Which Of The Following Statements About Monetary Policy Is True

The intricacies of monetary policy often remain shrouded in complexity, leaving many citizens unsure of its true mechanisms and effects. Recent economic discussions, fueled by fluctuating inflation rates and evolving market conditions, have brought the topic to the forefront. Understanding the fundamental principles of monetary policy is crucial for informed decision-making in personal finance and civic engagement.

This article aims to clarify key aspects of monetary policy by examining various statements and determining their validity. Monetary policy decisions, typically made by central banks, have far-reaching consequences for individuals, businesses, and the overall economy. We will explore how these policies are implemented and their intended impact.

What is Monetary Policy?

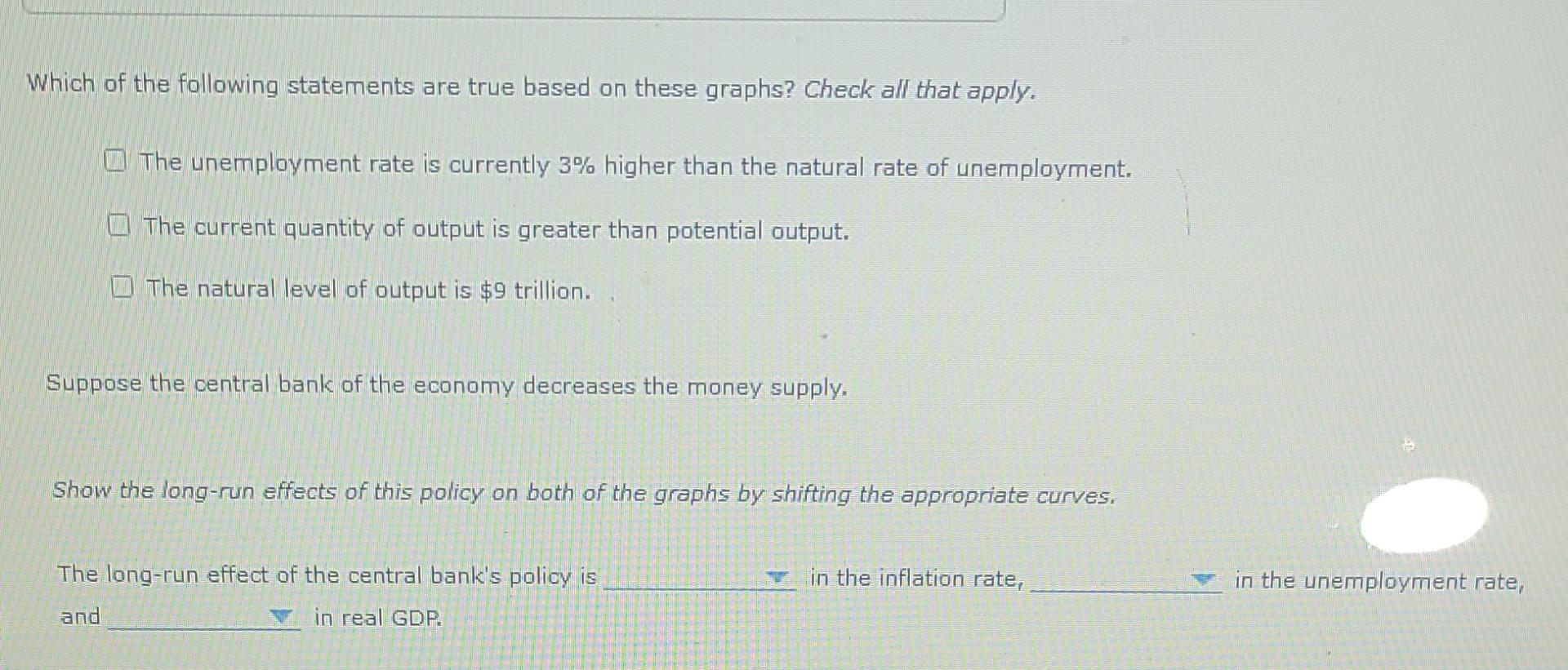

Monetary policy refers to actions undertaken by a central bank to manipulate the money supply and credit conditions to stimulate or restrain economic activity. The primary goals typically involve managing inflation, promoting full employment, and fostering sustainable economic growth. These goals are often intertwined, requiring careful calibration and strategic decision-making.

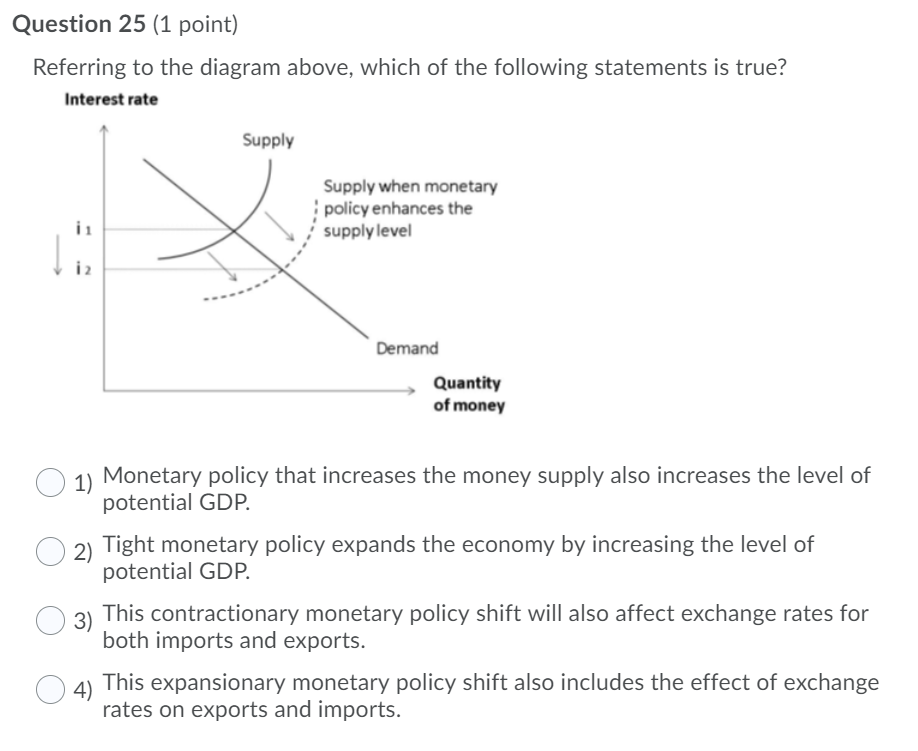

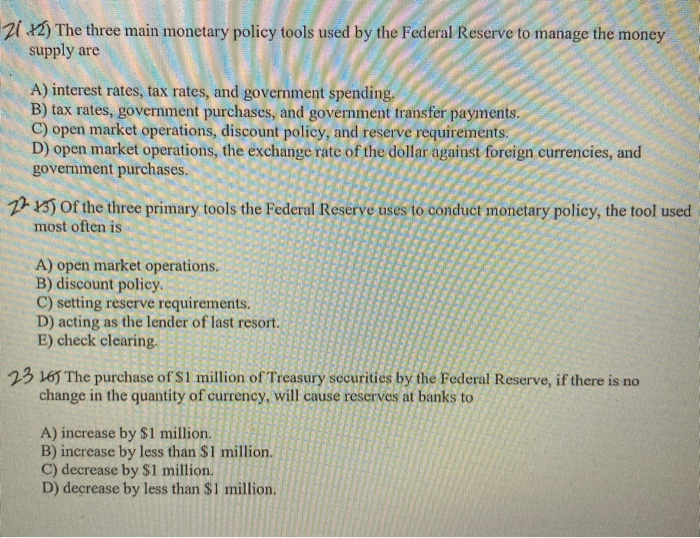

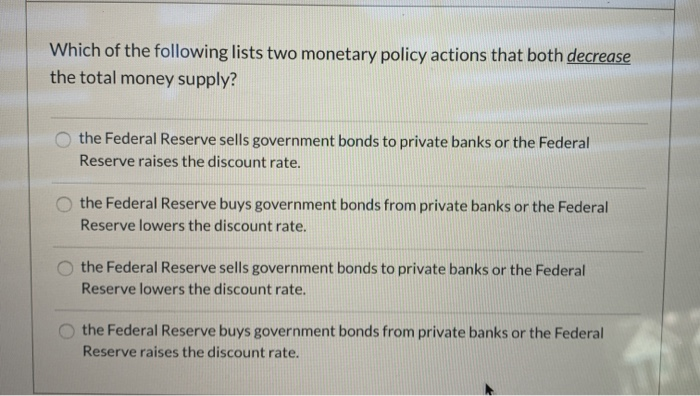

Central banks use several tools to implement monetary policy, including adjusting interest rates, setting reserve requirements for banks, and conducting open market operations. The specific tools used and their application depend on the prevailing economic conditions and the central bank's objectives.

Examining Common Statements about Monetary Policy

Statement 1: Lowering Interest Rates Always Leads to Inflation

This statement is an oversimplification. While lowering interest rates can stimulate demand and potentially lead to inflation if not managed carefully, it doesn't always trigger inflationary pressures.

The impact depends on the state of the economy. If the economy is operating below its potential, with significant unemployment and unused capacity, lower interest rates can help boost activity without necessarily causing excessive inflation. However, if the economy is already near full capacity, lowering rates can indeed exacerbate inflationary pressures.

Statement 2: Monetary Policy Affects Everyone Equally

This statement is false. Monetary policy's effects are not uniformly distributed across the population. Certain groups and sectors are more sensitive to changes in interest rates and credit conditions than others.

For example, borrowers, particularly those with variable-rate loans, are directly impacted by interest rate adjustments. Businesses with significant debt burdens also feel the effects more acutely. Similarly, industries that are highly sensitive to interest rates, such as housing and durable goods, tend to experience larger fluctuations in response to monetary policy changes.

Statement 3: Monetary Policy Operates with an Immediate Impact

This statement is incorrect. Monetary policy operates with a lag. The effects of policy changes take time to fully materialize in the economy.

The exact length of the lag is debated among economists, but it is generally acknowledged that it can take several months or even quarters for the full impact of a monetary policy decision to be felt. This lag makes it challenging for central banks to fine-tune policy and requires them to anticipate future economic conditions.

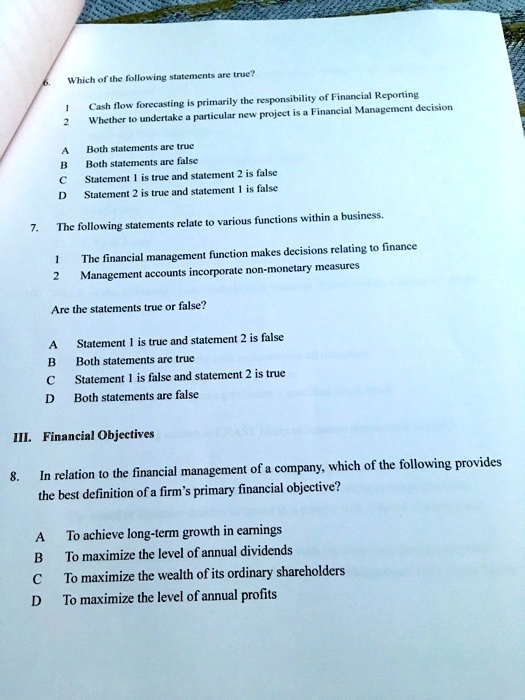

Statement 4: Monetary Policy is the Only Tool for Economic Stabilization

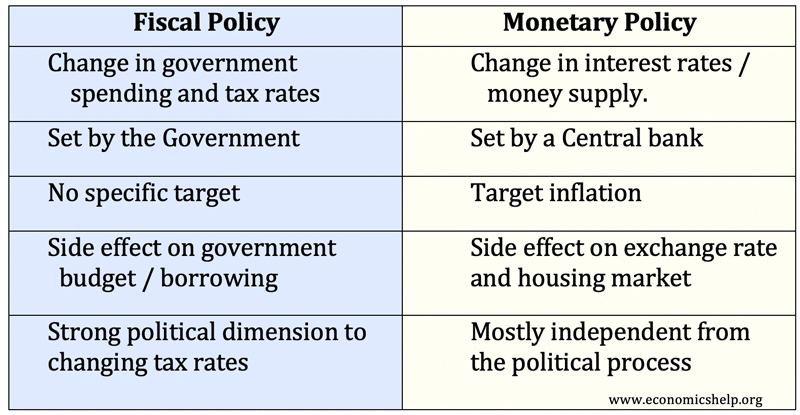

This statement is demonstrably untrue. While monetary policy plays a crucial role in economic stabilization, it is not the only tool available to policymakers. Fiscal policy, which involves government spending and taxation, is another important instrument.

Fiscal policy can complement or counteract monetary policy depending on the specific circumstances. For example, during a recession, both lower interest rates (monetary policy) and increased government spending (fiscal policy) can be used to stimulate demand. The effectiveness of each policy can also depend on the specific context and how they are coordinated.

The Importance of Understanding Monetary Policy

A clear understanding of monetary policy empowers individuals to make informed financial decisions. Knowing how interest rates and credit conditions affect borrowing costs, investment returns, and the overall economy can help people better manage their personal finances.

Moreover, understanding monetary policy is essential for informed civic engagement. Citizens who understand the implications of central bank decisions are better equipped to hold policymakers accountable and advocate for policies that align with their economic interests.

The Human Angle: Impact on Real People

Consider the example of a young couple planning to buy their first home. Changes in interest rates directly impact their affordability. If the central bank raises interest rates to combat inflation, their mortgage payments would increase, potentially delaying or even derailing their homeownership plans. Conversely, lower interest rates could make homeownership more accessible.

Small business owners are also heavily influenced by monetary policy. Lower interest rates can make it easier and cheaper to access credit, enabling them to invest in expansion, hire new employees, and grow their businesses. However, high interest rates can stifle investment and growth, leading to layoffs and closures.

Conclusion

Monetary policy is a complex and nuanced topic with significant implications for individuals, businesses, and the economy as a whole. Understanding its fundamental principles and the potential impact of policy decisions is crucial for informed decision-making and responsible citizenship. The statements examined highlight the importance of avoiding oversimplifications and recognizing the multifaceted nature of monetary policy.

By staying informed and engaging in thoughtful discussions about monetary policy, we can contribute to a more stable and prosperous economic future. The Federal Reserve, and other central banks, continuously monitor economic indicators and adjust policies to navigate the ever-changing economic landscape.