Phone Companies That Don't Do Credit Checks

In an era defined by near-ubiquitous connectivity, the digital divide continues to cast a long shadow. Access to a mobile phone, once a luxury, is now a necessity for employment, education, and participation in modern society. But for millions with poor or non-existent credit histories, obtaining a cell phone plan can feel like an insurmountable obstacle.

While major carriers often require credit checks, a growing number of companies are offering alternatives, promising access to communication without the barrier of a credit score. This raises critical questions: Who are these companies? What are the trade-offs for consumers? And are these services genuinely bridging the digital divide or simply preying on vulnerable populations?

Understanding the No-Credit-Check Landscape

The core appeal of no-credit-check phone plans is their accessibility. These plans bypass the traditional credit screening process, opening doors for individuals with damaged credit, those who are new to credit, or those who simply prefer not to have their credit history scrutinized.

Often, these plans fall into one of two categories: prepaid plans or alternative postpaid options with unique qualification criteria. Understanding the nuances of each is essential for consumers.

Prepaid Plans: Pay-as-You-Go Freedom

Prepaid plans, also known as pay-as-you-go, are the most common type of no-credit-check phone service. Consumers purchase airtime or data in advance, eliminating the need for a credit check or long-term contract. Major carriers like Verizon and AT&T, as well as smaller providers like Mint Mobile and Visible (owned by Verizon), offer prepaid options.

This model provides greater flexibility and control over spending. Users only pay for what they need, avoiding surprise bills and potential overage charges.

However, prepaid plans often come with caveats. Data speeds might be throttled after a certain usage threshold, and features like international calling or roaming may be limited or unavailable.

Alternative Postpaid Options: Beyond Credit Scores

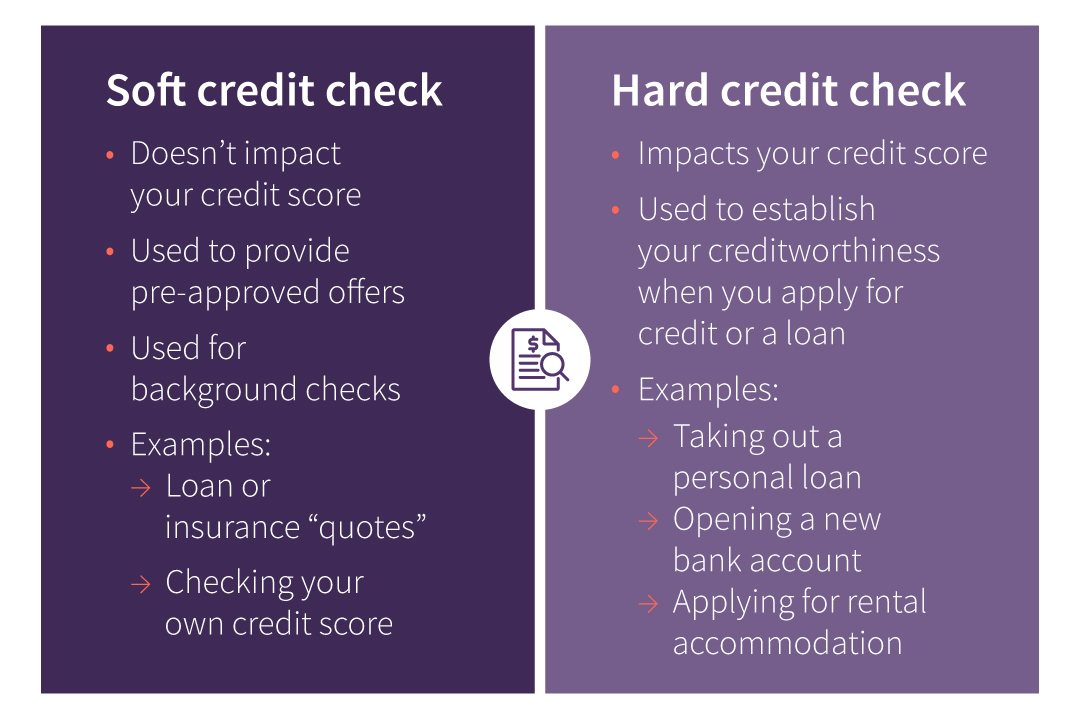

A smaller, but increasingly relevant, segment of the market offers postpaid plans without traditional credit checks. These companies employ alternative methods to assess risk and eligibility.

One approach involves requiring a security deposit. This deposit acts as collateral, mitigating the risk for the provider and allowing consumers to establish a payment history. The deposit is typically refundable after a period of on-time payments.

Another strategy involves focusing on employment history or income verification. By demonstrating stable income, potential customers can prove their ability to pay, even without a strong credit score. Some providers also utilize alternative credit scoring models that incorporate factors beyond traditional credit bureau data.

The Pros and Cons: Weighing the Options

Choosing a no-credit-check phone plan involves carefully considering the advantages and disadvantages. While these plans offer crucial access, they often come with trade-offs.

The primary benefit is, of course, accessibility. For individuals rebuilding their credit or those with limited financial history, these plans provide a vital connection to the outside world.

Prepaid plans, in particular, offer budgeting advantages. The pay-as-you-go model eliminates the risk of overspending and provides greater control over monthly expenses.

However, potential drawbacks include higher upfront costs. Purchasing a phone outright or paying a security deposit can be a significant financial burden for low-income individuals. Data speeds might also be slower compared to traditional postpaid plans.

Moreover, some no-credit-check providers may offer less favorable customer service or limited plan options. It's crucial to research providers thoroughly and compare features and pricing before making a decision.

Consumer advocates also raise concerns about potential predatory practices. Some companies may target vulnerable populations with hidden fees or misleading marketing tactics. It is important to check BBB rating and look for verified customer reviews.

The Digital Divide and Social Equity

The availability of no-credit-check phone plans plays a significant role in addressing the digital divide. In today's society, access to a phone is not simply a convenience; it's a prerequisite for economic opportunity and social inclusion.

Lack of access to communication can hinder job searches, limit access to education, and impede participation in civic life. The Federal Communications Commission (FCC) has recognized the importance of affordable communication services and has implemented programs like the Lifeline program to provide subsidies to low-income individuals for phone and internet access.

However, more needs to be done to ensure equitable access for all. Expanding broadband infrastructure, promoting digital literacy, and supporting innovative solutions like no-credit-check phone plans are all crucial steps toward bridging the digital divide.

The Future of No-Credit-Check Phone Services

The demand for no-credit-check phone plans is likely to continue growing. As the economy evolves and more individuals work remotely or participate in the gig economy, reliable communication becomes increasingly essential.

Technological advancements, such as the rise of 5G and the proliferation of affordable smartphones, are also driving demand. As these technologies become more accessible, the need for affordable and accessible phone plans will only intensify.

The future of no-credit-check phone services may also involve greater collaboration between providers and community organizations. By partnering with non-profits and social service agencies, phone companies can reach vulnerable populations and offer tailored solutions that address their specific needs. It would be beneficial for major service providers to also offer a viable, affordable plan that does not rely on credit checks.

Ultimately, the goal is to create a more inclusive and equitable digital ecosystem where everyone has the opportunity to connect and participate in the modern world.