loan debt is a significant burden for millions of Americans. According to the Education Data Initiative, total outstanding student loan debt in the United States exceeds $1.7 trillion.

Refinancing can be a viable option for borrowers seeking to lower their interest rates and manage their debt more effectively. By providing a centralized platform for comparing refinance options, Credit Karma aims to make this process more accessible.

"Our goal is to empower consumers with the tools and information they need to make informed financial decisions," said a Credit Karma spokesperson.

Potential Impact and Considerations

The launch of Credit Karma's student loan refinance platform could have a positive impact on borrowers by increasing transparency and competition in the student loan refinancing market.

The platform's ease of use and comparison tools may encourage more borrowers to explore refinancing as a way to manage their debt. However, it's important for borrowers to carefully consider the terms and conditions of any refinancing offer.

Refinancing federal student loans into private loans can result in the loss of federal benefits, such as income-driven repayment plans and potential loan forgiveness programs. Borrowers should carefully weigh these considerations before making a decision.

Ultimately, the success of Credit Karma's student loan refinance platform will depend on its ability to provide borrowers with competitive rates and a user-friendly experience. As the platform continues to evolve, it could play a significant role in helping borrowers navigate the complexities of student loan debt management.