National Entertainment Charge On Credit Card Reddit

A storm is brewing in the digital realm, fueled by cryptic credit card charges labeled "National Entertainment." Across Reddit forums, consumers are banding together, sharing screenshots, theories, and frustrations over these unexpected and often unexplained debits. The ambiguity surrounding these charges, coupled with difficulties in obtaining clear explanations from banks and merchants, has ignited widespread suspicion and demands for greater transparency.

At the heart of this growing controversy lies the “National Entertainment” charge, a seemingly innocuous descriptor that masks potentially unauthorized or miscategorized transactions. The problem is compounded by a lack of consistent information from financial institutions and merchants, leaving cardholders in a frustrating loop of unanswered questions. This article delves into the origins of this charge, the concerns raised by Reddit users, and the potential implications for consumers and the entertainment industry alike.

The Reddit Uprising: A Call for Clarity

The r/personalfinance and r/legaladvice subreddits have become hubs for individuals grappling with the "National Entertainment" charge. Threads are filled with users recounting their experiences, often detailing small, recurring charges that they don't recognize. Many report spending hours on the phone with their banks and credit card companies, only to receive vague or unhelpful responses.

One Reddit user, u/FrustratedConsumer123, wrote: "I've been getting these $4.99 charges every month for the past six months. I have no idea what they are for! My bank said it was 'National Entertainment,' but they couldn't tell me anything else." This sentiment is echoed across countless posts, highlighting a systemic issue of inadequate information disclosure.

The lack of clarity is breeding distrust. Users are speculating on potential culprits, ranging from subscription services they forgot to cancel to outright fraudulent activity. The ambiguity even leads to suspicion about data breaches, with some users like u/DataConcerned questioning the security of their financial information. "Could this be a sign that my card has been compromised?" they asked.

Decoding "National Entertainment": A Merchant Category Code Mystery

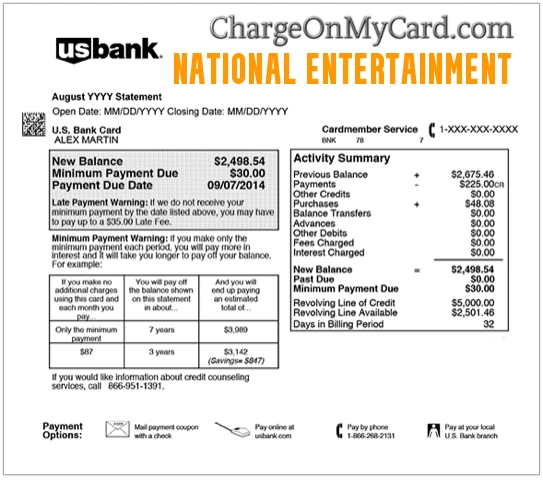

The "National Entertainment" descriptor often corresponds to a specific Merchant Category Code (MCC). MCCs are four-digit numbers used to classify businesses based on the types of goods or services they provide. Banks and credit card companies use these codes to categorize transactions and track spending patterns. However, the ambiguity arises because several different types of businesses could potentially fall under the "National Entertainment" umbrella.

According to Visa’s official merchant category code list, there is no code listing for "National Entertainment". This raises concerns as to what business or entities are using this term on customers' statements. This vagueness allows a wider range of merchants to use the descriptor, making it harder for consumers to identify the specific source of the charge.

“The problem isn’t necessarily the charge itself,” explains consumer finance expert Sarah Miller of *Consumer Advocate Today*. “It’s the lack of transparency. Consumers have a right to know exactly who they are paying and what they are paying for.”

The Bank's Perspective: Navigating Complex Systems

Banks and credit card companies face their own challenges in addressing these concerns. They rely on MCCs to categorize transactions, but they don't always have direct insight into the specific services or products being offered by a merchant. Furthermore, processing a high volume of inquiries related to disputed charges can strain customer service resources.

In a statement provided to this publication, a spokesperson for *Capital One* stated: "We understand the frustration that customers experience when they don't recognize a charge on their statement. We encourage customers to contact us directly so that we can investigate the transaction and provide as much information as possible."

However, many Reddit users report that contacting their banks often yields unsatisfactory results. “I spent over an hour on the phone with my bank, and they couldn’t tell me anything more than what was already on my statement,” lamented u/BankDisappointment. This gap between bank policy and user experience further fuels the frustration.

Potential Scenarios: From Subscriptions to Scams

The "National Entertainment" charge could stem from a variety of legitimate and illegitimate sources. It could be linked to:

- Subscription Services: Online streaming platforms, gaming subscriptions, or other entertainment-related services.

- Hidden Fees: Charges for add-ons or premium features within an app or service.

- Fraudulent Activity: Unauthorized charges made by scammers using stolen or compromised credit card information.

- Misleading Marketing: Companies using deceptive tactics to enroll consumers in recurring subscriptions without their explicit consent.

The lack of clarity makes it difficult to determine the exact cause of the charge. This uncertainty can leave consumers feeling vulnerable and anxious about the security of their financial information.

Moving Forward: Demanding Greater Transparency

The "National Entertainment" charge controversy highlights the need for greater transparency in credit card billing practices. Consumers deserve clear and detailed information about every transaction, including the name of the merchant, the specific product or service purchased, and the contact information for resolving disputes.

Consumer advocacy groups are calling for greater regulatory oversight of merchant category codes and billing practices. They argue that banks and credit card companies should be required to provide more detailed information about transactions, especially when ambiguous descriptors like "National Entertainment" are used.

Ultimately, the responsibility also lies with consumers to actively monitor their credit card statements and report any suspicious or unrecognized charges immediately. By working together and demanding greater transparency, consumers can help to prevent fraud and ensure that they are not being unfairly charged for products or services they did not authorize.

The Reddit threads dedicated to this issue serve as a powerful reminder of the collective strength of consumers. By sharing their experiences and demanding accountability, they are forcing a conversation about transparency and fairness in the digital marketplace. The future will likely see increased scrutiny of billing practices and a push for more consumer-friendly policies within the financial industry.