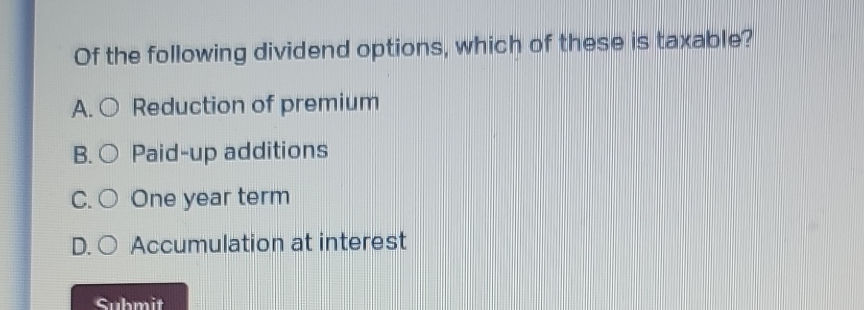

Of The Following Dividend Options Which Of These Is Taxable

Navigating the complexities of dividend taxation can be a daunting task for investors. Understanding which types of dividends are taxable, and under what circumstances, is crucial for effective financial planning and compliance with tax regulations. Failure to properly account for dividend income can lead to unwanted tax liabilities and potential penalties.

This article aims to clarify the different types of dividend options available to investors and delineate which of these are subject to taxation. We will delve into qualified dividends, non-qualified dividends, and dividends received in specific account types, providing a comprehensive overview of their tax implications. By understanding these distinctions, investors can make informed decisions about their investment strategies and manage their tax obligations effectively.

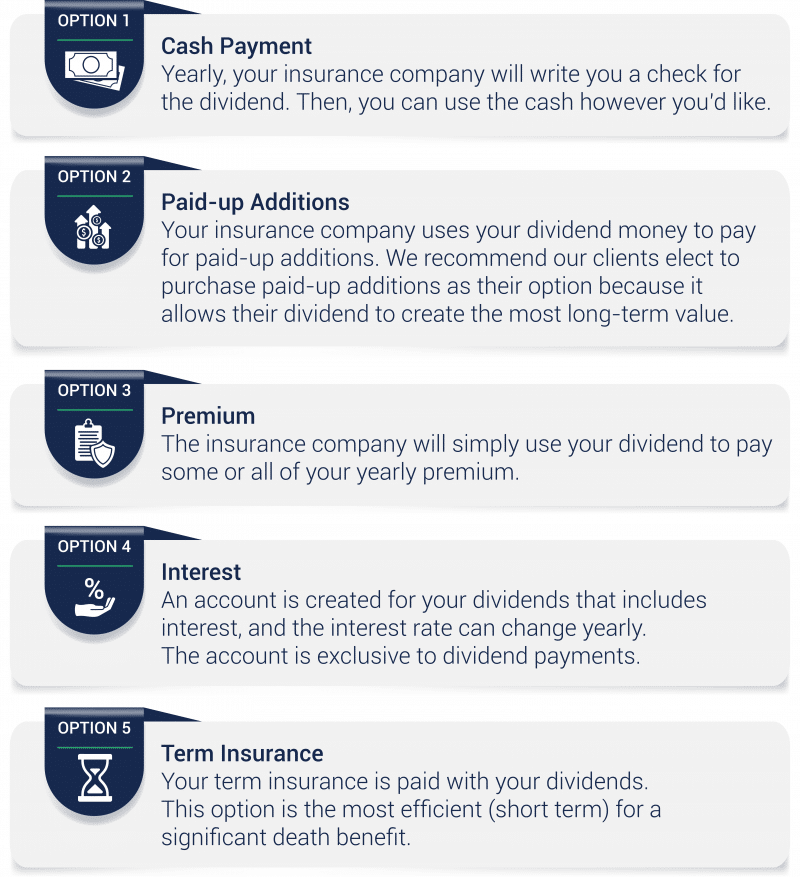

Understanding Dividend Types and Tax Implications

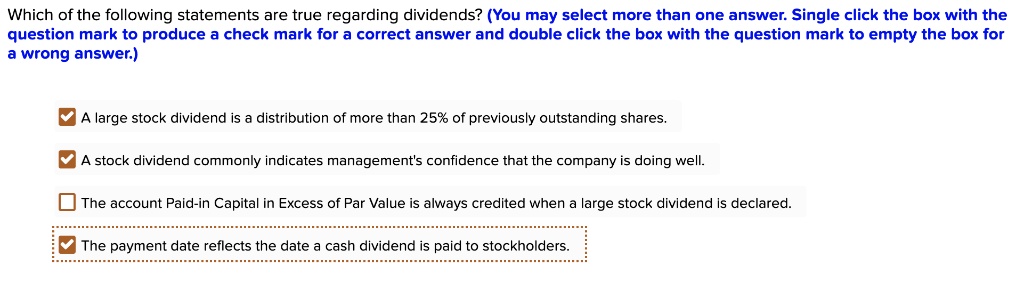

Dividends represent a portion of a company's profits distributed to its shareholders. However, not all dividends are created equal when it comes to taxation. The Internal Revenue Service (IRS) classifies dividends into different categories, each with its own set of rules.

Qualified Dividends

Qualified dividends are generally taxed at lower rates than ordinary income. This preferential tax treatment is designed to encourage long-term investment. To qualify for this lower rate, the dividend must meet certain requirements.

The stock must be held for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date. Furthermore, the dividend must be paid by a U.S. corporation or a qualified foreign corporation.

According to the IRS, the specific tax rates for qualified dividends depend on your overall taxable income. In 2023, these rates are 0%, 15%, or 20%, mirroring the long-term capital gains rates.

Non-Qualified Dividends

Non-qualified dividends, also known as ordinary dividends, do not meet the requirements for the preferential tax treatment afforded to qualified dividends. As such, they are taxed at your ordinary income tax rate. This rate can be significantly higher than the qualified dividend rate, depending on your income bracket.

Common examples of non-qualified dividends include dividends from REITs (Real Estate Investment Trusts) and master limited partnerships (MLPs). Also, dividends from companies that haven't been held for the minimum required time also fall into this category.

It's crucial to distinguish between qualified and non-qualified dividends when filing your taxes. Form 1099-DIV, which you receive from your brokerage, will typically report these dividends separately.

Dividends in Tax-Advantaged Accounts

The tax implications of dividends also vary based on the type of account in which they are held. Retirement accounts like 401(k)s and traditional IRAs offer tax-deferred growth, meaning you don't pay taxes on dividends as they are earned.

However, when you withdraw funds from these accounts in retirement, the withdrawals are taxed as ordinary income, which include any dividends received over the years. Roth accounts, such as Roth IRAs and Roth 401(k)s, offer tax-free growth and withdrawals, provided certain conditions are met.

This means that dividends earned within a Roth account are not taxed, either when they are earned or when they are withdrawn in retirement. Understanding these differences is vital for strategic retirement planning.

Impact and Considerations for Investors

The taxability of dividends can significantly impact an investor's overall return. High-income earners may find that their dividend income is taxed at a higher rate, reducing their net gains. Conversely, those in lower income brackets may benefit from the 0% tax rate on qualified dividends.

Investors should consider the tax implications when choosing between dividend-paying stocks and other investment options. For example, if an investor is in a high tax bracket, they may prefer to hold dividend-paying stocks in a tax-advantaged account to minimize their tax liability. Alternatively, they may focus on growth stocks that do not pay dividends until they are closer to retirement and in a lower tax bracket.

Furthermore, it's essential to consult with a qualified tax advisor to understand the specific tax implications of your investment decisions. Tax laws are complex and can change, so seeking professional advice ensures you remain compliant and optimize your tax strategy.

The Importance of Accurate Reporting

Accurate reporting of dividend income is essential for compliance with tax laws. The IRS receives copies of Form 1099-DIV from brokerage firms, which details the amount and type of dividends you received during the year. Failing to report this income can lead to penalties and interest charges.

Investors should carefully review their Form 1099-DIV to ensure the information is accurate. If you notice any discrepancies, contact your brokerage firm immediately to correct the error. Keep detailed records of your investment transactions, including purchase dates and dividend payments, to support your tax filings.

Staying informed about dividend taxation and maintaining accurate records is crucial for responsible financial management. By understanding the rules and seeking professional guidance, investors can navigate the complexities of dividend taxation effectively and maximize their investment returns.

![Of The Following Dividend Options Which Of These Is Taxable [FREE] Select the correct answer. Sue's taxable income is $30,000 a](https://media.brainly.com/image/rs:fill/w:750/q:75/plain/https://us-static.z-dn.net/files/d39/77532b68785aa957c7306470fb615442.png)

.jpg)