Mr Cooper Class Action Lawsuit Payout Per Person

Imagine opening your mailbox, not to bills or junk mail, but to a check representing a small measure of justice. For thousands of homeowners who felt wronged by Mr. Cooper, that day has arrived, or is soon to. The settlement in the class action lawsuit against the mortgage servicing giant is finally being distributed, offering a tangible resolution to years of alleged misconduct.

The heart of this news focuses on the Mr. Cooper class action lawsuit settlement and, more specifically, the payout amounts individuals can expect to receive. While the exact figures vary depending on the nature and extent of the harm experienced, this article will explore the factors influencing those payouts and provide context to understand what this settlement means for affected homeowners.

Background of the Lawsuit

The class action lawsuit, officially known as In re: Mr. Cooper Mortgage Servicing Litigation, alleged a range of misconduct related to Mr. Cooper's mortgage servicing practices. Plaintiffs claimed that Mr. Cooper, one of the nation's largest mortgage servicers, engaged in practices that resulted in improper fees, inaccurate account statements, and mishandling of escrow accounts.

These alleged errors, according to the lawsuit, led to significant financial distress for homeowners. Many individuals faced unwarranted late fees. Others experienced difficulties with loan modifications or were wrongly threatened with foreclosure.

Allegations and Key Issues

The core allegations centered on Mr. Cooper's alleged failures to adequately manage escrow accounts. Homeowners argued that the company incorrectly calculated property taxes and insurance premiums.

This resulted in both overpayment and underpayment of escrow funds. These miscalculations created substantial financial burdens for many homeowners, leading to confusion and mistrust.

The lawsuit also targeted Mr. Cooper's communication practices. Plaintiffs argued that the company provided unclear or inaccurate information regarding loan balances, payment histories, and escrow account activity.

This lack of transparency made it difficult for homeowners to effectively manage their mortgages. It fueled frustration and a sense of being misled by the company.

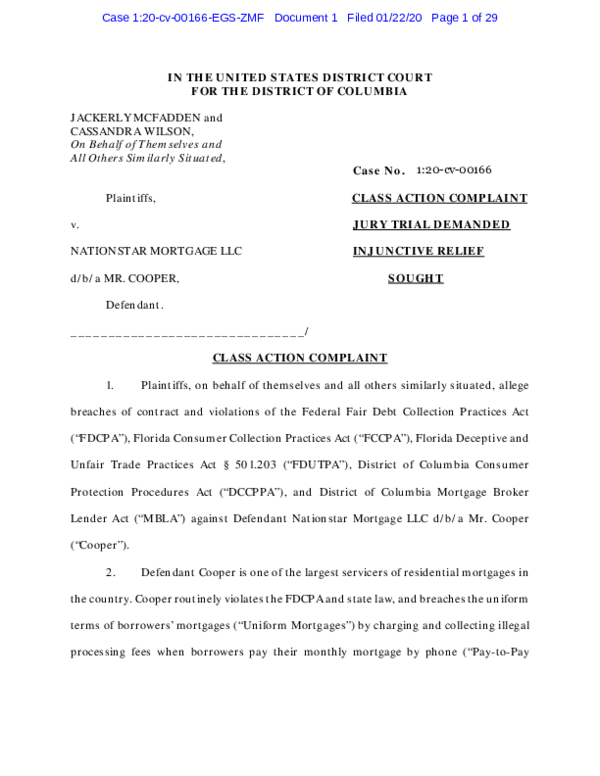

The Settlement Agreement

After considerable legal wrangling, Mr. Cooper agreed to a settlement to resolve the class action lawsuit. While the company did not admit any wrongdoing, the settlement allowed them to avoid a potentially lengthy and costly trial.

The settlement agreement included both monetary compensation and changes to Mr. Cooper's servicing practices. This combination aimed to provide immediate relief to affected homeowners while also preventing future misconduct.

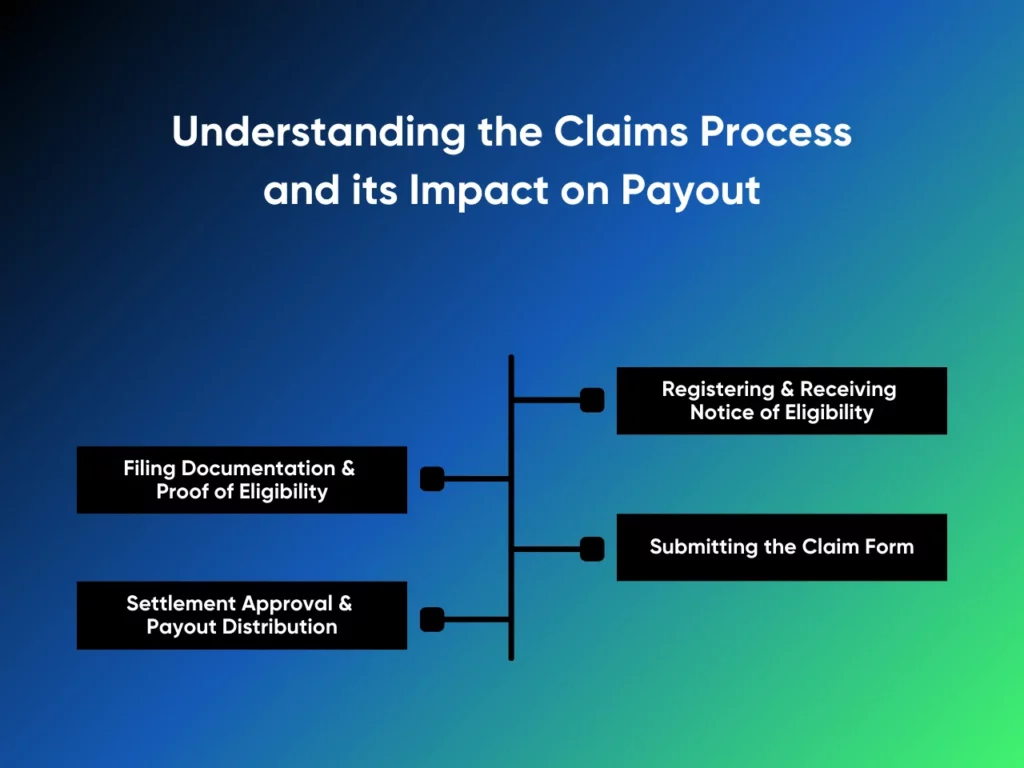

Monetary Compensation: Understanding the Payout

The monetary component of the settlement is what many homeowners are most interested in. However, determining the exact payout per person is complex, as it depends on several factors.

The settlement fund was allocated based on the type and severity of the harm suffered by each individual. Those who experienced significant financial losses or faced foreclosure threats were generally eligible for larger payouts.

Specifically, the settlement administrator categorized claimants based on the nature of their claims. For example, those who experienced escrow account errors received a different level of compensation compared to those who faced improper foreclosure proceedings.

The amount of documentation and evidence submitted by each claimant also played a role. Those who provided strong supporting documentation for their claims were more likely to receive a higher payout.

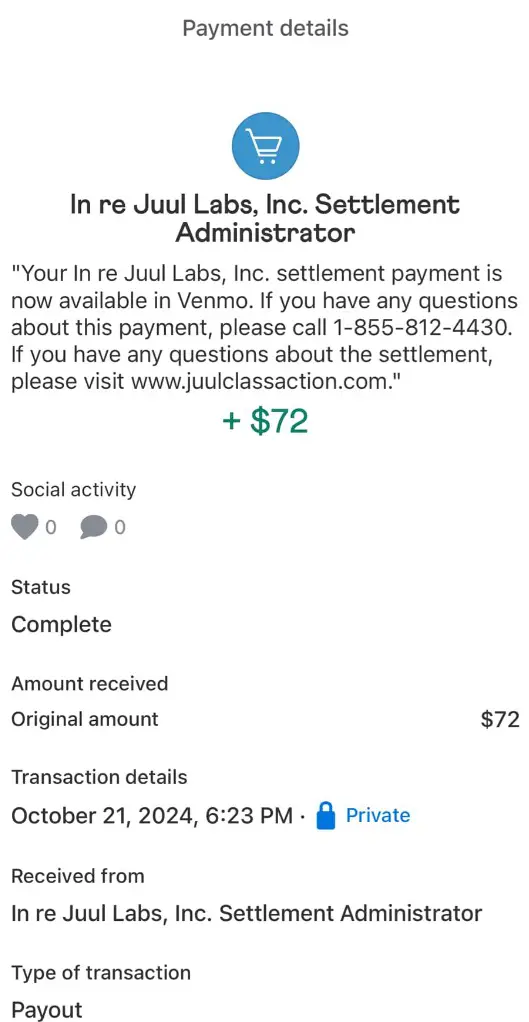

While it's impossible to provide a single average payout amount, reports suggest that payments ranged from a few dollars to several thousand dollars. The specific amount depended on the individual's circumstances and the strength of their claim.

Importantly, the settlement administrator sent notices to eligible class members outlining the specific details of their potential payout. These notices provided clear instructions on how to claim their share of the settlement fund.

Beyond Monetary Relief: Changes in Servicing Practices

The settlement also required Mr. Cooper to implement changes to its mortgage servicing practices. These changes aimed to improve transparency, accuracy, and communication with homeowners.

Mr. Cooper agreed to enhance its escrow account management procedures. They also committed to providing clearer and more accurate account statements.

Furthermore, the company implemented additional training programs for its employees. This ensured that they are properly equipped to handle homeowner inquiries and resolve disputes efficiently.

Impact and Significance

The Mr. Cooper class action settlement represents a significant victory for homeowners. It demonstrates the power of collective action in holding large corporations accountable for their actions.

The settlement serves as a reminder to mortgage servicers of their responsibility to treat homeowners fairly and ethically. It underscores the importance of transparency, accuracy, and clear communication in the mortgage servicing industry.

Furthermore, the case highlights the potential for homeowners to seek legal recourse when they believe they have been wronged by a mortgage servicer. It empowers individuals to stand up for their rights and demand fair treatment.

Conclusion

The distribution of settlement checks to affected homeowners marks the end of a long and often stressful chapter. While the payouts may not fully compensate for the hardship experienced, they represent a tangible form of redress.

This settlement serves as a reminder that even in the face of complex financial systems, individual voices can be heard, and justice, however incremental, can be achieved. It's a testament to the perseverance of homeowners and the importance of consumer protection laws.

Ultimately, the Mr. Cooper class action lawsuit settlement offers a sense of closure for those who felt wronged. It also provides a valuable lesson for the mortgage servicing industry as a whole. Perhaps it is possible to say that big companies would be more responsible from now on.

![Mr Cooper Class Action Lawsuit Payout Per Person Risperdal Lawsuit Payout Per Person 2023 [Updated] - LawGud](https://lawgud.com/wp-content/uploads/2023/10/Risperdal-Lawsuit-Payout-Per-Person-20231.png)