New Jersey Sales Tax On Jewelry

Jewelry retailers and consumers in New Jersey face a new financial reality: Sales tax is now being applied to most jewelry purchases, effective immediately. This change, impacting everything from engagement rings to everyday accessories, demands immediate attention from both businesses and shoppers.

The imposition of sales tax on jewelry, previously exempt under certain conditions, will reshape pricing strategies and consumer spending habits. Understanding the nuances of this tax is crucial for compliance and informed purchasing decisions.

The Immediate Impact

As of [Insert Date - e.g., October 26, 2023], New Jersey has broadened its sales tax application to include nearly all jewelry sales. Previously, items might have been exempt based on price point or specific material composition. Now, the exemption is significantly narrowed.

Retailers across the state are scrambling to update their point-of-sale systems and train staff. Consumers are seeing price increases at the register, impacting their budgets and potentially altering purchasing decisions.

What’s Taxable?

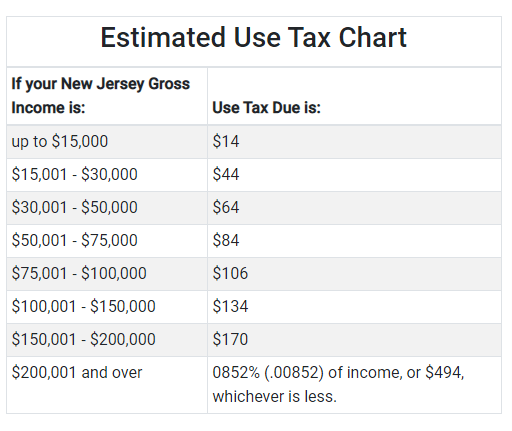

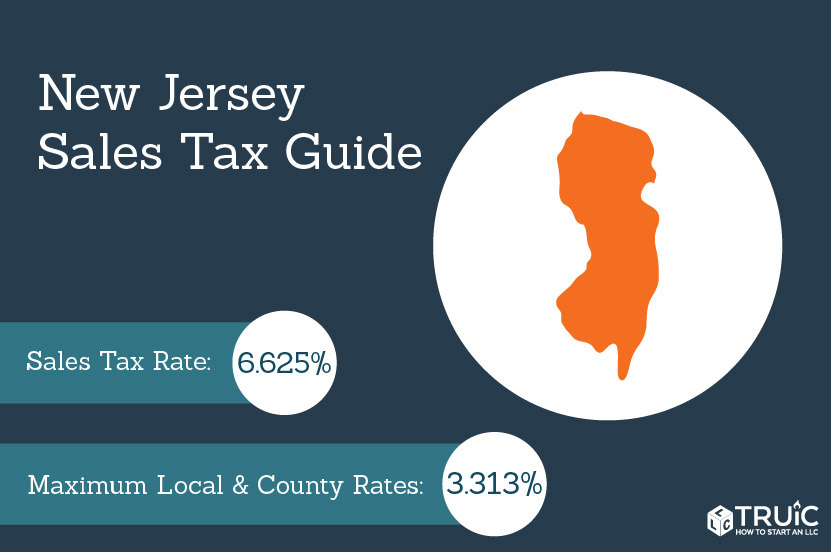

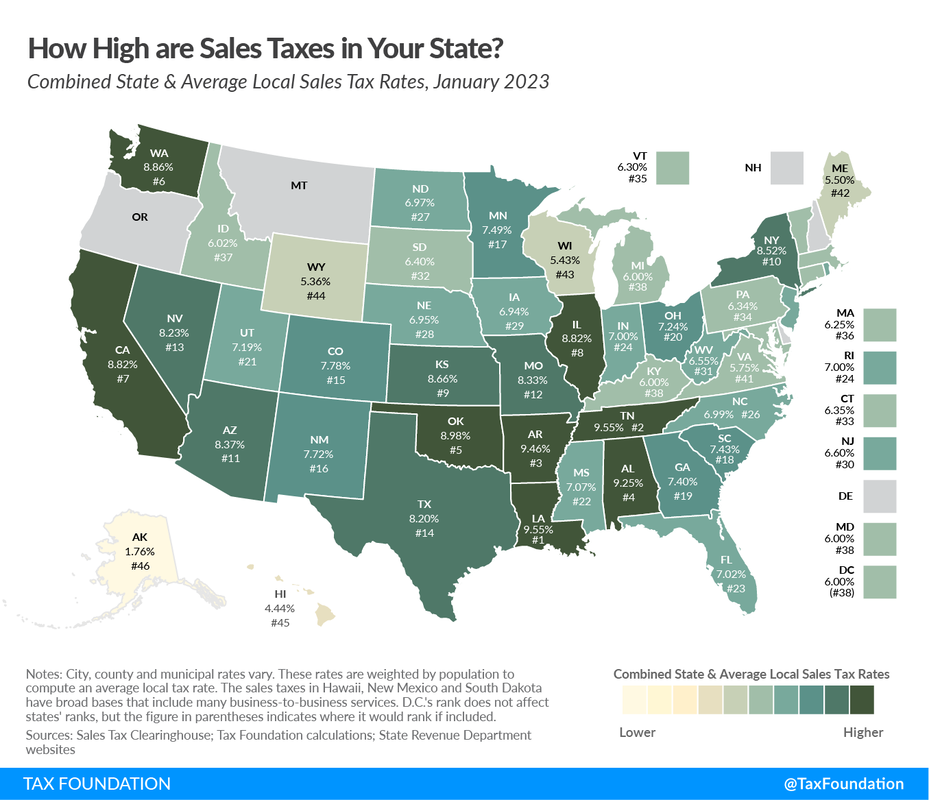

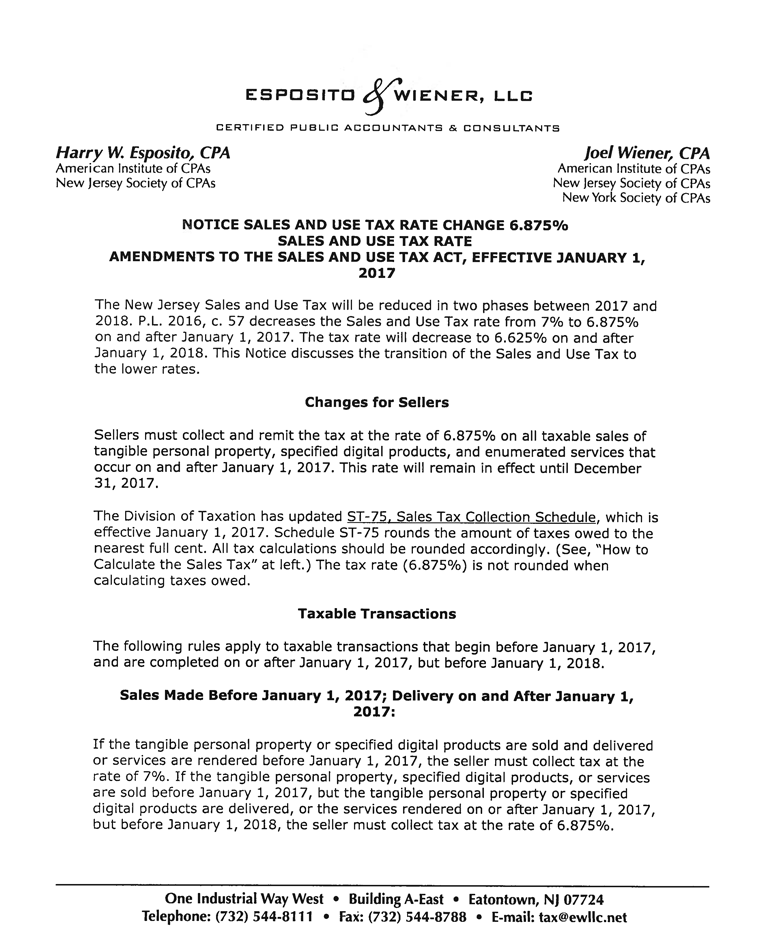

Generally, all jewelry items are now subject to the standard New Jersey sales tax rate of 6.625%. This includes rings, necklaces, bracelets, earrings, watches (unless specifically exempted as medical devices), and precious stones sold separately.

Online retailers selling jewelry to New Jersey residents are also required to collect and remit sales tax. This levels the playing field and eliminates a previous advantage for out-of-state vendors.

Exceptions and Nuances

While the vast majority of jewelry sales are now taxable, a few specific exceptions may exist. For example, repairs to existing jewelry might be taxed differently. Businesses should consult with a tax professional for clarification.

Items sold for resale, where the purchaser intends to resell the jewelry, are exempt from sales tax. This requires the presentation of a valid New Jersey Resale Certificate (Form ST-3).

The "Why" Behind the Change

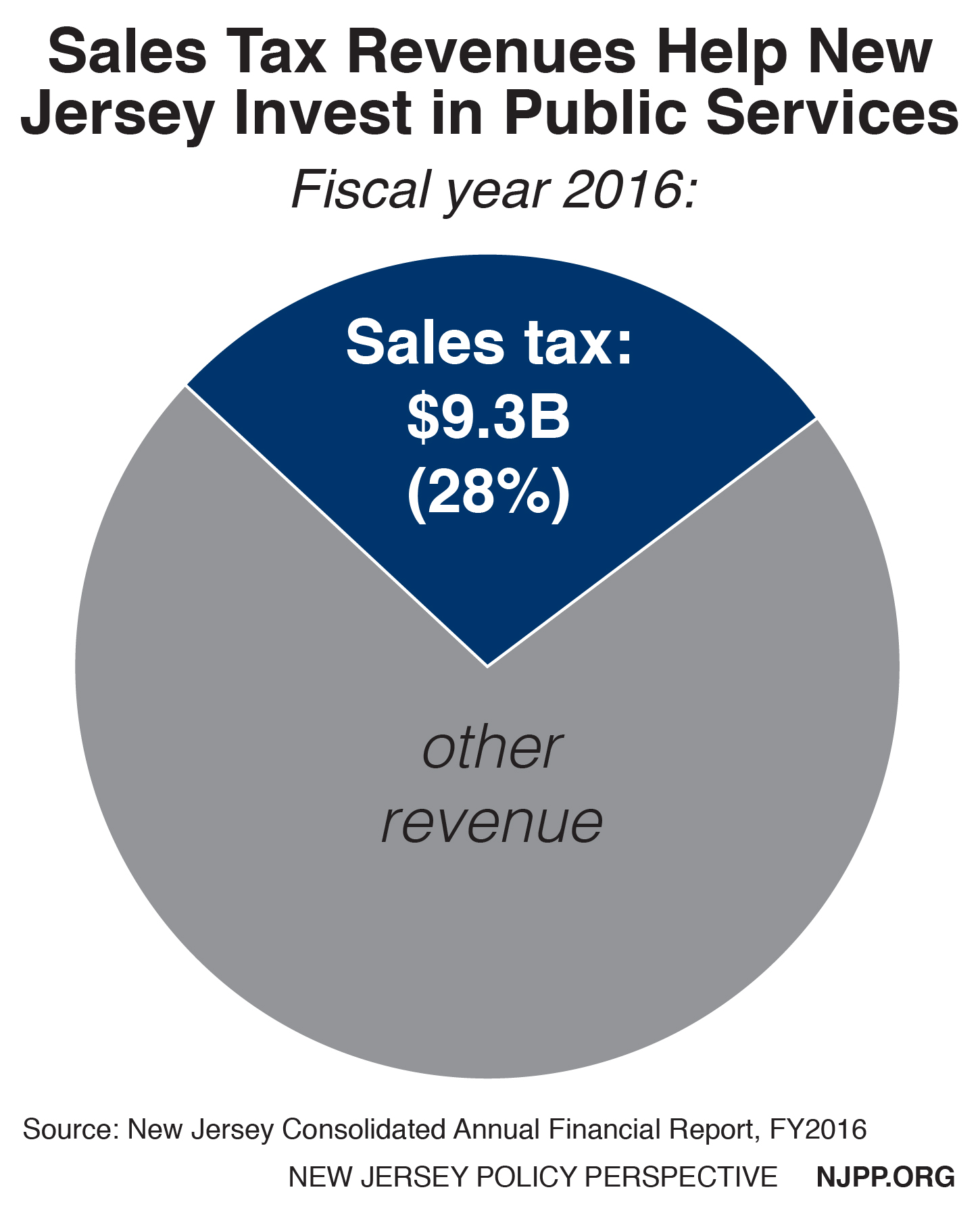

The New Jersey Department of Treasury has not issued a specific statement outlining the reasons for this change. However, broadening the tax base is generally seen as a way to increase state revenue.

Industry analysts suggest this move could generate significant additional revenue. However, the exact figure remains uncertain and will depend on how consumers react to the increased prices.

Retailer Responsibilities

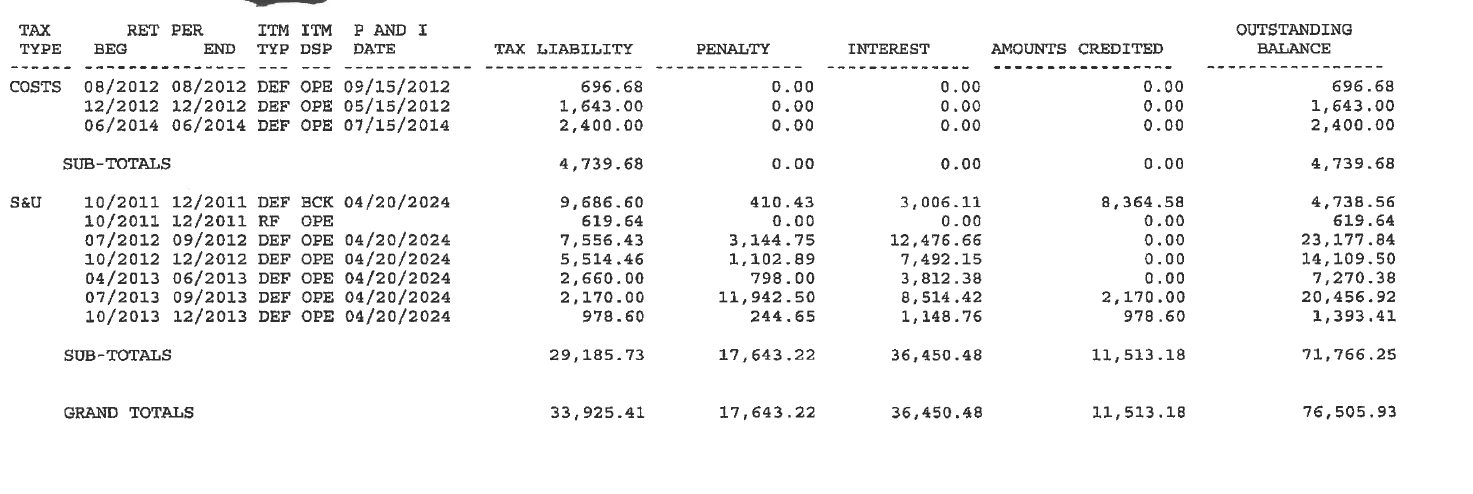

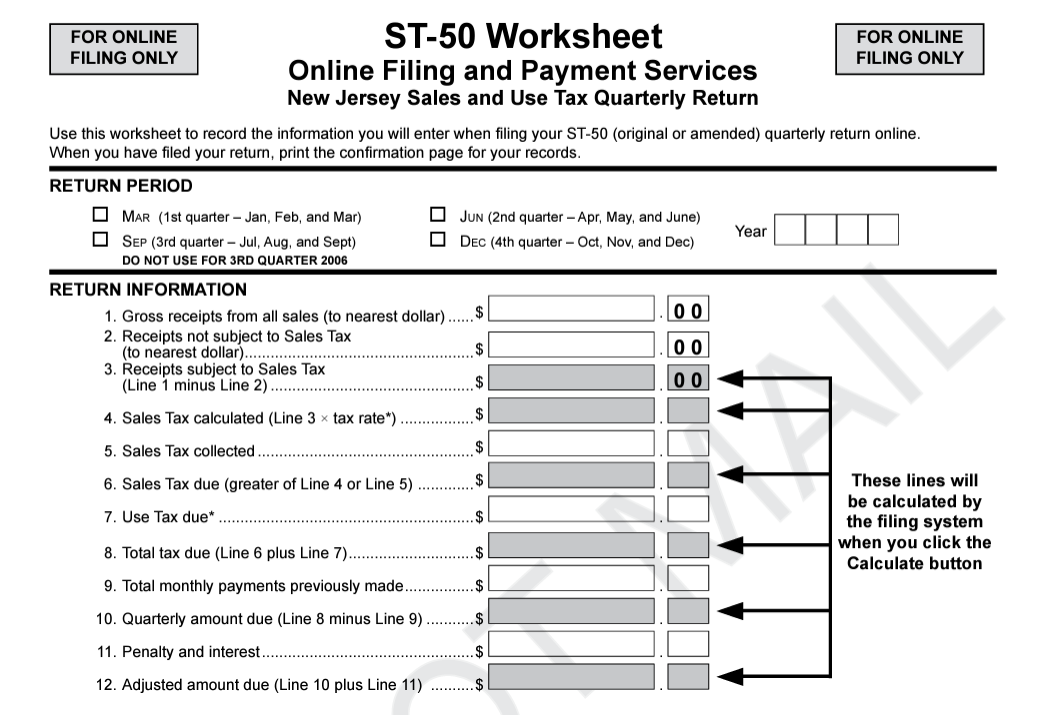

Jewelry retailers bear the primary responsibility for collecting and remitting sales tax. This includes accurately calculating the tax amount, collecting it from customers at the point of sale, and submitting it to the state in a timely manner.

Failure to comply with sales tax regulations can result in penalties, including fines and interest charges. Retailers should ensure their systems and processes are fully compliant.

Consumer Impact

The new sales tax directly impacts consumers, increasing the overall cost of jewelry purchases. An engagement ring priced at $5,000 will now cost an additional $331.25 in sales tax.

This added expense could lead consumers to postpone purchases, opt for less expensive items, or shop in neighboring states with lower sales tax rates. These adjustments will likely be more prominent with high ticket priced items.

Expert Advice

“This is a major shift for the jewelry industry in New Jersey,” says David Miller, a tax attorney specializing in retail. “Retailers need to immediately review their compliance procedures and educate their staff. Consumers should be aware of the added cost and factor it into their budgets.”

Susan Jones, a certified public accountant, advises, "Keep accurate records of all sales and taxes collected. Consult with a tax professional to ensure compliance and understand any potential exemptions."

Ongoing Developments and Next Steps

The New Jersey Department of Treasury is expected to release further guidance and clarifications regarding the implementation of this new tax policy. Stay informed through official government channels.

Retailers should monitor these updates and adjust their practices accordingly. Consumers should factor in the added sales tax when budgeting for jewelry purchases. Contacting your accountant or CPA is advised.

The New Jersey Retail Merchants Association is actively monitoring the situation and advocating for its members. For the most up to date official information, consult the New Jersey Division of Taxation website.