Mortgage Options For People With Bad Credit

Imagine this: the aroma of freshly baked bread wafts through the air, sunlight streams through the window, and you're holding the keys to your very own home. But what if your credit history casts a long shadow, making that dream feel distant? Don't lose heart. Even with a less-than-perfect credit score, owning a home is still attainable.

While navigating the mortgage landscape with bad credit can be challenging, it's certainly not impossible. This article explores the mortgage options available for individuals with lower credit scores, providing insights into securing a loan and paving your way to homeownership.

Understanding the Landscape

A lower credit score often translates to higher interest rates and stricter lending requirements. Lenders view individuals with bad credit as higher risk borrowers, increasing the cost of borrowing to offset that risk.

According to Experian, a good credit score generally falls between 670 to 739. Scores below that range might require exploring specialized mortgage options. It's essential to know where you stand before diving in.

The FHA Loan: A Popular Choice

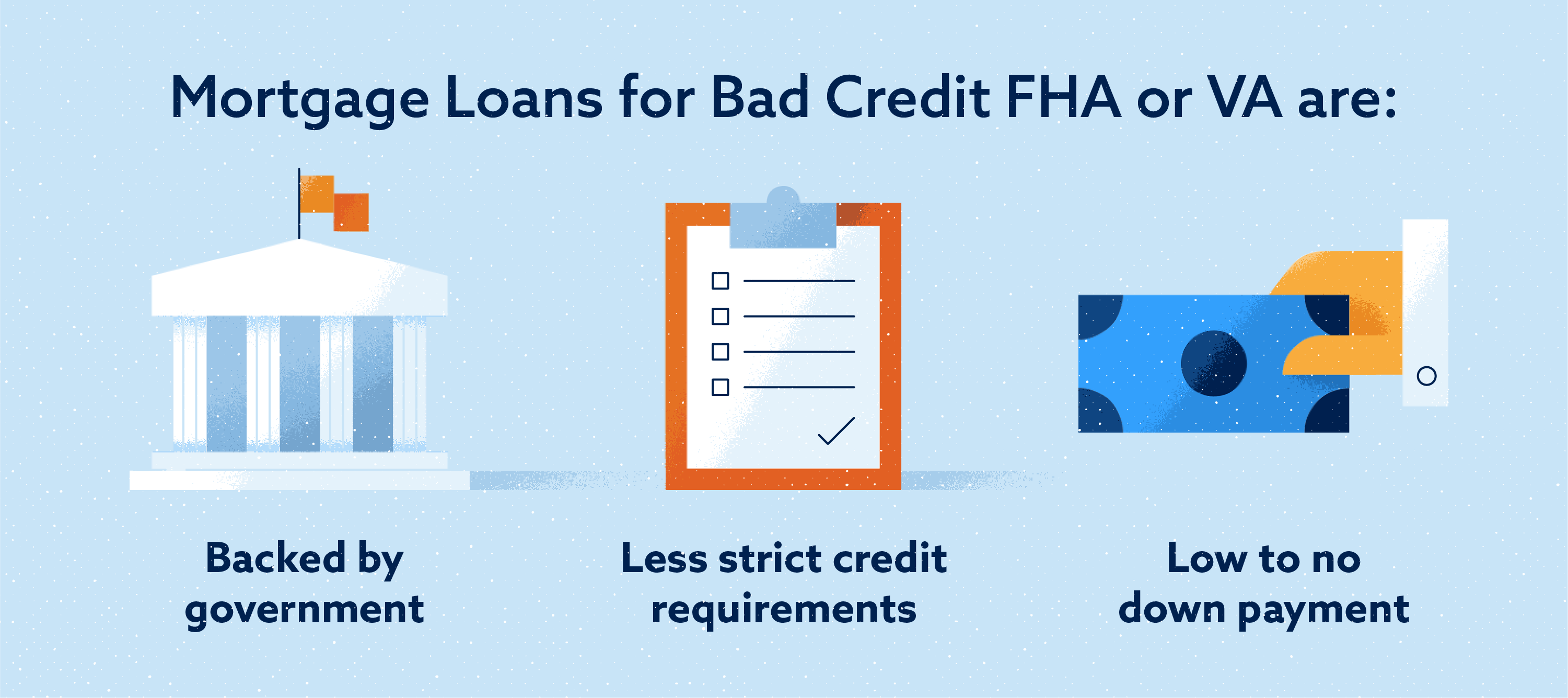

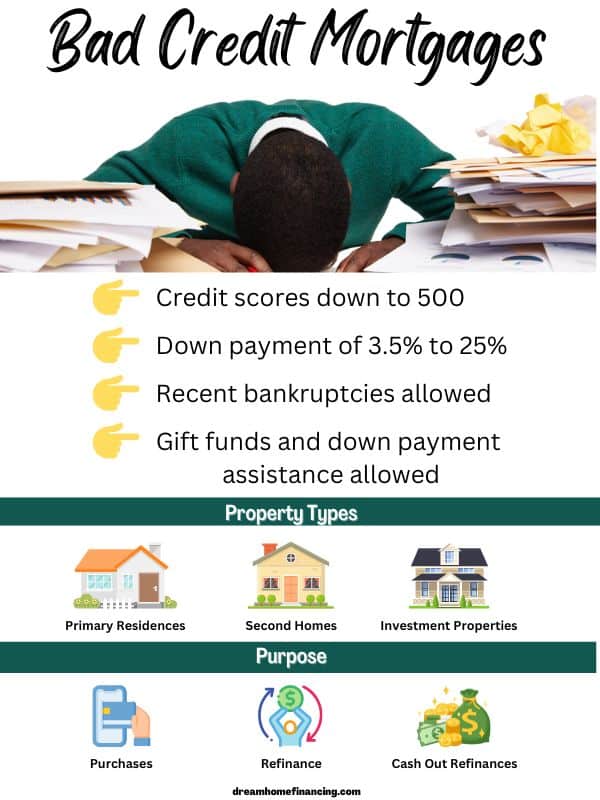

FHA loans, insured by the Federal Housing Administration, are a favorite among first-time homebuyers and those with lower credit scores. They often require a lower down payment (as low as 3.5%) and have more flexible credit requirements compared to conventional loans.

According to HUD (Housing and Urban Development), the minimum credit score for an FHA loan can be as low as 500 with a 10% down payment. With a credit score of 580 or higher, you may only need a 3.5% down payment.

VA Loans: Serving Those Who Served

VA loans, guaranteed by the U.S. Department of Veterans Affairs, are available to eligible veterans, active-duty military personnel, and surviving spouses. These loans often require no down payment and don't have private mortgage insurance (PMI) requirements.

While the VA doesn't set a minimum credit score, lenders still have their own requirements. Often, they are more lenient compared to conventional loans. This makes them an attractive option for veterans with imperfect credit histories.

USDA Loans: Rural Opportunities

USDA loans, offered by the U.S. Department of Agriculture, assist low- to moderate-income borrowers in purchasing homes in eligible rural areas. These loans often require no down payment and are backed by the federal government.

Like VA loans, USDA loans don't have a set minimum credit score, but lenders will assess creditworthiness. These loans can open doors to homeownership for those seeking a quieter, more rural lifestyle.

Improving Your Chances

Regardless of the loan type you pursue, improving your credit score is always beneficial. Even a small increase can significantly impact your interest rate and loan terms.

Paying bills on time, reducing credit card debt, and disputing errors on your credit report are all effective strategies. Patience and consistency are key to rebuilding your credit.

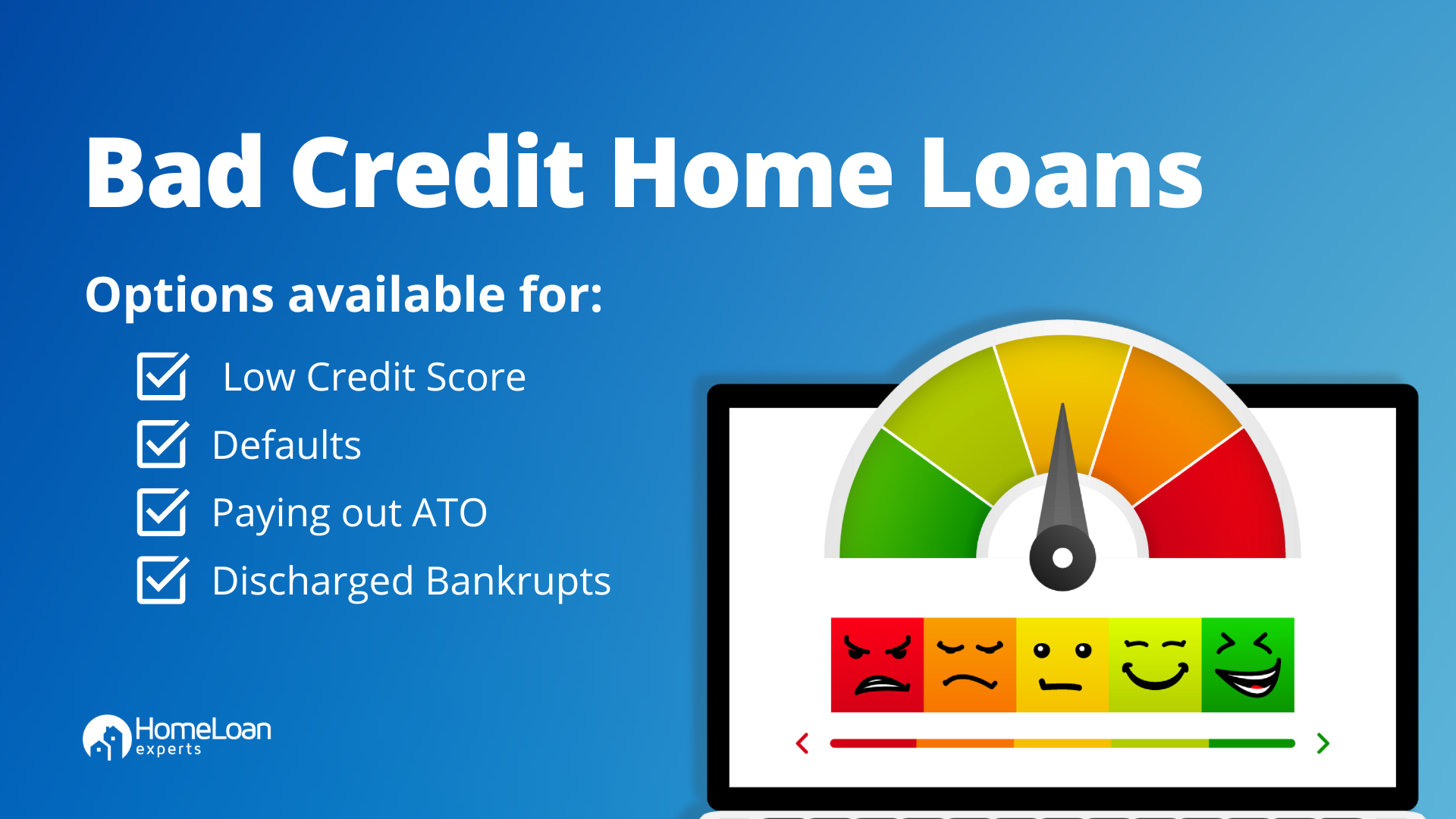

Consider working with a mortgage broker specializing in bad credit loans. These professionals have access to a wider range of lenders and can help you navigate the complexities of the mortgage process.

A Brighter Future

Homeownership, even with bad credit, isn't just a fleeting dream; it's an achievable goal. By exploring different loan options, improving your credit score, and seeking expert guidance, you can unlock the door to your new home.

The journey might require persistence and dedication, but the reward of owning a home is well worth the effort. Remember, your past doesn't define your future; it simply informs your path forward.

So, keep your dream alive. Take those first steps towards financial empowerment and embark on the exciting adventure of homeownership. Your perfect home awaits!

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)