Personal Loans With Bad Credit And A Cosigner

Bad credit weighing you down? A cosigner might be your ticket to a personal loan, but act fast – options are shrinking and interest rates are climbing.

This article provides immediate, essential information on securing personal loans with bad credit and a cosigner, detailing eligibility requirements, potential lenders, and crucial considerations for both borrowers and cosigners. Don't delay; your financial solution may depend on understanding these critical factors now.

Who Can Benefit From a Cosigned Personal Loan?

Individuals with credit scores below 630, often categorized as "bad" or "fair," frequently struggle to qualify for personal loans on their own.

A cosigner, someone with good to excellent credit (typically a score above 680), guarantees the loan, significantly increasing approval chances and potentially securing a lower interest rate.

This option is particularly useful for those with limited credit history, past bankruptcies, or high debt-to-income ratios.

What Are the Eligibility Requirements?

While a cosigner strengthens your application, you still need to meet basic lender criteria.

Expect to provide proof of income, stable employment history (typically at least six months with the same employer), and a valid government-issued ID.

Lenders will also assess your debt-to-income ratio, ensuring you can realistically manage repayments.

Where Can You Find Lenders Offering Cosigned Loans?

Several online lenders specialize in personal loans for borrowers with less-than-perfect credit.

Look into options like Upgrade, OneMain Financial, and Avant. These platforms often feature cosigner options.

Credit unions are another potential source, often offering more flexible terms and lower interest rates.

When Should You Consider a Cosigned Loan?

Consider a cosigned loan when you need funds for debt consolidation, emergency expenses, or necessary home repairs and are unable to qualify independently.

It's a viable option to rebuild credit, but only if you are absolutely certain you can make on-time payments.

Defaulting damages both your credit and your cosigner's.

How Does the Application Process Work?

The application process is similar to a standard personal loan, but both you and your cosigner will need to provide financial information and consent to credit checks.

Typically, this involves completing an online application, submitting supporting documentation (pay stubs, bank statements), and electronically signing the loan agreement.

The lender will evaluate both applicants' creditworthiness before making a decision.

Key Considerations for Borrowers

Understand the loan terms, including the interest rate, fees, and repayment schedule.

Prioritize on-time payments to avoid damaging your credit and straining your relationship with your cosigner.

Develop a budget and repayment strategy to ensure you can comfortably manage the debt.

Critical Information for Cosigners

Cosigning means you are legally responsible for the debt if the borrower defaults.

Your credit score will be affected by the borrower's payment behavior, both positively and negatively.

Before cosigning, carefully assess the borrower's financial stability and trustworthiness.

The Risks of Cosigning

Cosigning is a major financial responsibility.

It's crucial to be prepared to repay the loan if the borrower fails to do so.

Consider the potential impact on your own credit and finances before agreeing to cosign.

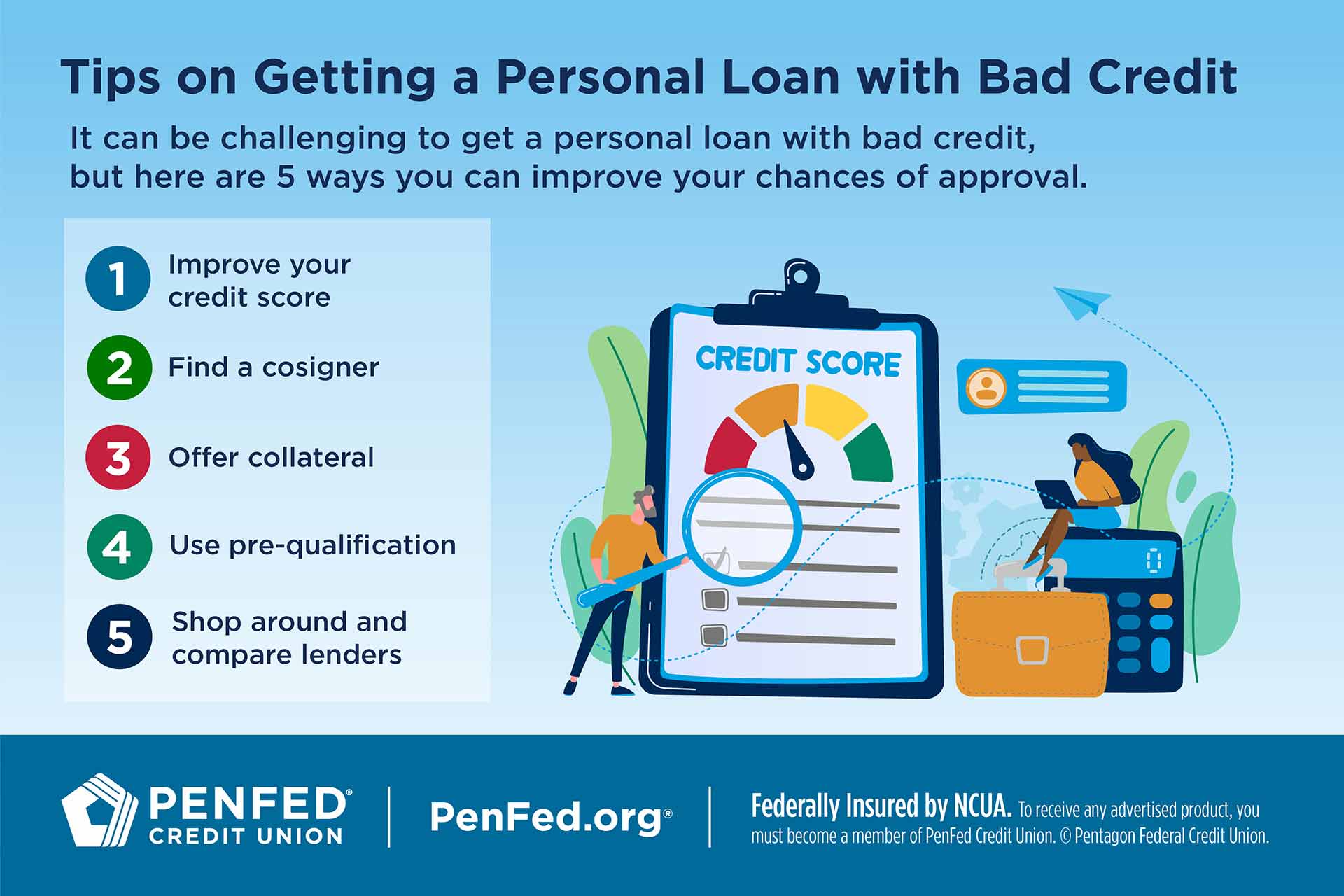

What Are the Alternatives?

Explore alternative options like secured loans (using an asset as collateral) or credit repair programs.

Consider asking a family member for a loan if a bank is not an option.

Focus on improving your credit score through responsible financial habits before seeking a loan.

Ongoing Developments and Market Trends

Interest rates on personal loans are currently trending upwards due to broader economic factors.

Lenders are becoming more cautious in their lending practices, making it harder for borrowers with bad credit to qualify, even with a cosigner.

Monitor market trends and compare offers from multiple lenders to secure the best possible terms.

Next Steps

Research and compare lenders offering cosigned personal loans.

Gather necessary documentation and prepare your application.

Discuss the responsibilities and risks with your potential cosigner and ensure they fully understand their commitment.

/cloudfront-us-east-1.images.arcpublishing.com/dmn/VQTVMZKYXBBLVECIAWNZC46WME.jpg)