Most User Friendly Accounting Software

The quest for user-friendly accounting software is no longer a luxury, but a necessity for businesses striving for efficiency and accuracy. From small startups grappling with their first ledgers to established enterprises seeking streamlined financial management, the demand for intuitive and accessible accounting solutions is surging.

This article delves into the landscape of accounting software, identifying leading contenders lauded for their ease of use, features, and affordability. We'll explore the key attributes that define user-friendliness, examine the offerings of prominent players, and consider the future trends shaping the industry, all with the aim of guiding businesses towards the optimal choice for their unique needs.

Defining User-Friendliness in Accounting Software

What exactly constitutes user-friendly accounting software? Beyond a visually appealing interface, it encompasses several critical elements.

These include intuitive navigation, comprehensive help resources, and a gentle learning curve for users with varying levels of accounting expertise. Furthermore, seamless integration with other business applications, such as CRM and e-commerce platforms, is paramount.

Key Features of User-Friendly Software

Several features contribute to a positive user experience. These often include automated bank reconciliation, customizable dashboards providing a snapshot of key performance indicators (KPIs), and mobile accessibility, allowing users to manage finances on the go.

The ability to generate insightful reports effortlessly is also crucial for informed decision-making.

Top Contenders in the User-Friendly Accounting Software Arena

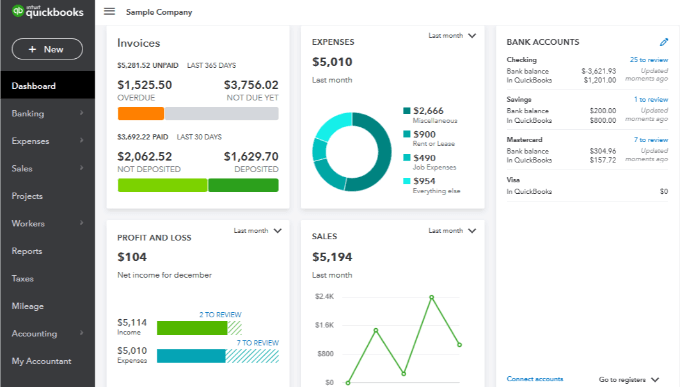

The market offers a plethora of accounting software options, but a few stand out for their commitment to user-friendliness. QuickBooks Online, a long-standing leader, is widely recognized for its intuitive interface and extensive feature set.

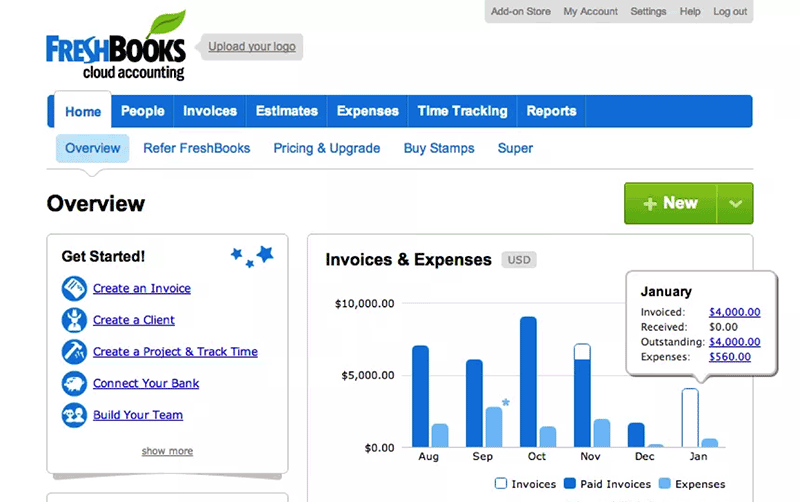

Xero is another popular choice, particularly among small businesses, boasting a clean design and robust cloud-based functionality. FreshBooks, initially designed for freelancers and service-based businesses, provides a simplified approach to invoicing and expense tracking.

Zoho Books offers a comprehensive suite of features within the broader Zoho ecosystem, known for its affordability and scalability.

Comparing Features and Pricing

Each software has its strengths and weaknesses. QuickBooks Online, while feature-rich, can sometimes feel overwhelming for novice users, and its pricing structure can be complex.

Xero's simplicity may limit its functionality for larger, more complex organizations. FreshBooks, while excellent for invoicing, may lack the in-depth reporting capabilities required by some businesses. Zoho Books, while budget-friendly, might not have the same level of brand recognition as its competitors.

Ultimately, the ideal choice depends on the specific needs and budget of the business. Most providers offer free trials or demos, allowing businesses to test the software firsthand before committing to a subscription.

The Impact of AI and Automation

Artificial intelligence (AI) and automation are increasingly shaping the future of accounting software. AI-powered features, such as automated transaction categorization and fraud detection, are streamlining processes and enhancing accuracy.

Automation is further simplifying tasks like bank reconciliation and invoice processing, freeing up valuable time for businesses to focus on strategic initiatives. According to a report by *Gartner*, AI adoption in finance is expected to grow significantly in the coming years, transforming the way businesses manage their finances.

Choosing the Right Solution

Selecting the most user-friendly accounting software requires careful consideration. Businesses should start by defining their specific needs and priorities, considering factors such as the size of the business, the industry, and the level of accounting expertise within the organization.

Reading reviews, comparing features, and taking advantage of free trials are essential steps in the decision-making process. Consulting with an accountant or financial advisor can also provide valuable insights.

The Future of User-Friendly Accounting

The future of accounting software is undoubtedly geared towards even greater user-friendliness and accessibility. We can anticipate further advancements in AI and automation, as well as a growing emphasis on mobile accessibility and seamless integration with other business applications.

Software vendors will likely continue to prioritize user feedback and refine their interfaces to create truly intuitive and empowering accounting solutions. By embracing these advancements, businesses can unlock new levels of efficiency, accuracy, and financial control.