Viva Payday Loans No Credit Check

Financial distress is escalating as Viva Payday Loans No Credit Check faces increasing scrutiny amid claims of predatory lending practices. Consumers are urged to exercise extreme caution when considering short-term loans from this provider.

The company allegedly targets vulnerable individuals with promises of quick cash without credit checks, potentially trapping them in cycles of high-interest debt.

Mounting Concerns Over Loan Practices

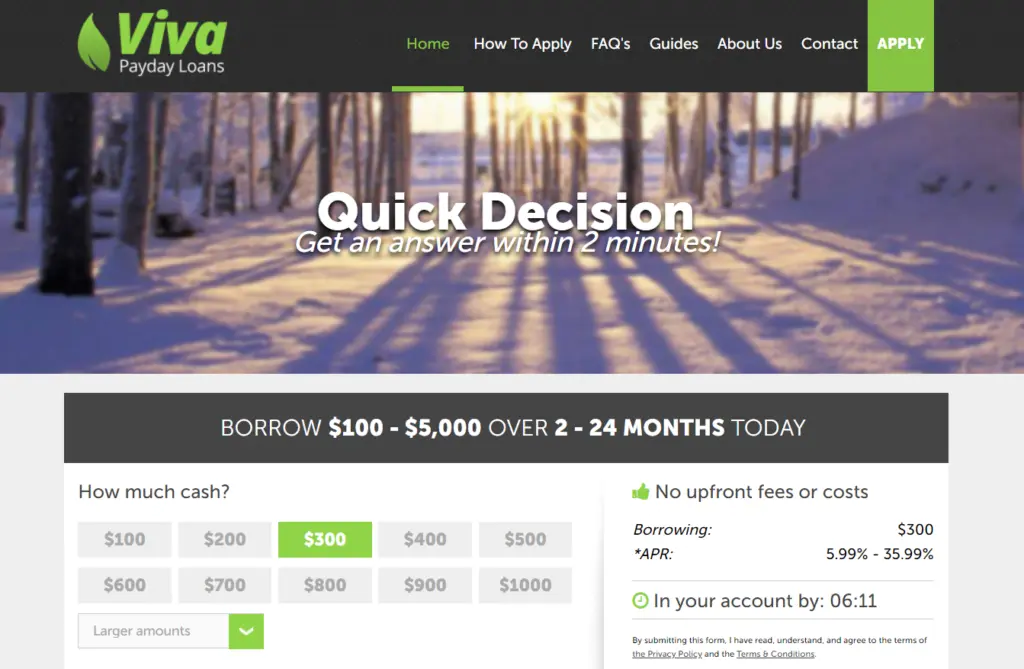

Viva Payday Loans operates online, advertising loans ranging from $100 to $5,000. The advertised appeal is speed and accessibility, particularly for those with poor or no credit history.

However, consumer advocacy groups report that the annual percentage rates (APRs) associated with these loans can exceed 400%. This staggering figure significantly increases the burden on borrowers.

Who is Affected?

Individuals with low incomes, poor credit scores, and urgent financial needs are particularly susceptible. Many use the loans to cover emergency expenses, rent, or utilities.

The lack of a credit check, while appealing, masks the true cost of borrowing and potentially encourages taking on unsustainable debt. The demographic affected tend to be unaware of the trap.

What are the Allegations?

The primary allegation revolves around excessively high interest rates and hidden fees. Borrowers claim that the total cost of the loan far outweighs the initial principal.

Critics also point to aggressive collection practices, including persistent phone calls and threats of legal action. These actions often exacerbate the borrower's financial and emotional distress.

Furthermore, there are claims of misleading advertising, where the terms and conditions are not clearly disclosed. This makes it difficult for borrowers to fully understand their obligations.

Where is This Happening?

Viva Payday Loans operates primarily online, offering its services across several states. The exact geographical reach is difficult to determine as they leverage digital platforms.

However, the impact is felt disproportionately in communities with limited access to traditional banking services. Vulnerable areas are often prone to these predators.

When Did These Issues Arise?

Complaints against Viva Payday Loans have been accumulating over the past several months, gaining increased attention recently. The consistent reports paint a disturbing picture.

Consumer protection agencies are now actively investigating the company's practices. They try to determine the extent of the alleged misconduct.

How Do the Loans Work?

The application process is typically online and requires minimal documentation. Borrowers often receive funds within 24 hours, which is part of the draw.

Repayment is usually structured as a lump sum due on the borrower's next payday. This creates a short repayment window and puts immense pressure on limited budgets.

Failure to repay on time can result in hefty late fees and additional interest charges. The loan cycle becomes a vicious spiral of debt.

Regulatory Scrutiny and Consumer Warnings

Several consumer advocacy groups have issued urgent warnings about Viva Payday Loans No Credit Check. They encourage consumers to explore alternative borrowing options.

These groups also emphasize the importance of understanding the terms and conditions of any loan agreement. They advocate for responsible financial decision-making.

The Consumer Financial Protection Bureau (CFPB) is reportedly monitoring the situation. Any violations of federal lending laws will be met with the full extent of the law.

What Can Consumers Do?

If you are currently dealing with Viva Payday Loans, carefully review your loan agreement. Seek advice from a financial advisor to understand your rights and options.

Consider filing a complaint with the CFPB and your state's attorney general. These agencies can investigate and potentially take action against the lender.

Explore alternatives like credit counseling, debt consolidation, or borrowing from trusted family or friends. Avoid high-interest payday loans at all costs.

Remember: if it seems too good to be true, it probably is. Protect yourself from predatory lending practices.

Next Steps and Ongoing Developments

The investigations into Viva Payday Loans are ongoing. Expect further updates and potential regulatory actions in the coming weeks.

This situation serves as a critical reminder of the risks associated with no-credit-check loans. The urgency for caution and informed decision-making has never been more pressing.

We will continue to monitor this story and provide updates as they become available. Stay informed and protect your financial well-being.