Notes Receivable Differ From Accounts Receivable In That Notes Receivable

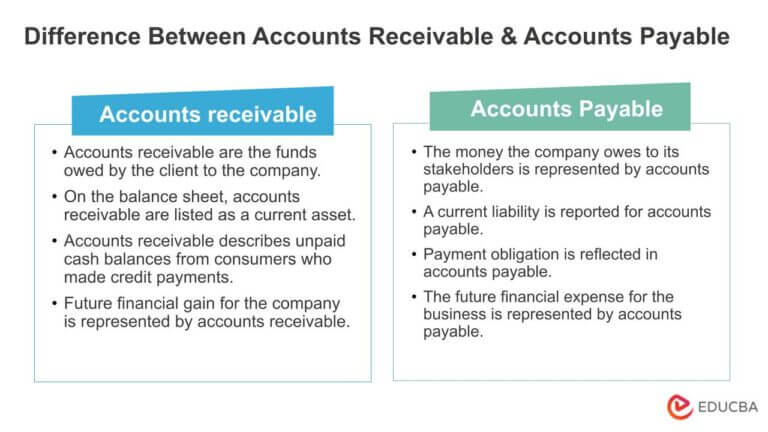

In the complex world of business finance, even seemingly subtle distinctions can have significant implications for a company's financial health and strategic planning. One such distinction lies between accounts receivable and notes receivable, two common types of assets representing money owed to a company. While both reflect credit extended to customers, their inherent nature and associated risks differ significantly, impacting how they are managed and valued.

Understanding the nuances between these receivables is crucial for accurate financial reporting, risk assessment, and effective cash flow management. Misinterpreting or misclassifying them can lead to distorted financial statements, potentially misleading investors, creditors, and internal decision-makers.

The Core Difference: A Matter of Formalization

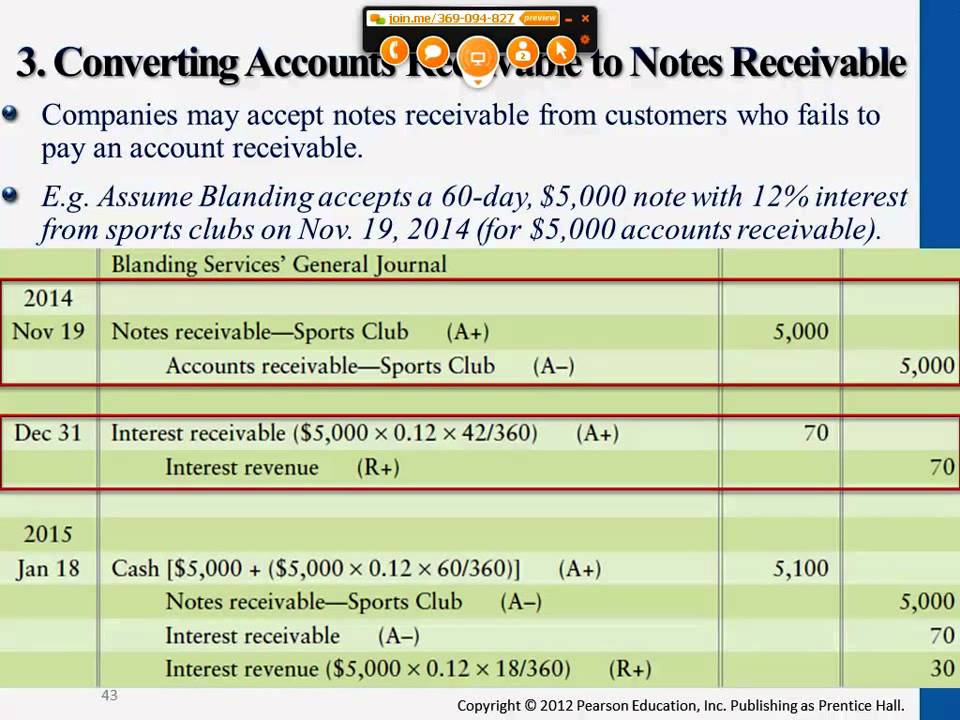

At their core, the difference between accounts receivable and notes receivable stems from the level of formalization involved in the credit agreement. Accounts receivable represent informal promises of payment, typically arising from routine sales transactions where goods or services are delivered on credit. These are usually short-term, often requiring payment within 30 to 90 days.

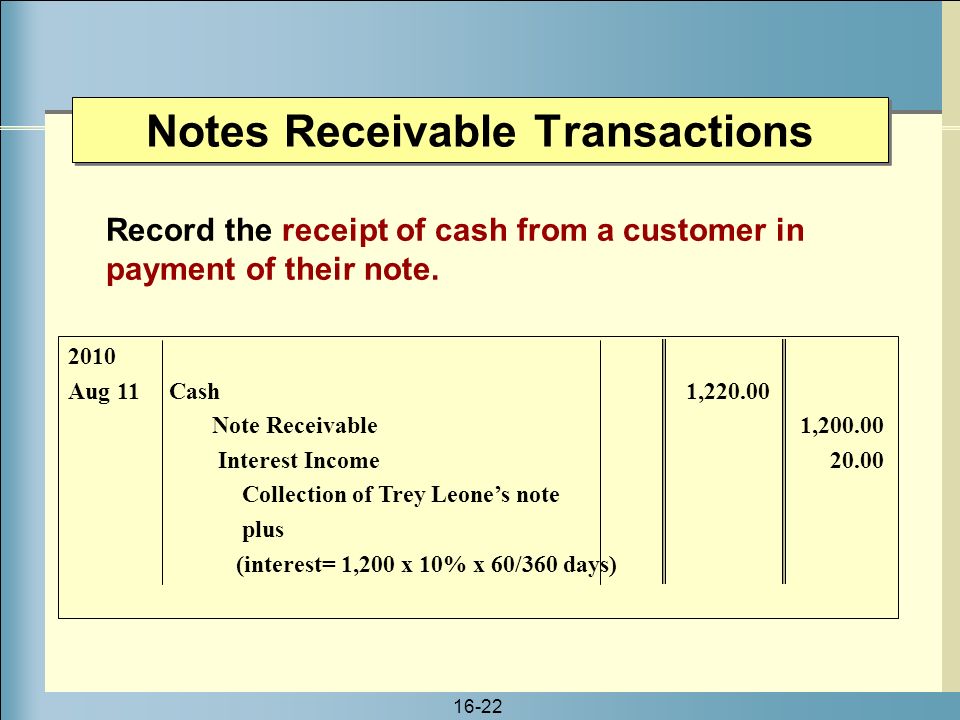

In contrast, notes receivable are formal, written promises to pay a specific sum of money on a specific date or dates, often including interest. They are legally binding documents, offering a stronger claim than accounts receivable.

Key Differentiators Unpacked

Several key factors distinguish notes receivable from accounts receivable. These factors extend beyond mere formality and impact various aspects of financial management. Let's explore these in detail.

Formal Documentation: As mentioned, notes receivable involve formal promissory notes, detailing the terms of repayment, including interest rates, due dates, and any collateral pledged. Accounts receivable, on the other hand, are typically supported by invoices or sales orders, lacking the legal weight of a promissory note.

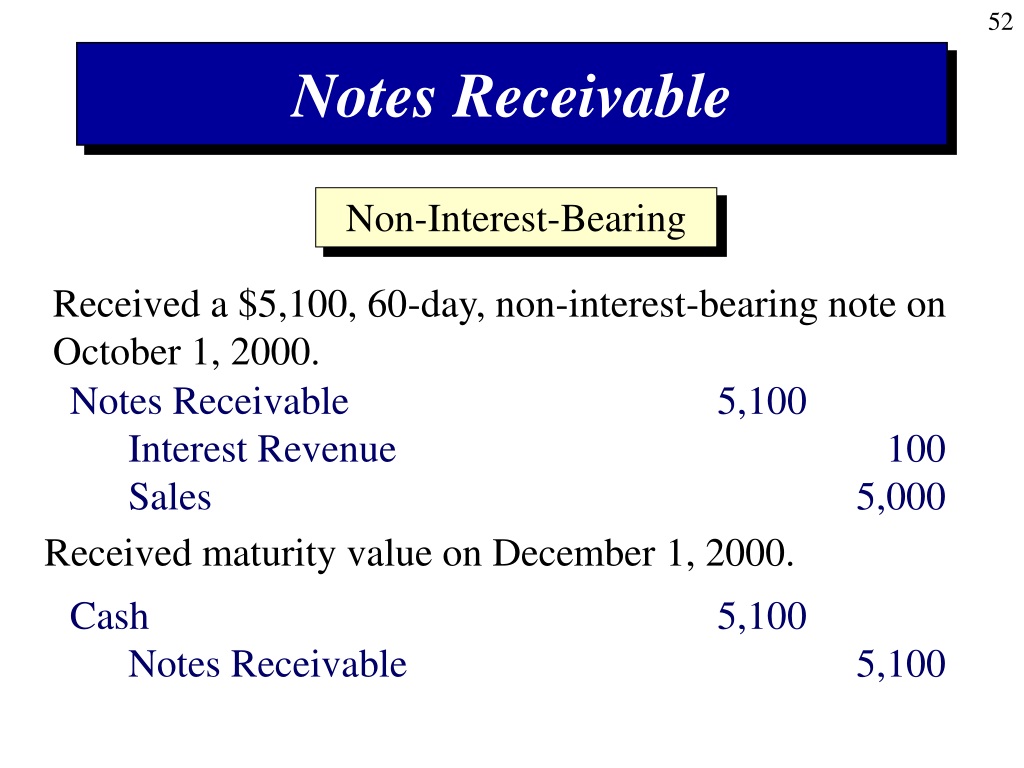

Interest Bearing: Notes receivable almost always accrue interest, compensating the lender for the time value of money and the risk involved. Accounts receivable generally do not accrue interest unless payment is significantly delayed and late payment fees are applied.

Term Length: While both can be short-term, notes receivable often have longer repayment periods than accounts receivable. This is especially true for notes used to finance significant purchases or large projects.

Collateral: Notes receivable may be secured by collateral, such as equipment or real estate, providing the lender with recourse in case of default. Accounts receivable are generally unsecured, meaning the lender has no specific asset to claim if the customer fails to pay.

Negotiability: Notes receivable can be negotiable instruments, meaning they can be transferred to another party, such as a bank, through endorsement. This allows the original holder to obtain immediate cash flow. Accounts receivable are generally not negotiable in the same manner.

Impact on Financial Reporting

The distinction between accounts receivable and notes receivable also affects how they are presented on the balance sheet. Both are classified as assets, but their specific presentation may differ depending on their liquidity and expected realization period. Accurate classification ensures that the financial statements provide a true and fair view of the company's financial position.

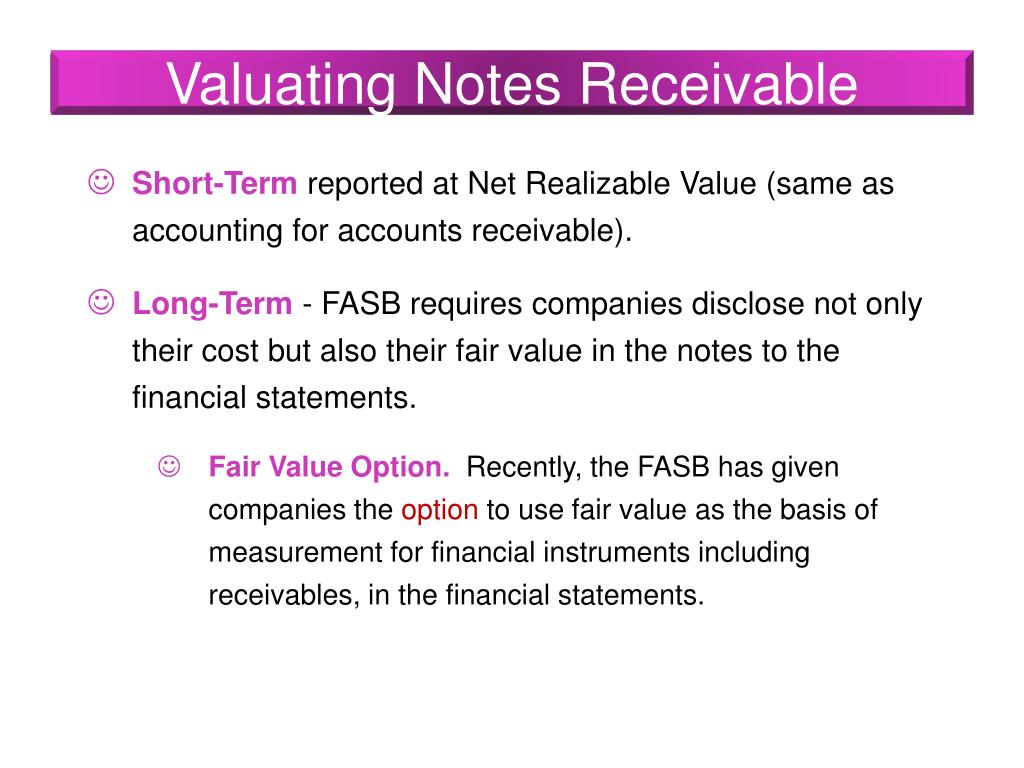

Balance Sheet Presentation: Both are classified as current assets if they are expected to be collected within one year. However, notes receivable with maturities longer than one year are classified as non-current assets.

Valuation and Impairment: Both are subject to impairment, meaning their carrying value may need to be reduced if there is doubt about their collectability. The method for determining impairment can differ slightly, reflecting the greater certainty associated with notes receivable.

Disclosure Requirements: Companies are required to disclose information about their receivables, including the nature of the receivables, the terms of repayment, and any collateral pledged. This provides transparency for investors and creditors.

Real-World Examples

Consider a manufacturing company that sells its products to retailers. Sales on credit, requiring payment within 30 days, generate accounts receivable. These are standard business transactions with minimal formal documentation.

Now, imagine the same company selling a large piece of equipment to a customer. To finance the purchase, the customer signs a note receivable agreeing to pay the purchase price, plus interest, over a period of three years, secured by the equipment itself. This represents a formalized agreement with specified terms and collateral.

Risk Assessment and Management

The risk associated with notes receivable is generally considered lower than that of accounts receivable due to the formal documentation and potential collateral. However, both are still subject to credit risk, the risk that the customer will default on their payment obligations.

Creditworthiness Evaluation: Companies extending credit should carefully evaluate the creditworthiness of their customers, regardless of whether they are issuing accounts receivable or notes receivable. This includes reviewing their financial statements, credit history, and industry outlook.

Collection Policies: Effective collection policies are essential for minimizing losses from uncollectible receivables. These policies should include timely invoicing, diligent follow-up on overdue payments, and legal action when necessary.

Insurance and Factoring: Companies can mitigate the risk of uncollectible receivables through credit insurance or factoring. Credit insurance protects against losses due to customer default, while factoring involves selling receivables to a third party at a discount.

The Future Landscape of Receivables Management

The advent of new technologies and evolving business practices is reshaping the landscape of receivables management. Automation, data analytics, and blockchain technology are transforming how companies manage their receivables, improving efficiency, reducing risk, and enhancing cash flow.

Automated Invoicing and Payment: Automated invoicing and payment systems streamline the entire receivables process, from generating invoices to processing payments. This reduces manual errors and improves efficiency.

Data Analytics for Credit Risk: Data analytics can be used to assess credit risk more accurately, identifying customers who are at a higher risk of default. This allows companies to make more informed credit decisions.

Blockchain for Secure Transactions: Blockchain technology can be used to create a secure and transparent record of receivables transactions, reducing the risk of fraud and improving trust between parties.

In conclusion, understanding the differences between accounts receivable and notes receivable is paramount for sound financial management. While both represent money owed, the level of formality, associated risks, and potential for interest earnings distinguish them significantly. As technology continues to evolve, companies must embrace innovative strategies to manage their receivables effectively, ensuring a healthy financial future.