Potash Corporation Of Saskatchewan Share Price

The stock of Nutrien Ltd., formerly Potash Corporation of Saskatchewan (PotashCorp), has experienced a complex trajectory in recent years, marked by fluctuations influenced by global agricultural trends, geopolitical events, and company-specific strategic decisions. Investors and market analysts are closely watching Nutrien's performance as it navigates a dynamic and often unpredictable landscape.

Understanding these movements requires an examination of the broader market conditions affecting the fertilizer industry. This article will analyze the factors contributing to these shifts, provide insights into their significance, and explore the potential impacts on stakeholders.

Key Factors Influencing Nutrien's Stock Performance

Several elements have played a pivotal role in shaping Nutrien's stock value. Demand for potash, a key ingredient in fertilizers, is directly linked to agricultural production.

Global population growth and changing dietary habits fuel the need for higher crop yields, thus increasing the demand for fertilizers. Geopolitical factors, such as trade agreements and political instability in key potash-producing regions, can also significantly impact supply chains and, consequently, prices.

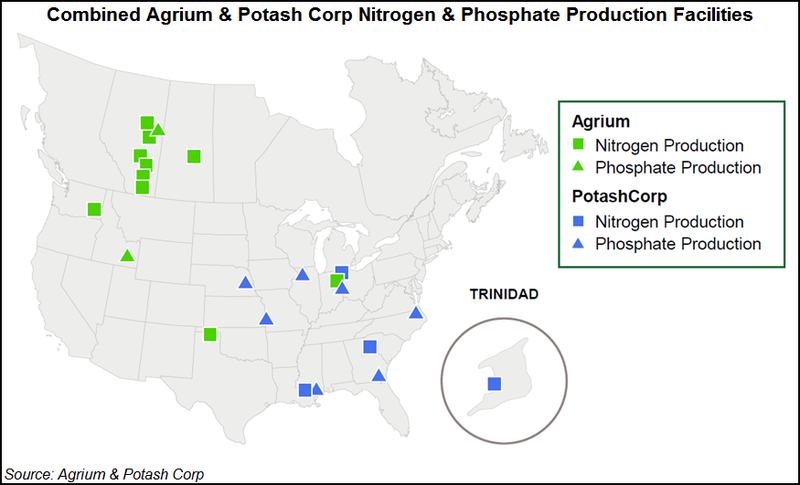

Company-specific developments, including production capacity, operational efficiency, and strategic acquisitions or divestitures, also contribute to the stock's movement.

Global Agricultural Trends

Agricultural commodity prices and farm incomes greatly influence farmers' ability to invest in fertilizers. Higher crop prices often translate to greater fertilizer demand, positively impacting Nutrien's revenue and stock performance.

Conversely, periods of low commodity prices can lead to reduced fertilizer applications and downward pressure on Nutrien's stock. Weather patterns, impacting crop yields and planting schedules, also factor into fertilizer demand fluctuations.

Geopolitical Landscape

International trade policies, particularly those affecting potash exports and imports, can create volatility in the market. Sanctions, tariffs, and trade disputes between major potash-producing nations and consumer countries can disrupt supply chains and impact prices.

Political instability in countries with significant potash reserves can also cause uncertainty. Such events can influence investor sentiment towards Nutrien, resulting in stock price adjustments.

Company-Specific Strategies

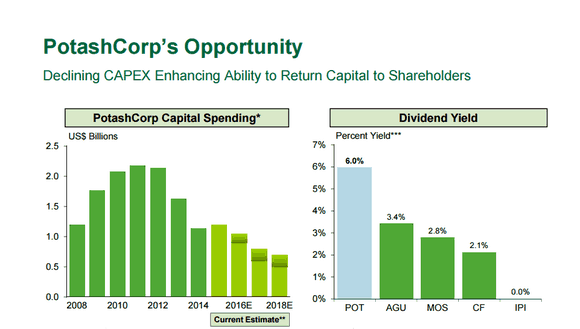

Nutrien's operational performance, including production costs, sales volumes, and market share, directly affects its financial health and investor confidence. Investment in expanding production capacity or improving operational efficiency can positively influence the stock price.

Strategic acquisitions or divestitures, which expand Nutrien's market reach or streamline its operations, also contribute to the stock's valuation. Announcements regarding new technologies, sustainable practices, or strategic partnerships can sway investor perception.

Recent Performance and Market Analysis

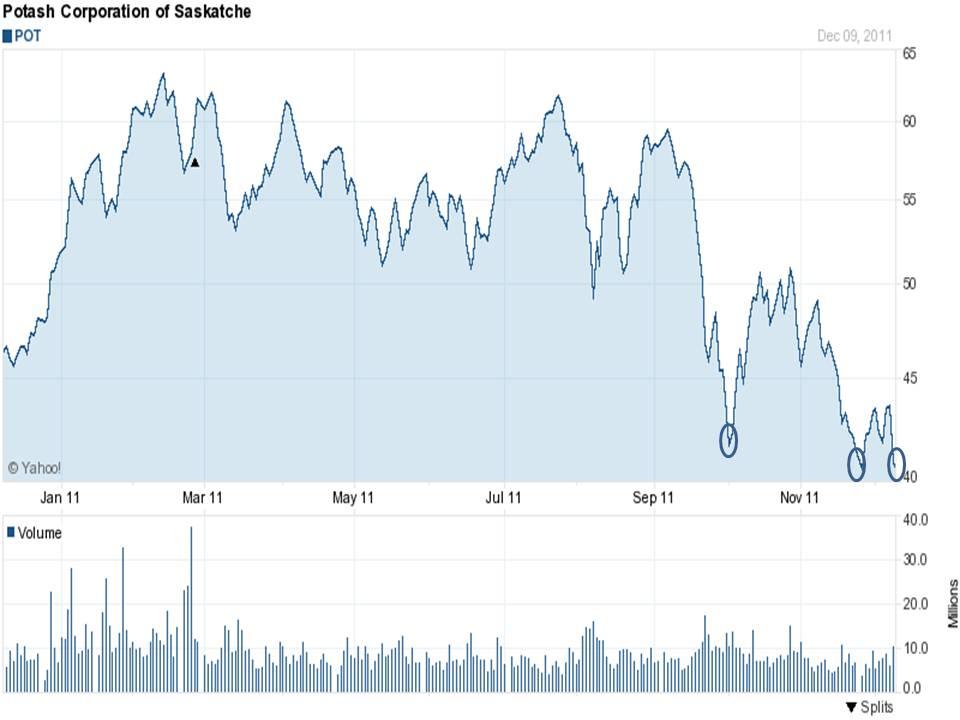

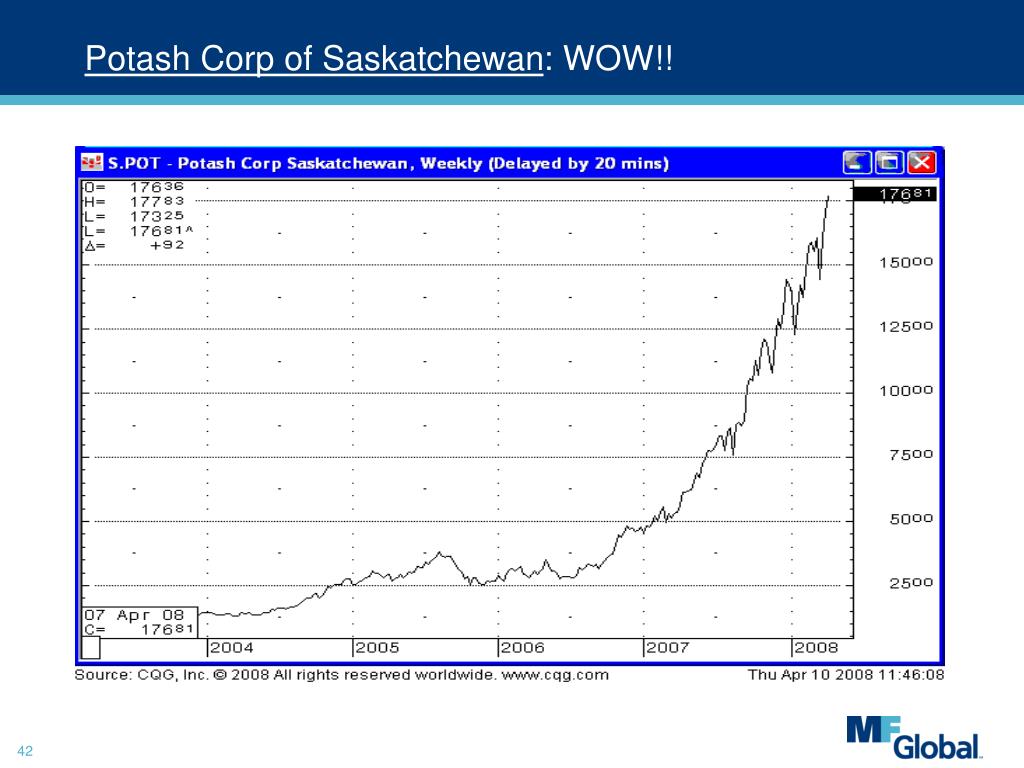

In recent years, Nutrien's stock has reflected the volatile nature of the fertilizer market. Periods of increased demand, driven by rising agricultural commodity prices and favorable planting conditions, have been followed by periods of correction due to oversupply or macroeconomic concerns.

Nutrien's ability to manage production costs and maintain a strong market position has been crucial in mitigating potential losses. Market analysts closely monitor key indicators such as potash prices, inventory levels, and global demand forecasts to predict future stock performance.

The Human Impact

While focusing on stock prices, it is important to acknowledge the broader implications for agricultural communities. Farmers around the world rely on fertilizers, including potash, to sustain crop yields and food production.

Fluctuations in potash prices can directly impact their profitability and ability to remain competitive in the global market. Stable potash supplies at affordable prices are critical to ensuring food security and supporting livelihoods of farmers.

The fertilizer industry plays a crucial role in feeding a growing global population.

Nutrien's actions, therefore, have far-reaching consequences beyond the realm of finance, affecting food production and the livelihoods of millions of people.

Future Outlook and Predictions

The future performance of Nutrien's stock hinges on several factors, including global agricultural demand, geopolitical stability, and the company's strategic decisions. The increasing emphasis on sustainable agriculture may lead to innovation in fertilizer technology and the development of more environmentally friendly products.

This creates opportunities for Nutrien to expand its market reach and enhance its brand image. However, growing concerns about environmental sustainability and the potential impact of fertilizer use on soil health may also present challenges.

The company's ability to adapt to these changing trends and invest in sustainable practices will be crucial to maintaining its competitive edge and long-term financial success.

Conclusion

The performance of Nutrien's stock reflects a complex interplay of global agricultural trends, geopolitical events, and company-specific strategies. Monitoring these factors is essential for investors and stakeholders seeking to understand the fertilizer industry and the potential impact on agriculture, food production, and global sustainability.

The company's future will likely depend on its ability to adapt to changing market dynamics, embrace innovation, and contribute to sustainable agricultural practices. Only through a comprehensive understanding of these forces can one fully appreciate the nuances of Nutrien's stock trajectory and its role in a rapidly changing world.