Mutual Funds Provide The Following For Their Shareholders

Imagine a bustling marketplace, not of fruits and vegetables, but of financial opportunities. Investors, both seasoned and novice, mingle, seeking guidance and avenues to grow their wealth. The air buzzes with possibilities, fueled by the collective power of shared resources and expert management. At the heart of this vibrant scene lies the concept of mutual funds, a cornerstone of modern investing.

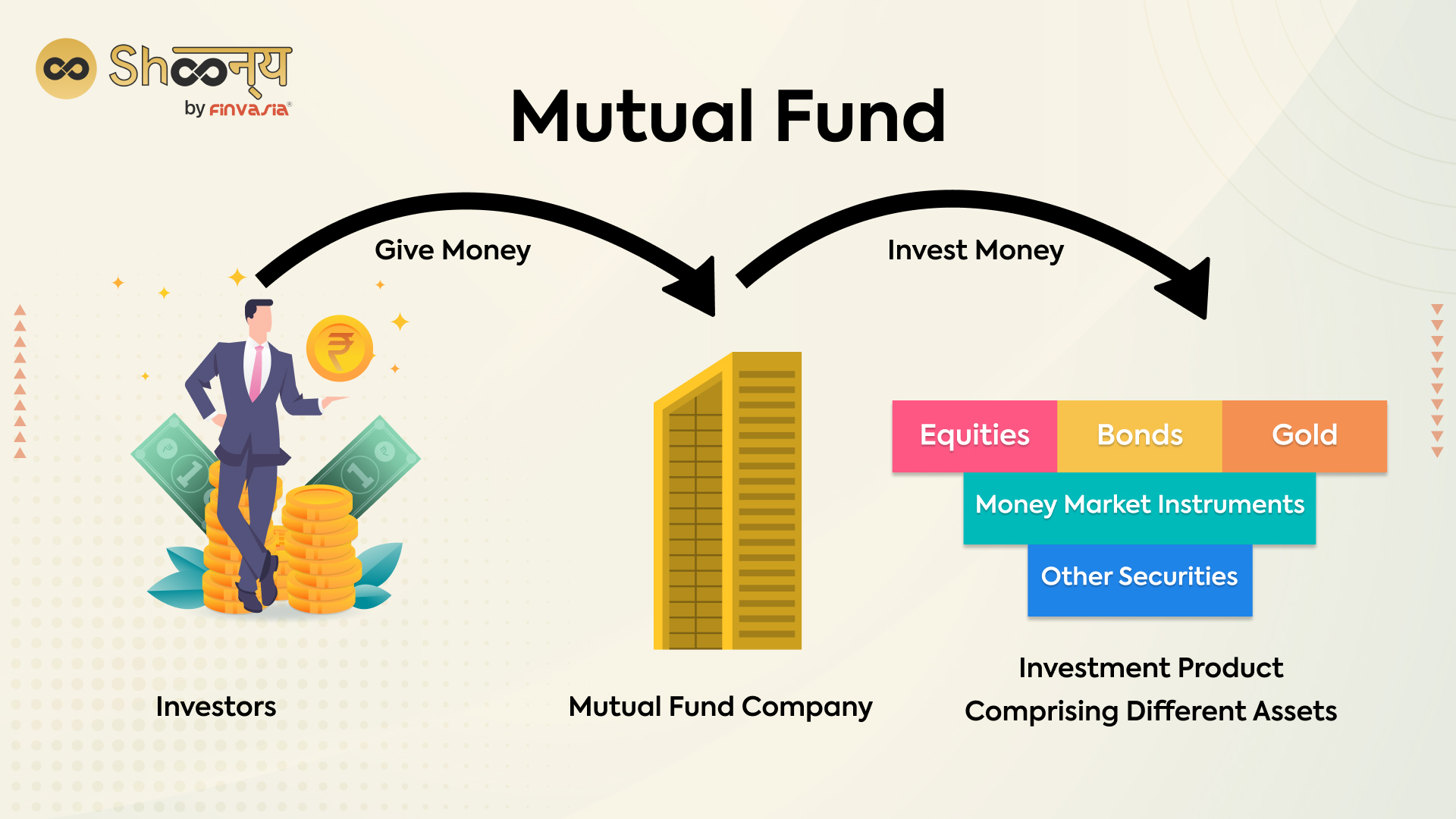

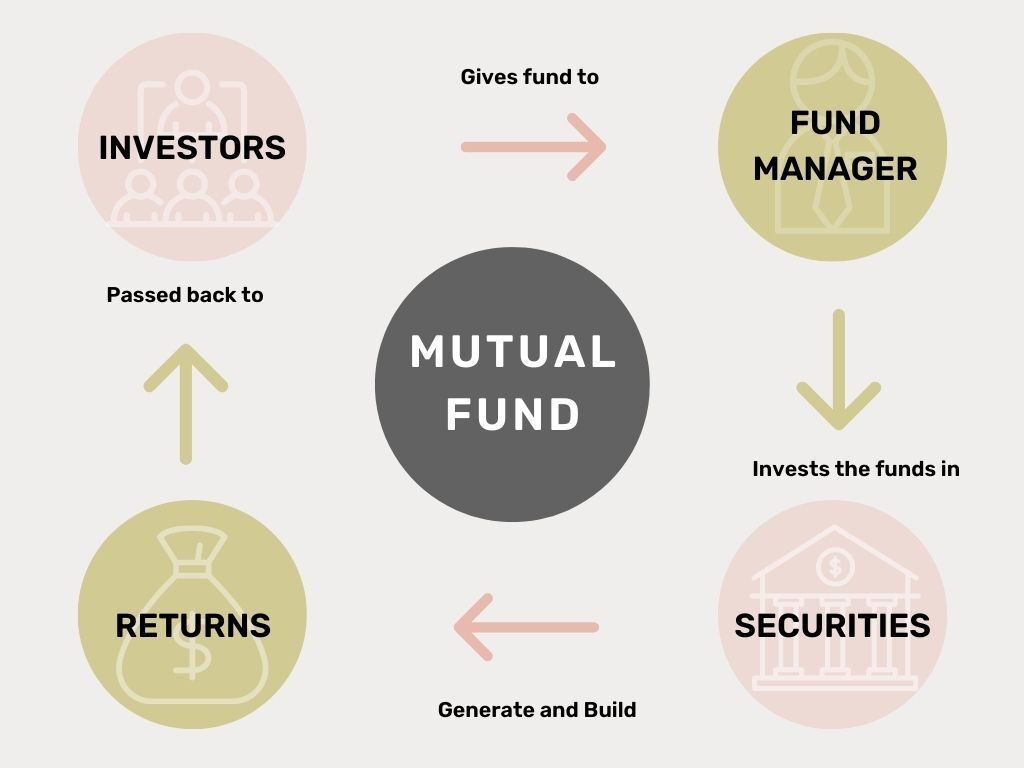

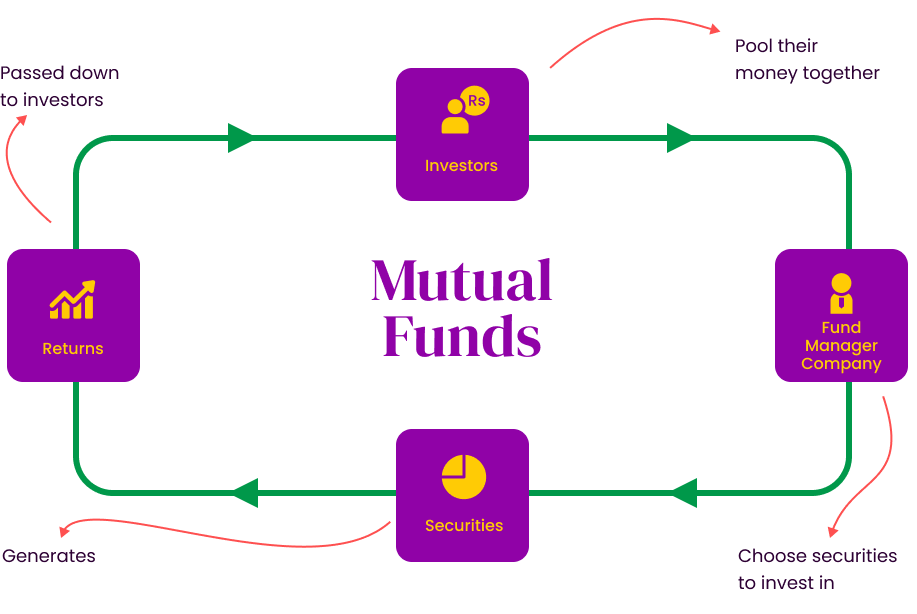

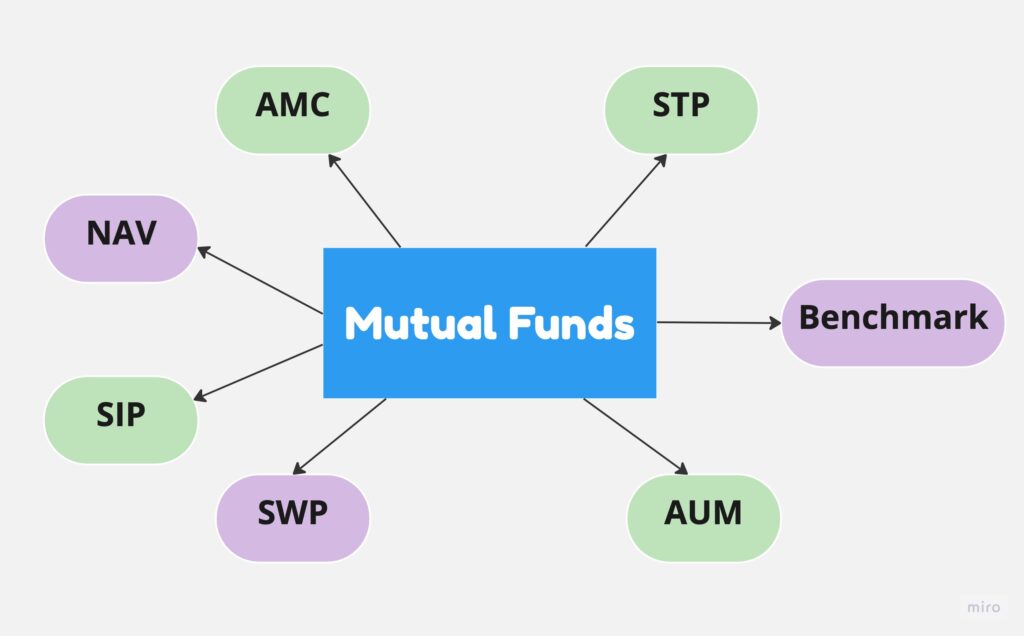

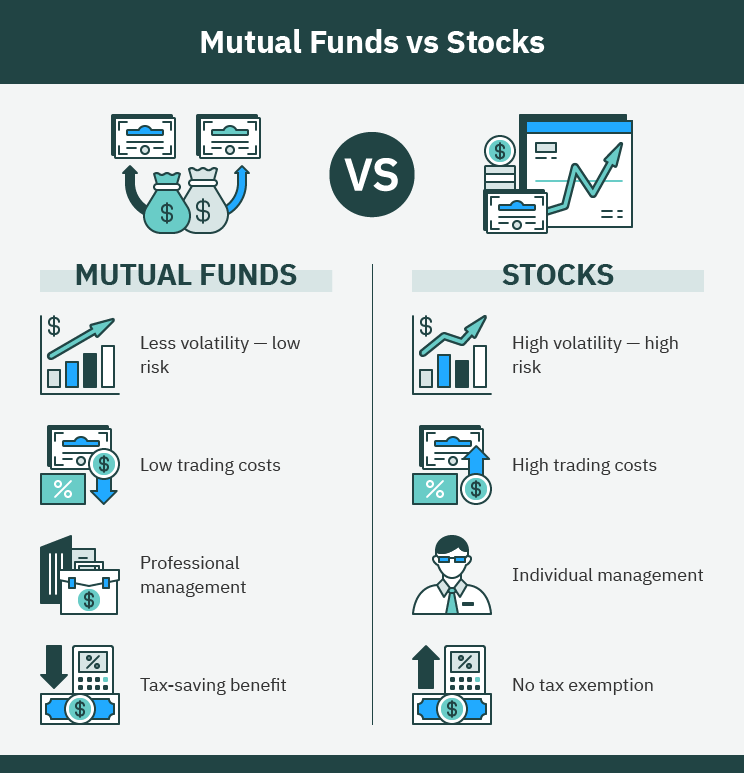

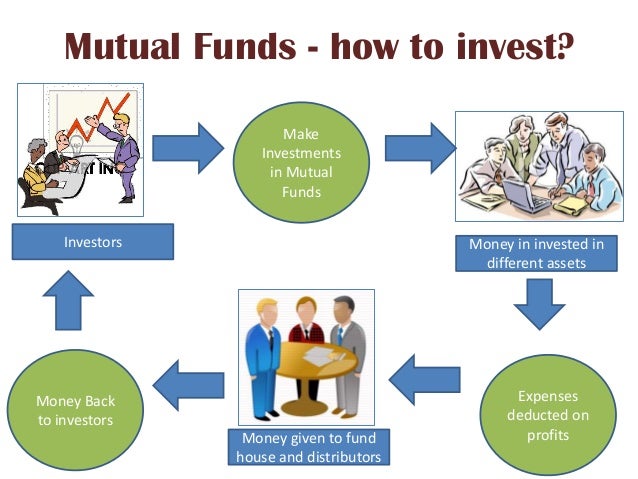

Mutual funds offer individuals a way to pool their money with other investors to purchase a diversified portfolio of stocks, bonds, or other assets. This provides numerous benefits, including professional management, diversification, liquidity, and accessibility, making them a popular choice for those seeking to achieve their financial goals. They truly empower investors with tools to navigate the complexities of the financial world.

The Power of Professional Management

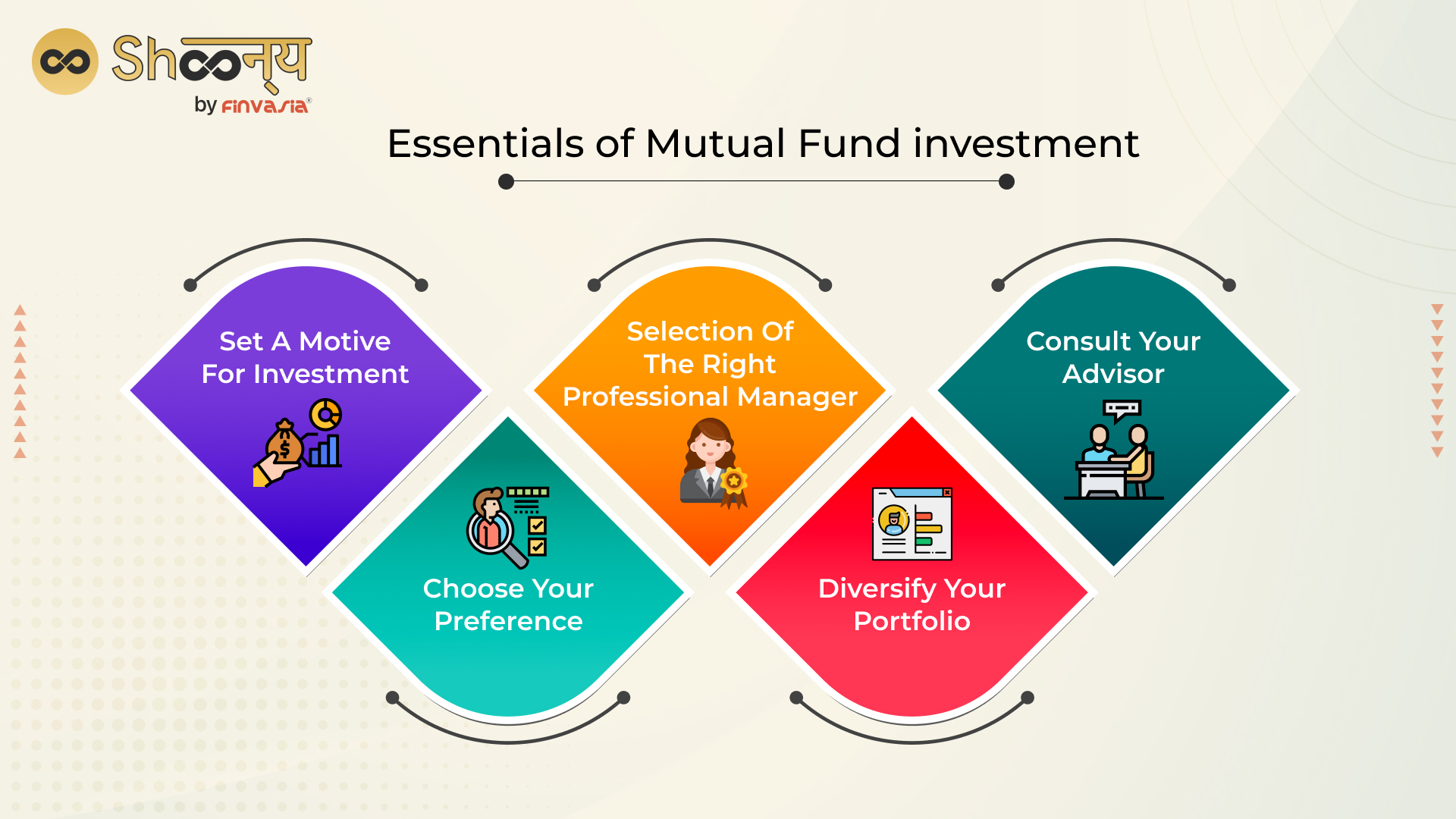

One of the most significant advantages of mutual funds is professional management. Instead of spending countless hours researching individual stocks or bonds, investors entrust their capital to experienced fund managers. These managers possess the knowledge, skills, and resources to make informed investment decisions.

They analyze market trends, economic data, and company financials to identify potentially profitable opportunities. This expertise is particularly valuable for those who lack the time or inclination to actively manage their own investments.

Fund managers also take on the responsibility of executing trades, monitoring portfolio performance, and making adjustments as needed. This hands-on approach ensures that the fund remains aligned with its investment objectives.

Diversification: Spreading the Risk

Diversification is a fundamental principle of investing, and mutual funds excel in this area. By pooling money from numerous investors, they can create a portfolio that holds a wide range of assets. This diversification helps to reduce risk.

For instance, instead of investing solely in a single company's stock, a mutual fund might hold shares in dozens or even hundreds of different companies across various sectors. If one company performs poorly, its impact on the overall portfolio is minimized.

This built-in diversification shields investors from the potentially devastating consequences of concentrating their investments in a few select holdings. Diversification is a key risk mitigation strategy.

Liquidity and Accessibility

Mutual funds offer a high degree of liquidity, meaning that investors can easily buy or sell their shares. This is a crucial advantage, especially when unexpected financial needs arise.

Unlike some other investment vehicles that may have lock-up periods or require significant effort to liquidate, mutual fund shares can typically be redeemed on any business day. This provides investors with the flexibility to access their capital when they need it.

Additionally, mutual funds are highly accessible to a wide range of investors. They often have relatively low minimum investment requirements, making them suitable for both small and large investors.

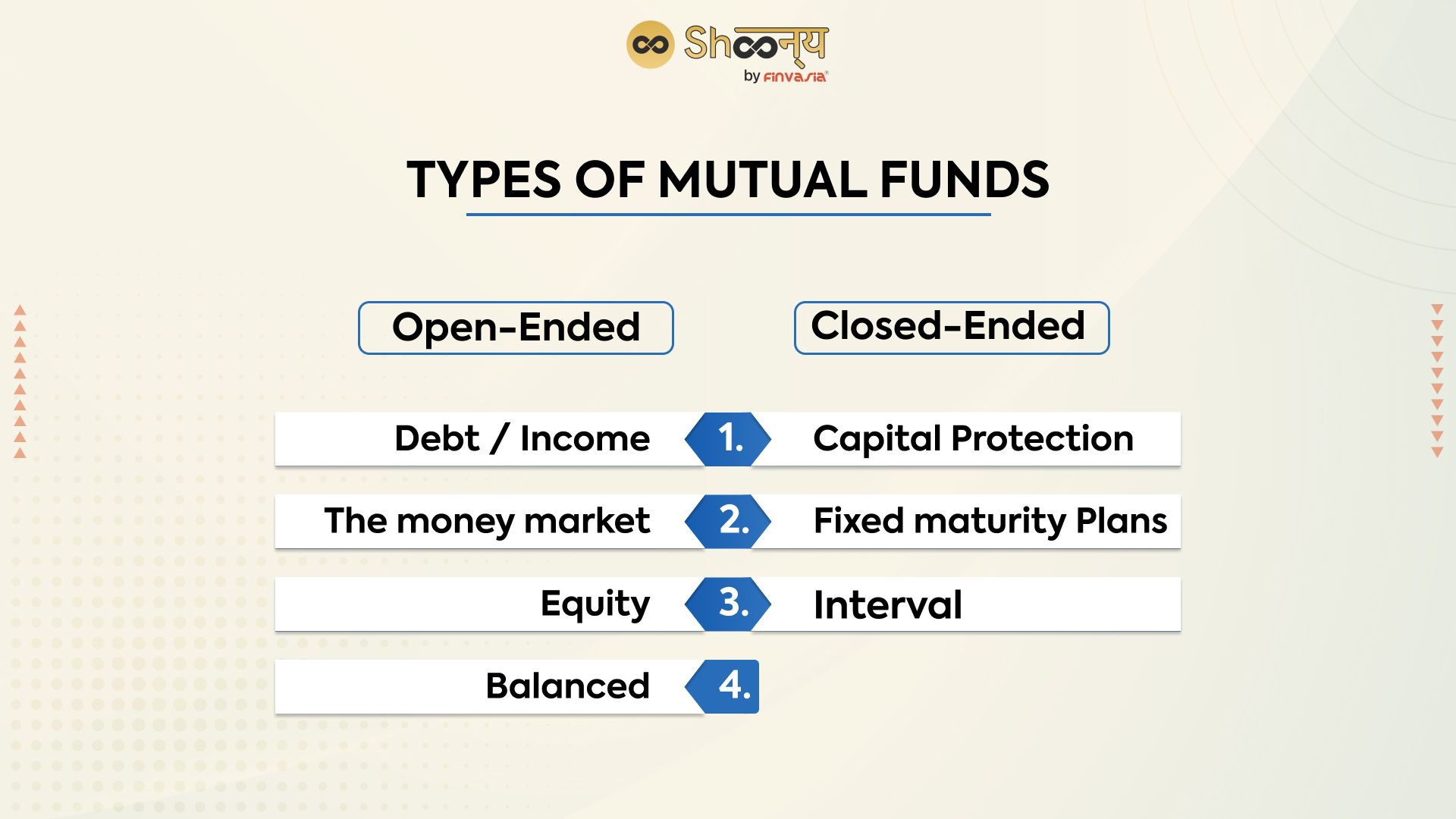

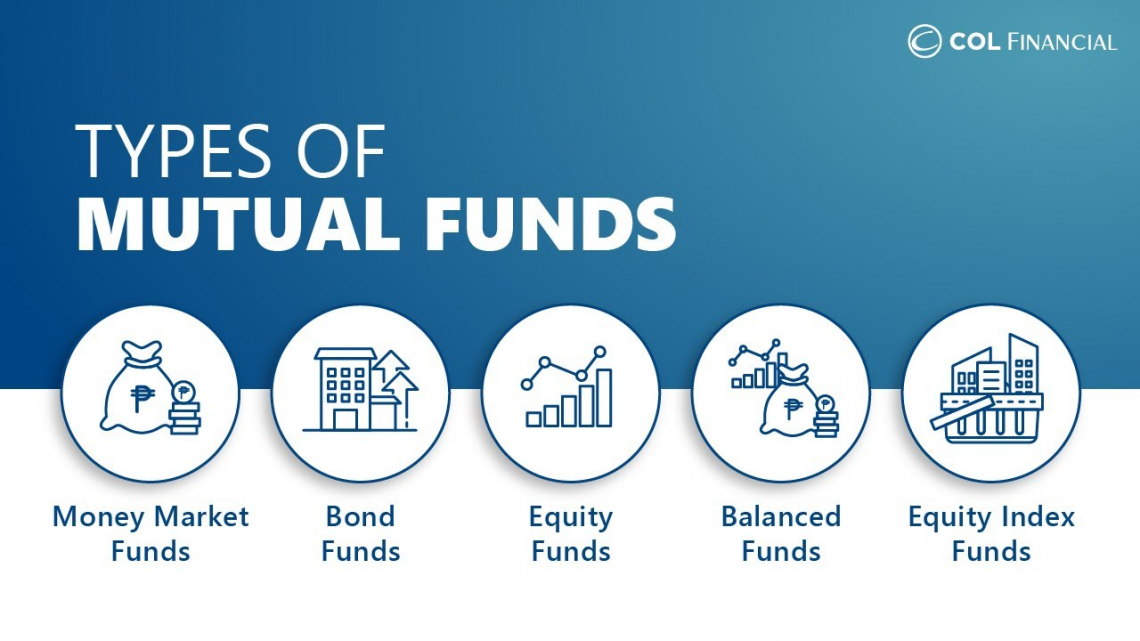

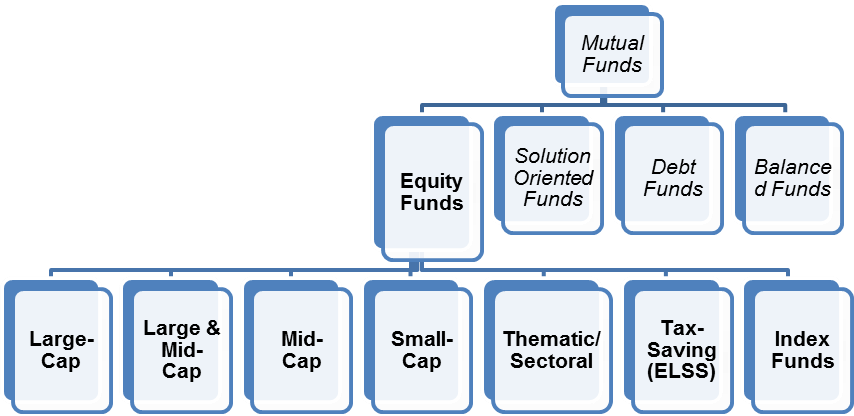

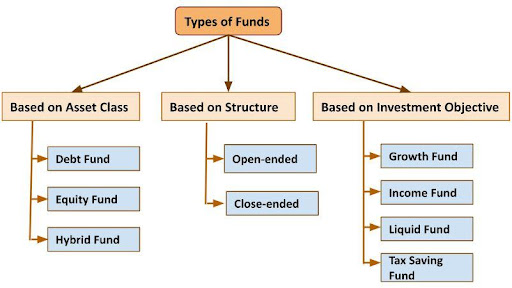

Variety and Choice: Finding the Right Fit

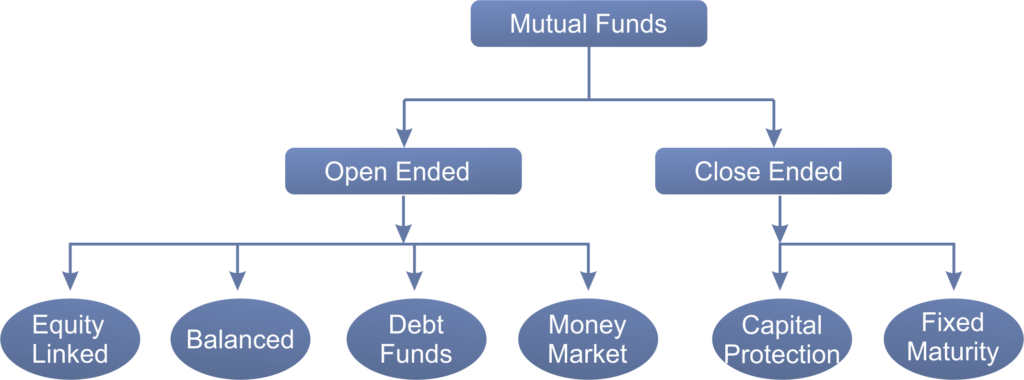

The mutual fund landscape is incredibly diverse, offering a wide array of options to suit different investment goals, risk tolerances, and time horizons. From aggressive growth funds focused on maximizing capital appreciation to conservative income funds emphasizing stability, there's a fund for nearly every investor.

Index funds, for example, aim to replicate the performance of a specific market index, such as the S&P 500. These funds typically have low expense ratios and provide broad market exposure.

Sector funds, on the other hand, concentrate their investments in a particular industry or sector, such as technology or healthcare. They offer the potential for higher returns but also come with greater risk. Investors can select a fund aligned with their individual needs and preferences.

Transparency and Regulation

Mutual funds operate under strict regulatory oversight, which helps to protect investors. They are required to provide regular reports on their performance, holdings, and expenses, ensuring transparency.

These reports allow investors to monitor their investments and make informed decisions. Regulatory bodies like the Securities and Exchange Commission (SEC) enforce rules and regulations designed to prevent fraud and protect investor interests.

This commitment to transparency and regulation fosters trust and confidence in the mutual fund industry. It’s a regulated landscape meant to protect.

Cost Considerations

While mutual funds offer numerous benefits, it's essential to consider the associated costs. These costs can include expense ratios, which cover the fund's operating expenses, and sales loads, which are commissions paid to brokers or financial advisors.

Expense ratios can vary significantly from fund to fund, so it's crucial to compare the costs of different options before investing. Lower expense ratios generally lead to better long-term returns.

Some mutual funds also charge transaction fees, such as redemption fees, which are incurred when investors sell their shares. Understanding these costs is essential for making informed investment decisions.

Mutual Funds: The Building Blocks of Financial Security

Mutual funds are not a magic bullet, but they are a valuable tool for building financial security. They offer a convenient, diversified, and professionally managed way to invest in the financial markets.

Whether you're saving for retirement, a down payment on a home, or simply seeking to grow your wealth, mutual funds can play a crucial role in achieving your financial goals. Their accessibility makes them great for all.

By carefully selecting the right mutual funds and understanding their associated costs, investors can harness the power of collective investing to build a brighter financial future.

Consider the young couple saving for their first home. They contribute a small amount each month to a diversified mutual fund, leveraging the power of compounding and professional management.

Think of the retiree who relies on the steady income stream from a bond mutual fund to supplement their pension. They are seeing the value of a sound financial decision.

Picture the ambitious entrepreneur who invests in a growth-oriented mutual fund, seeking to capitalize on the potential of innovative companies. Their future looks bright.

These are just a few examples of how mutual funds empower individuals from all walks of life to achieve their financial aspirations. The accessibility means more people can join in.

The journey to financial well-being is rarely a straight line. It requires careful planning, consistent effort, and a willingness to adapt to changing circumstances. But with the right tools and guidance, anyone can achieve their financial dreams.

Mutual funds offer a pathway to participate in the growth of the economy and build a secure future. As investors, we have the privilege of shaping our financial destinies.

Let us approach this responsibility with knowledge, diligence, and a commitment to lifelong learning. This is how you make the most of your financial choices.