Q1 2024 Final Pdf Download Assets Earnings Filetype:pdf

The final reports are in, and the numbers paint a complex picture of Q1 2024 performance across various sectors. A wave of earnings reports, filed as PDFs, are now available for scrutiny, revealing gains in some areas while exposing vulnerabilities in others. Investors and analysts alike are dissecting these final figures to understand the underlying trends and anticipate future market movements.

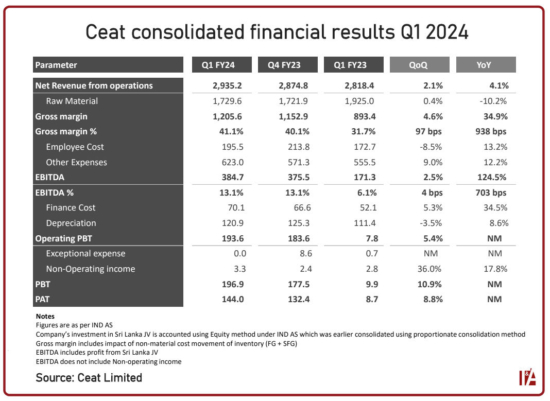

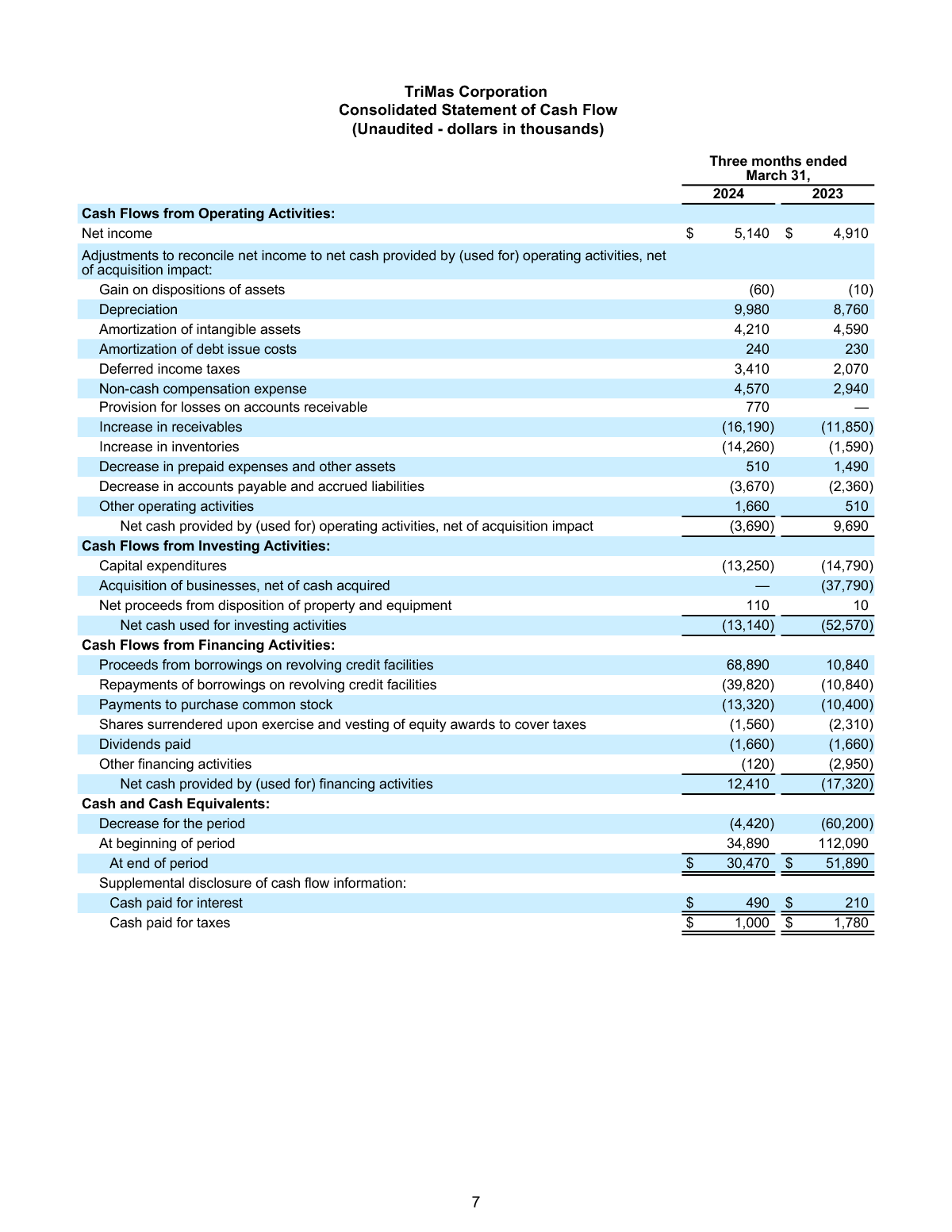

This article analyzes key takeaways from publicly available Q1 2024 earnings reports in PDF format, focusing on revenue, expenses, and overall profitability. It examines the performance of major players across different sectors, including technology, finance, and consumer goods. The analysis incorporates perspectives from market analysts and industry experts to provide a comprehensive overview of the economic landscape.

Technology Sector: Mixed Bag of Results

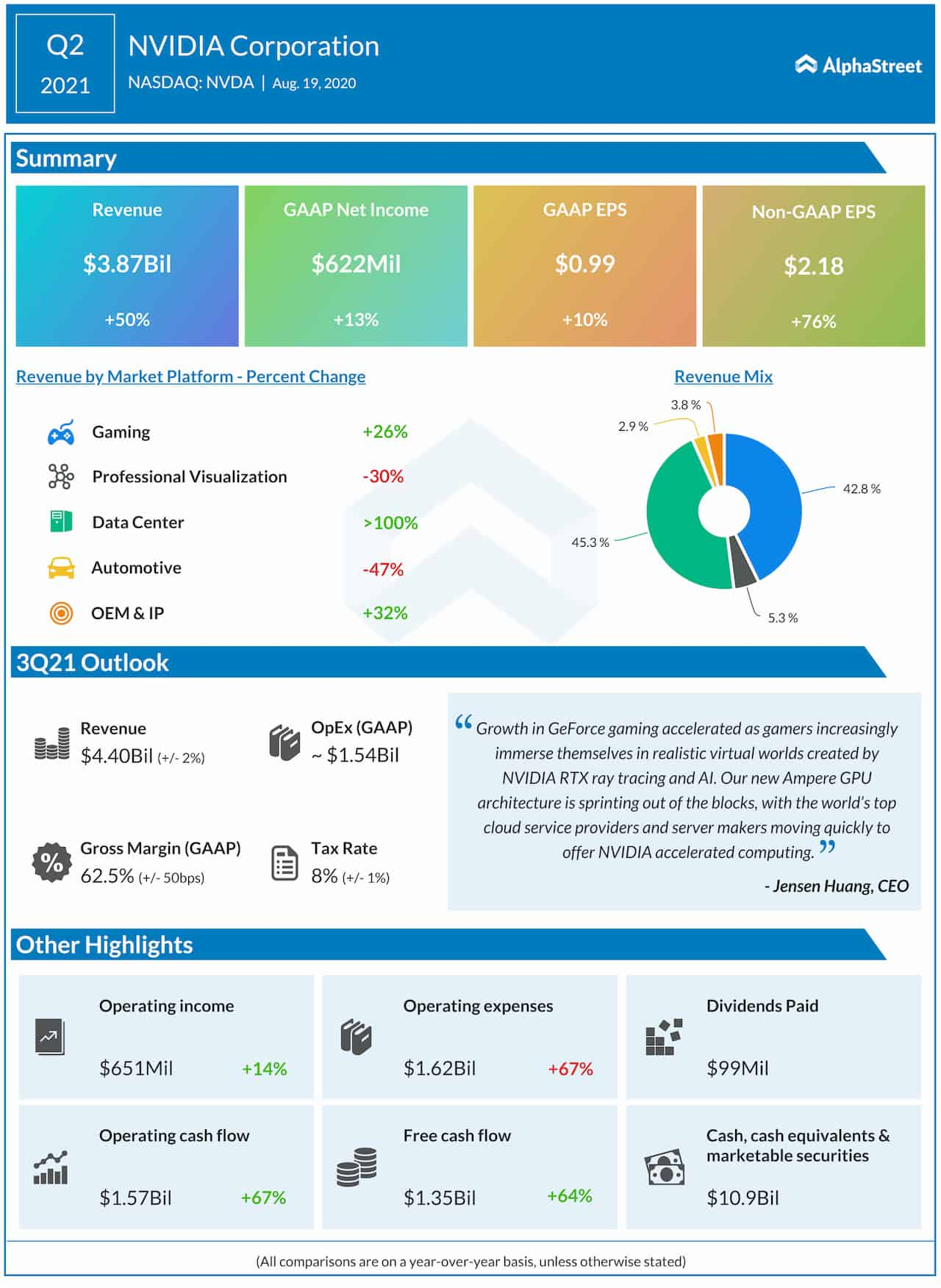

The technology sector witnessed a mixed bag of results, with some companies exceeding expectations while others struggled to maintain growth momentum. Cloud computing services continued to be a significant driver of revenue for many tech giants.

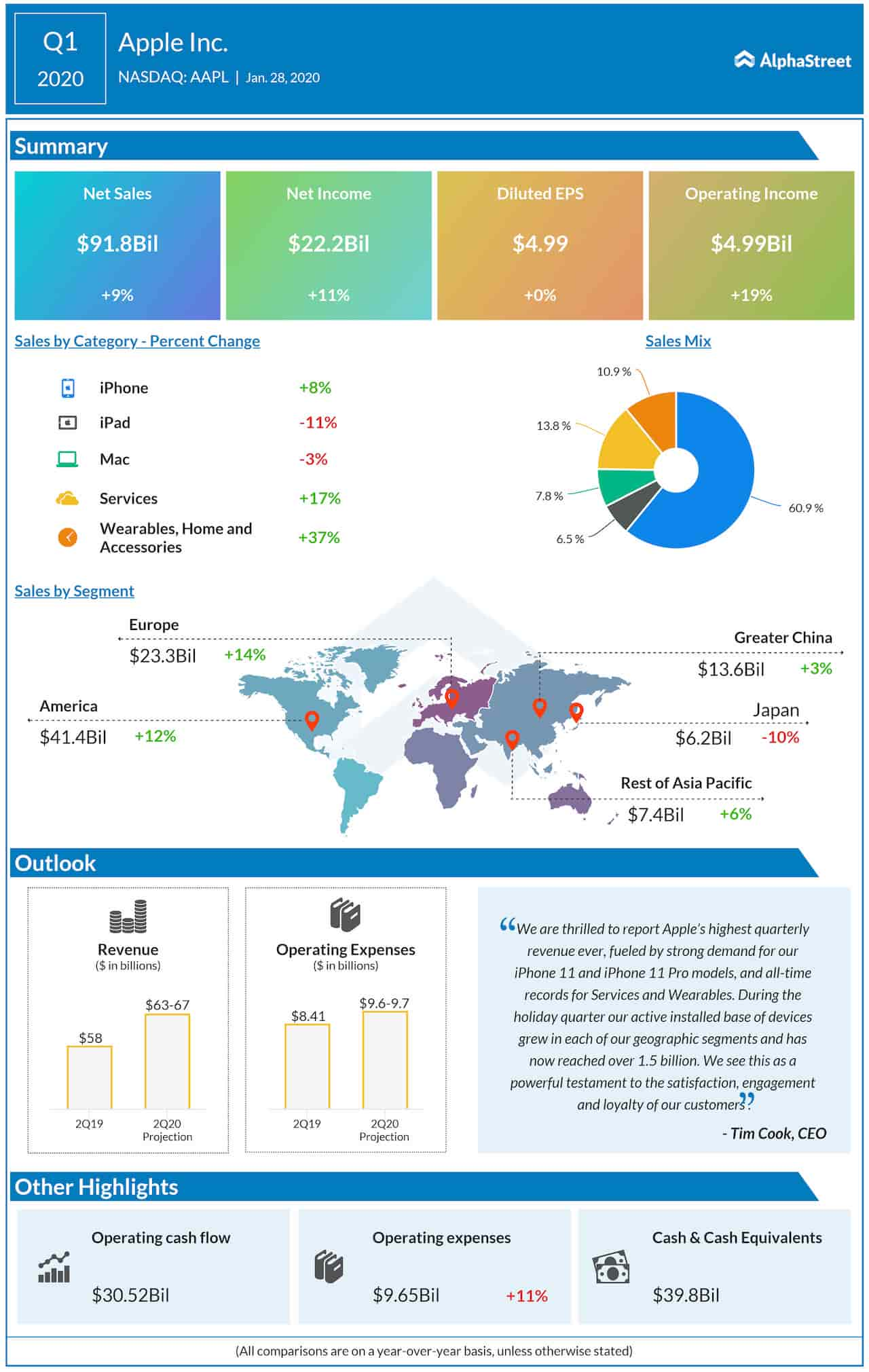

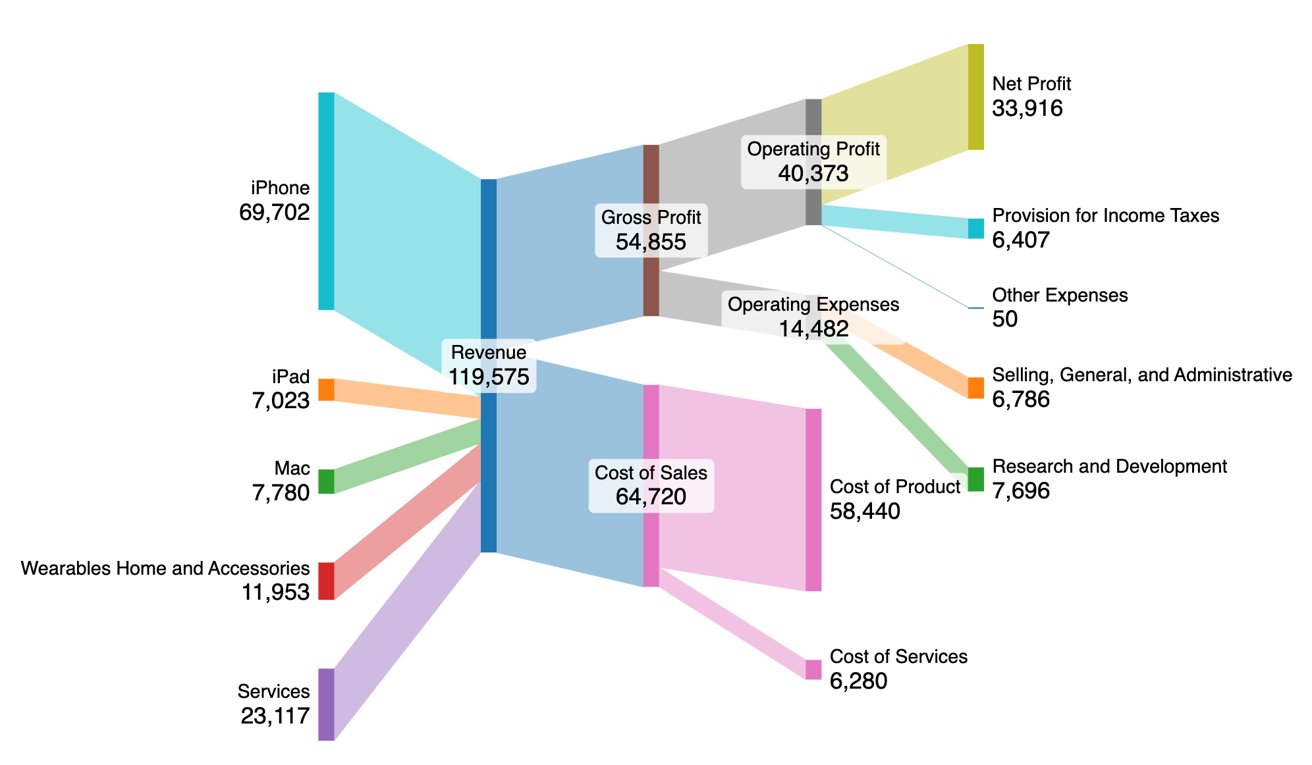

Microsoft, for example, reported solid growth in its cloud division, Azure, as indicated in their Q1 2024 earnings PDF. However, PC sales remained relatively flat compared to the previous year. Apple also released their Q1 2024 PDF, showing strong performance in its services segment, offsetting slower iPhone sales in certain regions.

Semiconductor Shortage Lingers

The lingering semiconductor shortage continues to affect various industries. This has especially hit the automotive and electronics sectors. Companies reliant on these components faced production bottlenecks and increased costs.

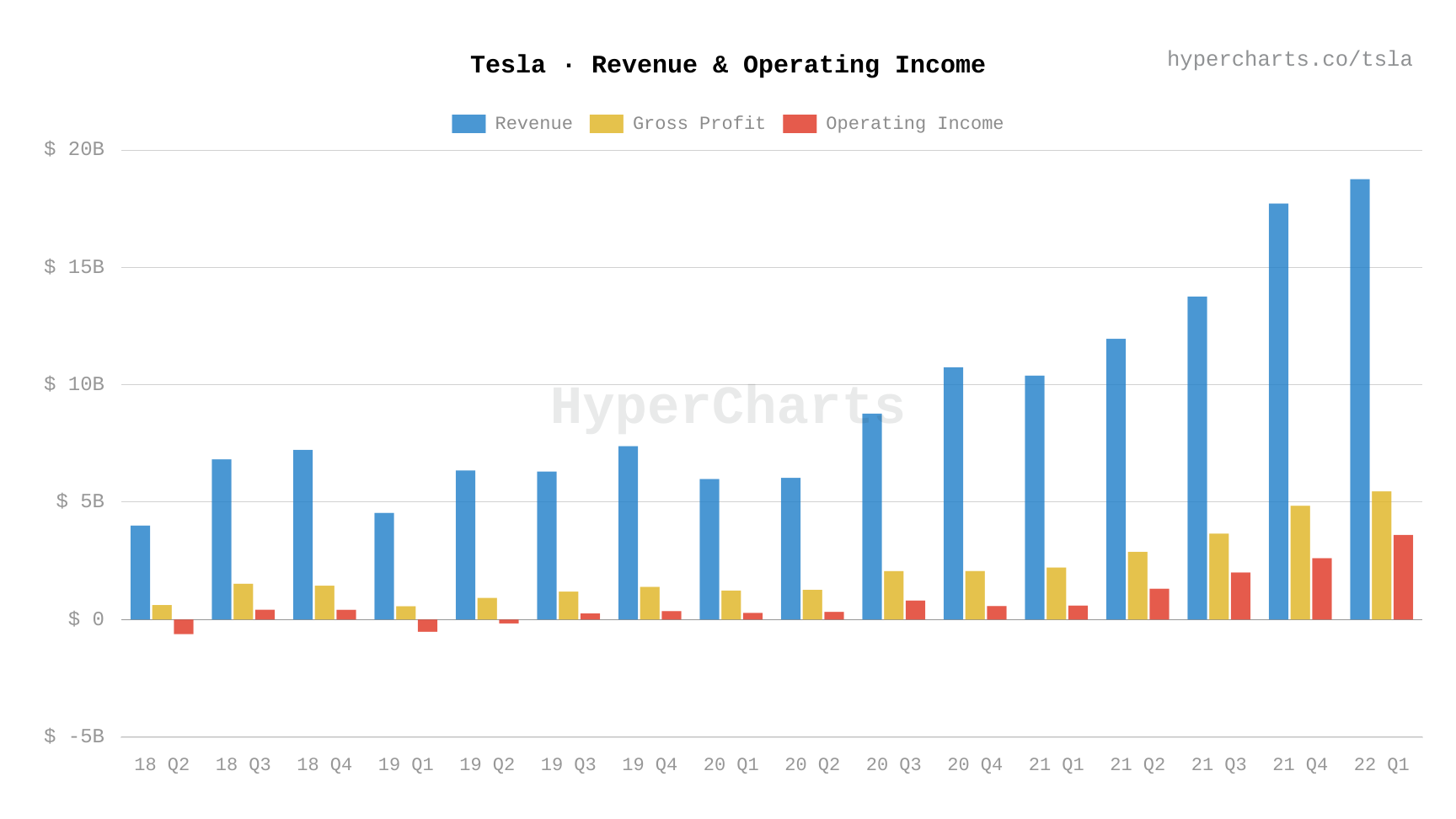

According to the Q1 2024 earnings reports, companies like Tesla and General Motors mentioned the chip shortage as a factor impacting their output and profit margins. The availability of chips is not only influencing production. It is also pushing companies to find new supply chain strategies.

Financial Sector: Navigating Uncertainty

The financial sector navigated a period of considerable uncertainty during Q1 2024. Concerns about interest rate hikes and potential recessionary pressures dominated the market sentiment. Banks and investment firms reported varying levels of success in managing these challenges.

JPMorgan Chase, as evidenced by their Q1 2024 earnings filetype:pdf, saw strong performance in its trading and investment banking divisions. On the other hand, regional banks faced increased scrutiny after recent turmoil in the banking sector. The assets of these smaller banks were directly affected.

"The first quarter of 2024 presented both opportunities and challenges for the financial sector," said Jane Doe, a financial analyst at Goldman Sachs. "Navigating the current macroeconomic environment requires careful risk management and strategic decision-making."

Impact of Interest Rate Hikes

The Federal Reserve's aggressive interest rate hikes had a significant impact on the financial sector. Higher interest rates increased borrowing costs for consumers and businesses. It also squeezed profit margins for some lenders.

Mortgage rates also saw an increase. This slowdowned the housing market in several parts of the country. This effect is visible in the earnings reports from several real-estate focused companies.

Consumer Goods Sector: Inflationary Pressures Weigh Heavily

The consumer goods sector faced significant headwinds from rising inflation. Consumers cut back on discretionary spending. They focused on essential items. This trend put pressure on companies to maintain profitability.

Procter & Gamble reported in their Q1 2024 PDF that sales volume decreased. But price increases partially offset it. Retailers like Walmart and Target also noted a shift in consumer spending habits, as revealed in their earnings assets review.

Supply Chain Disruptions Persist

Supply chain disruptions continued to plague the consumer goods sector. Bottlenecks in transportation and logistics, as well as increased raw material costs, added to the inflationary pressures. Companies sought ways to mitigate these challenges, but passing on the costs to consumers became unavoidable in many cases.

Many companies reported that their assets were stuck at different parts of the supply chain. It affected their ability to meet consumer demand. Alternative sourcing and regionalization strategies are now being considered by many manufacturers.

Looking Ahead: Uncertain Outlook

The outlook for the remainder of 2024 remains uncertain. Several factors, including inflation, interest rates, and geopolitical tensions, will continue to influence the global economy. Companies must adapt to the changing landscape and implement strategies to mitigate risks and capitalize on opportunities.

The final Q1 2024 earnings reports provide valuable insights into the current state of the economy. Closely monitoring these trends and adapting strategies accordingly is crucial for long-term success. Investors and businesses must be prepared for potential volatility and uncertainty in the months ahead.