One Of The Objectives Of Reconciling Bank Statements Is

The routine task of reconciling bank statements, often perceived as a simple accounting procedure, plays a crucial role in maintaining the financial health and integrity of individuals, businesses, and organizations alike. It’s a process that extends beyond mere bookkeeping, offering a layered defense against errors and fraud, and providing a clear picture of actual financial standing.

At its core, bank reconciliation involves comparing the internal financial records of an entity with the corresponding bank statement. While identifying discrepancies is a primary aim, the underlying objective is to ensure accuracy, detect fraudulent activities, and ultimately, achieve a reliable financial position assessment. This process safeguards against potential losses and supports informed decision-making.

Understanding the Significance

Bank reconciliation is essential for organizations of all sizes, from small startups to multinational corporations. It’s not just about matching numbers; it’s about verifying that all transactions are accounted for and correctly recorded.

The process offers a layer of financial control that's difficult to replicate with other methods. According to the Association of Certified Fraud Examiners (ACFE), a robust internal control system, including regular bank reconciliations, can significantly reduce the risk of fraud.

Key Objectives Explained

The core objective of reconciling bank statements is multifaceted, going beyond simple balance verification. Accuracy, fraud detection, and financial insight are key elements.

One primary objective is to ensure the accuracy of financial records. By comparing internal records with the bank statement, any discrepancies, such as errors in recording amounts, dates, or payees, can be identified and corrected.

Secondly, reconciliation helps in detecting fraudulent activities. This includes identifying unauthorized transactions, forged checks, or other forms of financial manipulation. Early detection is critical in minimizing potential losses and mitigating the impact of fraud.

Finally, bank reconciliation provides valuable financial insight. It allows businesses to track cash flow, monitor spending patterns, and identify potential areas for improvement. This information is essential for making informed decisions about investments, budgeting, and financial planning.

The Reconciliation Process

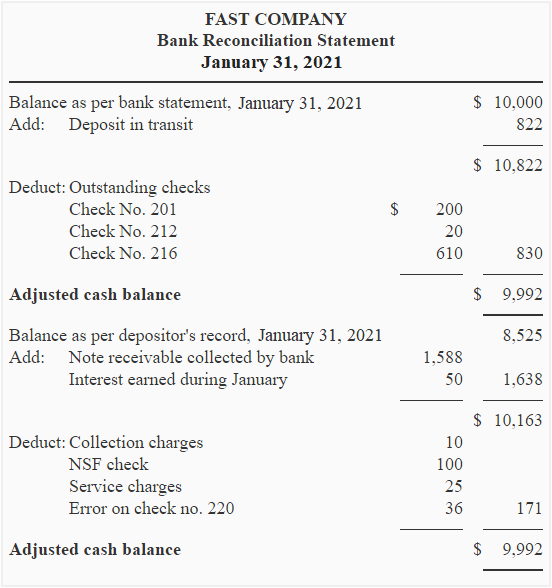

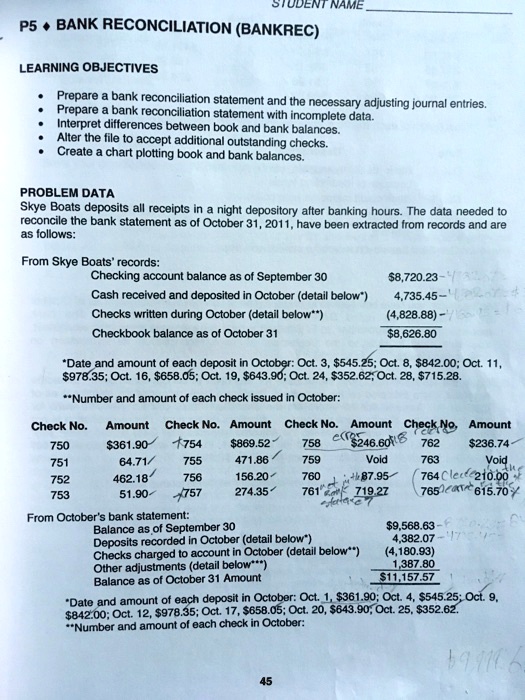

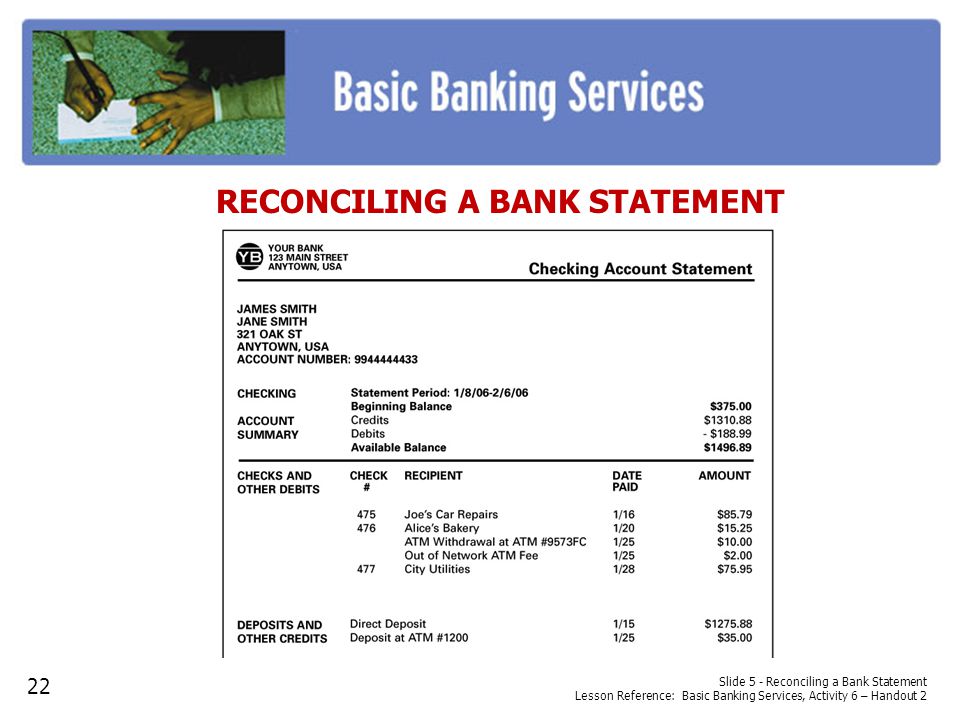

The reconciliation process generally involves several steps. These include gathering necessary documents, comparing balances, identifying discrepancies, and making necessary adjustments.

The process begins with collecting both the bank statement and the internal accounting records. This typically involves the general ledger, cash receipts journal, and cash disbursements journal.

Next, the balances are compared. Any differences must be investigated. Common discrepancies include outstanding checks, deposits in transit, bank charges, and errors made by either the bank or the company.

Once discrepancies are identified, adjustments must be made to either the bank statement or the company's records to reflect the true cash balance. This ensures that both sets of records are in agreement.

Potential Impact and Benefits

The impact of effective bank reconciliation is far-reaching. It extends beyond simply balancing the books to improving overall financial management and reducing risks.

For businesses, accurate bank reconciliation can improve the accuracy of financial reporting, making it easier to secure loans or investments. It also reduces the risk of financial penalties for non-compliance.

For individuals, bank reconciliation can help protect against identity theft and fraud. By regularly reviewing bank statements, individuals can identify unauthorized transactions and take steps to prevent further losses.

Moreover, reconciling your accounts regularly gives insight into your own spending habits. This can help with making informed decisions regarding personal budgeting.

Expert Opinions and Data

Financial experts consistently emphasize the importance of regular bank reconciliation. "Bank reconciliation is a fundamental control activity that all organizations should perform," says Sarah Johnson, a certified public accountant (CPA) specializing in forensic accounting.

According to data from the Small Business Administration (SBA), small businesses that regularly reconcile their bank statements are more likely to have better financial management practices and lower rates of business failure.

"Failing to reconcile bank statements is like driving a car without looking at the dashboard. You might get to your destination, but you won't know how much fuel you're using or if there's a problem with the engine," says David Miller, a financial advisor.

Conclusion

Bank reconciliation is more than just a routine task; it is a critical component of sound financial management. Its primary objective of ensuring accuracy, detecting fraud, and providing financial insight makes it indispensable for individuals, businesses, and organizations alike.

By adopting a consistent and thorough approach to bank reconciliation, stakeholders can safeguard their financial interests, make informed decisions, and build a foundation for long-term financial stability. Ignoring the process can have dire consequences, while embracing it unlocks a wealth of benefits.

Ultimately, the seemingly simple act of reconciling bank statements offers a powerful tool for navigating the complexities of modern finance, fostering trust, and achieving peace of mind.

:max_bytes(150000):strip_icc()/Bank_Reconciliation-V3-5c8a5643055c402fb16a4268b449ac0e.png)