Polish & Slavic Federal Credit Union Locations

In a financial landscape increasingly dominated by mega-banks and online-only platforms, the Polish & Slavic Federal Credit Union (PSFCU) stands as a testament to community-focused banking. Its network of branches, primarily concentrated in the Northeast and beyond, serves as more than just transactional spaces; they are anchors of Polish-American communities, offering financial services tailored to their unique needs.

This article delves into the current footprint of PSFCU's branches, exploring their strategic importance, the services they provide, and how the institution navigates the evolving banking preferences of its members. We will examine the challenges and opportunities PSFCU faces in maintaining its physical presence while embracing digital innovation to best serve its membership in the 21st century.

PSFCU's Branch Network: A Geographical Overview

PSFCU's branch network is heavily concentrated in the New York metropolitan area, particularly in neighborhoods with significant Polish-American populations. These include locations in Brooklyn, Queens, and Staten Island, as well as branches in New Jersey and Pennsylvania.

Beyond the Northeast, PSFCU has also expanded its presence to other states with sizable Polish communities, such as Illinois and Florida, demonstrating a strategic approach to serving its membership across the country. These locations are not merely financial outposts; they are vital hubs for community engagement.

The Role of Branches in a Digital Age

Despite the rise of online and mobile banking, PSFCU recognizes the continued importance of physical branches for many of its members. "Our branches are not just places to conduct transactions; they are places where members can build relationships with our staff and receive personalized financial advice," stated Bożena Kamiński, a long-time member of PSFCU, emphasizing the personal connection fostered by branch presence.

PSFCU's branches offer a range of services, including account openings, loan applications, financial counseling, and assistance with digital banking tools. These services are especially valuable for members who may be less comfortable with technology or who prefer face-to-face interactions.

Moreover, branches play a crucial role in building trust and credibility, particularly within immigrant communities that may have limited experience with the U.S. financial system. The ability to speak with a representative in Polish or another Slavic language provides a sense of comfort and security.

Adapting to Changing Member Needs

PSFCU acknowledges that the banking landscape is constantly evolving, and it is actively adapting its branch strategy to meet the changing needs of its members. This includes investing in technology to enhance the branch experience, such as self-service kiosks and improved online access.

The credit union is also exploring new branch formats, such as smaller, more streamlined locations that focus on providing personalized financial advice and support. These smaller branches can be more cost-effective to operate and can be located in areas where a full-service branch may not be feasible.

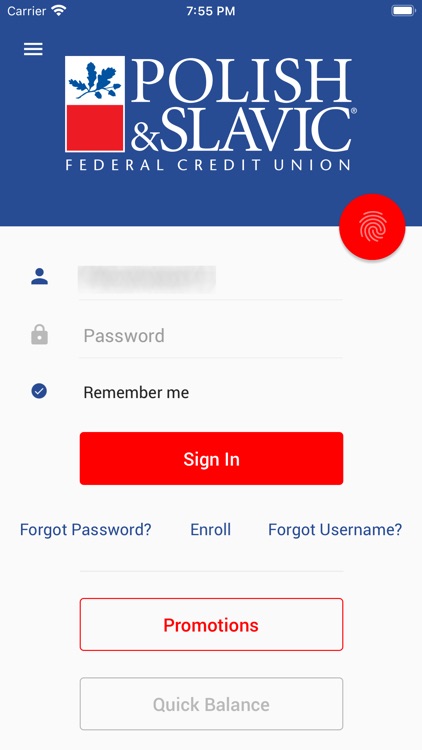

In addition to physical branches, PSFCU is also expanding its digital offerings, including online and mobile banking platforms. This allows members to access their accounts and conduct transactions from anywhere in the world.

Challenges and Opportunities

Maintaining a network of branches presents both challenges and opportunities for PSFCU. The cost of operating physical locations can be significant, particularly in high-cost areas like New York City.

However, branches also provide a competitive advantage, allowing PSFCU to differentiate itself from online-only banks and build stronger relationships with its members. The presence of branches reinforces the sense of community and personal service that is central to PSFCU's mission.

Furthermore, branches can serve as a valuable source of new members, attracting individuals who are drawn to the credit union's community focus and its commitment to serving the Polish-American community. PSFCU sees the branch network as essential.

The Future of PSFCU Branches

Looking ahead, PSFCU is committed to maintaining a strong network of branches while embracing digital innovation to better serve its members. This will involve carefully evaluating the performance of existing branches, investing in technology to enhance the branch experience, and exploring new branch formats.

PSFCU will also continue to focus on providing personalized financial advice and support to its members, recognizing that many individuals value the opportunity to speak with a knowledgeable representative in person. Building trust is paramount.

By striking a balance between physical and digital channels, PSFCU aims to remain a vital resource for the Polish-American community for generations to come. The institution understands that its role goes beyond mere financial transactions; it is a cultural touchstone and a pillar of support.

The future for PSFCU looks promising. The credit union's strong commitment to its members, combined with its strategic investments in technology and its dedication to maintaining a robust branch network, positions it for continued success in a rapidly evolving financial landscape. PSFCU’s success is dependent on its members.