Online Accounting Packages For Small Businesses

For small business owners, juggling finances, tracking expenses, and ensuring compliance can feel like a Herculean task. The digital age, however, has ushered in a new era of accessible and affordable online accounting solutions, promising to streamline these processes and empower entrepreneurs to focus on growth. But with a plethora of options available, navigating the landscape and choosing the right package can be overwhelming, demanding careful consideration and a solid understanding of individual business needs.

This article delves into the world of online accounting packages for small businesses, examining their benefits, features, and potential drawbacks. It also explores the key considerations for selecting the right solution and offers insights into the future of accounting technology. Understanding these aspects is crucial for small businesses looking to leverage technology for enhanced financial management and sustainable growth.

The Rise of Cloud Accounting

Cloud accounting, also known as online accounting, has revolutionized the way small businesses manage their finances. Unlike traditional desktop software, cloud-based solutions store data on remote servers, accessible from anywhere with an internet connection. This accessibility offers unparalleled flexibility and collaboration opportunities for business owners and their teams.

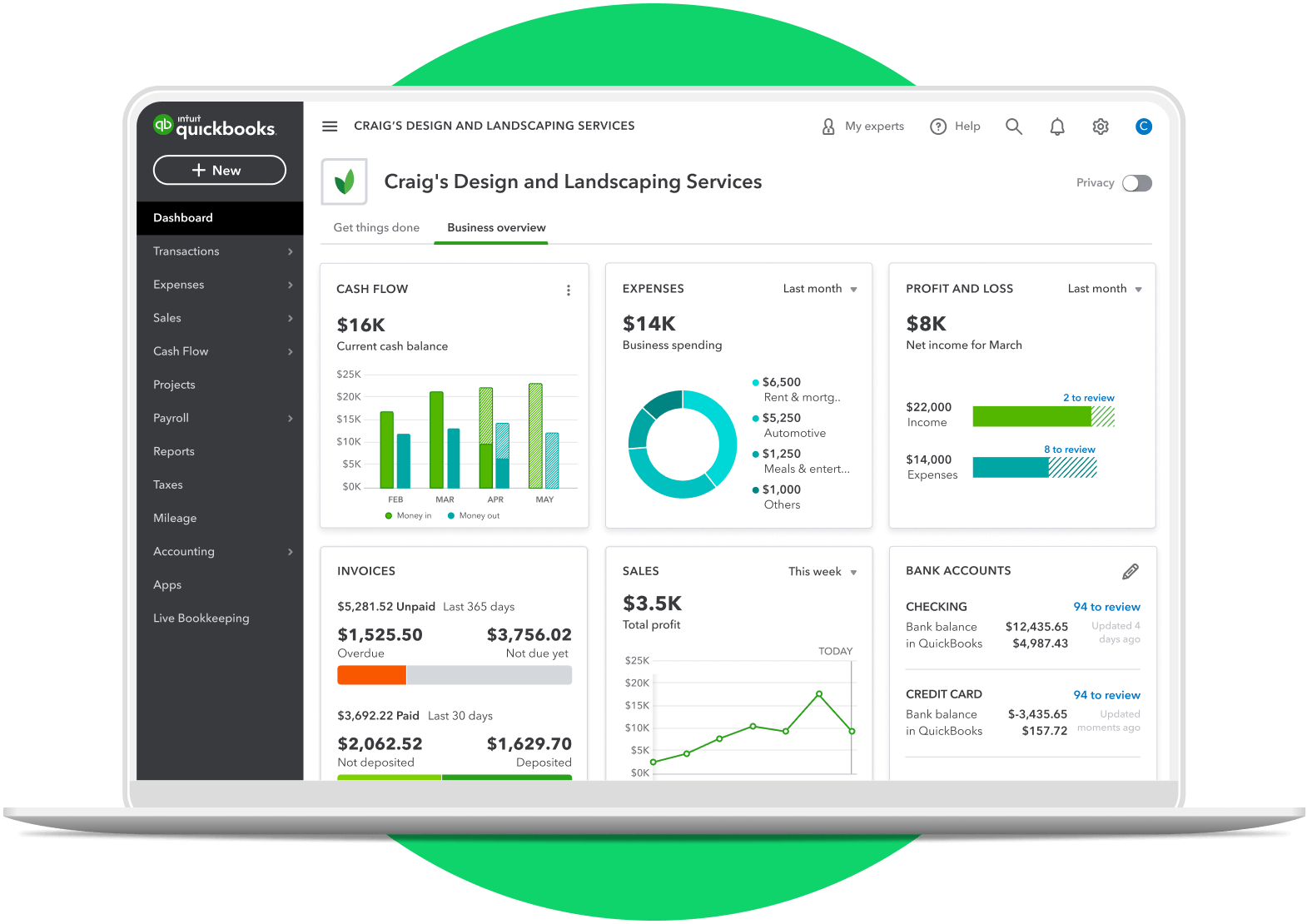

According to a report by Statista, the global cloud accounting market is projected to reach $5.2 billion by 2027, reflecting the growing adoption of these solutions. Xero, QuickBooks Online, and Sage Business Cloud Accounting are some of the prominent players in this market, offering a range of features tailored to different business sizes and industries.

Benefits of Online Accounting Packages

The advantages of online accounting are numerous. Automation of tasks such as bank reconciliation and invoice generation saves time and reduces the risk of human error.

Real-time financial data provides business owners with up-to-date insights into their cash flow, profitability, and overall financial health. This empowers them to make informed decisions based on accurate and timely information.

Collaboration is enhanced as multiple users can access and work on the same data simultaneously, improving communication between bookkeepers, accountants, and business owners. Security is also paramount, with reputable providers implementing robust measures to protect sensitive financial data.

Key Features to Consider

When selecting an online accounting package, several key features warrant careful consideration. Invoice management capabilities, including the ability to create and send professional invoices, track payments, and automate reminders, are crucial.

Expense tracking functionality allows businesses to easily record and categorize expenses, simplifying tax preparation and providing insights into spending patterns. Bank reconciliation tools automate the process of matching bank transactions with accounting records, ensuring accuracy and saving time.

Reporting and analytics features provide valuable insights into key performance indicators (KPIs), enabling businesses to monitor their financial performance and identify areas for improvement. Furthermore, integration with other business applications, such as CRM and e-commerce platforms, can streamline workflows and eliminate data silos.

Potential Drawbacks and Considerations

While online accounting offers numerous advantages, it is not without its potential drawbacks. Dependence on an internet connection means that access to financial data can be disrupted in areas with unreliable internet service. Security concerns, although addressed by reputable providers, remain a valid consideration, requiring careful due diligence in selecting a vendor.

The learning curve associated with new software can also be a challenge for some users, requiring training and support to fully utilize the platform's capabilities. Cost is another factor to consider, as subscription fees can vary depending on the features and number of users required.

Data migration from existing accounting systems can also be a complex and time-consuming process. Small business owners should carefully assess these potential drawbacks and weigh them against the benefits before making a decision.

The Future of Accounting Technology

The future of accounting technology is likely to be shaped by advancements in artificial intelligence (AI) and machine learning (ML). AI-powered accounting solutions can automate even more complex tasks, such as fraud detection and forecasting, freeing up accountants to focus on higher-level strategic work.

Blockchain technology has the potential to enhance the security and transparency of financial transactions. Increased integration with other business systems and the rise of mobile accounting will further streamline workflows and empower businesses to manage their finances on the go.

The evolution of online accounting packages is poised to continue, offering small businesses even more sophisticated and accessible tools to manage their finances effectively. By embracing these technologies, entrepreneurs can gain a competitive edge and pave the way for sustainable growth.