Not Eligible For Options Trading Robinhood

The dream of accessible options trading, once seemingly within reach for all through platforms like Robinhood, is proving elusive for a segment of its user base. Reports are surfacing of users, particularly newcomers and those with limited trading experience, finding themselves ineligible for options trading permissions. This raises concerns about financial literacy, risk management, and the very promise of democratized investing.

Robinhood's decision to restrict options trading access to some users, while perhaps intended to protect them from significant losses, has sparked debate about the platform's role in financial education and the responsibility it bears to its user base. This article examines the criteria Robinhood uses for granting options trading access, the impact on affected users, the regulatory landscape surrounding options trading platforms, and the broader implications for the future of retail investing. It aims to provide a balanced perspective, exploring both the potential benefits and drawbacks of these restrictions.

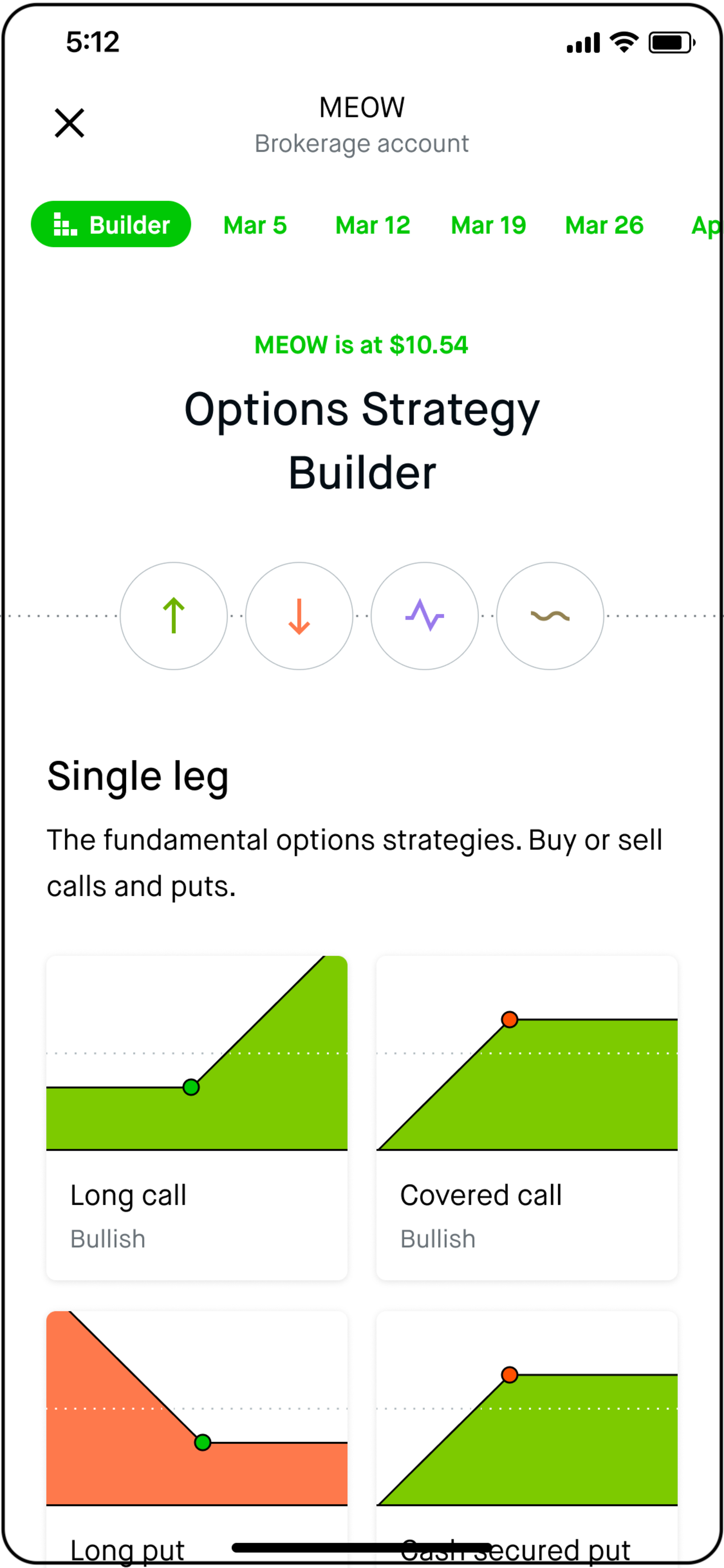

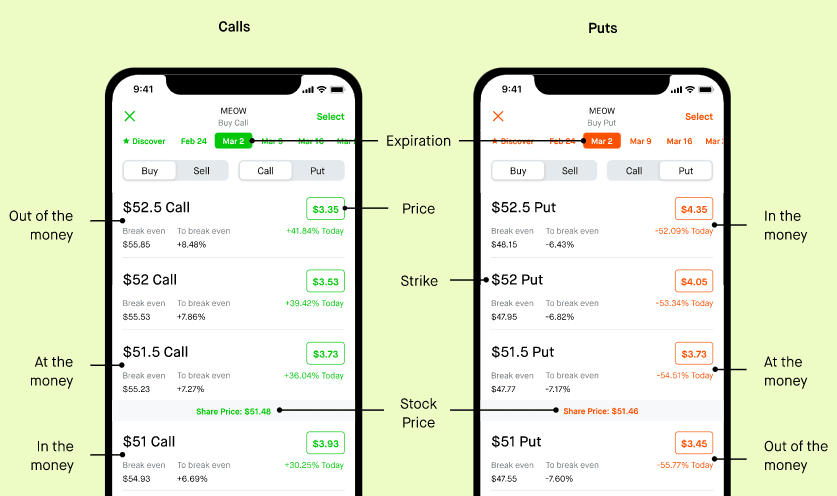

Understanding Robinhood's Options Approval Process

Robinhood's options approval process isn't a black box, but it's not entirely transparent either. The platform states that it assesses various factors to determine eligibility for options trading.

These factors typically include a user's trading experience, investment knowledge, financial resources, and risk tolerance. Users are required to answer a series of questions related to these areas when applying for options trading.

Specifically, Robinhood looks at prior experience trading options, stocks, and other securities. Income, net worth, and investment goals are also scrutinized.

The User Experience: Frustration and Confusion

For many users, the denial of options trading access comes as a surprise and a source of frustration. Some report feeling misled by Robinhood's initial marketing, which often emphasizes ease of use and accessibility.

"I felt like I was promised this ability to trade options, and then the door was slammed shut," says one Reddit user, echoing the sentiment of many others online. Others express confusion about the specific reasons for the denial, as Robinhood often provides generic explanations.

The lack of clear, actionable feedback leaves some users unsure of how to improve their chances of approval in the future. The feeling of being excluded from a potentially lucrative, albeit risky, investment strategy is palpable within these online communities.

Regulatory Scrutiny and Platform Responsibility

Robinhood and other options trading platforms operate under the watchful eye of regulatory bodies like the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). These agencies are tasked with ensuring fair markets and protecting investors.

FINRA, for example, has specific rules regarding the suitability of options trading for retail investors. These rules require broker-dealers to have a reasonable basis for believing that a customer has the knowledge and experience necessary to understand the risks of options trading.

Robinhood's tightened restrictions could be seen as a response to increased regulatory scrutiny and concerns about the platform's role in the meme stock frenzy of 2021. The company has faced criticism for allegedly encouraging excessive risk-taking among inexperienced investors.

The Broader Impact on Retail Investing

The debate over options trading access on Robinhood reflects a larger tension within the world of retail investing. On one hand, the democratization of finance empowers individuals to take control of their financial futures.

On the other hand, it also raises concerns about the potential for inexperienced investors to make costly mistakes. The allure of high returns can be particularly dangerous when coupled with a lack of understanding of the underlying risks.

Financial literacy is a crucial component of responsible investing, and platforms like Robinhood are increasingly being called upon to play a more active role in educating their users. The company offers some educational resources, but critics argue that these are insufficient to fully prepare users for the complexities of options trading.

Looking Ahead: Navigating the Future of Options Trading Access

The future of options trading access on Robinhood, and other similar platforms, is likely to be shaped by a combination of regulatory pressures, technological advancements, and evolving user expectations. Robinhood may further refine its approval process, incorporating more sophisticated risk assessment tools and personalized education resources.

The platform could also consider tiered access models, allowing users to trade less complex options contracts before graduating to more advanced strategies. Increased transparency about the specific criteria for options approval would also help alleviate some of the frustration currently felt by users.

Ultimately, the goal is to strike a balance between empowering individuals to participate in the financial markets and protecting them from undue risk. Finding that equilibrium will require a collaborative effort from regulators, platforms, and individual investors themselves. The responsibility for informed decision-making ultimately rests with the individual investor, but platforms have a crucial role to play in providing the necessary tools and knowledge.

![Not Eligible For Options Trading Robinhood Robinhood Review [2024]: Grow Your Wealth, Avoid the Fees | FinanceBuzz](https://images.financebuzz.com/filters:quality(75)/images/2022/07/26/robinhood-review-3.jpg)