No Score Loan Through Manual Underwriting Reddit

The online forum Reddit has become an unexpected hub for individuals seeking unconventional paths to homeownership, particularly those exploring "no score" loans obtained through manual underwriting. This trend highlights a growing segment of potential homebuyers who are either credit invisible or have damaged credit histories, finding traditional mortgage avenues closed to them.

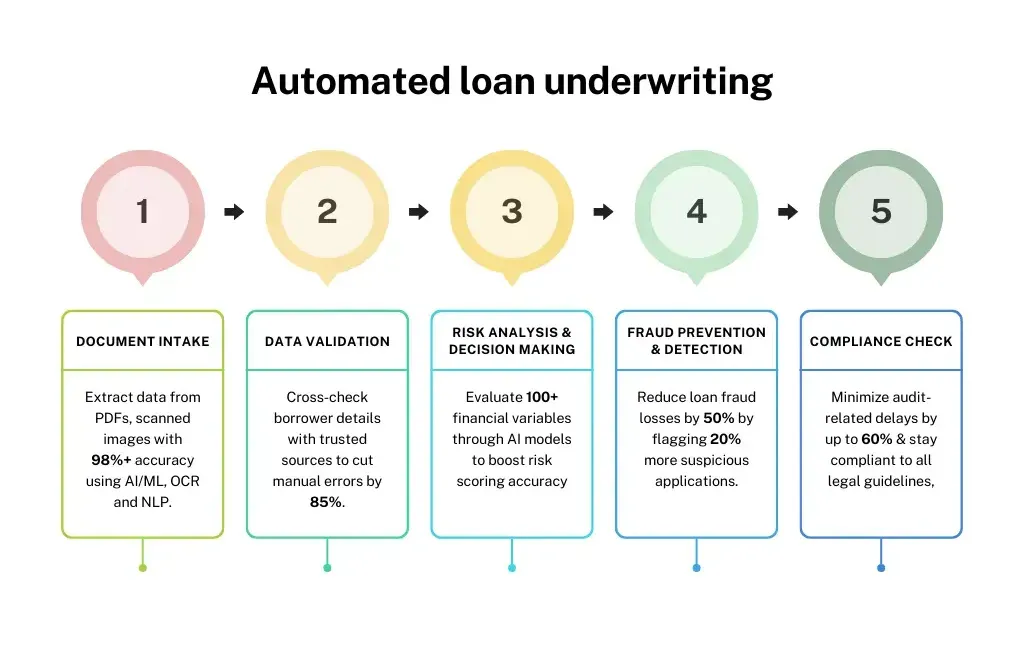

The rise of this phenomenon on Reddit reflects a broader frustration with rigid, automated lending systems. Many are turning to manual underwriting, a process that relies on a comprehensive assessment of an applicant's financial history rather than solely on credit scores. This article explores the increasing interest in "no score" loans and manual underwriting as discussed on Reddit, examining its significance, potential benefits, and inherent risks.

The Allure of "No Score" Loans and Manual Underwriting

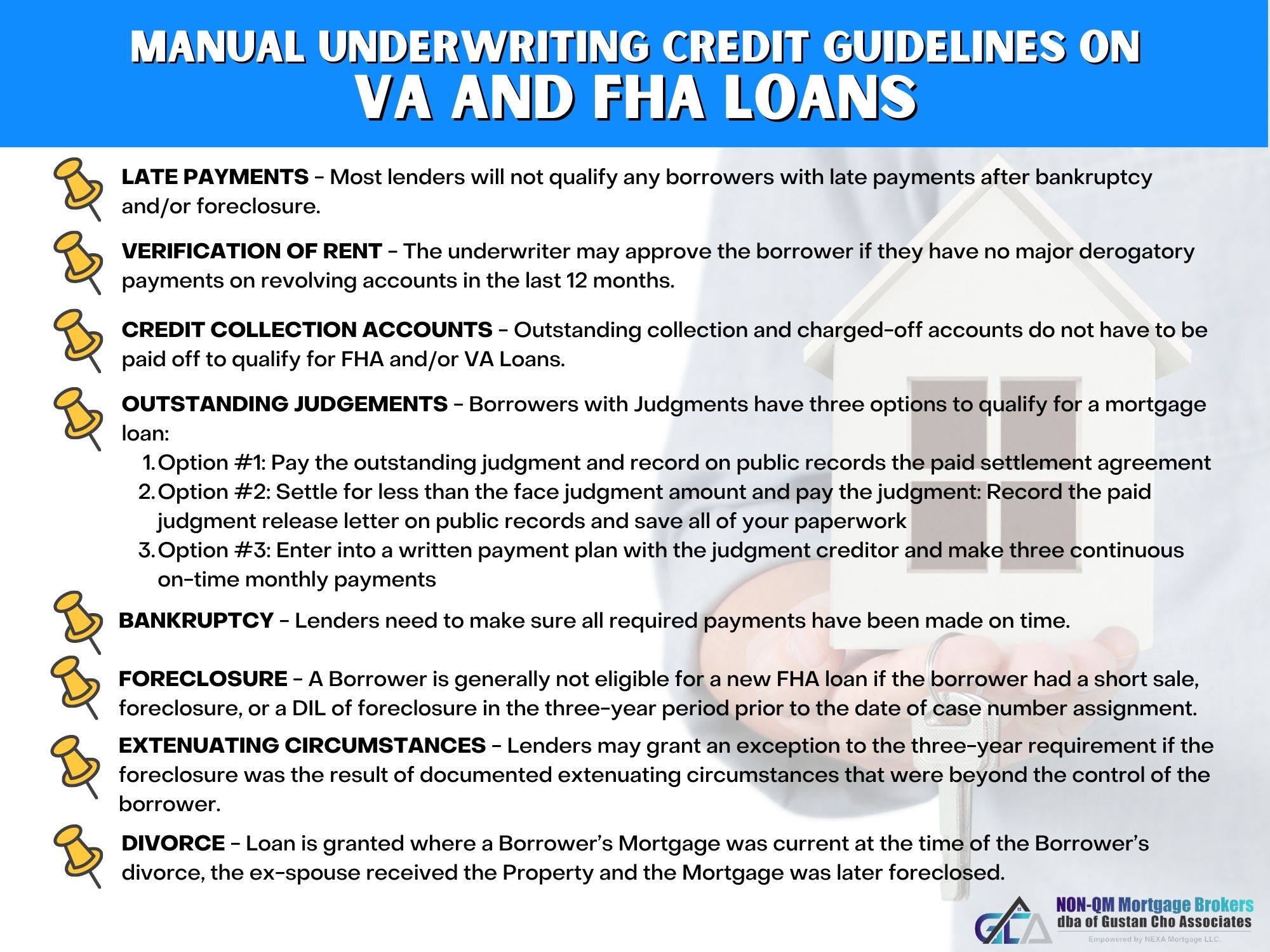

The term "no score" loan, while not entirely accurate, refers to mortgages offered to individuals without a traditional FICO score. These loans are typically secured through manual underwriting, a process where a loan officer meticulously examines an applicant’s financial documentation.

Unlike automated underwriting systems that rely heavily on credit scores, manual underwriting takes a holistic view of an applicant's ability to repay the loan. This involves scrutinizing bank statements, employment history, rent payment records, and other financial data to assess creditworthiness.

On Reddit, various subreddits dedicated to personal finance and real estate have become platforms for sharing information and experiences related to "no score" loans. Users often share tips, recommend lenders specializing in manual underwriting, and discuss the challenges and successes they've encountered in their journey to homeownership.

Reddit as a Resource and Support System

Reddit provides a space for individuals to connect and share information about navigating the complexities of manual underwriting. Users often post questions regarding documentation requirements, lender recommendations, and strategies for strengthening their applications.

The anonymity afforded by Reddit allows users to openly discuss their financial situations without fear of judgment. This can be particularly valuable for those who have experienced credit challenges or face unique financial circumstances.

However, information shared on Reddit should be viewed with caution. It is essential to verify information with official sources and consult with qualified financial professionals.

The Significance of Manual Underwriting in Today's Market

The increasing interest in manual underwriting reflects a growing number of individuals who are excluded from traditional lending systems due to low or nonexistent credit scores. This includes young adults with limited credit history, immigrants new to the country, and individuals who have experienced financial setbacks.

Manual underwriting provides an opportunity for these individuals to demonstrate their creditworthiness through alternative means. It can be a pathway to homeownership for those who are otherwise unable to access traditional mortgages.

According to the Consumer Financial Protection Bureau (CFPB), understanding different lending options and financial literacy is crucial for consumers to make informed decisions. They also encourage individuals to explore all possible options before making any financial commitments.

Potential Benefits and Risks

One of the key benefits of "no score" loans through manual underwriting is that they offer a pathway to homeownership for those who might otherwise be excluded. This can lead to increased financial stability and wealth accumulation.

However, these loans often come with higher interest rates and fees compared to traditional mortgages. Lenders typically charge a premium to compensate for the increased risk associated with lending to borrowers with limited or damaged credit histories.

Another potential risk is the complexity of the manual underwriting process. Applicants must be prepared to provide extensive documentation and may face greater scrutiny from lenders. Diligence and patience are essential.

Finding a Lender and Navigating the Process

Finding a lender specializing in manual underwriting is a crucial first step. Not all mortgage companies offer this option, so it is essential to research and identify those that do.

Applicants should gather all necessary documentation, including bank statements, pay stubs, rent payment records, and any other information that can demonstrate their ability to repay the loan. Organization is key.

Working with a qualified mortgage broker or financial advisor can be invaluable in navigating the complexities of the manual underwriting process. These professionals can provide guidance and support, and help applicants understand their options.

A Word of Caution

While "no score" loans through manual underwriting can be a viable option for some, it is crucial to approach them with caution. Be wary of lenders who make unrealistic promises or charge excessive fees.

Carefully review all loan documents and understand the terms and conditions before signing anything. Seek advice from a qualified financial professional if you have any questions or concerns.

It's always wise to improve your credit score, even while pursuing manual underwriting. The higher the credit score, the more choices you have and the less you have to pay for a loan.

Conclusion

The increasing interest in "no score" loans through manual underwriting, as evidenced by discussions on Reddit, highlights the need for more inclusive lending practices. While these loans offer a pathway to homeownership for those excluded from traditional lending systems, they also come with potential risks and higher costs.

By understanding the benefits and risks, and by taking steps to improve their financial situations, individuals can make informed decisions about whether a "no score" loan is right for them. Education and preparation are critical.

The trend underscores a larger societal conversation about access to credit and the need for alternative lending models that can better serve the needs of a diverse population. The discussions on Reddit are a snapshot of this evolving financial landscape.