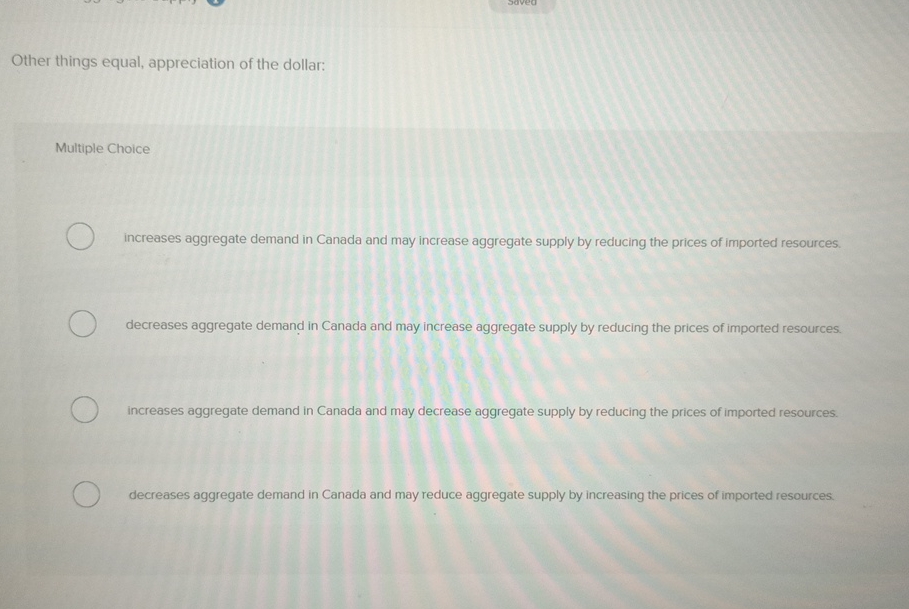

Other Things Equal Appreciation Of The Dollar

The dollar's recent ascent on the global stage has sent ripples through international markets, stirring both excitement and concern among economists and policymakers alike. Its strengthened position, while potentially beneficial for some, carries complex implications for trade balances, inflation, and economic growth both within the United States and abroad.

At the heart of this currency conundrum lies a simple yet powerful economic principle: *ceteris paribus*, or "other things equal." This article delves into the factors driving the dollar's appreciation, examining the potential impacts—assuming all other relevant economic variables remain constant—while acknowledging the inherent complexities of a dynamic global economy. It will explore the beneficiaries and the potentially burdened, shedding light on the nuanced consequences of a stronger dollar.

Understanding the Drivers

Several key factors typically contribute to the appreciation of a currency. Chief among these are interest rate differentials, economic growth prospects, and safe-haven demand during times of global uncertainty.

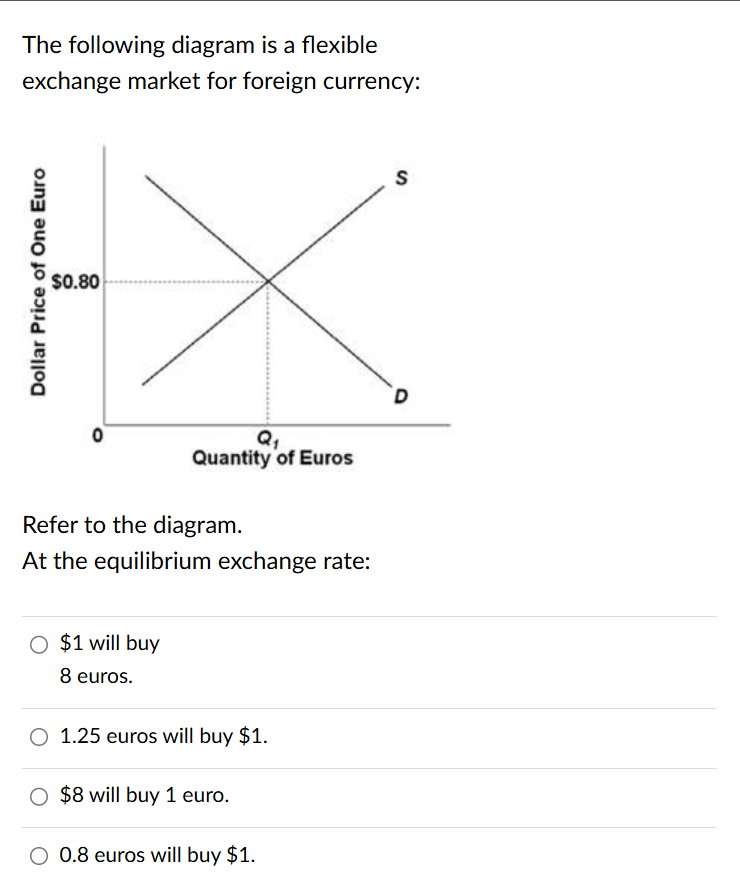

When the Federal Reserve raises interest rates, for example, US assets become more attractive to foreign investors. This increased demand for dollar-denominated investments drives up the dollar's value.

Stronger economic growth in the US, relative to other countries, can also fuel demand for the dollar. Investors seeking higher returns are drawn to markets with robust economic activity, further bolstering the currency.

Global instability, geopolitical tensions, or economic downturns elsewhere often lead to a "flight to safety." Investors flock to assets perceived as less risky, and the US dollar, traditionally considered a safe haven, benefits from this increased demand.

The Ceteris Paribus Assumption

The phrase "*ceteris paribus*" is crucial in understanding the theoretical impact of dollar appreciation. It means that we are analyzing the effect of a stronger dollar while holding all other factors constant. In reality, this is rarely the case.

However, using this assumption allows economists to isolate the specific effects of currency fluctuations, providing a framework for analysis. This simplified model helps clarify the potential consequences before considering real-world complexities.

Winners and Losers: A Theoretical Perspective

Under the *ceteris paribus* assumption, a stronger dollar theoretically creates distinct winners and losers in the global economy.

American consumers generally benefit from a stronger dollar. Imports become cheaper, increasing purchasing power and potentially lowering inflation. This allows consumers to buy more goods and services from overseas at a lower cost.

US companies that import raw materials or components also benefit. The cost of these inputs decreases, potentially leading to higher profits or lower prices for consumers.

However, American exporters face challenges. A stronger dollar makes their goods more expensive for foreign buyers, potentially reducing demand and hurting their competitiveness. This can lead to lower sales and decreased profitability.

Foreign countries whose currencies have weakened relative to the dollar may experience increased export competitiveness. Their goods become cheaper for US consumers, potentially boosting their economies.

Companies and countries that have borrowed heavily in US dollars may find their debt burdens increasing. As the dollar strengthens, they need more of their local currency to repay their dollar-denominated debts.

The Real-World Complications

The *ceteris paribus* assumption is a simplification. In the real world, many other factors influence the impact of a stronger dollar.

For example, if global demand for US goods remains strong despite the higher prices, the impact on US exporters may be mitigated. This could be due to the unique qualities of US products or the lack of readily available substitutes.

Exchange rate movements are not always fully passed through to prices. Companies may absorb some of the currency fluctuations to maintain their market share. This can limit the impact on both consumers and exporters.

Central banks often intervene in currency markets to manage exchange rate volatility. These interventions can offset the effects of market forces and influence the dollar's value.

Furthermore, the global economy is interconnected. A stronger dollar can have ripple effects on other countries, which in turn can affect the US economy. This creates a complex feedback loop that is difficult to predict.

“Currency movements are never isolated events,” stated a recent report from the International Monetary Fund (IMF). “Their impact depends on a multitude of factors, including the overall state of the global economy, the policies of individual countries, and the expectations of market participants.”

Impact on Inflation

A stronger dollar is often touted as a tool to combat inflation. Cheaper imports can help lower the prices of goods and services in the US. This effect, however, can be nuanced.

If domestic demand remains strong, the impact of cheaper imports on inflation may be limited. Companies may choose to maintain prices rather than passing on the savings to consumers.

A strong dollar may also disincentivize domestic production, as cheaper imports become more attractive. This can create a dependency on foreign suppliers and potentially lead to supply chain vulnerabilities.

Forward-Looking Perspective

Predicting the future trajectory of the dollar is notoriously difficult. Economic conditions, policy decisions, and geopolitical events can all influence its value.

The Federal Reserve's monetary policy will continue to be a key driver. Further interest rate hikes could strengthen the dollar, while a more dovish stance could weaken it.

The relative strength of the US economy compared to other major economies will also play a crucial role. If the US economy continues to outperform its peers, the dollar is likely to remain strong.

Geopolitical risks and global uncertainty could lead to increased safe-haven demand for the dollar. These factors can create unpredictable fluctuations in its value.

In conclusion, while the theoretical impact of a stronger dollar can be analyzed using the *ceteris paribus* assumption, the real-world consequences are far more complex. A nuanced understanding of the various factors at play is essential for navigating the challenges and opportunities presented by currency fluctuations. The long-term effects will depend on the interplay of numerous economic forces, highlighting the need for careful monitoring and adaptive policy responses.

![Other Things Equal Appreciation Of The Dollar [Class 12] What is Appreciation and Depreciation of Domestic Currency?](https://cdn.teachoo.com/0ddfc720-a644-42e2-b48a-0fbd6a173a36/difference-between-depreciation-and-appreciation-of-domestic-currency---teachoo.jpg)

.jpg)