Palomar Excess And Surplus Insurance Company

The California insurance market is facing continued turbulence, particularly for homeowners in wildfire-prone areas. Palomar Excess and Surplus Insurance Company, a key player in providing specialized property insurance, finds itself navigating a complex landscape of increasing risk and regulatory pressures.

The company's strategies in managing these challenges, including its approach to underwriting and reinsurance, are under close scrutiny by both policyholders and industry analysts. Understanding Palomar's position and its response to the current crisis is crucial for anyone affected by the escalating insurance costs and dwindling coverage options in California.

Navigating a Challenging Market

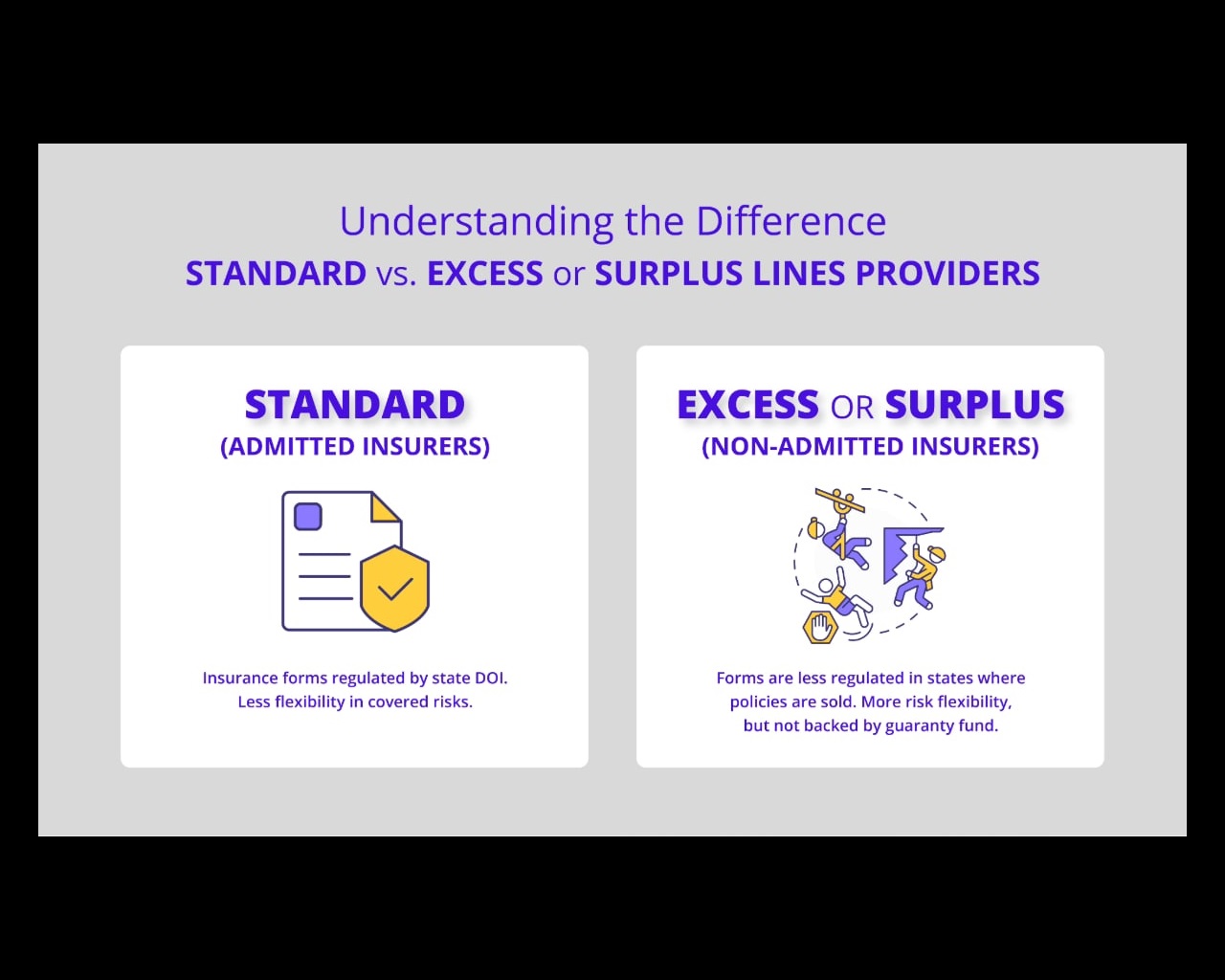

Palomar Excess and Surplus Insurance Company, a subsidiary of Palomar Holdings, Inc., specializes in providing excess and surplus lines insurance. This segment of the market caters to risks that standard insurers are unwilling or unable to cover. In California, this primarily involves properties facing heightened wildfire danger.

The company's role has become increasingly important as major national insurers have reduced their presence or completely exited the state's riskiest regions. This has left homeowners with fewer options and potentially higher premiums.

The current market situation is driven by a confluence of factors. These include escalating wildfire frequency and severity, coupled with the increasing costs of reinsurance and regulatory constraints on pricing risk.

The Impact on Policyholders

The decisions made by companies like Palomar Excess and Surplus directly affect homeowners in vulnerable areas. As insurance options dwindle, many are facing significantly higher premiums or the prospect of being uninsured altogether.

The rising cost of insurance can place a significant financial burden on families. Some might even be forced to sell their homes due to unaffordable premiums.

The California Department of Insurance (CDI) has been attempting to balance the need for insurer solvency with the protection of consumers. This leads to ongoing negotiations regarding rate increases and coverage requirements.

Palomar's Strategic Response

Palomar Excess and Surplus Insurance Company has adopted a multi-faceted approach to managing the risks and challenges in the California market. This includes refined underwriting practices, robust reinsurance programs, and proactive engagement with regulators.

The company utilizes sophisticated risk modeling to assess wildfire exposure and price policies accordingly. This helps to ensure that premiums accurately reflect the potential for loss.

Reinsurance plays a crucial role in Palomar's strategy. By transferring a portion of its risk to reinsurers, the company can mitigate potential losses from catastrophic events.

Underwriting and Risk Assessment

Palomar employs a data-driven approach to underwriting, considering various factors such as location, construction materials, and mitigation efforts. These factors determine the level of risk associated with each property.

Homes located in areas with high wildfire scores or lacking adequate defensible space may face higher premiums or be denied coverage. This reflects the increased risk of loss.

The company actively encourages homeowners to implement fire-resistant landscaping and home hardening measures. This can help to reduce risk and potentially lower insurance costs.

The Role of Reinsurance

Reinsurance is essential for insurance companies that deal with catastrophic risks. It allows them to transfer a portion of their risk to other insurers. Palomar heavily relies on the reinsurance market.

Through reinsurance agreements, Palomar can pay a premium to a reinsurer in exchange for coverage in the event of significant losses. This helps to protect the company's financial stability.

However, the cost of reinsurance has been increasing in recent years, which can translate to higher premiums for policyholders. This trend reflects the growing global awareness of climate-related risks.

Regulatory Scrutiny and Future Outlook

The California Department of Insurance is actively monitoring the insurance market and working to ensure fair and accessible coverage for homeowners. CDI must consider the financial health of insurers.

Ongoing discussions between the CDI and insurance companies, including Palomar Excess and Surplus, aim to find sustainable solutions. These solutions address the challenges posed by wildfire risk.

The future of the California insurance market remains uncertain. It is influenced by factors such as climate change, regulatory changes, and the availability of reinsurance.

Looking Ahead

Palomar Excess and Surplus Insurance Company, and other insurers in California, face an ongoing challenge in balancing risk management with the need to provide affordable coverage. Collaboration between insurers, regulators, and homeowners is crucial to finding sustainable solutions.

Continued investments in wildfire mitigation and prevention efforts are essential to reduce risk and stabilize the insurance market. These measures protect communities and potentially lower insurance costs.

The evolving insurance landscape in California demands innovative approaches and a commitment to long-term sustainability. Palomar's continued success will depend on its ability to adapt to the changing environment and effectively manage the risks associated with insuring properties in wildfire-prone areas.

![Palomar Excess And Surplus Insurance Company What Is Excess And Surplus Lines Insurance? [E&S] - YouTube](https://i.ytimg.com/vi/Gfij_hOq1Rg/maxresdefault.jpg?sqp=-oaymwEmCIAKENAF8quKqQMa8AEB-AH-CYAC0AWKAgwIABABGA8gZShRMA8=&rs=AOn4CLDaMA3UdrT6F09rbup_zRDdewwfFw)