No Denial Payday Loan Bad Credit

The promise of quick cash, especially for those with a poor credit history, can be incredibly alluring. But the marketing of "no denial payday loans" preys on desperation and often leads individuals into a cycle of debt that's exceedingly difficult to escape.

These loans, heavily advertised online and through targeted marketing campaigns, offer seemingly instant approval regardless of credit score. However, the reality is far more complex and potentially devastating, with hidden fees, exorbitant interest rates, and predatory lending practices commonplace.

The Allure and the Reality of "No Denial" Loans

The core issue revolves around the deceptive marketing tactic of guaranteeing approval. While some lenders may advertise "no denial" payday loans, this typically masks significantly higher interest rates and stringent repayment terms, effectively trapping borrowers.

This article will delve into the deceptive nature of these loans, examine the regulatory landscape, and explore the potential consequences for vulnerable borrowers who fall victim to these predatory practices.

Understanding Payday Loans and Their Risks

Payday loans are short-term, high-interest loans typically due on the borrower's next payday. These loans are often marketed as a quick fix for unexpected expenses or financial emergencies.

However, according to a report by the Consumer Financial Protection Bureau (CFPB), the average payday loan borrower ends up in debt for five months of the year. This is primarily due to the difficulty in repaying the loan plus interest within the short repayment period.

The "no denial" aspect simply means that lenders are willing to overlook a poor credit score. They instead focus on verifying income and access to a bank account. This seemingly lenient approach comes at a steep price.

The Truth Behind "No Denial" Advertising

The phrase "no denial" is a marketing tactic, not a guarantee. While lenders may approve a higher percentage of applicants, they do so by shifting the risk onto the borrower through higher interest rates and fees.

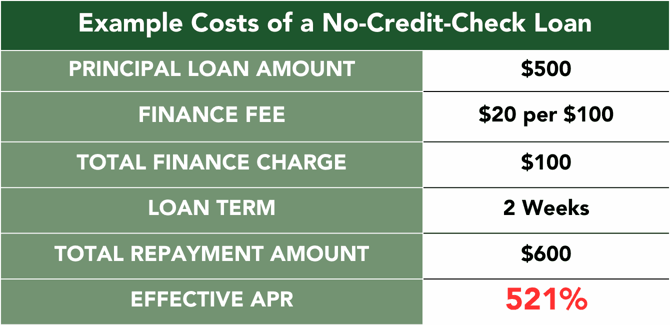

These fees can translate to an Annual Percentage Rate (APR) of 400% or higher, making repayment incredibly difficult. Many borrowers find themselves needing to take out additional loans to cover the original debt, creating a debt spiral.

Lenders who advertise "no denial" often target vulnerable populations, including low-income individuals, people with poor credit, and those facing unexpected financial hardships. These individuals may feel they have no other option, making them particularly susceptible to predatory lending practices.

The Role of Credit Scores

A credit score is a numerical representation of an individual's creditworthiness, based on their borrowing and repayment history. Lenders use credit scores to assess the risk of lending money to an individual.

A low credit score indicates a higher risk, making it more difficult to obtain traditional loans or credit cards with favorable terms. This is where "no denial" payday loans step in, offering a seemingly easy solution to those who have been turned down elsewhere.

However, accepting these loans can further damage a borrower's credit score. The high interest rates and short repayment periods make defaults more likely, leading to negative marks on their credit report.

Regulatory Scrutiny and Legal Implications

The payday lending industry is subject to varying levels of regulation at the state and federal levels. Some states have capped interest rates or banned payday lending altogether, recognizing the potential for abuse.

The CFPB has also taken steps to regulate the industry, aiming to protect consumers from predatory lending practices. However, these regulations are often subject to political challenges and ongoing debates.

Borrowers who believe they have been victimized by a predatory lender may have legal recourse. They can file complaints with the CFPB, state attorneys general, or consumer protection agencies. They should also seek advice from a qualified attorney.

Alternatives to "No Denial" Payday Loans

For individuals facing financial hardship, there are several alternatives to consider before resorting to payday loans.

These include seeking assistance from local charities and non-profit organizations, exploring options for government assistance programs, negotiating payment plans with creditors, or considering a personal loan from a credit union or bank. While these options may not be as immediate as a payday loan, they are far less likely to lead to a cycle of debt.

Credit counseling can also provide valuable assistance in managing debt and developing a budget. Counselors can help individuals understand their financial situation and explore options for debt relief.

The Future of Payday Lending and Consumer Protection

The debate surrounding payday lending is likely to continue as regulators and consumer advocates strive to balance access to credit with the need to protect vulnerable borrowers. Technological advancements, such as online lending platforms and mobile payment apps, present both opportunities and challenges for regulation.

Increased transparency and stricter enforcement of existing regulations are crucial to prevent predatory lending practices. Financial literacy education is also essential to empower consumers to make informed decisions about borrowing money and managing their finances.

Ultimately, addressing the root causes of financial hardship, such as low wages and lack of access to affordable healthcare, is necessary to reduce the demand for high-cost, short-term loans and protect consumers from falling into the debt trap.