Personal Loan For High Debt To Income Ratio

Consumers grappling with high debt-to-income (DTI) ratios face a significant hurdle in securing personal loans. New data reveals that approval rates for these individuals are plummeting, intensifying financial strain for those already burdened by debt.

The situation demands immediate attention as more Americans find themselves trapped in a cycle of debt, struggling to access affordable credit solutions to consolidate or manage existing obligations. This article explores the challenges, available options, and expert advice for navigating the complex landscape of personal loans with a high DTI.

The DTI Dilemma: A Growing Crisis

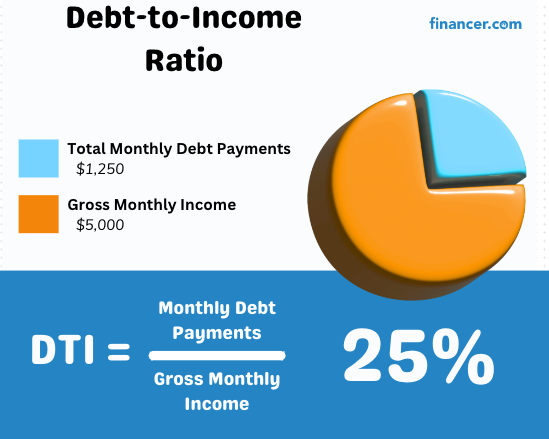

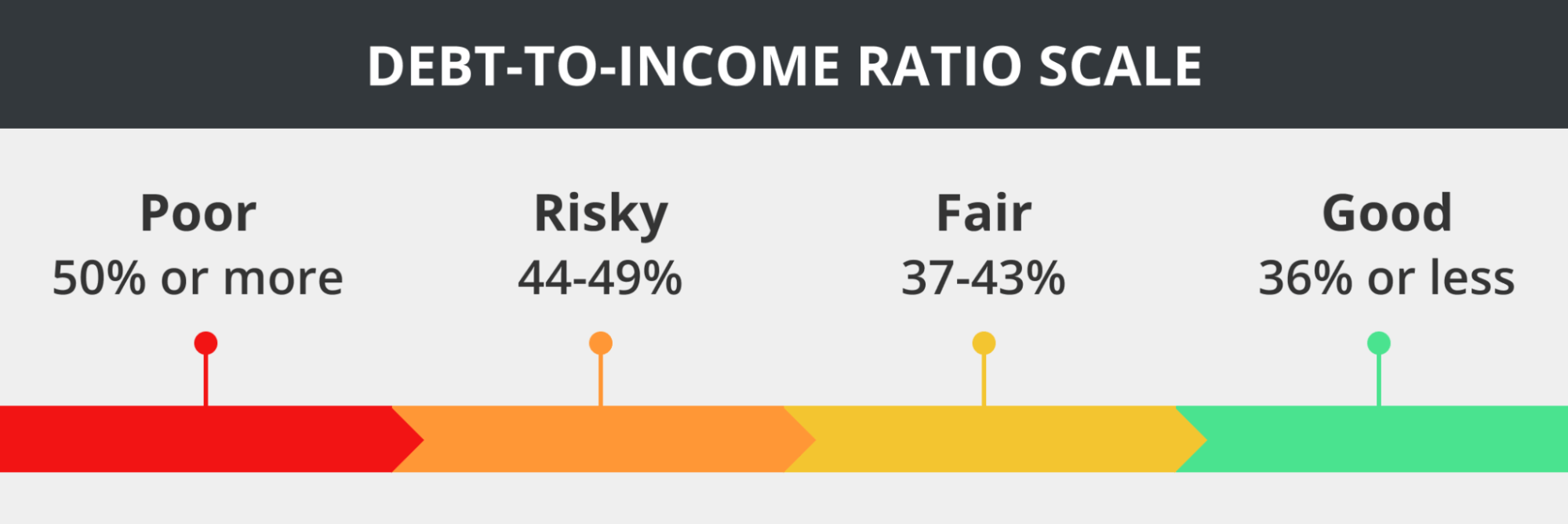

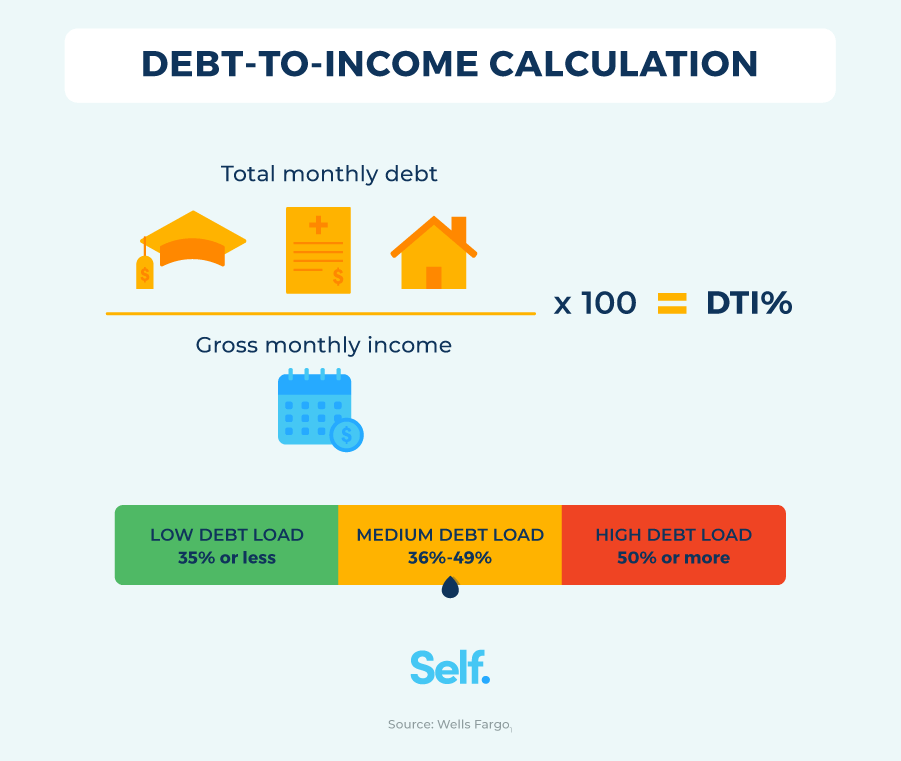

A high DTI, generally considered above 43%, signals to lenders that a borrower may struggle to repay additional debt. According to a recent report by the Federal Reserve, the average household debt in the United States reached $17.29 trillion in the first quarter of 2024, increasing the pressure on individuals' DTI ratios.

TransUnion data indicates that personal loan origination for borrowers with a DTI above 50% has decreased by 22% year-over-year. This decline reflects lenders' increasing risk aversion in the face of economic uncertainty and rising interest rates.

Why Lenders Are Hesitant

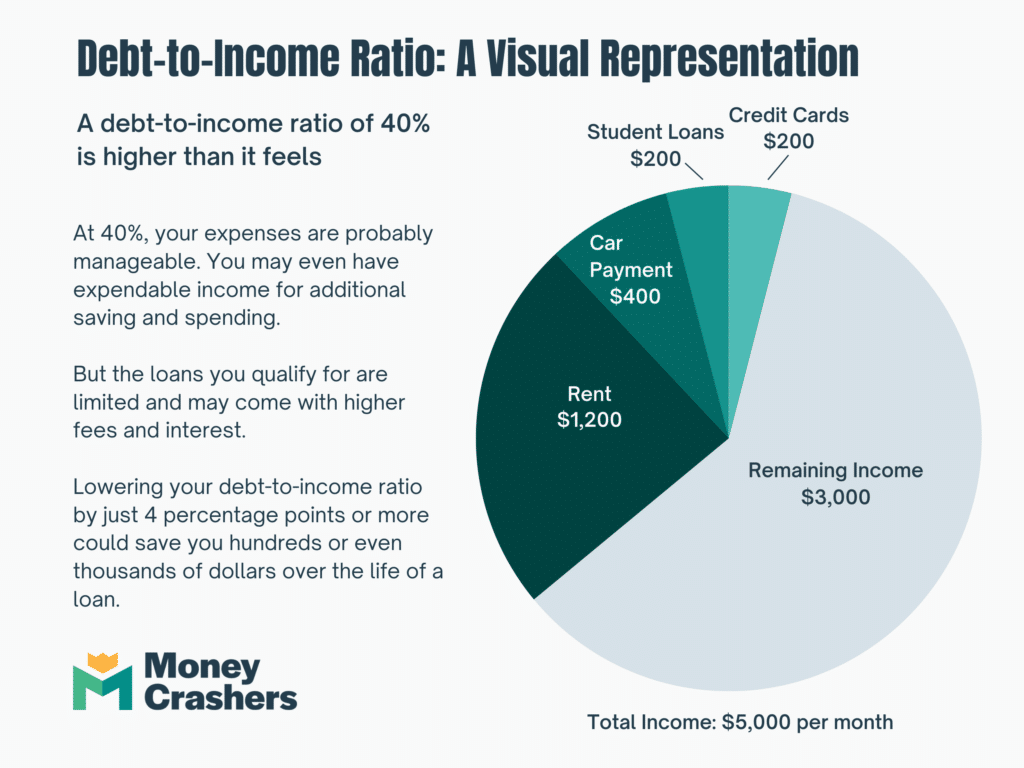

Lenders assess DTI to gauge a borrower's ability to manage monthly payments. A high DTI suggests a larger portion of income is already allocated to existing debt, leaving less room for new obligations.

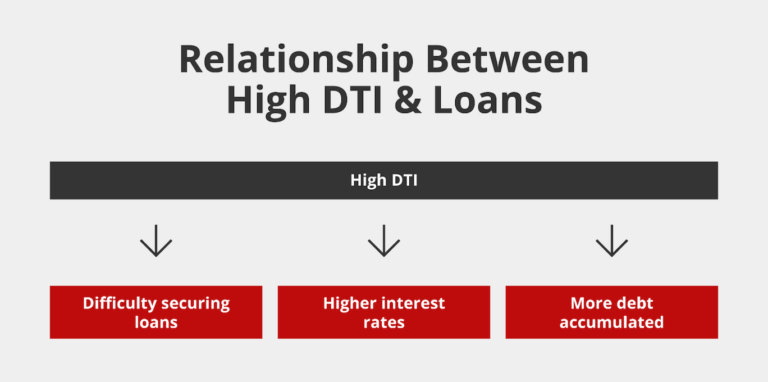

The risk of default is significantly higher for borrowers with high DTIs, making lenders wary of extending credit. Regulatory pressures and internal risk management policies further contribute to the tightening of lending standards.

Navigating the Loan Landscape with High DTI

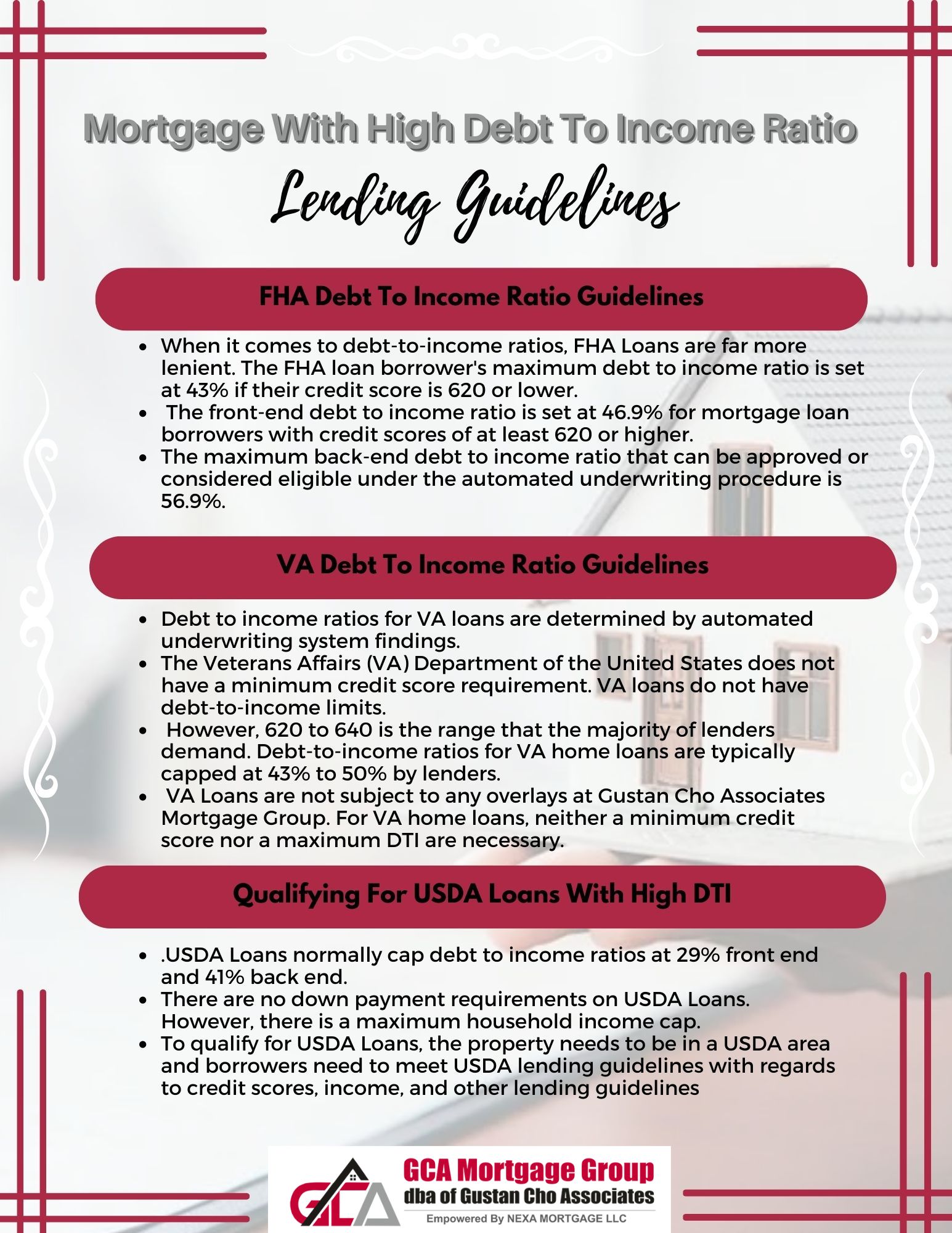

Despite the challenges, options remain for individuals with high DTIs seeking personal loans. These avenues, however, often come with higher interest rates and stricter terms.

Secured loans, backed by collateral such as a vehicle or property, can increase approval chances. However, this also exposes the borrower to the risk of losing the asset if they default on the loan.

Exploring Alternative Lending Options

Credit unions and online lenders may offer more flexible lending criteria than traditional banks. Some specialize in serving borrowers with less-than-perfect credit profiles, although interest rates are typically higher.

Peer-to-peer lending platforms connect borrowers directly with individual investors. While approval rates may be better, terms and conditions can vary widely.

Expert Advice: Strategies for Improvement

Financial experts emphasize the importance of improving DTI before applying for a personal loan. Reducing existing debt and increasing income are key strategies.

Creating a strict budget and prioritizing debt repayment can significantly impact DTI. Consider strategies like the debt snowball or debt avalanche method to accelerate debt reduction.

Seeking Professional Guidance

Consulting with a certified credit counselor can provide personalized advice and guidance. Counselors can help create a debt management plan, negotiate with creditors, and improve financial literacy.

The National Foundation for Credit Counseling (NFCC) is a valuable resource for finding reputable and certified credit counselors.

Case Studies: Real-World Challenges and Solutions

John Smith, a 45-year-old from Ohio, faced rejection from multiple lenders due to a DTI of 55%. After consolidating high-interest credit card debt through a secured loan and increasing his income through a side hustle, he successfully lowered his DTI and obtained a more favorable personal loan.

Maria Garcia, a single mother from California, utilized a debt management plan provided by a credit counselor to reduce her DTI from 60% to 40% within two years. This enabled her to qualify for a personal loan to cover essential home repairs.

The Road Ahead: Ongoing Developments

The impact of economic fluctuations on lending practices continues to evolve. Monitoring interest rate trends and regulatory changes is crucial for borrowers and lenders alike.

Financial advocacy groups are pushing for policies that promote responsible lending and protect vulnerable borrowers from predatory practices. Efforts to increase financial literacy and access to affordable credit remain ongoing.

Individuals struggling with high DTI and seeking personal loans should prioritize improving their financial standing. Seeking professional guidance and exploring alternative lending options are crucial steps in navigating this challenging situation. Stay informed about changing market conditions and advocate for responsible lending practices to foster a more equitable financial landscape.