Payday Loans Online No Credit Check Instant Approval

Desperate for cash? Online payday loans promising "no credit check" and "instant approval" are surging, but experts warn of predatory practices and devastating financial consequences. Borrowers face crippling interest rates and a cycle of debt that can quickly spiral out of control.

These loans, easily accessible through a quick online search, target vulnerable individuals with limited financial options. The allure of immediate cash bypasses traditional lending scrutiny, masking the inherent risks.

The Allure of Instant Gratification

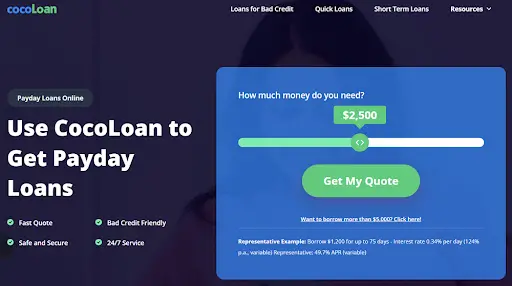

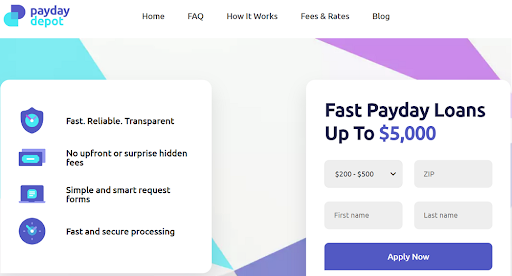

The online payday loan market is booming. Companies like Ace Cash Express and Check 'n Go, though not exclusively online, have expanded their digital presence, alongside numerous online-only lenders.

These platforms advertise loans ranging from $100 to $1000, or even higher in some cases. The "no credit check" promise is a major draw, particularly for those with poor or nonexistent credit histories.

According to a 2023 report by the Consumer Financial Protection Bureau (CFPB), online payday loans often carry annual percentage rates (APRs) exceeding 300%, and in some instances, surpassing 600%.

The Reality of Sky-High Interest Rates

The "instant approval" comes at a steep price. Borrowers are often unaware of the true cost of the loan until it's too late.

For example, borrowing $500 with a 391% APR means paying back over $1,955 within a year. This rapid accumulation of interest traps many borrowers in a continuous cycle of debt.

Short repayment periods, typically two weeks or a month, exacerbate the problem. Many borrowers are unable to repay the loan in full, leading to rollovers and additional fees.

Predatory Practices Unveiled

Critics accuse these lenders of predatory lending practices. They argue that the target audience is intentionally those least able to afford the exorbitant interest rates.

The National Consumer Law Center (NCLC) has documented numerous cases of borrowers facing bank account overdrafts, harassment from debt collectors, and even lawsuits due to unpaid payday loans.

Many online lenders operate outside of state regulations, making it difficult for borrowers to seek legal recourse. This lack of oversight allows them to circumvent consumer protection laws.

Where Are These Loans Offered?

These loans are available across the country, but are especially prevalent in states with lax regulations. States like Texas, Ohio, and California see a high volume of payday lending activity.

The ease of access through online platforms means that even residents of states with stricter regulations can be targeted. Geolocation technology and targeted advertising make it difficult to avoid these offers.

The internet serves as a boundless marketplace, bypassing geographical limitations and regulatory boundaries.

Who is Most Vulnerable?

Low-income individuals, minorities, and those with limited access to traditional banking services are particularly vulnerable. A sudden emergency expense can easily push them towards seeking a quick fix.

The allure of "instant cash" can be incredibly tempting when facing eviction, utility shut-offs, or medical bills. However, this short-term solution often creates a long-term financial crisis.

The lack of financial literacy also plays a significant role. Many borrowers fail to fully understand the terms and conditions of the loan, including the true APR and repayment schedule.

The Regulatory Landscape

The CFPB has been working to strengthen regulations around payday lending. However, these efforts have faced pushback from industry lobbyists and political opposition.

Some states have implemented caps on interest rates and fees, but these regulations are often insufficient to protect consumers. Many lenders find loopholes to circumvent these restrictions.

Consumer advocacy groups are calling for stronger federal regulations and increased enforcement to combat predatory lending practices.

What Can You Do?

If you are struggling with payday loan debt, seek help immediately. Contact a credit counseling agency or a non-profit organization that provides financial assistance.

The Federal Trade Commission (FTC) offers valuable resources on how to avoid payday loan scams and manage debt. Educate yourself about your rights as a borrower.

Explore alternative options for obtaining emergency funds, such as personal loans from credit unions or borrowing from friends and family.

Looking Ahead

The fight against predatory payday lending is ongoing. Increased awareness and stronger regulations are crucial to protecting vulnerable consumers.

The CFPB continues to monitor the online payday loan market and take enforcement actions against lenders engaging in illegal practices. Stay informed about the latest developments.

Ultimately, financial literacy and responsible borrowing habits are the best defenses against the predatory tactics of online payday lenders.