Monolithic Power Systems Earnings Date April 2025

Monolithic Power Systems (MPS) has set its earnings release date for April 2025. Investors are bracing for potential market movement following the announcement.

This earnings report is crucial, offering a glimpse into MPS's financial health and strategic direction amidst ongoing market fluctuations and technological advancements.

Earnings Date and Expectations

The official earnings release is scheduled for April 2025. Specific date and time will be announced closer to the event.

Analysts and investors will be keenly observing MPS's performance against projected revenue targets and earnings per share (EPS) estimates.

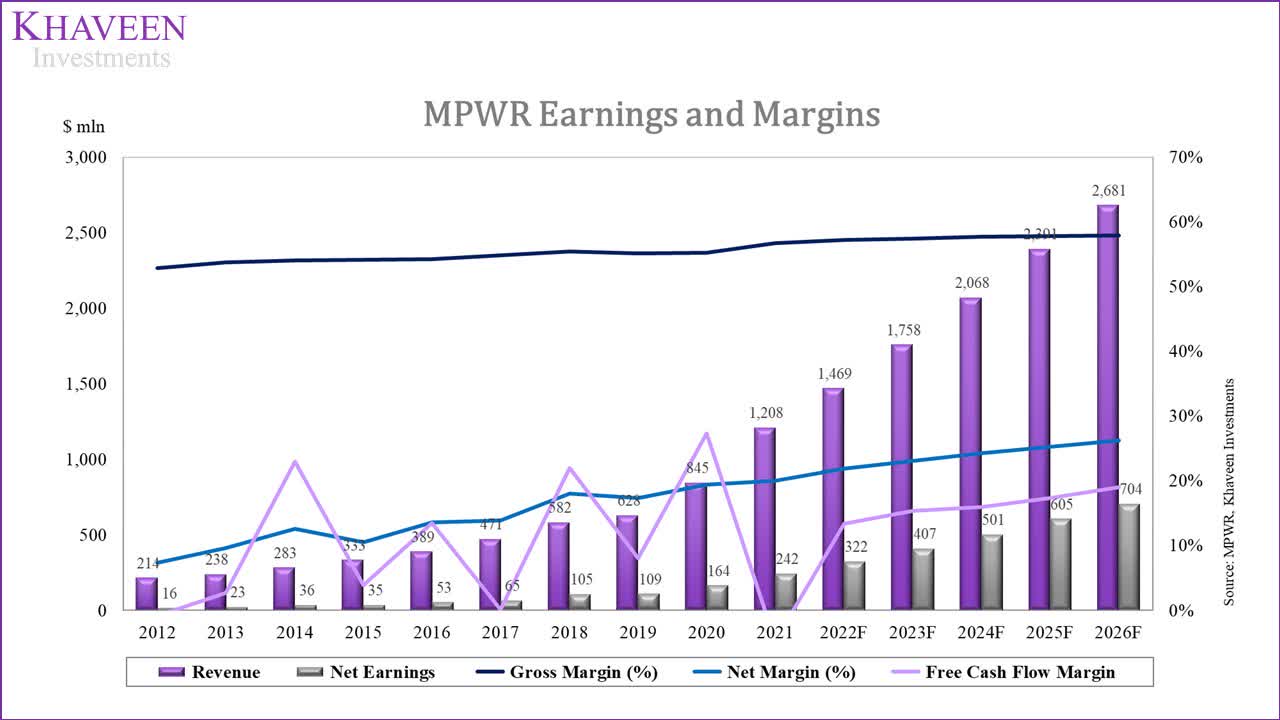

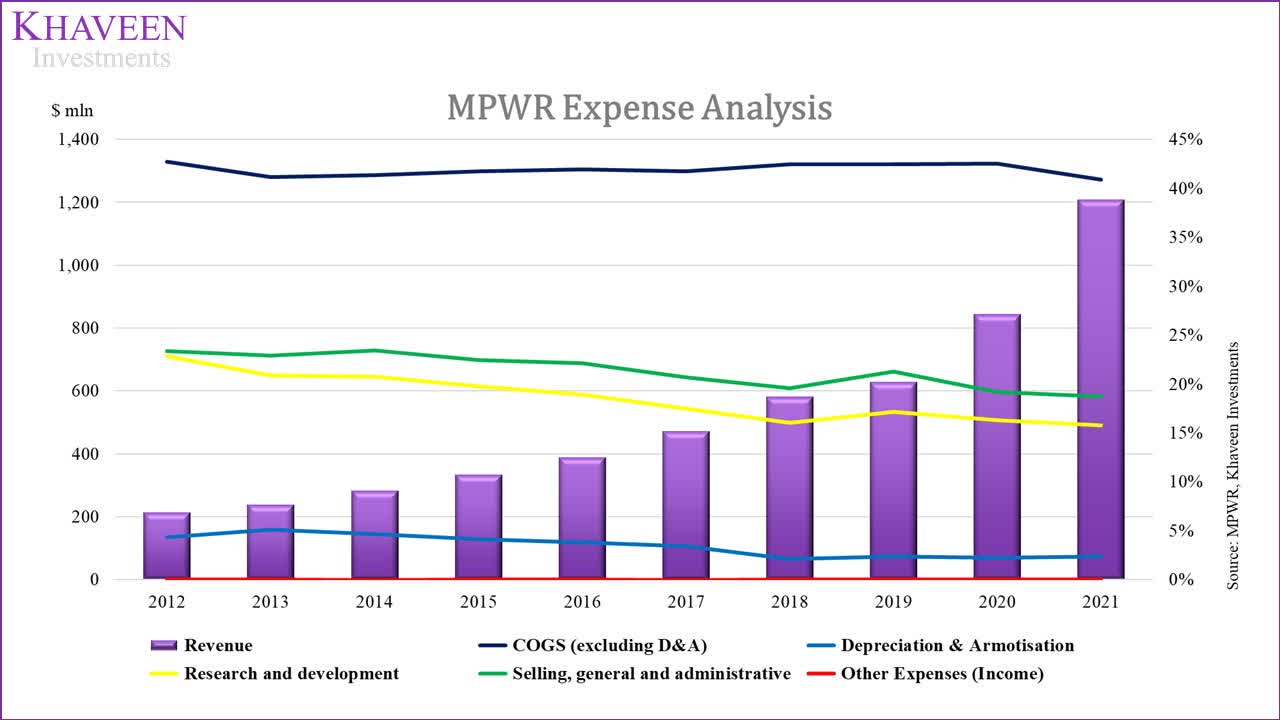

Key metrics will include gross margin, operating income, and net income growth. These numbers provide insight into the company’s operational efficiency and profitability.

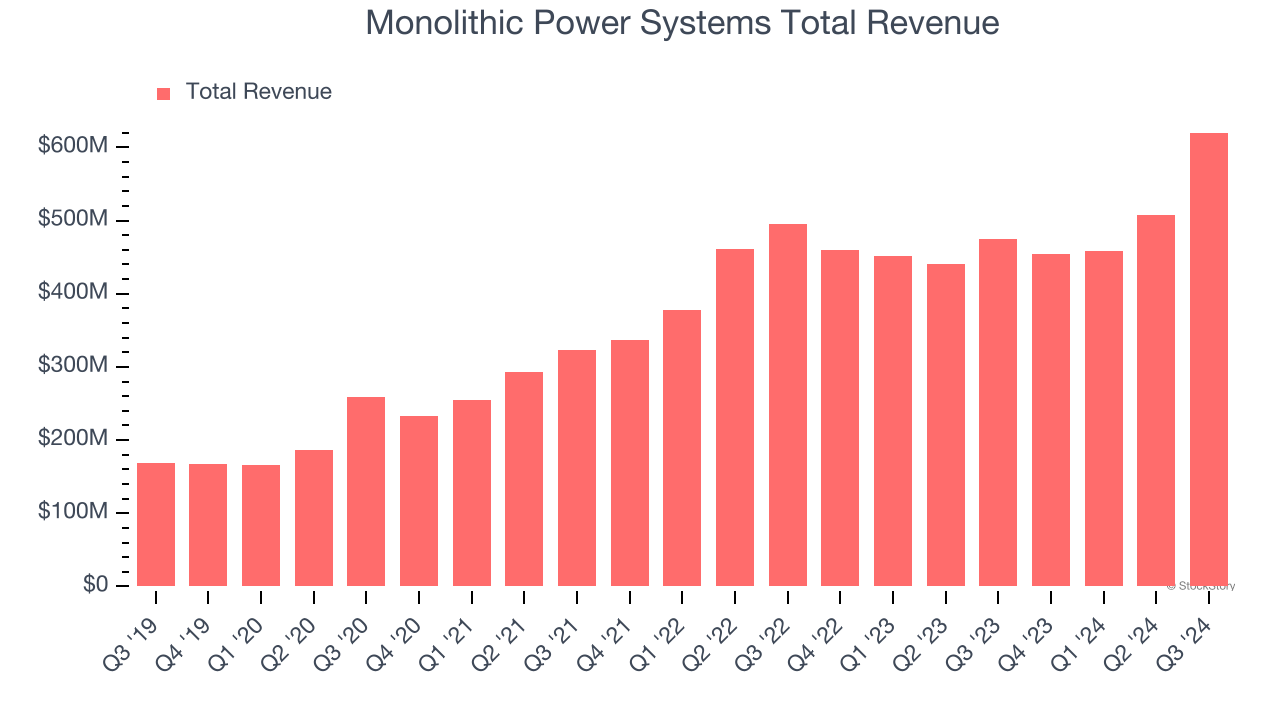

Previous Performance Snapshot

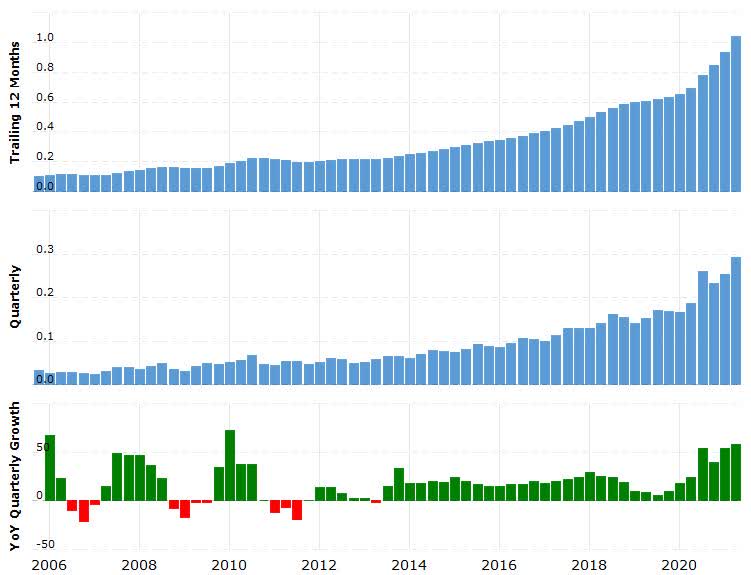

In the past year, Monolithic Power Systems has demonstrated significant growth. This has been driven by increased demand for its power solutions across various sectors.

The company's focus on innovation and expansion into new markets has played a key role. Prior performance has set a high bar for upcoming results.

However, global economic conditions and supply chain challenges could influence the upcoming earnings report. Investor sentiment remains cautiously optimistic.

Factors Influencing MPS's Performance

The demand for MPS's products is closely tied to several industries. These include automotive, industrial, computing, and communications.

Growth in electric vehicle (EV) adoption and increasing automation in manufacturing drive demand. Expansion of 5G networks and data centers also contributes.

Furthermore, geopolitical factors and trade policies can impact MPS's supply chain and market access. These external factors create both opportunities and risks.

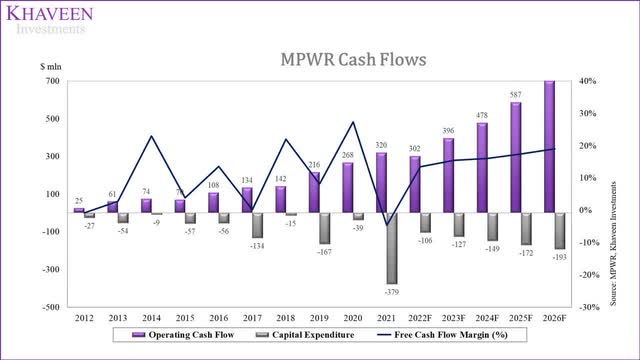

Financial Health Overview

MPS's balance sheet remains strong, characterized by healthy cash reserves. This is enabling strategic investments in research and development.

The company has also been actively managing its debt levels. The debt-to-equity ratio demonstrates financial stability.

A strong financial foundation allows MPS to weather potential economic headwinds and capitalize on growth opportunities. This attracts investor interest.

Market Impact and Investor Strategy

The earnings announcement is expected to have a notable impact on MPS's stock price. Volatility is anticipated in the days following the release.

Investors should closely monitor analyst ratings and price targets following the earnings report. These insights can inform investment decisions.

Long-term investors may view any dips as potential buying opportunities. While short-term traders might seek to profit from price fluctuations.

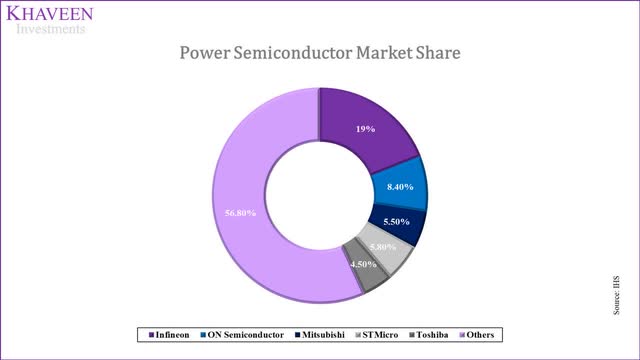

Competitive Landscape

Monolithic Power Systems operates in a highly competitive market. It faces competition from both established players and emerging companies.

The company's technological innovation and product differentiation are key to maintaining its competitive edge. MPS is investing in advanced power solutions to stay ahead.

Continuous monitoring of competitor activities and market trends is essential. This ensures MPS can adapt and thrive in the evolving landscape.

Key Areas to Watch

Pay close attention to the earnings call transcript and investor presentations. This information will provide deeper insights into MPS's strategy.

Assess the management's commentary on future growth prospects and potential challenges. The executives outlook will shape market expectations.

Analyze the breakdown of revenue by geographic region and product category. This will reveal areas of strength and opportunities for improvement.

Looking Ahead

The April 2025 earnings release will be a critical event for Monolithic Power Systems. It will define market perception and future strategy.

Investors should stay informed and prepare for potential market reactions. Diligence research and analysis are recommended.

The company's ability to deliver strong results and navigate the evolving economic landscape will determine its long-term success. Watch for further announcements leading up to the release.

/Monolithic Power System Inc logo magnified-by Casimiro PT via Shutterstock.jpg)