Why Is Green Thumb Industries Stock Falling

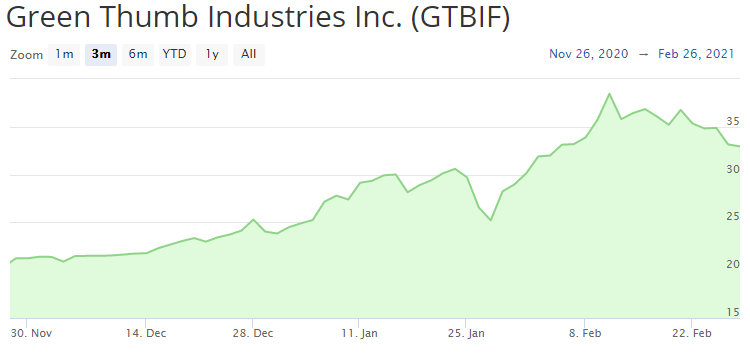

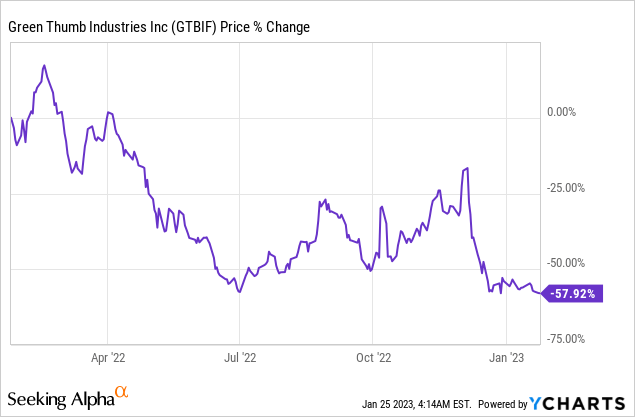

The bloom seems to be off the rose for Green Thumb Industries (GTI), one of the leading multi-state operators (MSO) in the burgeoning cannabis industry. Shares of the company have been steadily declining, leaving investors wondering if the once-promising growth story is losing its momentum.

While the cannabis sector as a whole has faced headwinds, GTI's underperformance raises specific questions about its operational efficiency, market positioning, and future prospects. This article dives deep into the factors contributing to the stock's decline, analyzing the broader market trends, company-specific challenges, and expert opinions to provide a comprehensive understanding of the situation.

Broader Market Headwinds

The cannabis industry, despite its long-term potential, is currently navigating a challenging landscape. Federal legalization, once seen as imminent, remains elusive, creating regulatory uncertainty and hindering access to traditional banking services.

This lack of federal reform has made it difficult for cannabis companies to secure funding, forcing them to rely on more expensive capital sources. The result is impacting profitability and growth.

Furthermore, many states that have legalized cannabis are experiencing market saturation, leading to price compression and increased competition. The influx of new players and the maturation of existing markets are squeezing margins across the board.

GTI-Specific Challenges

Beyond the broader market pressures, GTI faces challenges specific to its own operations. Some analysts point to the company's relatively high valuation compared to its peers as a potential factor weighing on the stock.

Green Thumb has historically traded at a premium, justified by its strong revenue growth and perceived market leadership. However, as growth rates moderate, investors may be reassessing whether the premium is still warranted.

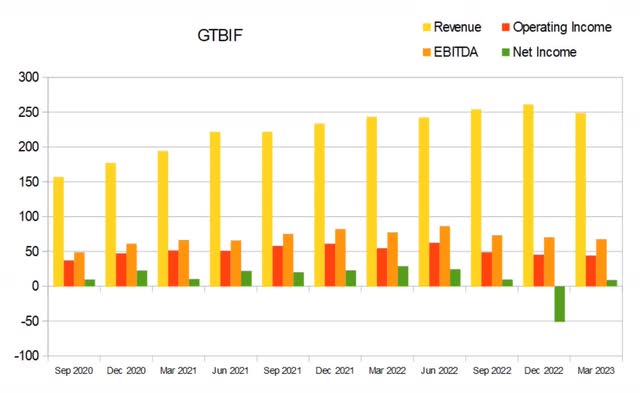

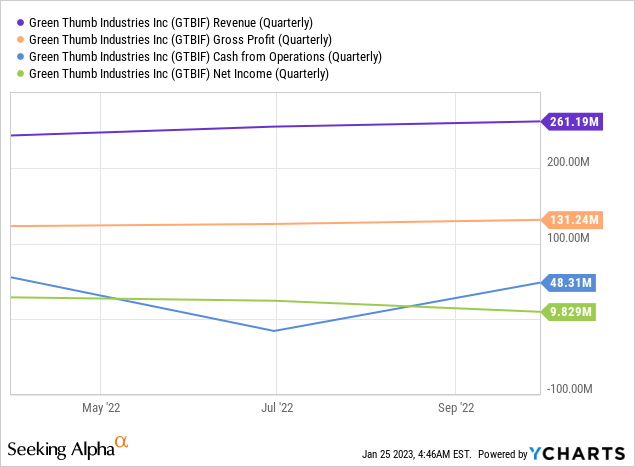

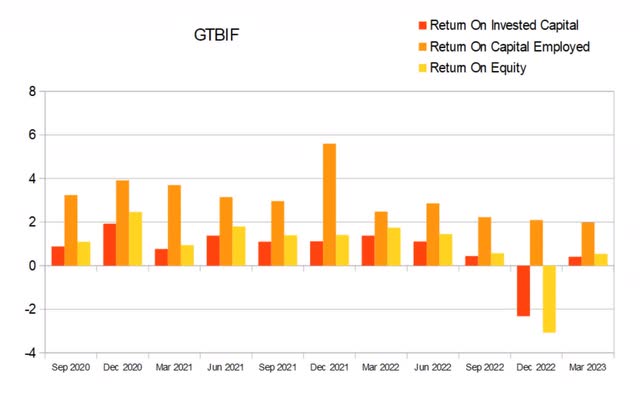

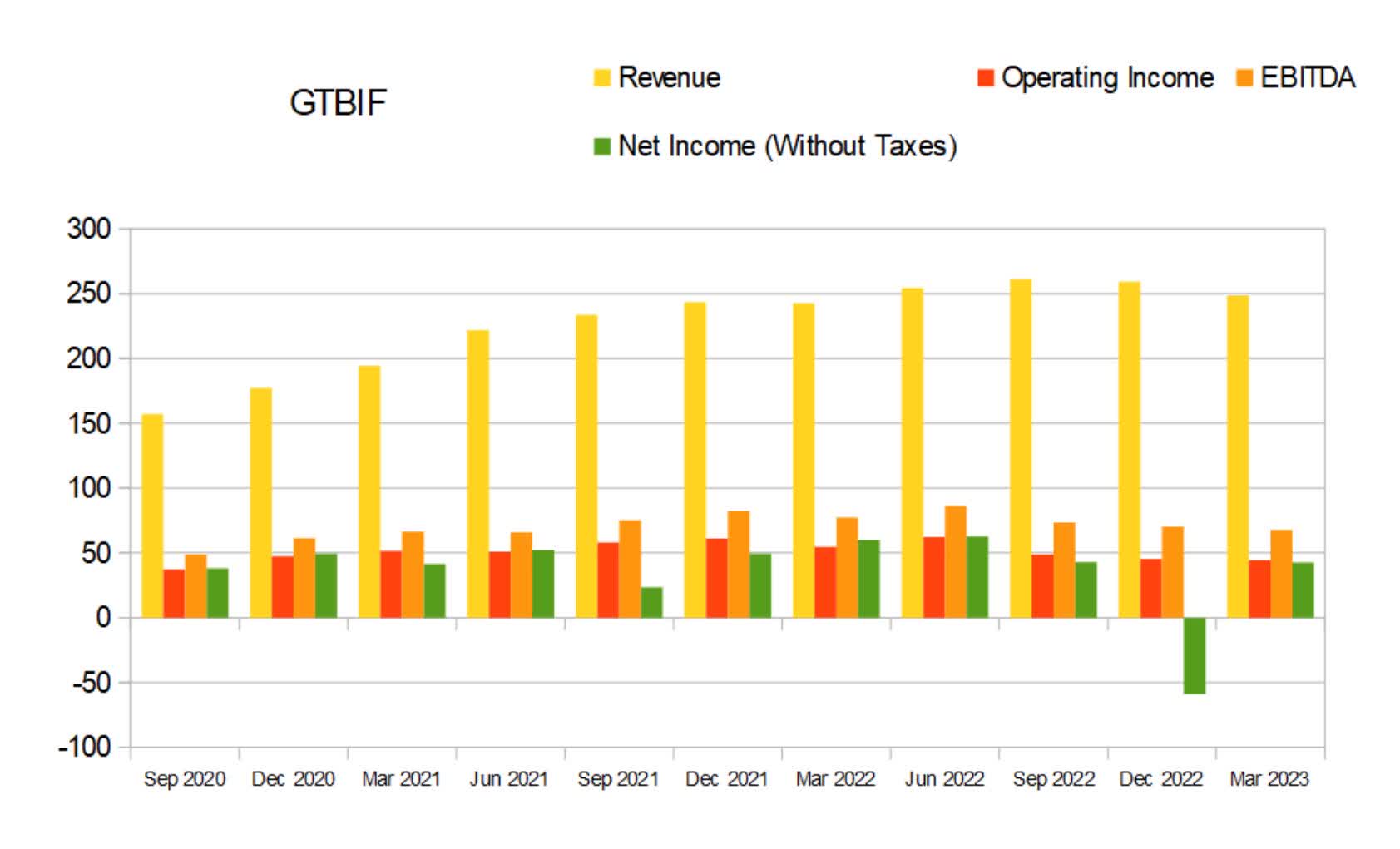

Concerns have also been raised about the company's profitability. While GTI has consistently increased its revenue, achieving sustained profitability has proven difficult, especially with the financial burden of expanding into new markets.

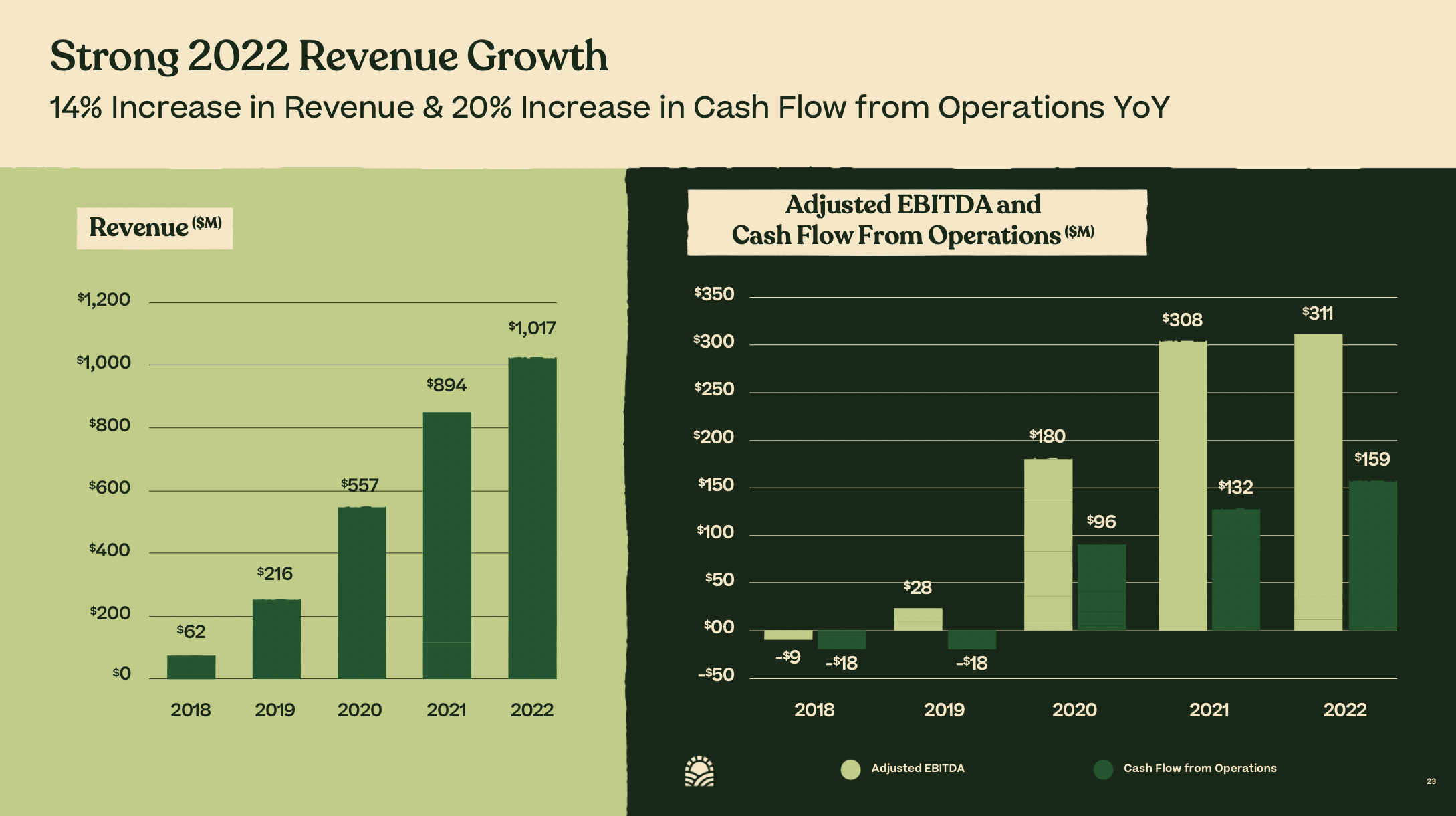

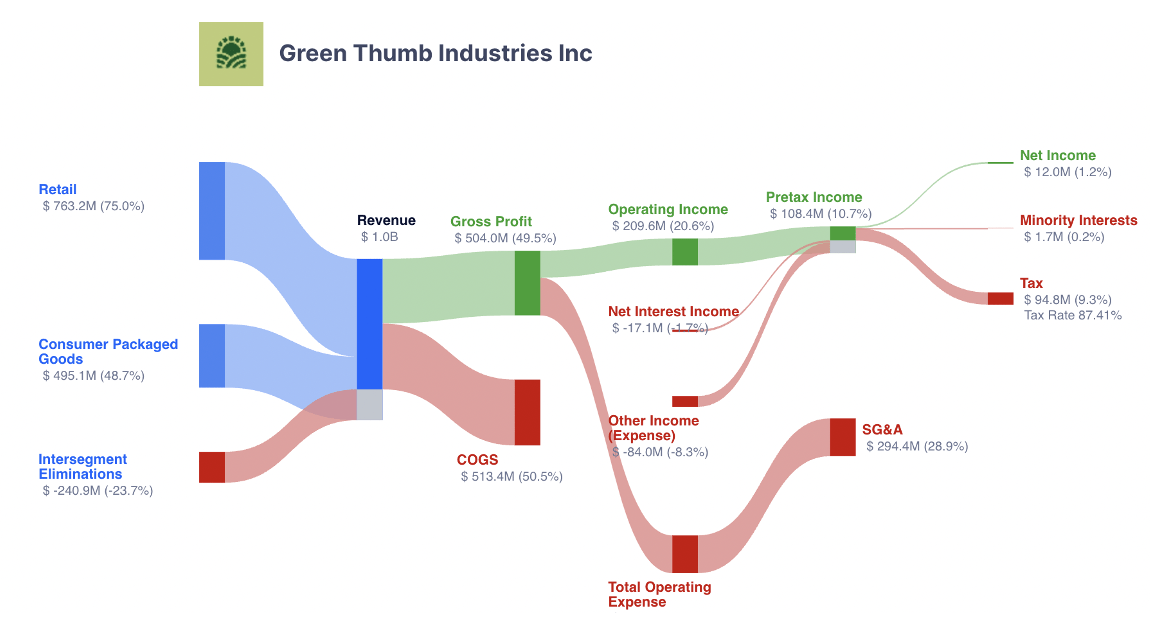

Financial Performance and Metrics

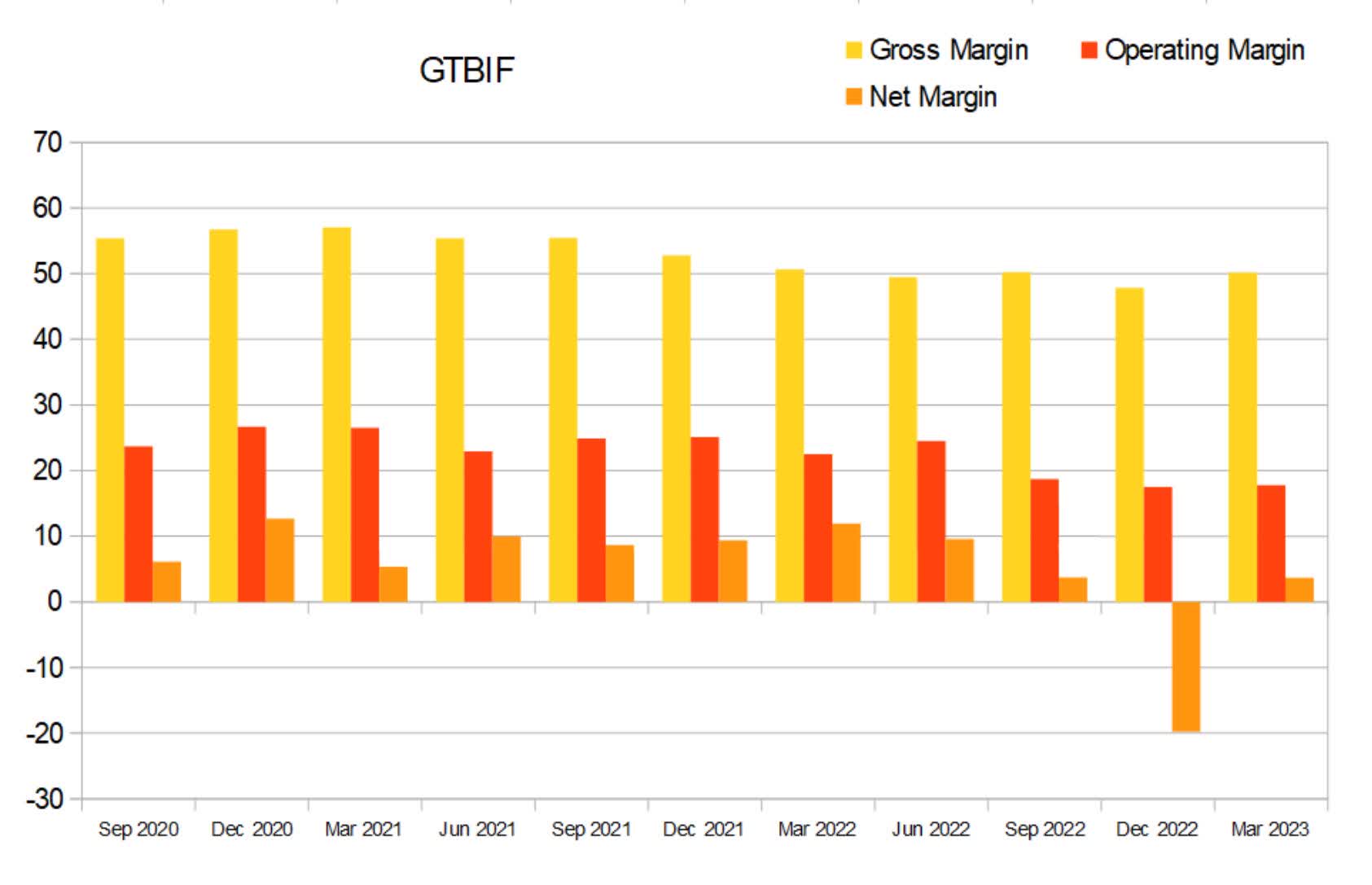

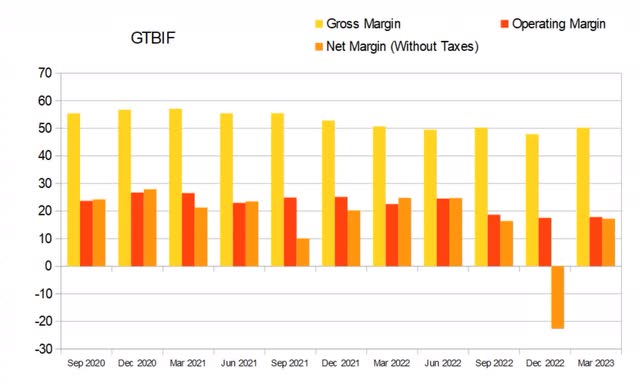

A closer look at GTI's financial performance reveals some key areas of concern. The company's gross margins, while generally healthy, have been under pressure due to the aforementioned price compression and increased competition.

Operating expenses, including marketing and administrative costs, have also been relatively high, further impacting profitability. Controlling these expenses will be critical for GTI to improve its bottom line.

Debt levels are another area of scrutiny. While GTI has been actively expanding its footprint, this expansion has come at a cost, resulting in a significant amount of debt on its balance sheet. According to recent financial reports, the company is actively managing its debt through refinancing and strategic asset allocation.

Competitive Landscape

The cannabis industry is becoming increasingly competitive, with a growing number of MSOs vying for market share. GTI faces stiff competition from established players like Curaleaf, Trulieve, and Cresco Labs, as well as smaller, regional operators.

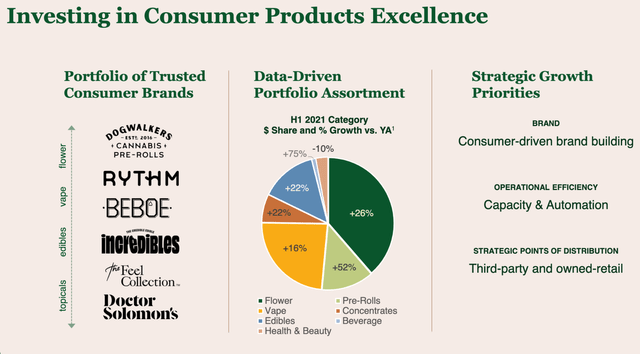

Each company employs different strategies, ranging from aggressive expansion to focusing on niche markets. Green Thumb's success hinges on its ability to differentiate itself and maintain its competitive edge.

Brand building, product innovation, and effective retail execution are all crucial for GTI to stand out in the crowded marketplace. The company has focused on building a strong portfolio of brands and expanding its retail footprint in key markets.

Analyst Perspectives

Wall Street analysts have mixed opinions on GTI's future prospects. Some remain optimistic, citing the company's strong management team, attractive market positioning, and long-term growth potential.

These analysts believe that GTI is well-positioned to benefit from the eventual federal legalization of cannabis and the continued expansion of state-level markets. Others are more cautious, pointing to the company's high valuation, profitability challenges, and competitive pressures.

These analysts suggest that investors should wait for further improvements in the company's financial performance before adding to their positions. Many analysts emphasize that the cannabis industry is highly volatile and subject to rapid changes, recommending a long-term investment horizon and a diversified portfolio.

Future Outlook

The future of GTI hinges on its ability to navigate the current challenges and capitalize on the long-term growth potential of the cannabis industry. The company's management team is focused on improving profitability, controlling costs, and expanding its market share.

GTI is also actively exploring new opportunities, such as expanding into emerging markets and developing innovative cannabis products. The success of these initiatives will be critical for the company to regain investor confidence and drive future growth.

While the near-term outlook remains uncertain, the long-term prospects for the cannabis industry are generally positive. As more states legalize cannabis and federal regulations evolve, GTI could be well-positioned to benefit from the growing market.

However, investors should carefully consider the risks and challenges before investing in GTI or any other cannabis stock. The industry is highly volatile, and past performance is not indicative of future results.