Online Accounting Software Small Business

The digital revolution has fundamentally reshaped the business landscape, and small businesses are increasingly turning to online accounting software to navigate the complexities of financial management. This shift represents a significant departure from traditional, often cumbersome, methods, offering a blend of accessibility, automation, and real-time insights. However, the transition isn't without its challenges, raising questions about security, data privacy, and the learning curve associated with new technologies.

At the heart of this trend lies the need for small business owners to streamline their accounting processes, reduce errors, and gain a clearer understanding of their financial health. Online accounting software offers a compelling solution, promising to simplify tasks such as invoicing, expense tracking, and bank reconciliation. Understanding the benefits, challenges, and future implications of this technological adoption is crucial for small businesses aiming to thrive in today's competitive environment.

The Rise of Cloud Accounting

Cloud-based accounting software has witnessed exponential growth in recent years, fueled by its accessibility and cost-effectiveness. Unlike traditional desktop software, online solutions allow users to access their financial data from anywhere with an internet connection.

This flexibility is particularly appealing to small business owners who are often on the move and need to stay connected to their finances regardless of location.

According to a report by Statista, the global cloud accounting market is projected to reach \$6.1 billion by 2027, highlighting the widespread adoption and increasing reliance on these tools.

Key Advantages for Small Businesses

One of the most significant advantages of online accounting software is its automation capabilities.

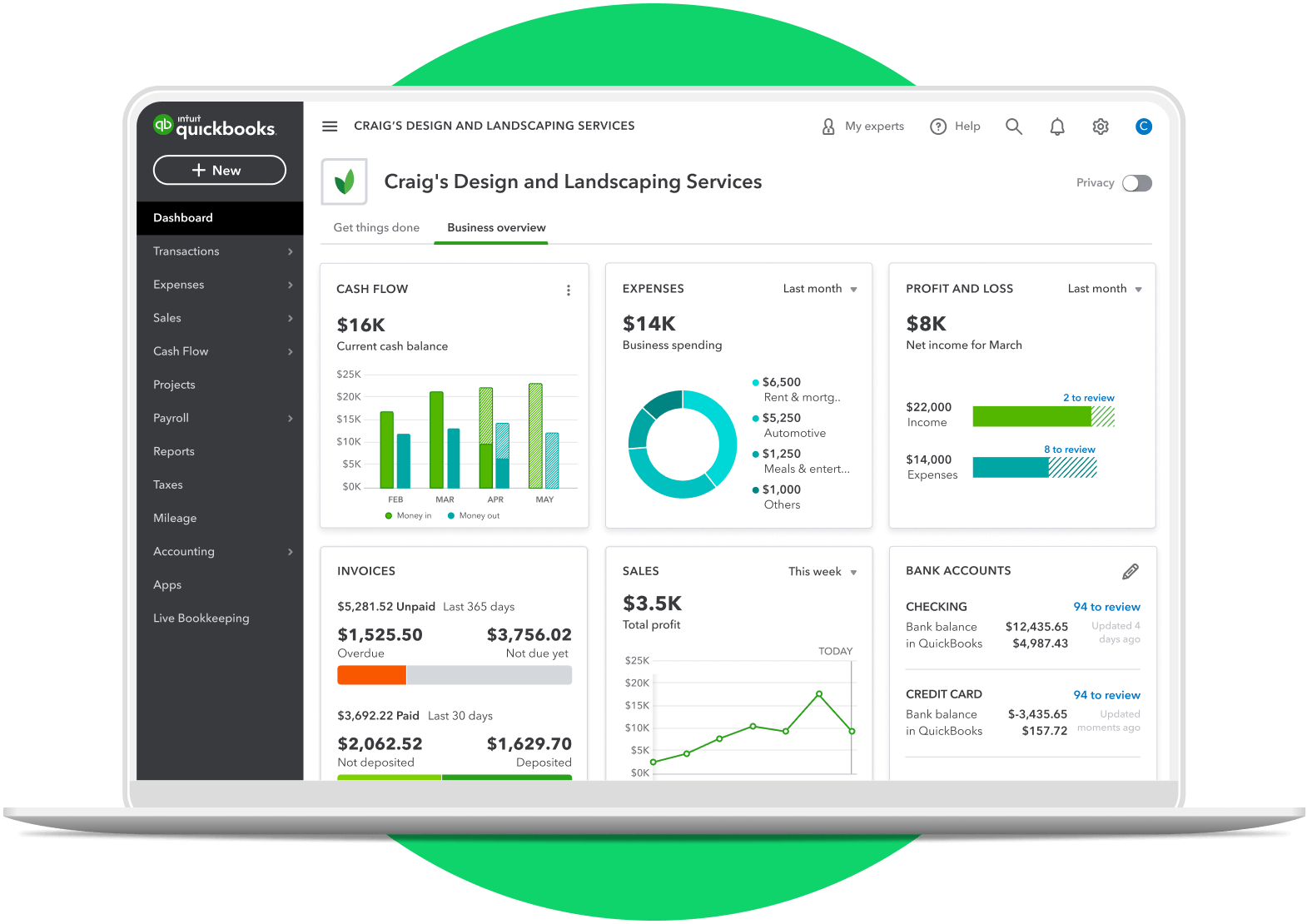

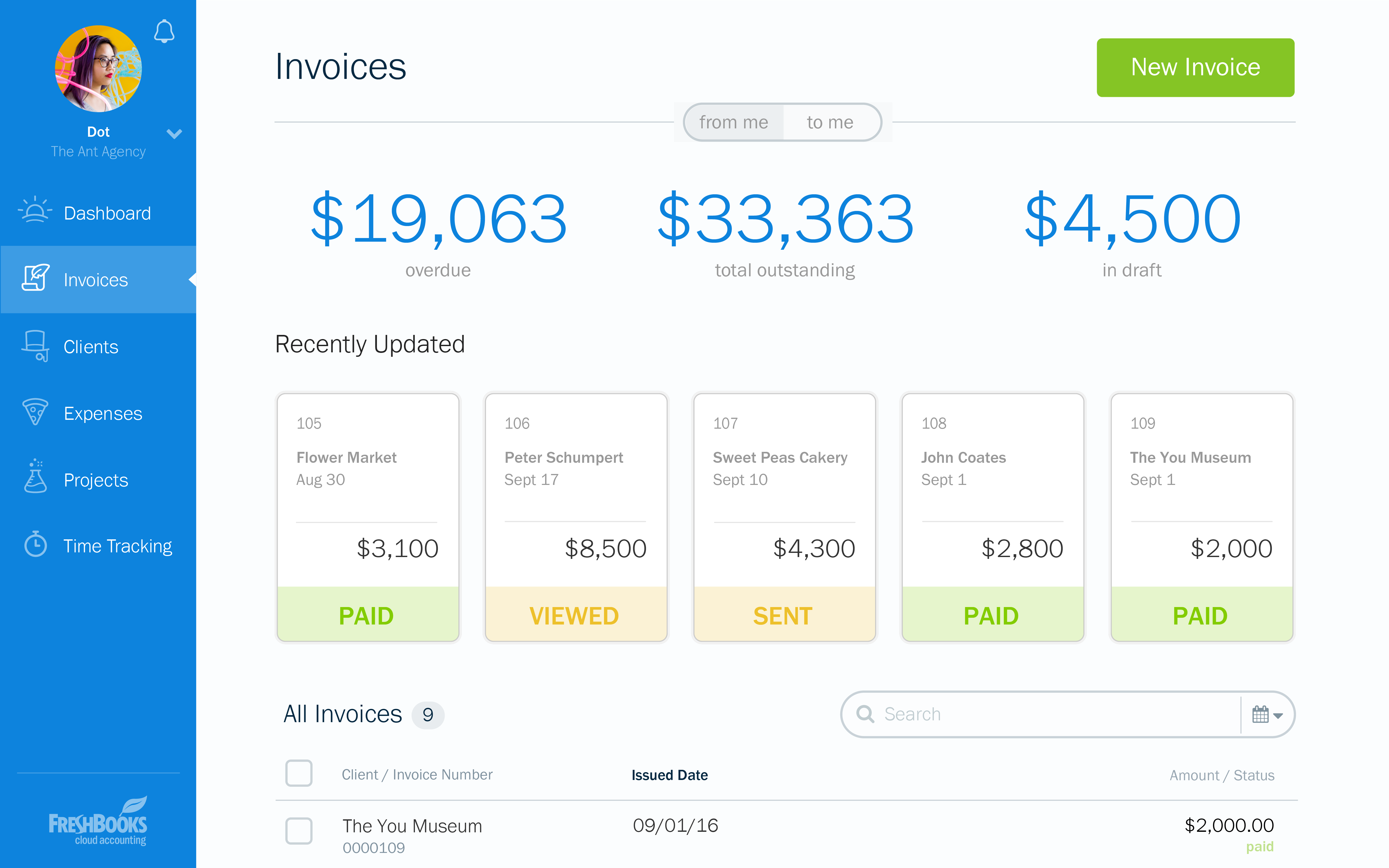

Tasks such as generating invoices, tracking expenses, and reconciling bank statements can be largely automated, freeing up valuable time for business owners to focus on other critical areas of their operations.

Furthermore, many platforms offer integration with other business tools, such as CRM systems and e-commerce platforms, creating a seamless flow of information and eliminating the need for manual data entry.

Real-time financial data is another key benefit.

Online accounting software provides business owners with an up-to-date view of their financial performance, enabling them to make more informed decisions.

This access to real-time data can be particularly valuable for managing cash flow, identifying potential problems early on, and optimizing business strategies.

Cost savings are also a major driver of adoption.

Cloud-based solutions typically operate on a subscription model, eliminating the need for upfront software purchases and ongoing maintenance fees.

This can be particularly appealing to small businesses with limited budgets, allowing them to access sophisticated accounting tools without breaking the bank.

Challenges and Considerations

Despite the numerous benefits, adopting online accounting software also presents several challenges for small businesses.

Security concerns are paramount, as businesses entrust sensitive financial data to third-party providers.

It's crucial to choose reputable vendors with robust security measures in place to protect against data breaches and cyberattacks.

Data privacy is another important consideration, especially in light of increasing regulations such as GDPR and CCPA.

Businesses need to ensure that their chosen software provider complies with all applicable data privacy laws and regulations.

They also need to implement appropriate data security practices to protect their customers' and employees' personal information.

The learning curve associated with new software can also be a barrier to adoption.

Small business owners and their staff may need training and support to effectively use the software and maximize its benefits.

Fortunately, many vendors offer online tutorials, webinars, and customer support to help users get up to speed.

Dependence on internet connectivity is another potential drawback.

If a business loses its internet connection, it may be unable to access its accounting data.

This can be particularly problematic for businesses that operate in areas with unreliable internet service.

Looking Ahead

The future of online accounting software for small businesses looks bright.

Technological advancements such as artificial intelligence (AI) and machine learning (ML) are poised to further automate accounting processes and provide even more insightful financial data.

AI-powered features such as automated invoice processing and fraud detection are already beginning to emerge, promising to streamline accounting tasks and enhance security.

As the market matures, competition among software vendors is likely to intensify, leading to lower prices and more innovative features.

Small businesses will have an even wider range of options to choose from, allowing them to find a solution that perfectly fits their needs and budget.

This increased competition will also drive vendors to improve their customer support and training offerings, making it easier for businesses to adopt and use online accounting software.

Ultimately, online accounting software is transforming the way small businesses manage their finances.

By embracing these technologies, small businesses can gain a competitive edge, improve their financial performance, and achieve their long-term goals.

The key is to carefully evaluate the available options, choose a reputable vendor, and invest in the necessary training and support to ensure a successful transition.