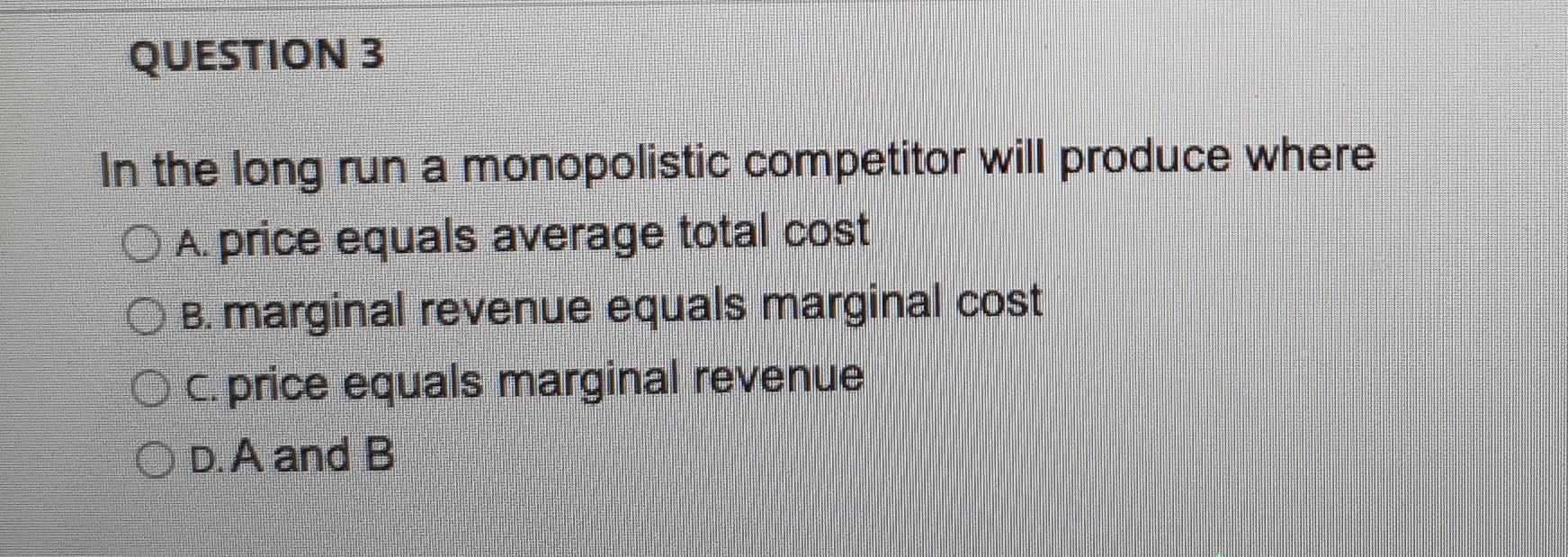

Price Equals Average Total Cost In The Long Run

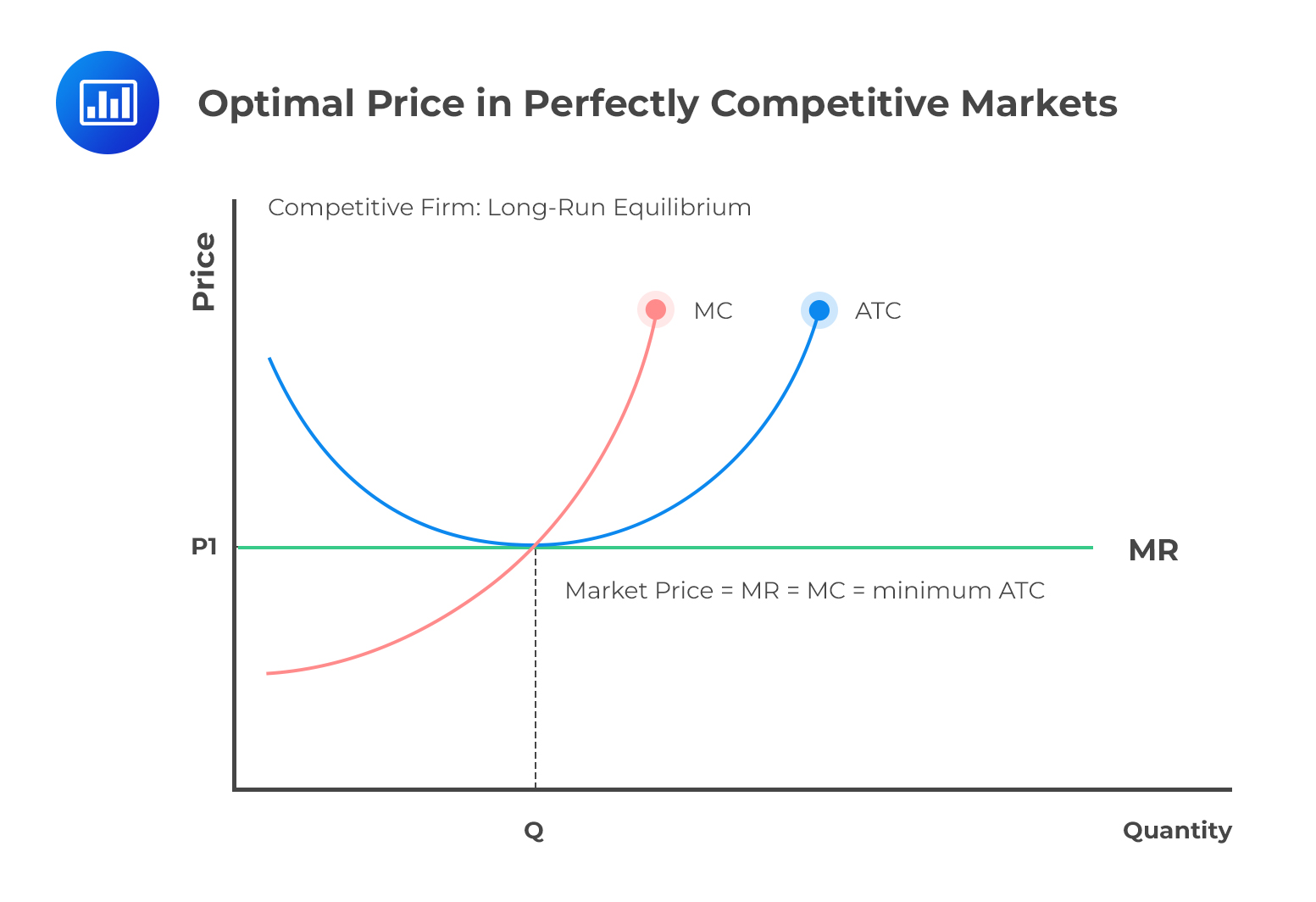

The equilibrium state in competitive markets, where price converges to the average total cost (ATC) in the long run, continues to be a cornerstone of economic theory. Recent analyses are reinforcing the real-world implications of this principle for businesses and consumers alike.

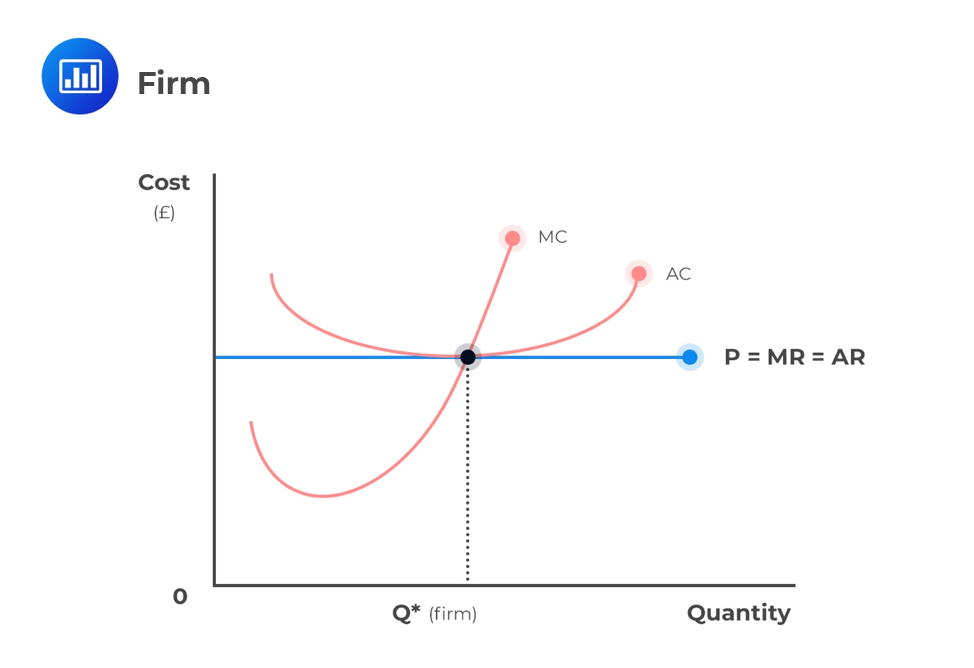

This long-run equilibrium signifies a crucial juncture where companies operate at their most efficient scale. No economic profit is earned, only normal profit, where the cost of production including opportunity cost is just covered. The implications impact everything from investment decisions to consumer pricing.

Understanding Long-Run Equilibrium

In a perfectly competitive market, characterized by numerous buyers and sellers, homogenous products, and free entry and exit, firms are price takers. This means they must accept the market price for their goods or services. If firms are making economic profit in the short-run, this will draw new firms into the market. This increases supply, which lowers the market price.

Conversely, if firms are suffering losses, some will exit the market. This reduces supply, driving prices upward. This dynamic process is a key characteristic of the long run.

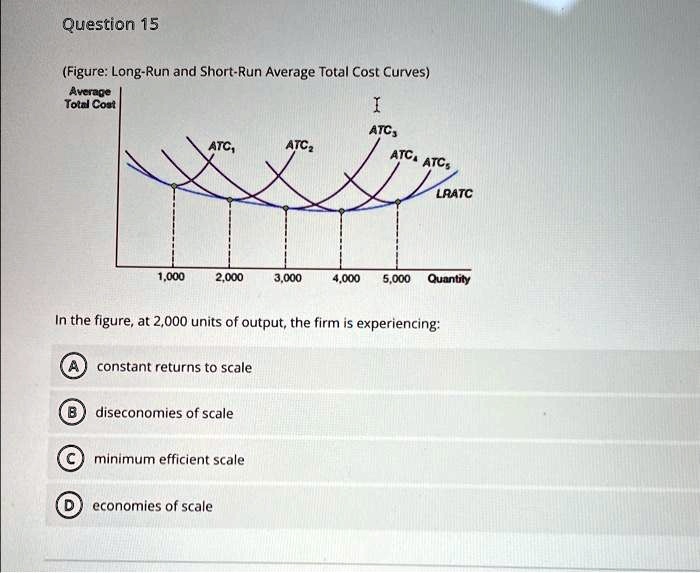

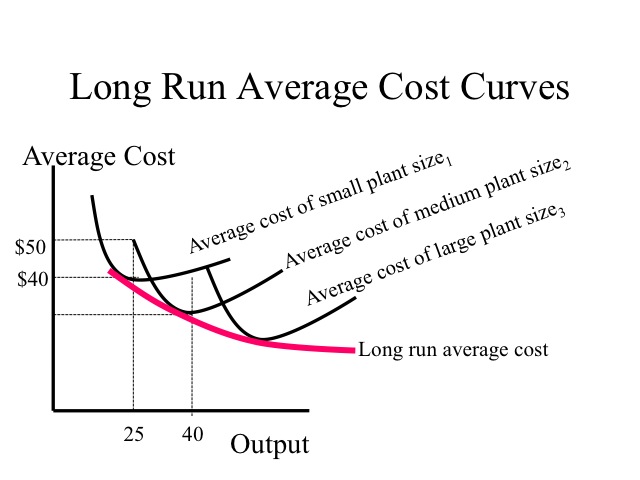

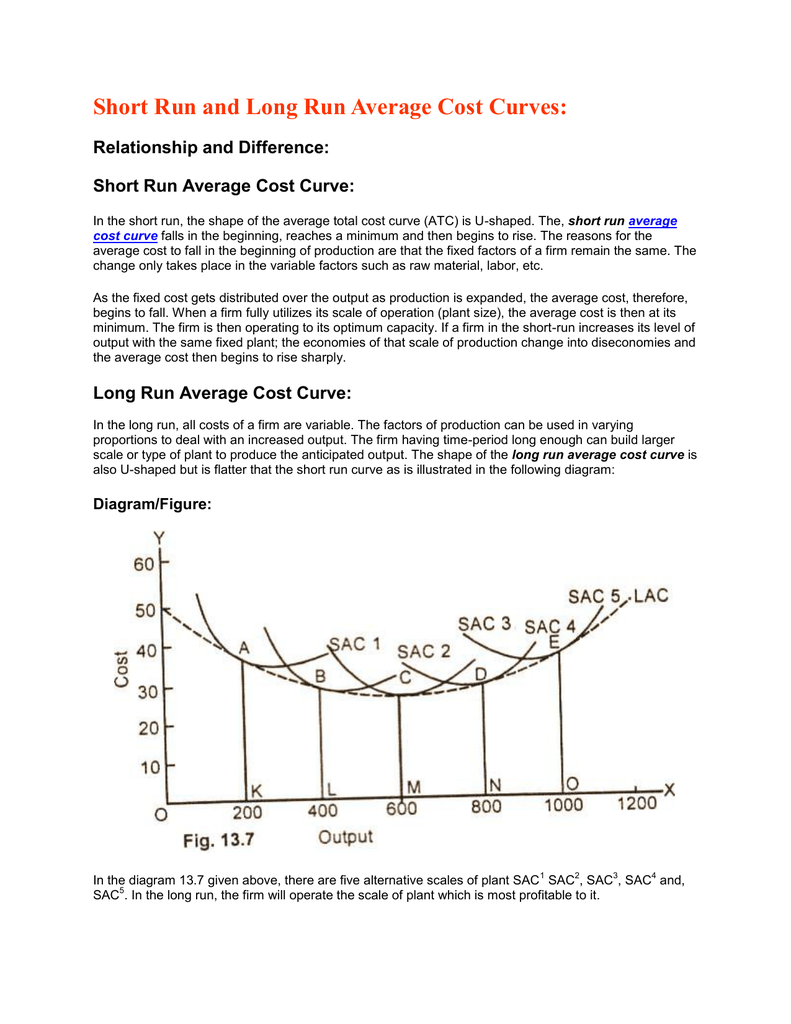

The average total cost (ATC) represents the total cost of production divided by the quantity produced. It includes both fixed and variable costs. In the long run, firms can adjust all their inputs, including the size of their factories, to achieve the most efficient scale of production.

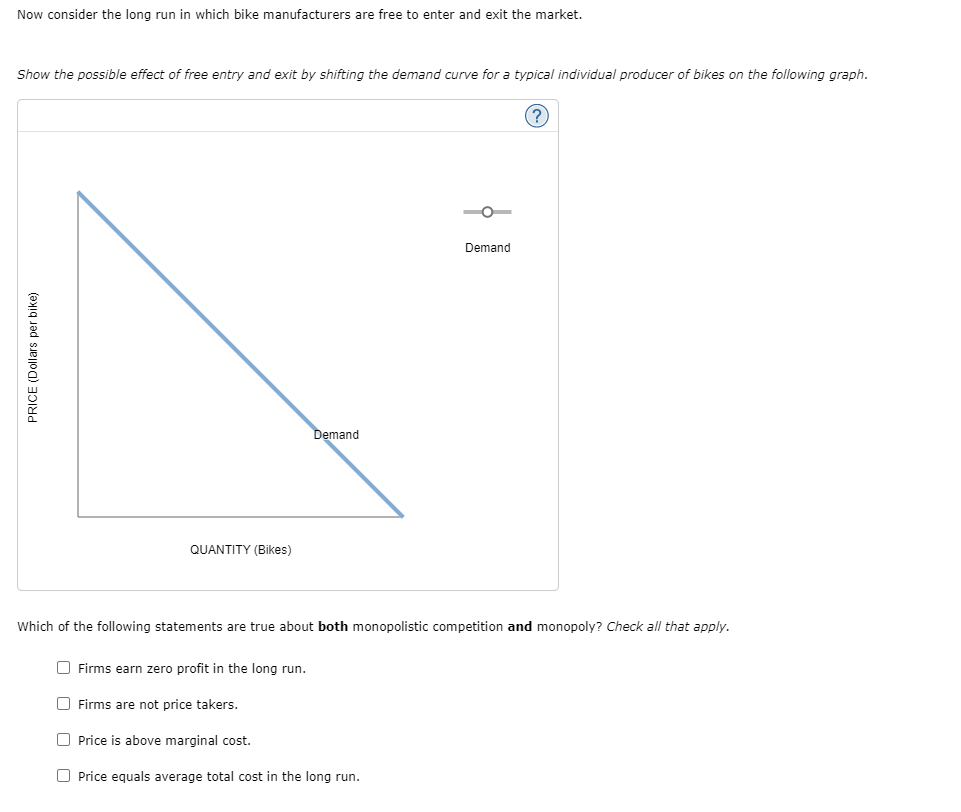

The Role of Entry and Exit

The free entry and exit of firms are paramount to reaching long-run equilibrium. This is because positive economic profits incentivize new businesses to enter the market, boosting supply.

Increased supply lowers the market price until it equals the minimum of the ATC curve. Similarly, losses encourage firms to exit, diminishing supply and elevating prices until they, too, converge with the minimum ATC.

According to a recent report by the National Bureau of Economic Research (NBER), industries with lower barriers to entry tend to reach this equilibrium faster and more consistently.

Impact on Businesses

For businesses, understanding this principle is crucial for strategic planning. Operating at the minimum ATC ensures they remain competitive and can withstand market fluctuations.

Firms must constantly strive for efficiency improvements to lower their ATC, giving them an edge even when market prices are at their lowest. This includes investing in technology, streamlining production processes, and managing their supply chains effectively.

Professor Anya Sharma, an economist at the University of Chicago, notes that "firms that ignore the long-run implications of cost structures often find themselves struggling to compete when market conditions change."

Impact on Consumers

Consumers benefit from this dynamic through lower prices and greater availability of goods and services. The drive for efficiency pushes companies to offer products at the lowest possible price, maximizing consumer surplus.

The equilibrium also encourages innovation. As firms look for ways to reduce their ATC, they also develop new and improved products and services to attract customers.

However, this competitive environment requires vigilance from regulatory bodies to ensure fair play. Antitrust laws are important in preventing monopolies and cartels that could artificially inflate prices above the ATC. The Federal Trade Commission (FTC) remains focused on cases of potential market manipulation.

A Real-World Example

The airline industry provides a real-world example of this dynamic. In recent years, low-cost carriers have entered the market, driving down fares and forcing established airlines to cut costs and operate more efficiently.

This competition benefits consumers through more affordable air travel but has also led to bankruptcies and consolidation among airlines unable to adapt. This demonstrates the pressures that firms face in a competitive environment.

Challenges and Criticisms

While the principle of price equaling ATC in the long run is a powerful model, it faces certain criticisms. Real-world markets are rarely perfectly competitive.

Barriers to entry, such as high start-up costs or regulatory hurdles, can prevent new firms from entering the market. Product differentiation can also give firms some market power, allowing them to charge prices above the minimum ATC.

Despite these limitations, the concept remains a valuable framework for understanding market dynamics and informing business strategy. Continuous advancements in technology and changing consumer preferences make the challenge of reaching and sustaining long-run equilibrium a constantly evolving challenge for businesses.

In conclusion, the convergence of price and average total cost in the long run is a vital economic principle that shapes competitive markets. Businesses that grasp this concept and adapt accordingly are more likely to succeed, while consumers benefit from lower prices and greater product availability. Though real-world complexities exist, understanding this principle is a key element in navigating the market.