Purchasing A Small Business Questions To Ask

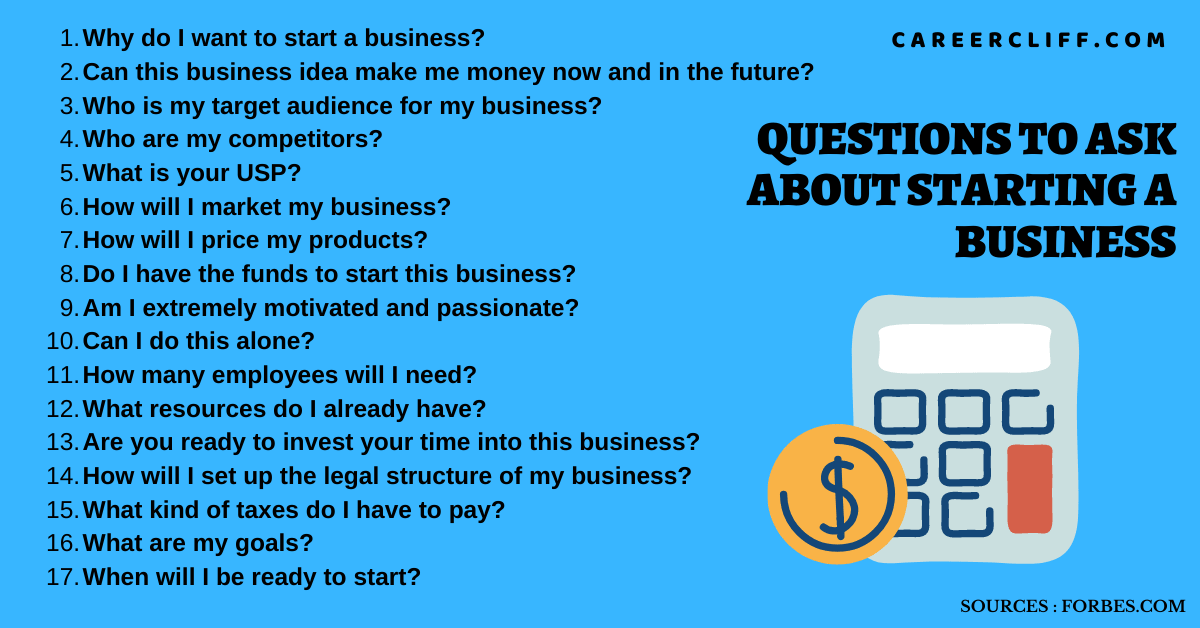

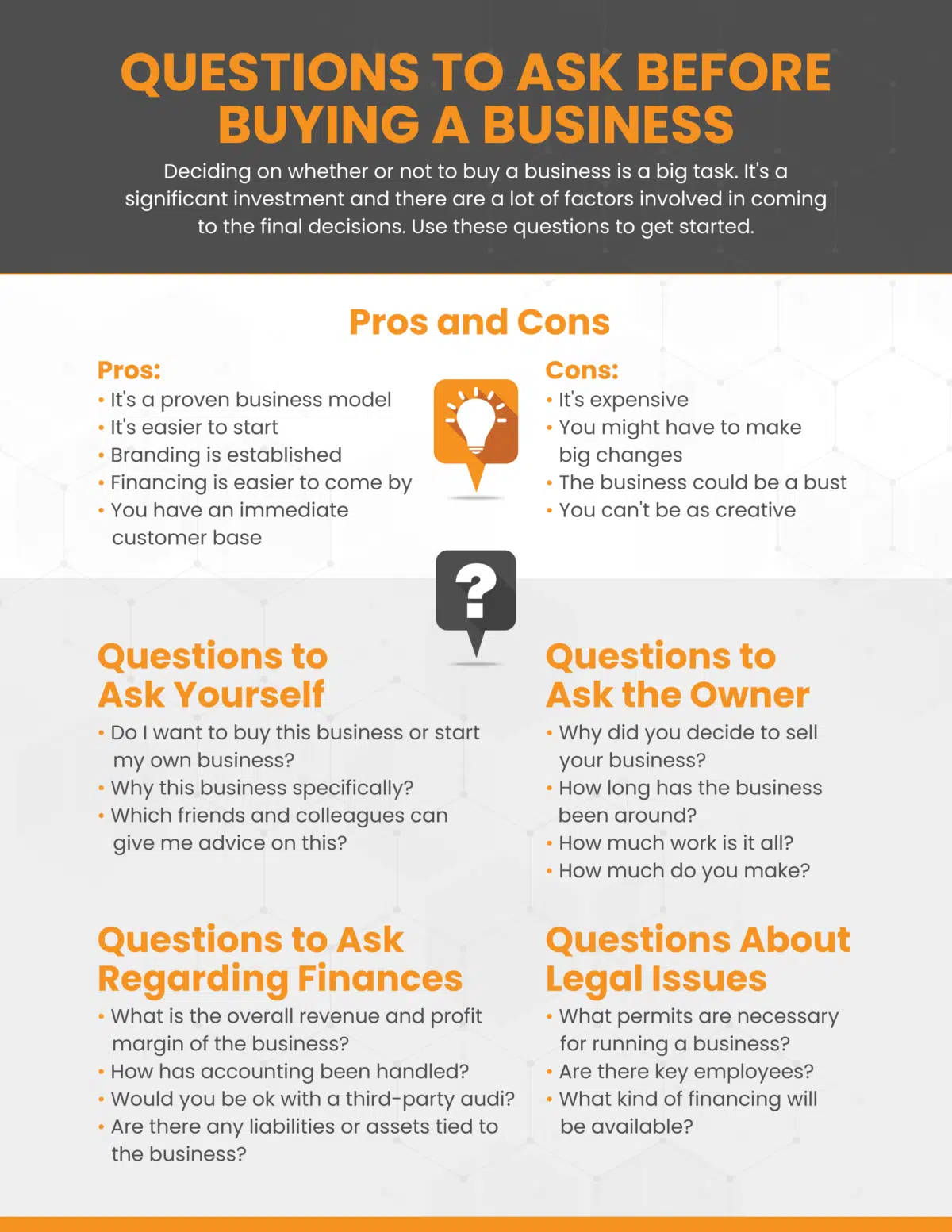

The dream of owning a small business is a powerful lure, a promise of independence and financial control. However, diving into entrepreneurship by acquiring an existing business requires meticulous due diligence, far beyond a simple glance at the books. Potential buyers must arm themselves with crucial questions to avoid inheriting hidden liabilities or overpaying for a failing enterprise.

Before signing on the dotted line, prospective owners need to thoroughly vet the business's financials, operational health, legal standing, and market position. This comprehensive investigation, guided by well-informed questions, can be the difference between a thriving venture and a costly mistake. Failing to ask the right questions upfront can lead to unforeseen costs, legal battles, and ultimately, the demise of the business you hoped to nurture.

Financial Scrutiny: Unearthing the Truth

The financial health of the business is paramount. Buyers should meticulously examine at least three to five years of financial statements, including balance sheets, income statements, and cash flow statements. These documents provide a historical perspective on the business's profitability, liquidity, and solvency.

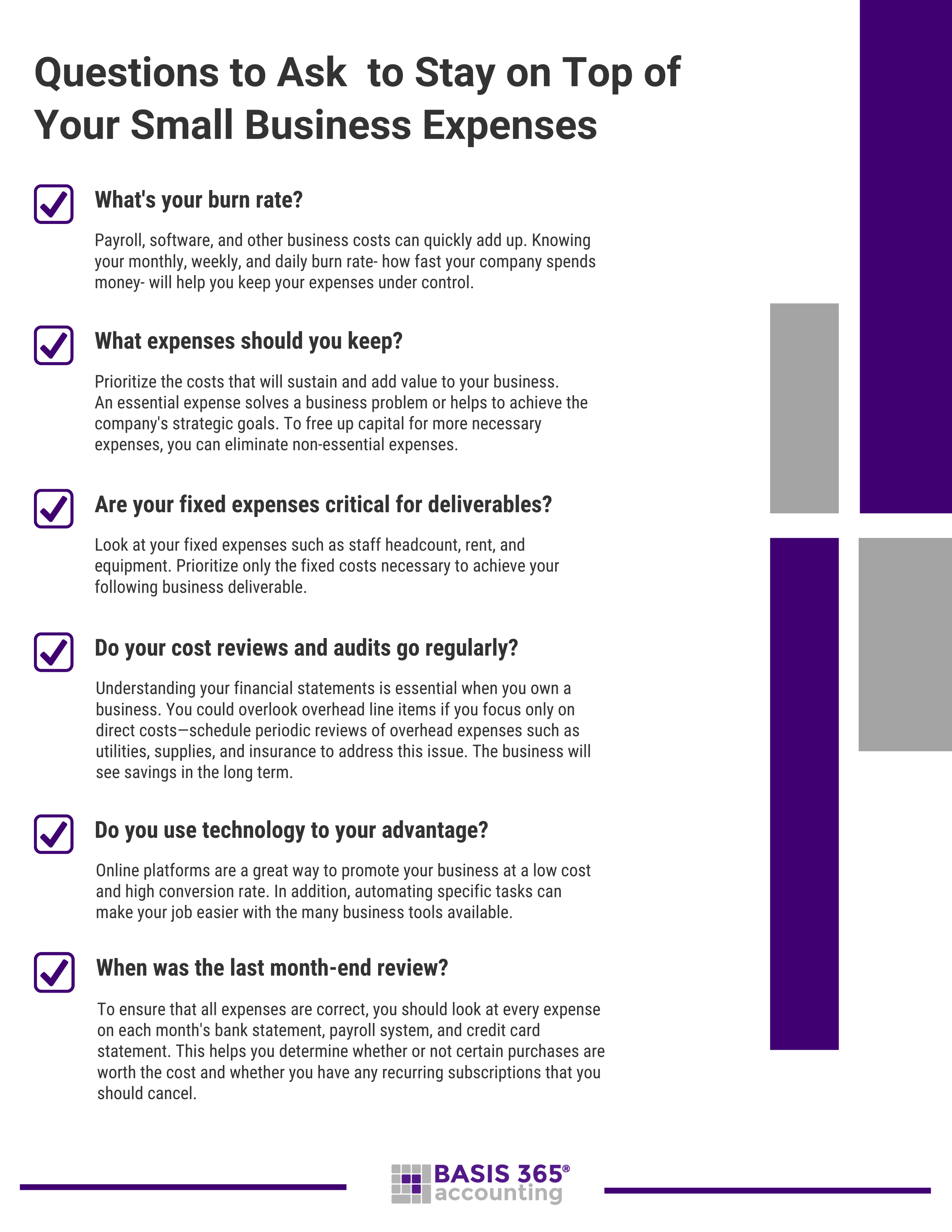

Key questions include: What are the trends in revenue and expenses? Are there any significant fluctuations or anomalies that require explanation? What are the gross profit and net profit margins, and how do they compare to industry averages? Understanding the answers to these questions helps ascertain the true earnings potential of the business and spot any potential red flags.

Beyond the standard financial statements, buyers should also request detailed information on accounts receivable and payable. This includes the aging of these accounts and the policies for managing them. Uncollectible accounts receivable can significantly impact cash flow, while unfavorable payment terms with suppliers can strain profitability.

Debt and Liabilities: Unveiling Hidden Burdens

A critical aspect of financial due diligence is understanding the business's debt structure and potential liabilities. This includes loans, leases, and any outstanding legal claims or lawsuits. A complete list of all debts, including interest rates, repayment terms, and collateral, is essential.

Questions to ask: What is the total amount of outstanding debt? Are there any personal guarantees associated with the debt? Are there any pending lawsuits or legal claims against the business? Unforeseen liabilities can quickly erode profits and even threaten the solvency of the business.

Operational Assessment: Understanding the Day-to-Day

Financial statements only paint a partial picture. Understanding the day-to-day operations of the business is equally crucial. This involves examining the business's processes, systems, and infrastructure. A detailed understanding of the operational aspects of the business helps buyers assess the efficiency and scalability of the business.

Key areas to investigate include: What are the key operational processes? Are these processes documented and standardized? What technology is used in the business, and is it up-to-date? What are the key performance indicators (KPIs) for the business? Understanding the operational landscape allows buyers to identify potential bottlenecks and areas for improvement.

Furthermore, understanding the supplier relationships is critical. Who are the key suppliers, and what are the terms of the contracts? Is the business reliant on a single supplier, which could pose a risk? Understanding supplier relationships allows buyers to assess the stability and resilience of the supply chain.

Employees and Management: Retaining Key Talent

The employees are often the most valuable asset of a small business. Therefore, understanding the employee base and management team is crucial. Questions to ask: What is the organizational structure of the business? What are the key employee roles and responsibilities? What is the employee turnover rate?

It's crucial to determine if key employees will remain with the business after the acquisition. Also, inquire about employee benefits, compensation, and any outstanding HR issues. The retention of key personnel can be critical to the success of the transition.

Legal and Regulatory Compliance: Avoiding Pitfalls

Ensuring the business is in compliance with all applicable laws and regulations is crucial to avoid costly legal battles. This includes environmental regulations, labor laws, and industry-specific regulations. A thorough review of all permits, licenses, and compliance records is essential. Engaging a lawyer specializing in business acquisitions is highly recommended.

Questions to ask: Are there any outstanding regulatory violations or fines? Are all permits and licenses up-to-date? What are the potential environmental liabilities associated with the business? Legal and regulatory compliance is a non-negotiable aspect of due diligence.

Market Analysis: Gauging Future Potential

Understanding the competitive landscape and the target market is critical to assessing the future potential of the business. This includes analyzing market trends, identifying competitors, and evaluating the business's market share. A thorough market analysis helps buyers assess the long-term viability of the business.

Questions to ask: What is the size of the target market? What are the key trends in the market? Who are the major competitors? Understanding the market dynamics allows buyers to make informed decisions about the future of the business.

Finally, understanding the customer base is essential. Who are the key customers? What is the customer retention rate? Understanding customer relationships helps buyers assess the long-term sustainability of the business.

Conclusion: Informed Decisions, Successful Ventures

Purchasing a small business is a complex undertaking that requires thorough due diligence. By asking the right questions and carefully evaluating the answers, potential buyers can significantly increase their chances of success. Remember, a well-informed decision is the foundation for a thriving entrepreneurial venture.