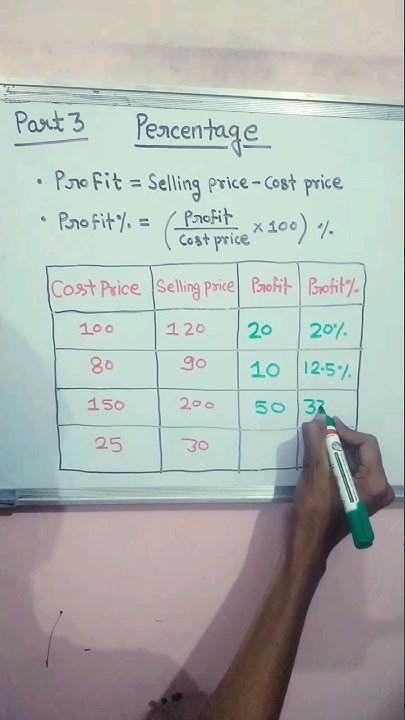

Step 1 Step 2 Step 3 Profit

Financial analysts are sounding the alarm: a new investment strategy promising guaranteed profits after just three steps is rapidly gaining traction, but experts warn it may be too good to be true.

The "Step 1, Step 2, Step 3, Profit" system, or S3P, is enticing novice investors with the allure of quick and easy returns, but its simplicity masks potential risks.

The Three Steps to Supposed Riches

The S3P strategy centers on identifying volatile micro-cap stocks, those with a market capitalization of less than $300 million, and exploiting their price swings. Step 1 involves purchasing a significant volume of a selected micro-cap stock. This initial purchase is designed to artificially inflate the stock's price, creating initial buzz and attracting attention.

Step 2 focuses on disseminating positive, often exaggerated or misleading, information about the company through online forums, social media, and paid promotional content. This orchestrated hype is designed to lure in unsuspecting investors, further driving up the stock price.

Step 3 is the crucial, and often ethically questionable, exit strategy: the original investors, having created artificial demand and a soaring stock price, sell their shares at a substantial profit. This sudden sell-off often triggers a rapid price decline, leaving later investors with significant losses.

Who is Behind S3P?

While no single entity has officially claimed ownership of the S3P strategy, investigations point towards a network of loosely connected online groups and self-proclaimed "financial gurus." These individuals often operate through encrypted messaging apps and offshore accounts, making them difficult to track and hold accountable.

The Securities and Exchange Commission (SEC) has confirmed they are investigating several individuals suspected of promoting and profiting from S3P-related schemes. An SEC spokesperson stated, "We are aware of these concerning trends and are actively working to identify and prosecute those who engage in manipulative trading practices."

Several well-known financial influencers, some boasting millions of followers, have been directly implicated in promoting S3P stocks. Their involvement has added credibility to the scheme and significantly widened its reach.

Where is This Happening?

The S3P scheme is primarily orchestrated online, making its geographical scope global. Online forums, social media platforms like Twitter and Reddit, and investment-focused websites have become breeding grounds for S3P-related discussions and promotions.

Data suggests that a significant portion of S3P activity originates from regions with less stringent financial regulations, such as certain Caribbean islands and Eastern European countries. These locations offer a layer of anonymity and protection for those orchestrating the scheme.

The target audience includes novice investors in the United States, Canada, United Kingdom and Australia, who may be more susceptible to the allure of quick profits. These regions have seen a surge in retail investor participation in recent years, creating a fertile ground for S3P to thrive.

When Did This Start?

While variations of "pump and dump" schemes have existed for decades, the S3P strategy has gained significant momentum in the last 12-18 months. This rise coincides with the increased popularity of online trading platforms and the proliferation of financial information on social media.

The COVID-19 pandemic, with its associated economic uncertainty and increased leisure time, may have also contributed to the growth of S3P. Many individuals, seeking alternative income streams, were drawn to the promise of quick profits.

The strategy appears to be most active during periods of high market volatility, as rapid price fluctuations create more opportunities for manipulation.

How Does it Impact Investors?

The impact of S3P on unsuspecting investors can be devastating. Those who buy into the hype at inflated prices are often left holding worthless shares when the orchestrators sell off their holdings.

Data indicates that average losses for investors caught in an S3P scheme range from 30% to 80% of their initial investment. In some cases, investors have lost their entire capital.

Beyond financial losses, S3P can also erode trust in the financial markets and discourage responsible investing. This can have long-term consequences for individual investors and the overall economy.

What's Next?

The SEC is actively pursuing investigations and issuing warnings to investors about the risks of S3P and similar schemes. They are also collaborating with international regulatory bodies to track down and prosecute those involved in orchestrating these schemes.

Online platforms are under increasing pressure to crack down on S3P-related content and accounts. However, the decentralized nature of the internet makes it challenging to completely eliminate this activity.

Investors are urged to exercise caution, conduct thorough research before investing in micro-cap stocks, and be wary of any investment opportunity that promises guaranteed profits.

4.png)

3.png)

2.png)