Private Wealth Management Salary Morgan Stanley

The world of private wealth management is often shrouded in secrecy, but one aspect that consistently piques interest is compensation. Morgan Stanley, a global financial behemoth, stands as a significant player in this field, and understanding its compensation structure offers a glimpse into the lucrative, yet demanding, nature of this career path.

This article delves into the intricacies of private wealth management salaries at Morgan Stanley, exploring factors that influence earnings, the different compensation components, and how they compare to industry benchmarks. We'll examine the roles driving revenue, the impact of market conditions, and future trends shaping compensation in this ever-evolving landscape. Understanding these dynamics is crucial for both aspiring wealth managers and seasoned professionals seeking to navigate their careers within this competitive environment.

Understanding the Landscape of Private Wealth Management Compensation

Private wealth management compensation is not a monolithic entity. It's a multi-faceted structure heavily influenced by performance, experience, assets under management (AUM), and the specific role within the firm.

At Morgan Stanley, the base salary forms only a portion of the total compensation package. The remaining, and often larger, portion comprises bonuses, commissions, and other incentives tied to individual and team performance.

Base Salary: The Foundation

The base salary provides a stable foundation for private wealth managers. Entry-level positions typically start with a base salary ranging from $60,000 to $80,000, depending on location and qualifications.

However, this figure can quickly escalate with experience and the accumulation of industry certifications like the Certified Financial Planner (CFP) designation.

Experienced wealth managers with a proven track record can command base salaries well into the six figures.

Bonuses and Commissions: The Performance Multiplier

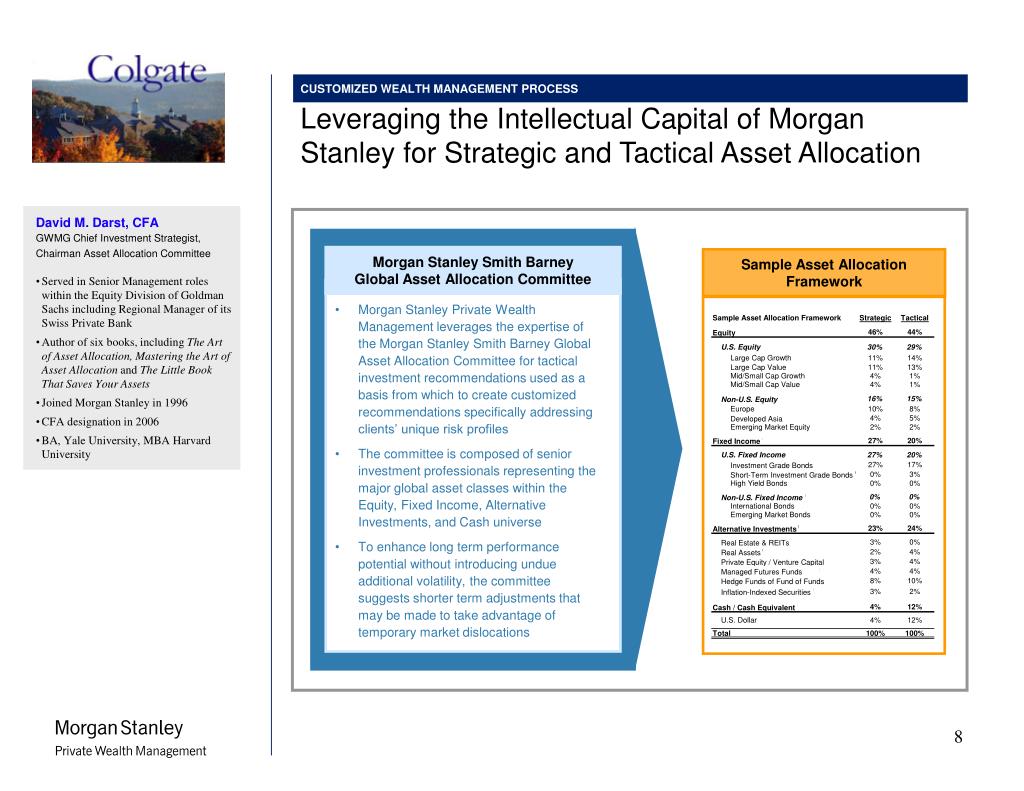

Bonuses and commissions are the primary drivers of high earnings in private wealth management. These components are directly linked to the revenue generated by the advisor.

Factors such as the amount of AUM, the number of new clients acquired, and the types of products sold all contribute to the bonus and commission pool.

For example, a wealth manager managing $100 million in AUM might earn a percentage of that AUM as a management fee, a portion of which is then distributed as commission.

Geographic Considerations and Cost of Living

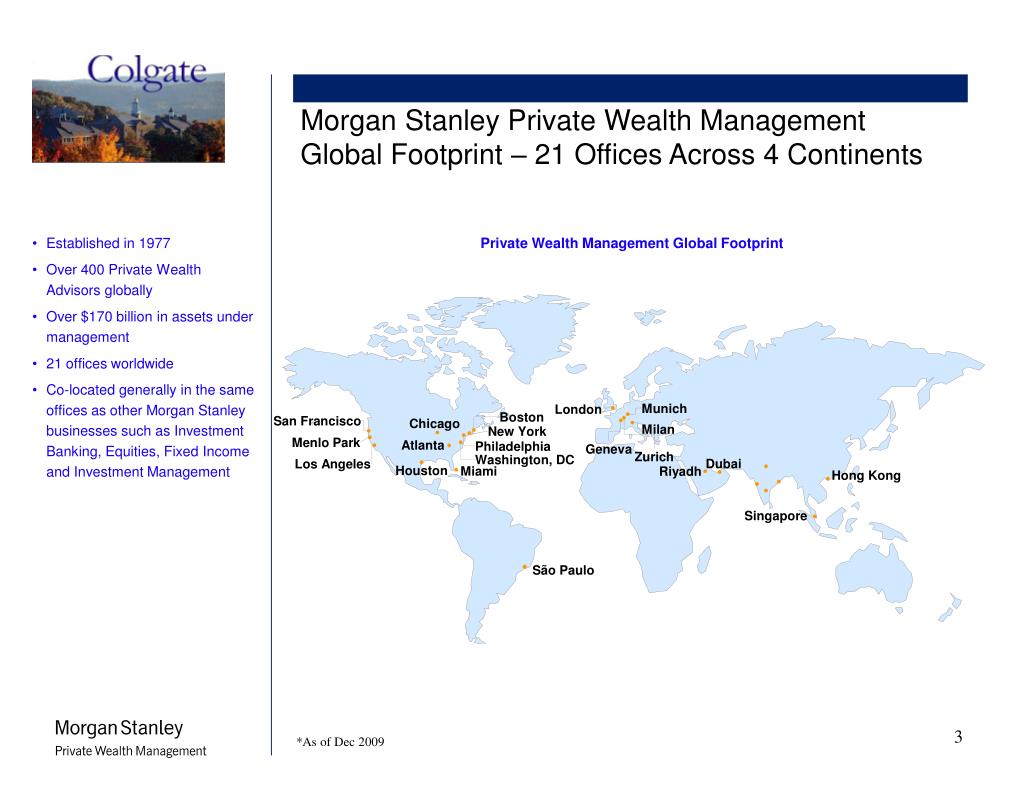

Location plays a significant role in determining compensation. Wealth managers in major metropolitan areas like New York City, San Francisco, and London typically earn more than their counterparts in smaller markets.

This reflects the higher cost of living and the concentration of high-net-worth individuals in these areas.

However, the higher compensation is often offset by increased expenses.

Comparing Morgan Stanley to Industry Benchmarks

Morgan Stanley is consistently ranked among the top wealth management firms globally. This prestigious ranking allows the company to attract top talent.

Salary surveys conducted by reputable organizations like Glassdoor and Payscale provide insights into industry-wide compensation trends.

While these figures offer a general guideline, actual compensation can vary significantly based on individual performance and firm-specific policies.

Morgan Stanley's reputation and brand recognition often allow it to offer slightly higher compensation packages to attract and retain top performers.

"Compensation in wealth management is highly variable and dependent on individual performance and market conditions," according to a recent report by Cerulli Associates, a leading research firm in the financial services industry.

The Impact of Market Volatility and Economic Conditions

Market volatility and economic downturns can significantly impact wealth management compensation. A bear market, for example, can lead to a decline in AUM, resulting in lower fees and reduced bonuses.

Conversely, a bull market can drive AUM higher, boosting both bonuses and commissions.

During periods of economic uncertainty, wealth managers need to adapt their strategies and focus on preserving capital for their clients, which may impact their immediate earnings.

Future Trends Shaping Compensation

The wealth management industry is undergoing rapid transformation, driven by technological advancements and changing client expectations. The rise of robo-advisors and the increasing demand for personalized financial advice are reshaping the role of wealth managers.

This evolution is likely to influence compensation models. A shift towards fee-based advisory services and a greater emphasis on holistic financial planning are expected.

In the future, skills in areas like financial technology (fintech) and client relationship management will become increasingly valuable, potentially leading to higher compensation for professionals who possess these skills.

.png)