Pay Rent In 4 Payments Online No Credit Check

Renters facing financial strain now have a new option: a service allowing rent payments to be split into four installments, processed online, and requiring no credit check. This aims to alleviate the burden of upfront rent costs for individuals and families.

The service, rapidly gaining traction, provides a flexible payment solution intended to prevent late fees and potential eviction threats.

New Rent Payment Option Emerges

Several platforms are now offering this "pay-in-4" rent option. These services partner with landlords or property management companies to integrate the payment option directly into the existing rent collection process.

Who: Renters in participating properties across the US.

What: A service enabling rent to be paid in four smaller installments instead of one lump sum.

Where: Available online and integrated into property management systems; primarily US-based currently.

When: Implemented immediately, with increasing adoption reported over the past quarter.

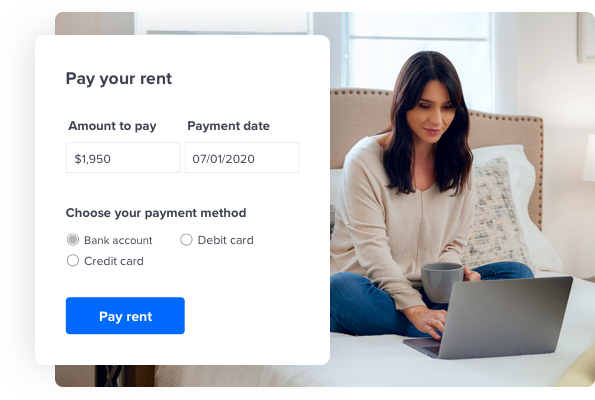

How: Renters sign up through the platform, link their bank account, and the rent is automatically divided into four payments scheduled throughout the month, typically with the first payment due on the original rent due date.

Key Features and Benefits

The primary advantage of this system is increased financial flexibility. Instead of scraping together a large sum once a month, renters can manage their cash flow more effectively.

No credit check is required, making it accessible to individuals with limited or poor credit histories. This is a significant advantage over traditional financing options.

According to a recent survey by the National Multifamily Housing Council, 35% of renters have difficulty paying rent on time at least once a year.

How It Works

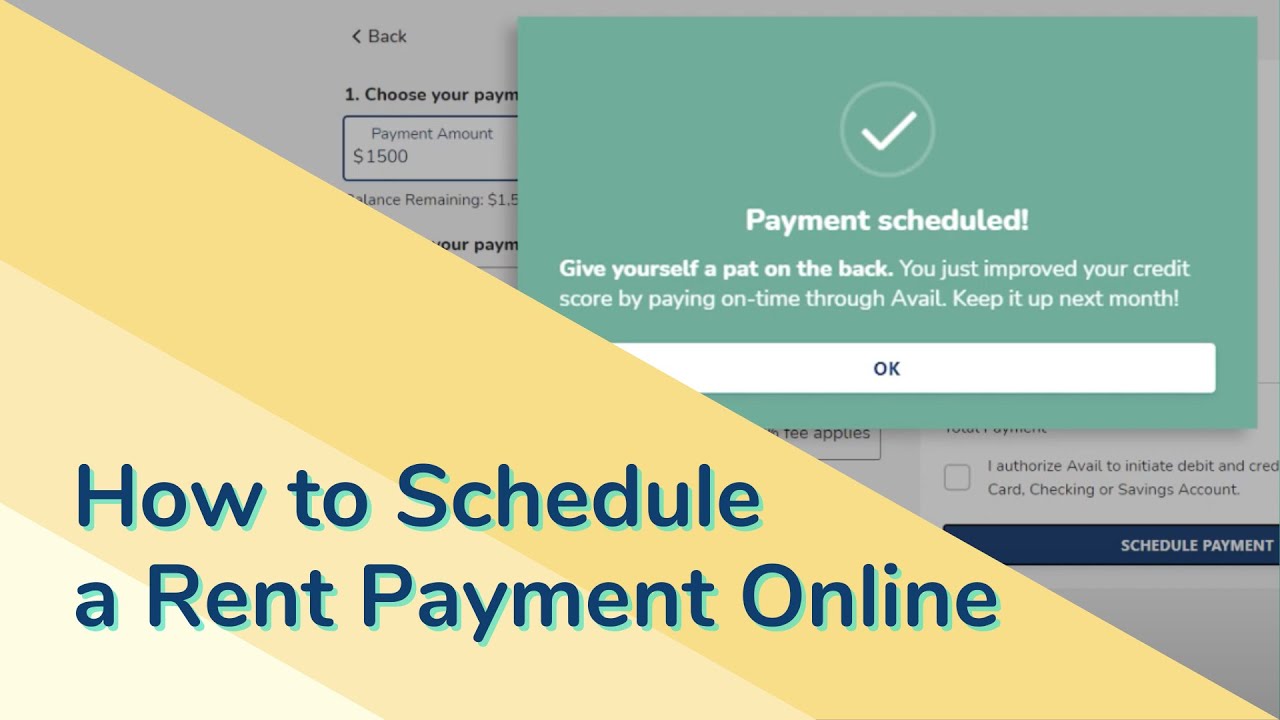

The process is relatively straightforward. Renters register with the designated platform, often at the invitation of their landlord.

They then link a bank account for automated payments. The total rent amount is divided into four equal (or near-equal, depending on fees) installments.

The first payment is typically due on the regular rent due date, with subsequent payments spaced out over the following weeks.

Potential Downsides and Considerations

While seemingly beneficial, some services charge fees for this payment arrangement. These fees can vary but typically range from 3% to 6% of the total rent amount.

It's crucial for renters to understand the terms and conditions, including any potential late payment fees associated with missed installments.

Renters should also evaluate whether the convenience and flexibility outweigh the additional cost of using the service.

Landlord Perspectives

Landlords may benefit from increased on-time rent payments, reducing the need for late fee collection and eviction proceedings. Participating landlords report a 15% decrease in late payments, according to early adopters.

However, landlords must also consider the platform fees and administrative burden associated with integrating these services into their existing systems.

Some landlords are hesitant due to the perceived increase in tenant debt, even though the rent is ultimately paid in full.

Industry Impact and Growth

The "pay-in-4" rent model is experiencing rapid growth. Several startups and established fintech companies are entering the market.

The increasing popularity suggests a growing demand for more flexible rent payment options. This trend aligns with the broader movement towards more accessible and personalized financial services.

Data from the Urban Institute suggests that a significant portion of renters are "rent burdened," spending more than 30% of their income on housing costs, fueling the demand for such services.

Next Steps and Ongoing Developments

Renters are advised to research different platforms and compare fees and terms before enrolling. Landlords should carefully evaluate the costs and benefits of integrating these services into their properties.

Consumer advocacy groups are monitoring these platforms to ensure transparency and fair practices. Regulatory bodies may also begin scrutinizing the industry as it continues to expand.

The long-term impact of these "pay-in-4" rent options on the housing market remains to be seen, but it represents a significant shift in how rent is managed and paid.