The Advantages To The Corporate Form Of Business Include

Imagine a sprawling oak tree, its roots reaching deep into the earth, its branches extending wide, offering shade and shelter to many. This magnificent tree, symbolizing strength and longevity, might just be the perfect metaphor for a successful corporation, weathering storms and growing stronger with each passing year. Just like this tree, a corporation offers stability and opportunity, but what are the hidden advantages that allow these entities to flourish?

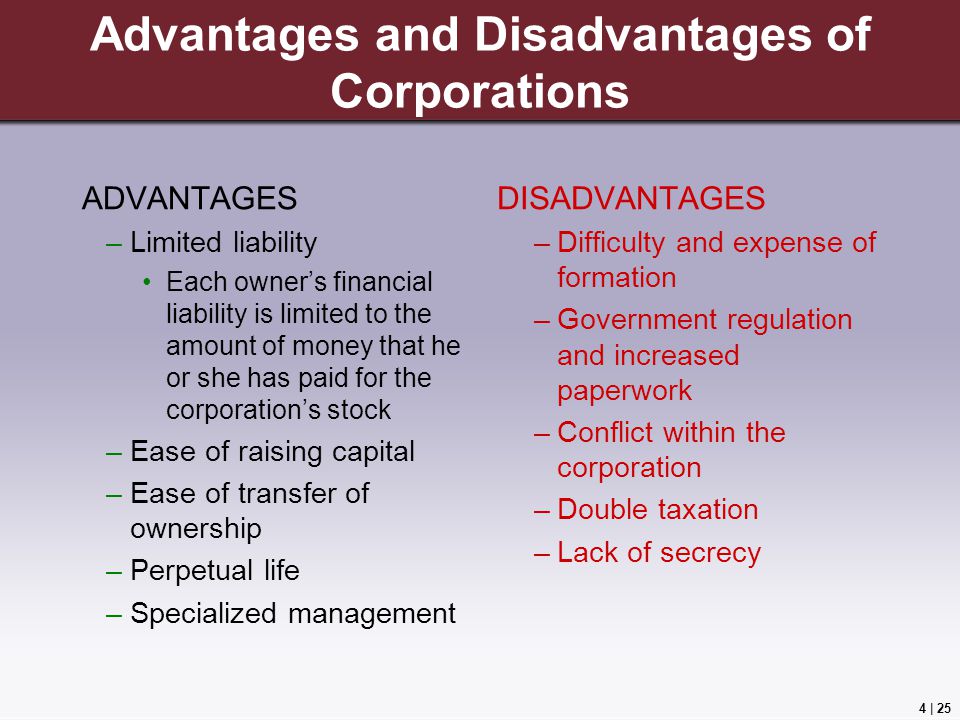

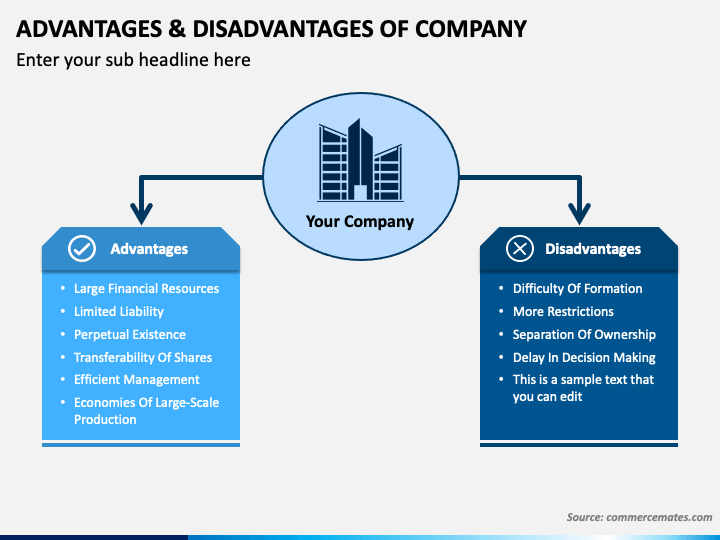

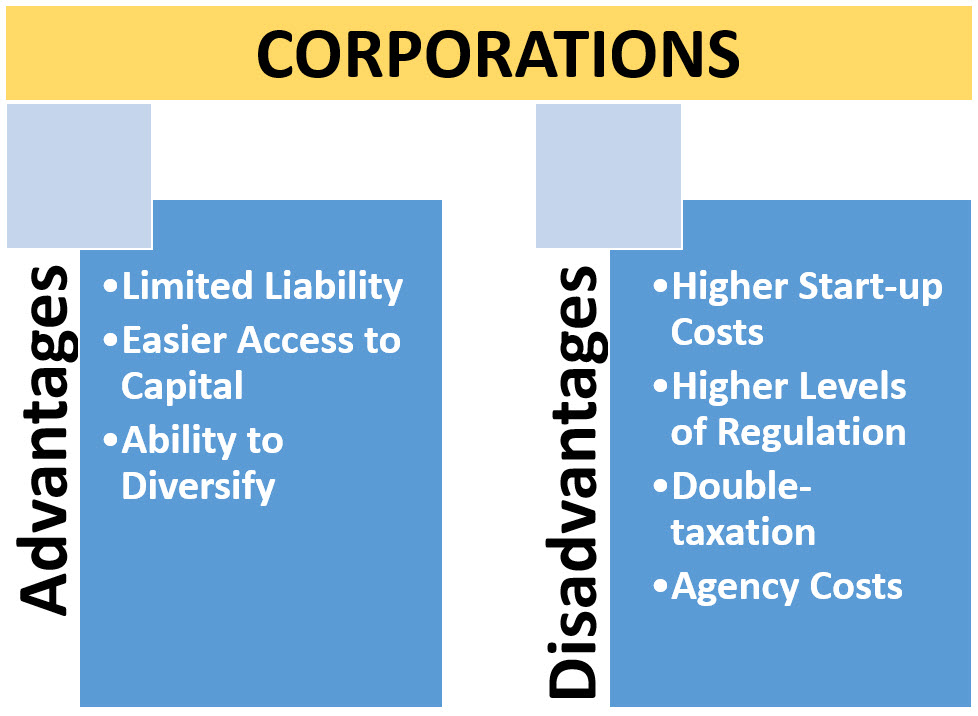

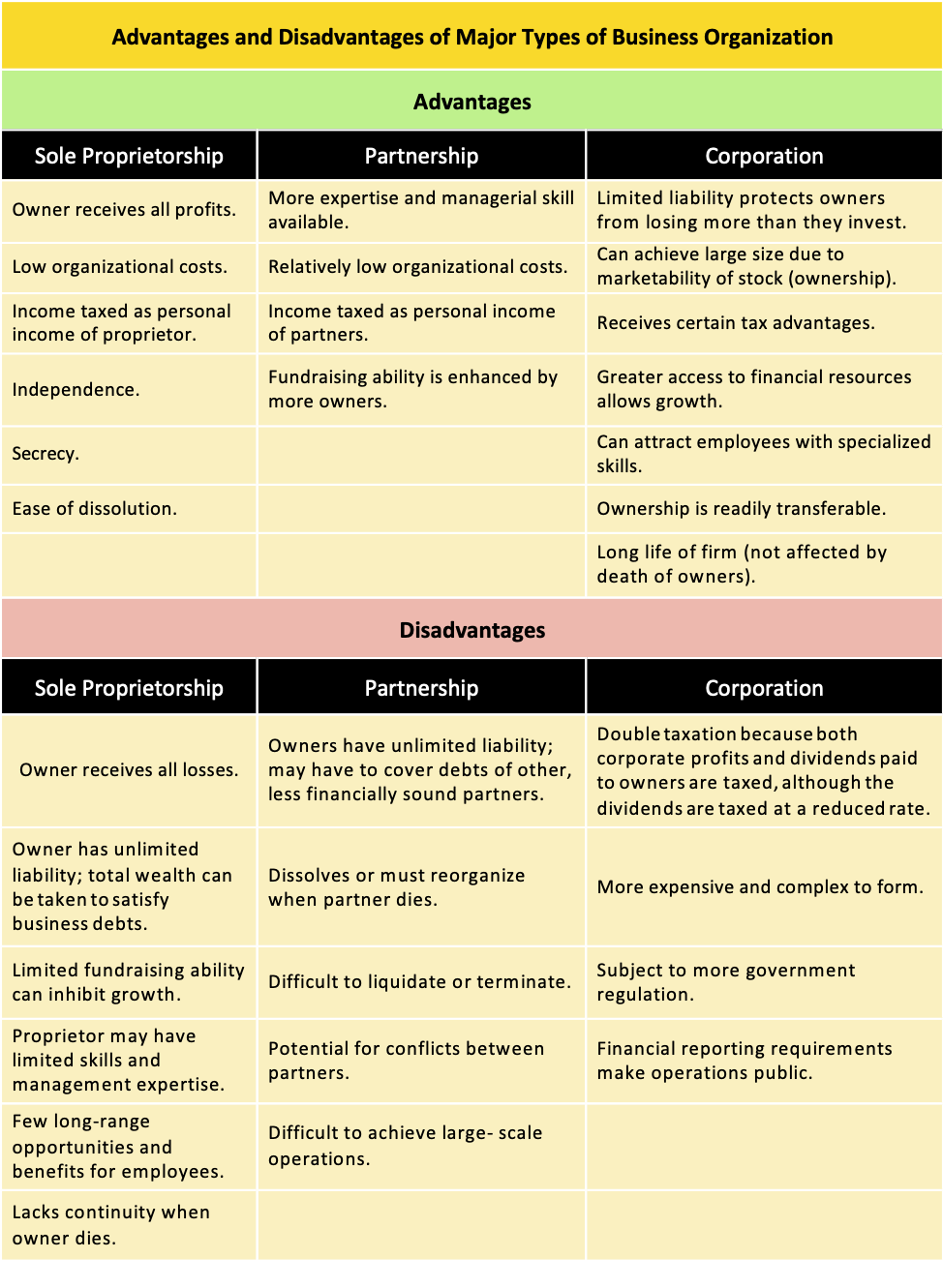

The corporate form of business, though sometimes perceived as complex, provides a wealth of advantages that fuel economic growth and foster innovation. From limited liability to perpetual existence and access to capital markets, the corporate structure offers benefits that are simply unmatched by other business forms.

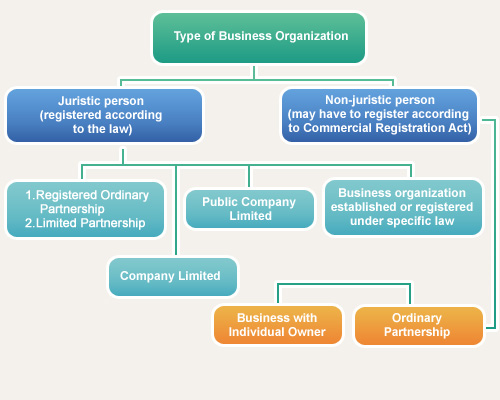

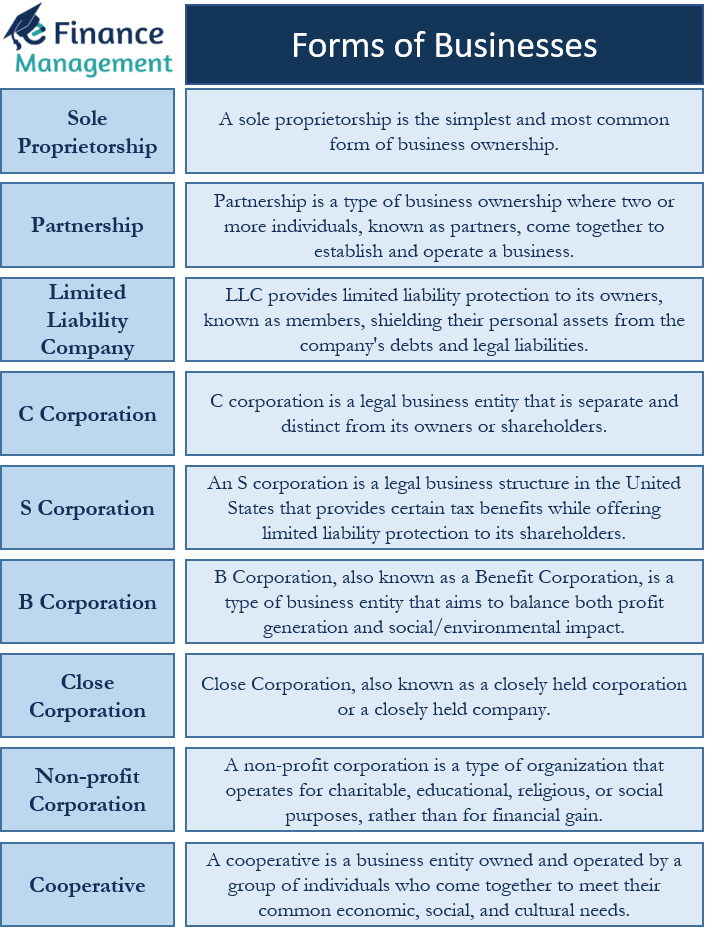

Understanding the Foundation: What is a Corporation?

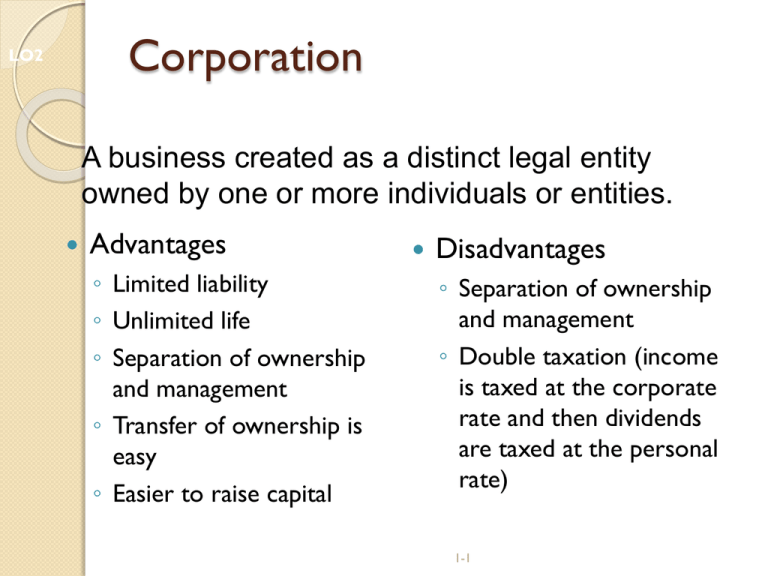

Before diving into the advantages, it's crucial to understand what exactly constitutes a corporation. Essentially, it's a legal entity, separate and distinct from its owners (shareholders). This separation is the cornerstone of many of its benefits.

Think of it as creating a new "person" in the eyes of the law, capable of owning property, entering contracts, and being sued, all independently of its shareholders.

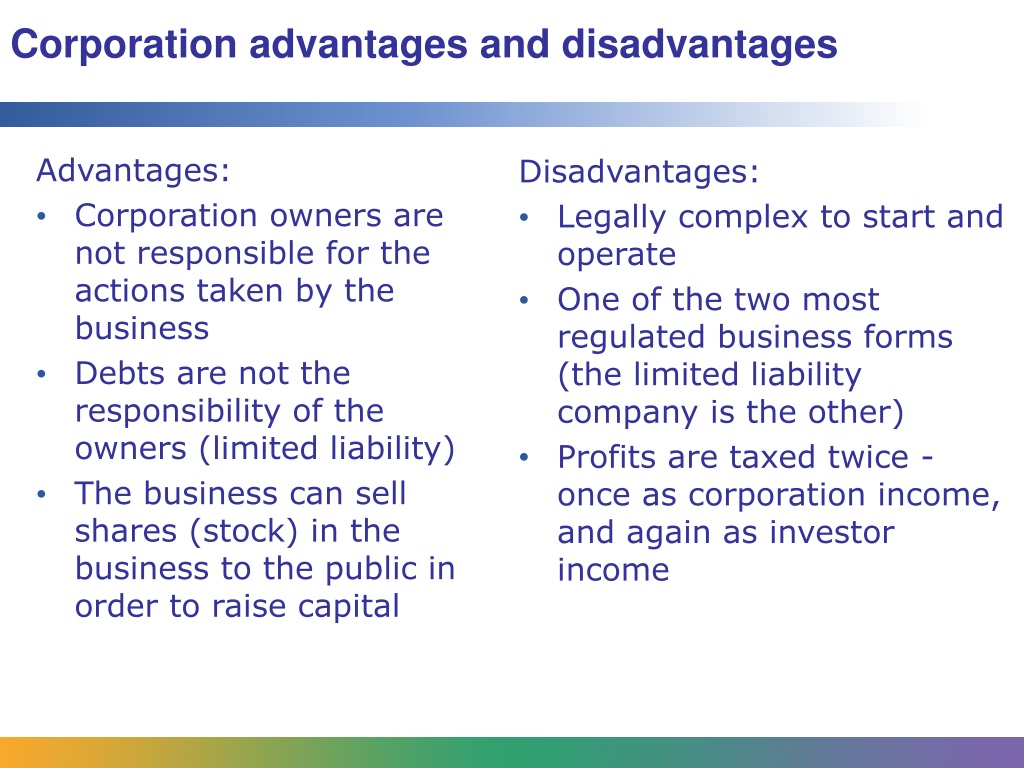

Limited Liability: A Shield for Personal Assets

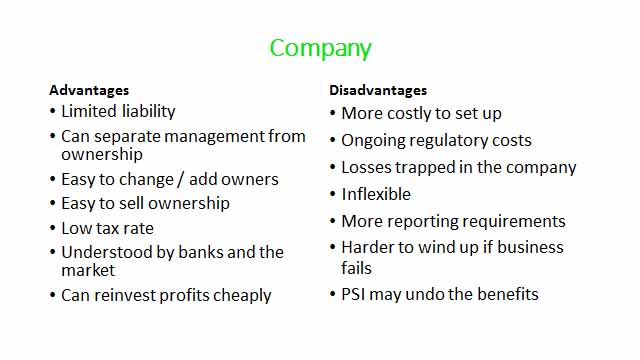

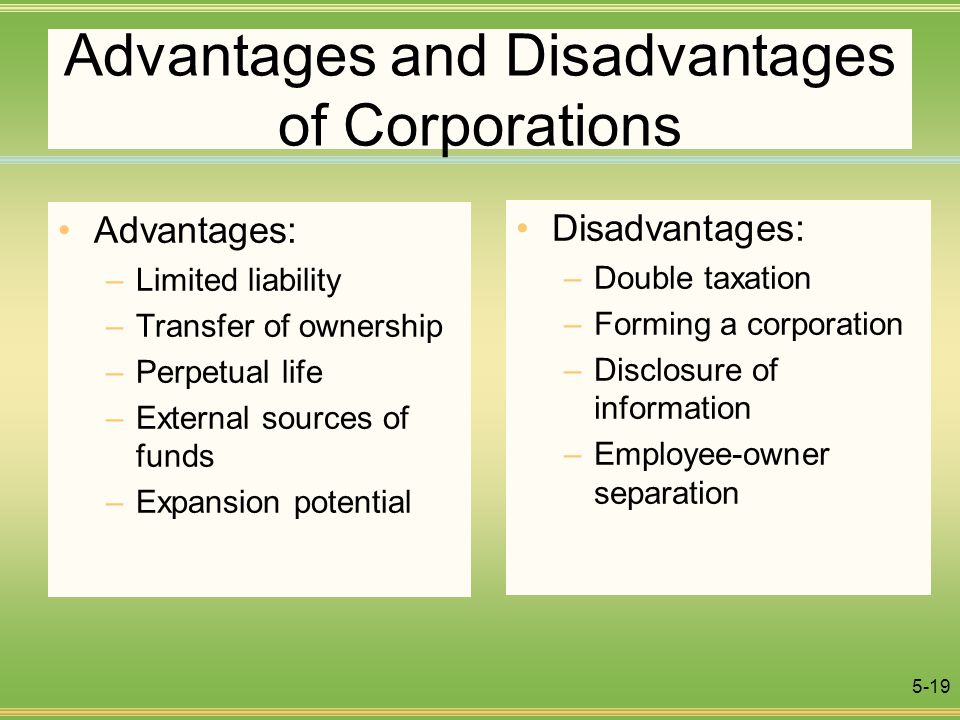

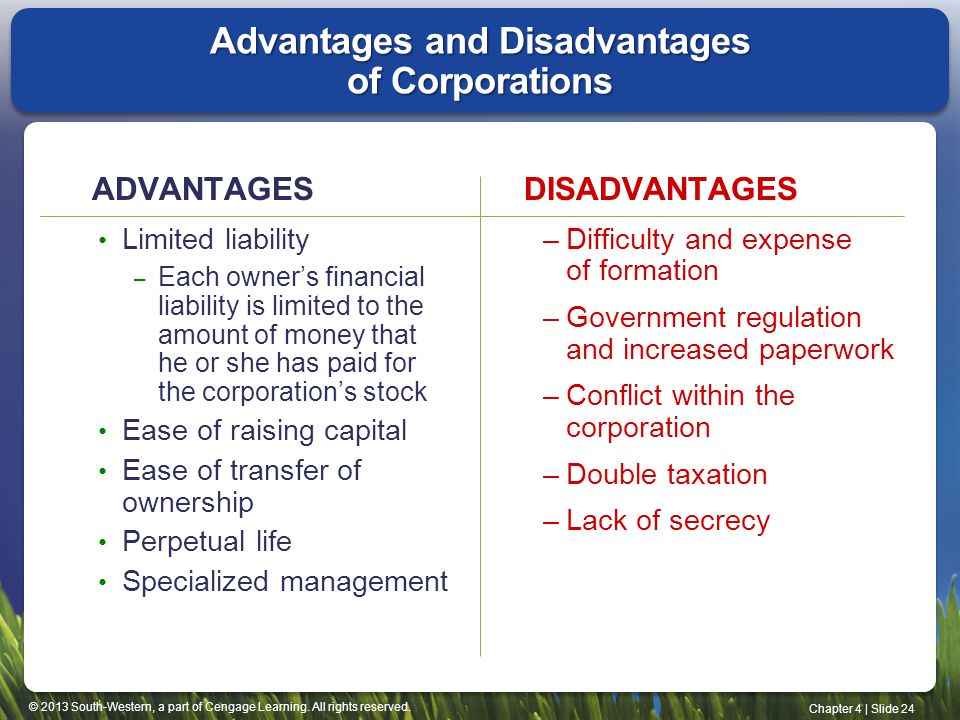

Perhaps the most significant advantage is limited liability. This means that the personal assets of the shareholders are generally protected from the corporation's debts and obligations.

In simpler terms, if the corporation incurs debt or faces a lawsuit, the shareholders typically only risk losing their investment in the company, not their homes, cars, or personal savings.

This feature significantly reduces the financial risk associated with business ownership, encouraging investment and entrepreneurship. Data from the Small Business Administration (SBA) consistently shows that businesses with limited liability attract more investment.

Perpetual Existence: A Legacy for the Future

Unlike sole proprietorships or partnerships, a corporation enjoys perpetual existence. This means that the corporation can continue to operate even if the original owners or shareholders die, retire, or sell their shares.

This continuity provides stability and allows the corporation to plan for the long term, investing in research and development, building brand loyalty, and developing long-term relationships with customers and suppliers.

The idea of a business lasting beyond the tenure of its founders is hugely appealing, fostering a culture of innovation and sustained growth, according to a recent study from Harvard Business Review.

Access to Capital: Fueling Growth and Expansion

Corporations have greater access to capital markets than other business structures. They can raise capital through the sale of stocks and bonds, attracting a wider range of investors.

This allows corporations to fund significant expansion plans, acquire new businesses, and invest in new technologies. Small businesses often struggle to secure the funding they need to grow, whereas corporations can tap into a much larger pool of resources.

A report by Bloomberg indicated that corporations are able to secure funding at lower interest rates compared to smaller businesses due to their perceived stability and lower risk.

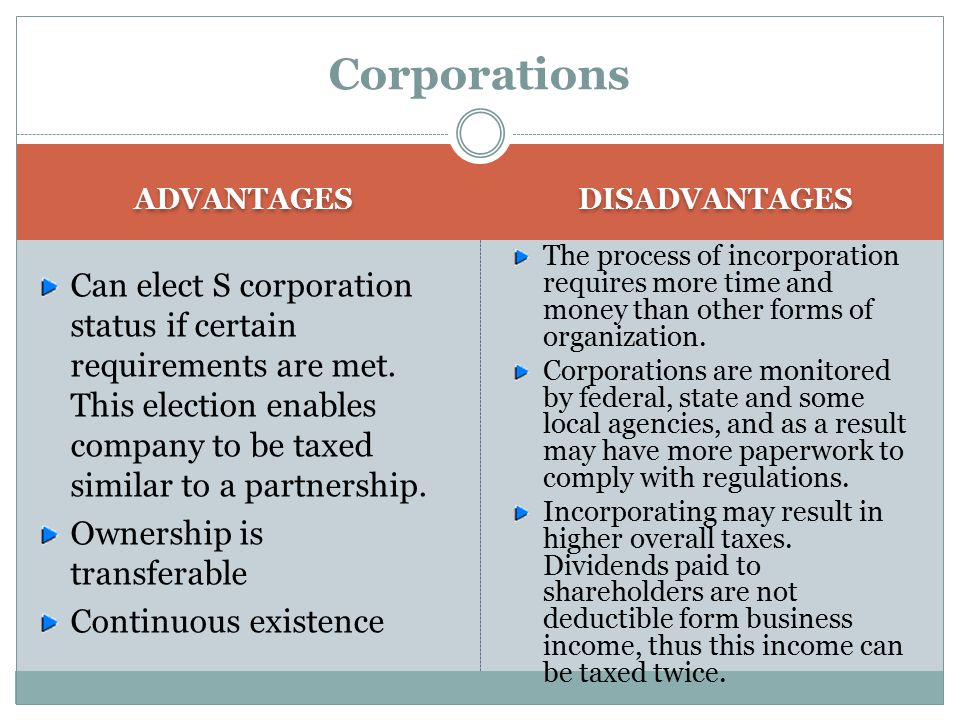

Transferability of Ownership: Facilitating Investment

Ownership in a corporation is easily transferable. Shares of stock can be bought and sold freely (depending on the type of corporation), making it easier for investors to enter and exit the business.

This liquidity makes corporate ownership more attractive to investors, further increasing the corporation's ability to raise capital. Imagine trying to sell your share in a family partnership versus selling shares of a publicly traded company.

The ease of transfer is a major draw for investors who value flexibility and the ability to quickly convert their investment into cash, according to the Securities and Exchange Commission (SEC).

Specialized Management: Expertise and Efficiency

The corporate structure allows for specialized management. Corporations can hire experienced professionals to manage different aspects of the business, leading to greater efficiency and expertise.

Unlike a sole proprietor who might wear many hats, a corporation can delegate tasks to individuals with specific skills and knowledge. This specialized management can significantly improve decision-making and operational effectiveness.

For example, a corporation can hire a Chief Financial Officer (CFO) to manage finances, a Chief Marketing Officer (CMO) to oversee marketing strategies, and a Chief Operating Officer (COO) to manage day-to-day operations.

A study by McKinsey & Company showed that companies with strong management teams consistently outperform their competitors.

Tax Advantages: Strategic Planning for Growth

While corporate tax laws can be complex, corporations can often utilize tax strategies to reduce their overall tax burden. This might involve deducting business expenses, depreciating assets, and taking advantage of tax credits.

The tax advantages are not always straightforward and require careful planning. Consultation with a qualified tax advisor is often necessary to maximize the benefits.

The Internal Revenue Service (IRS) provides guidelines and regulations that corporations must follow when filing their taxes.

Navigating the Corporate Landscape: Potential Drawbacks

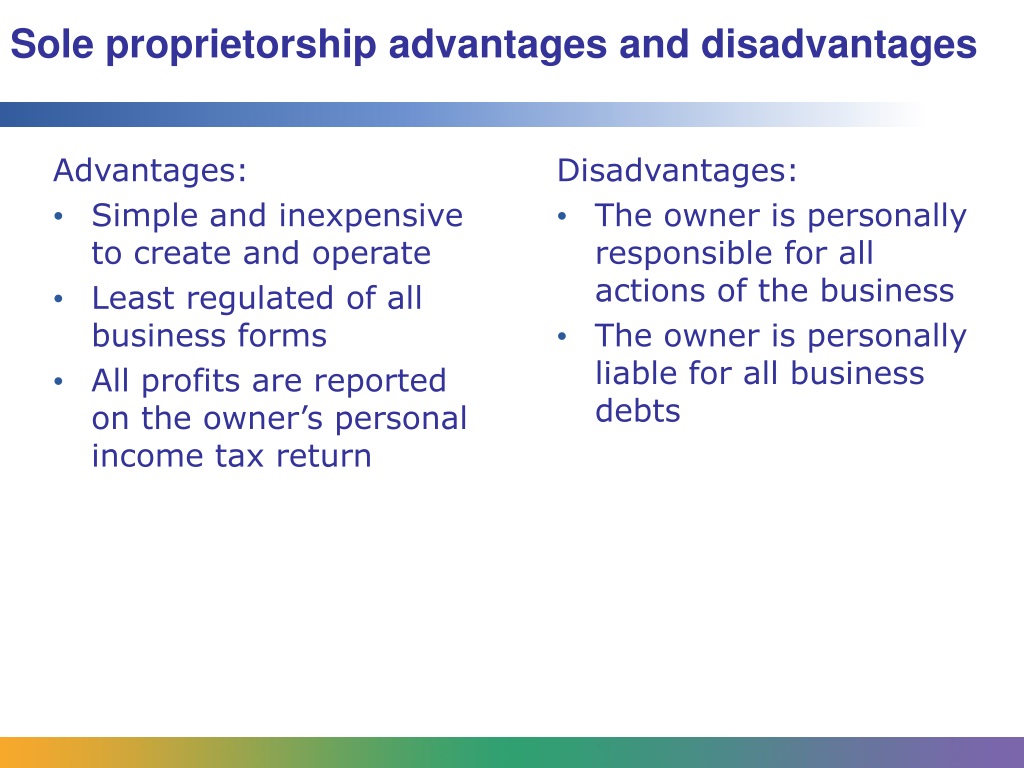

While the corporate form offers numerous advantages, it's important to acknowledge potential drawbacks. Setting up a corporation can be more complex and expensive than forming a sole proprietorship or partnership.

Corporations also face more stringent regulatory requirements and reporting obligations. The added administrative burden can be a challenge for smaller companies.

Double taxation, where profits are taxed at the corporate level and again when distributed to shareholders as dividends, can also be a disadvantage in some cases.

Despite these challenges, the benefits of the corporate form often outweigh the drawbacks, particularly for businesses seeking long-term growth and expansion.

The Corporate Ecosystem: A Catalyst for Innovation

The advantages of the corporate form have played a crucial role in fostering innovation and economic growth. Many of the world's most successful companies, from Apple to Amazon, operate as corporations.

By providing a stable and reliable structure, the corporate form encourages investment, innovation, and long-term planning. It enables businesses to scale, create jobs, and contribute to the overall prosperity of society.

The corporate model is not without its critics, but its impact on the global economy is undeniable. It continues to be a driving force behind progress and innovation.

Looking Ahead: The Enduring Appeal of the Corporation

As the business world continues to evolve, the corporate form remains a relevant and powerful structure. While new business models emerge, the fundamental advantages of limited liability, perpetual existence, and access to capital continue to make the corporate form an attractive option for entrepreneurs and investors alike.

The future of business will undoubtedly be shaped by technological advancements and changing consumer preferences. However, the corporate structure, with its inherent flexibility and adaptability, will likely remain a cornerstone of the global economy for years to come.

So, the next time you see that majestic oak tree, remember the corporation, a strong and enduring entity that fuels innovation and opportunity.