How Much Are Closing Costs On A 220 000 House

Homebuyers face a hidden expense beyond the down payment: closing costs. On a $220,000 house, these fees can significantly impact affordability and require careful budgeting.

Understanding these costs is crucial to avoid financial surprises and ensure a smooth home purchase.

What are Typical Closing Costs?

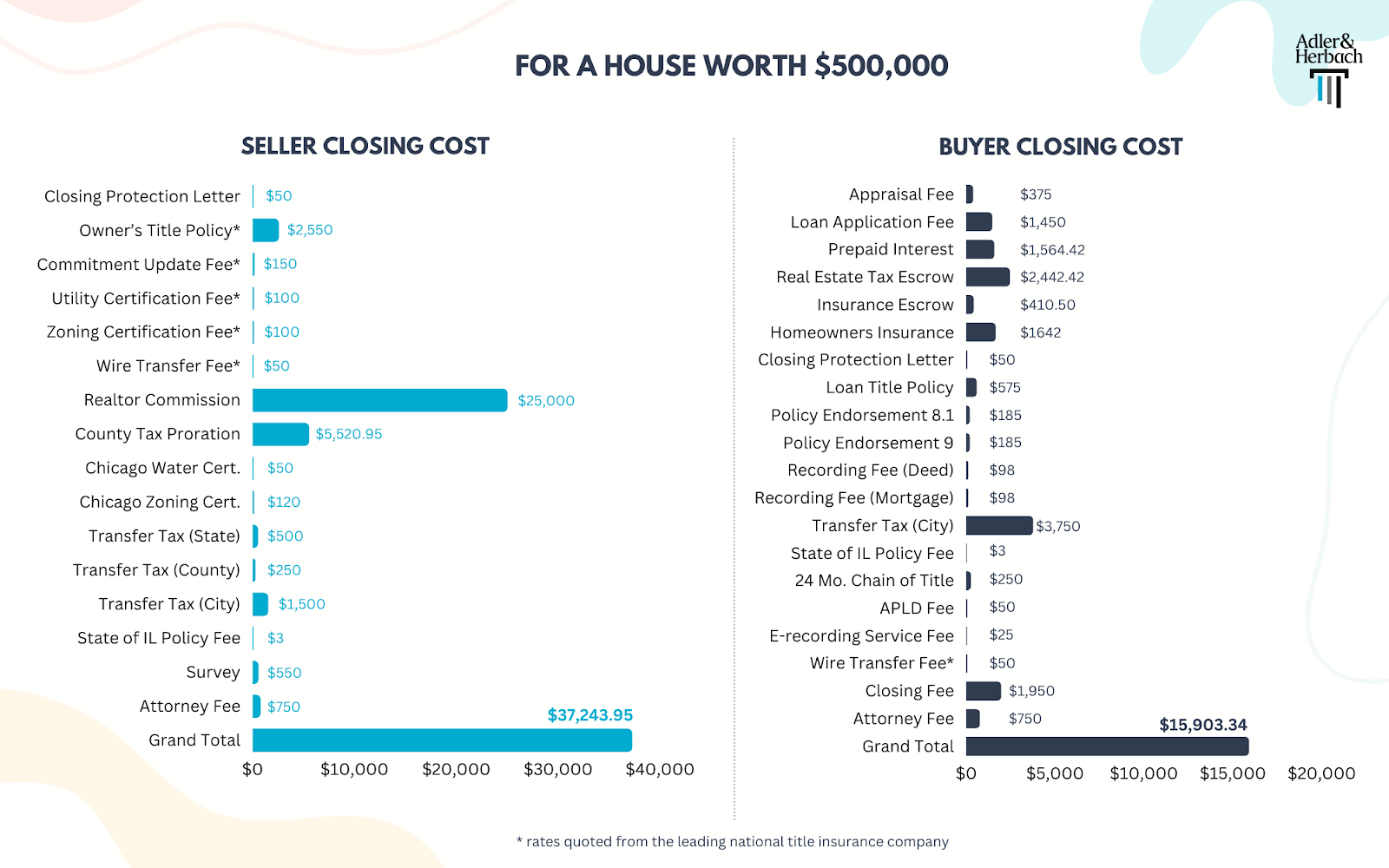

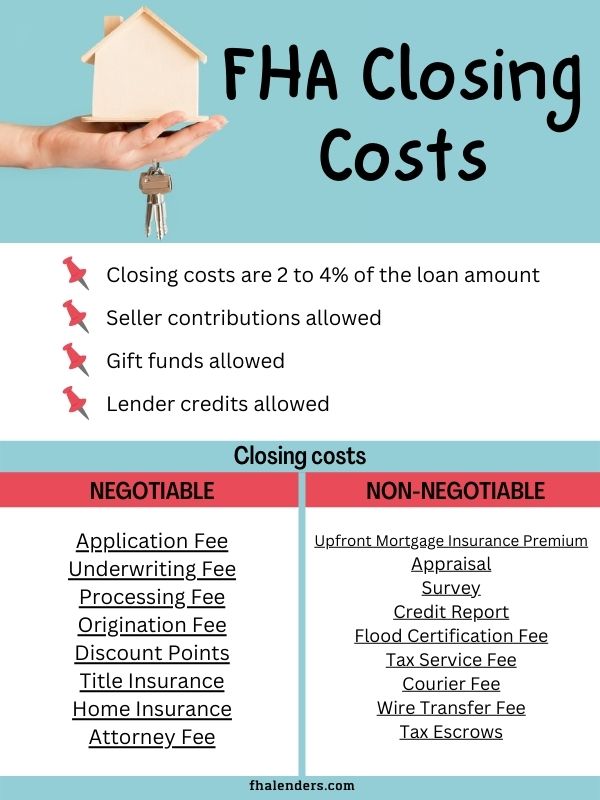

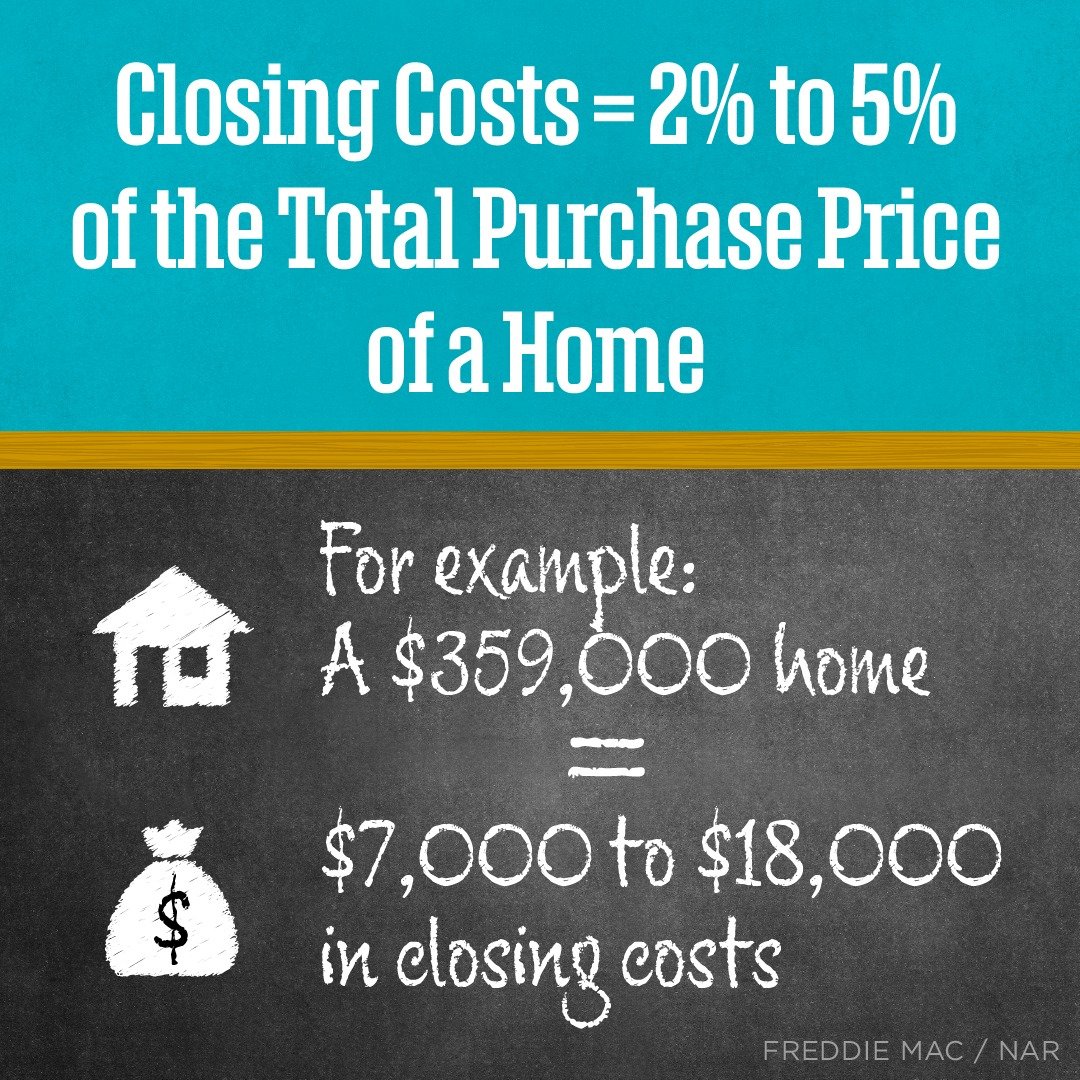

Closing costs typically range from 2% to 5% of the loan amount. For a $220,000 house, expect to pay between $4,400 and $11,000 in closing costs.

This figure includes various fees associated with securing the mortgage and transferring property ownership.

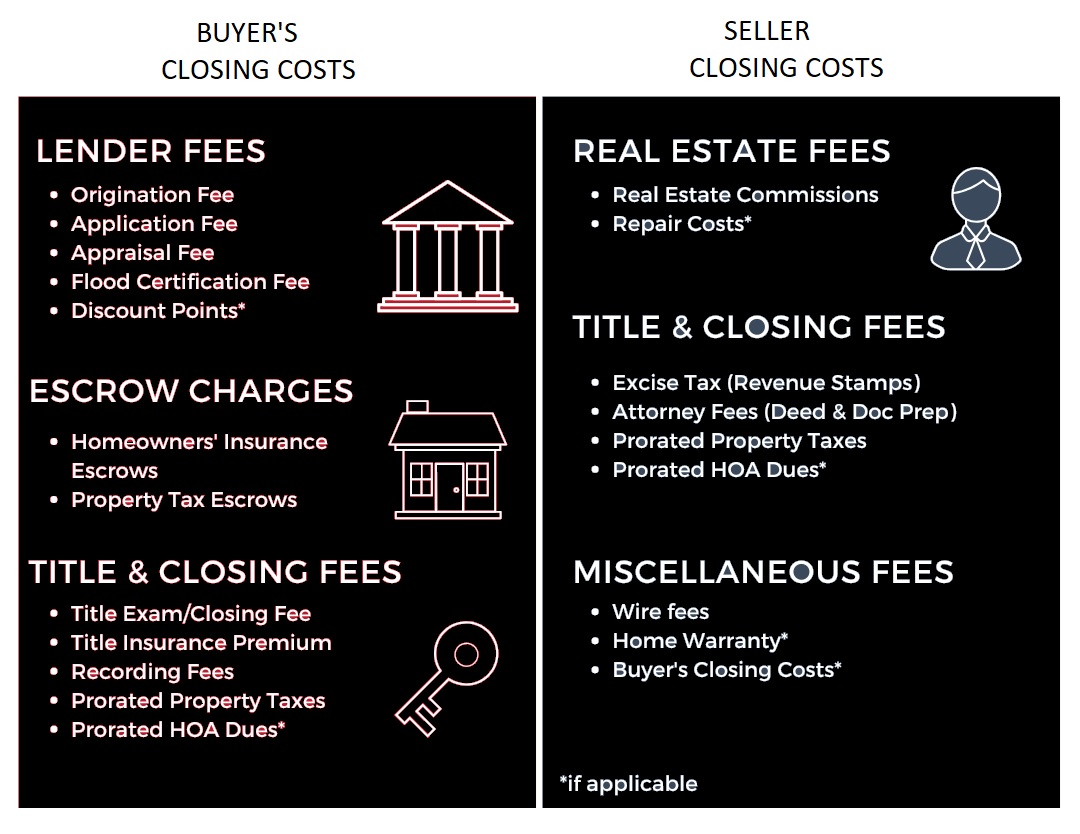

Key Components of Closing Costs

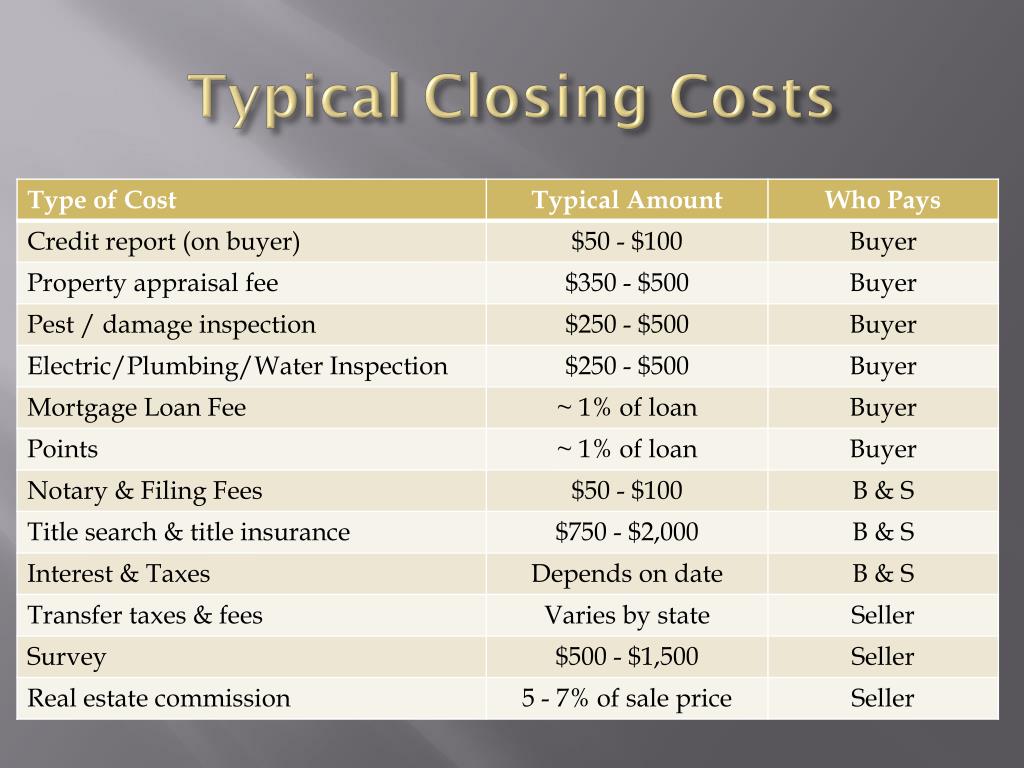

Several factors influence the final closing cost amount. These components can vary widely depending on location, lender, and loan type.

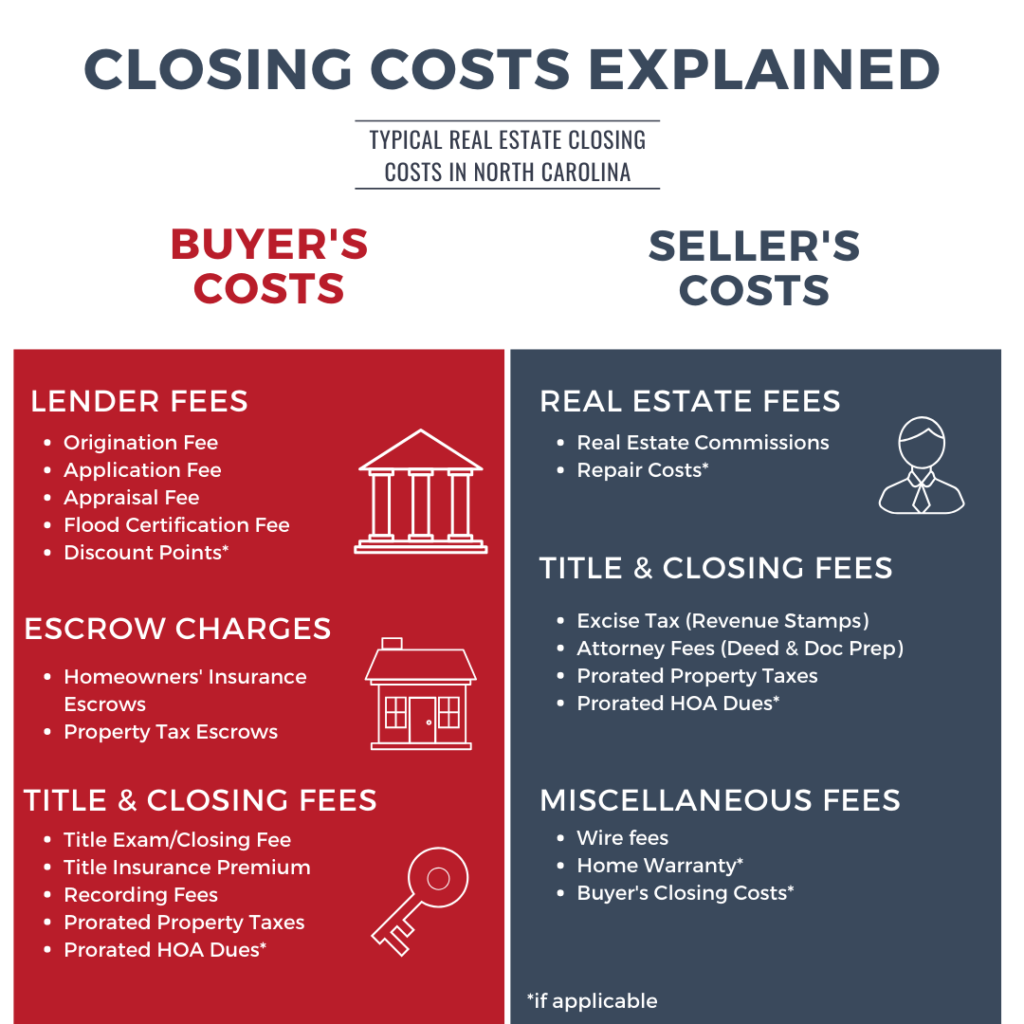

- Lender Fees: Application fees, underwriting fees, and loan origination fees are common. These fees compensate the lender for processing the loan.

- Appraisal Fee: An appraisal is required to determine the fair market value of the property. Expect to pay around $300 to $500 for this service.

- Title Insurance: This protects the lender and the buyer against any title defects or claims. The cost of title insurance can vary depending on the price of the home and location, but can range between $500 to $1,000.

- Property Taxes: You may need to prepay property taxes depending on the time of year and lender requirements. Check with your real estate agent for your tax amount.

- Homeowners Insurance: Lenders require homeowners insurance to protect the property from damage or loss. The first year's premium is often due at closing, which can range between $1,000 to $2,000 annually.

- Recording Fees: These fees cover the cost of recording the property transfer with the local government. Recording fees are typically a few hundred dollars.

Impact of Location

Closing costs vary considerably by state and even county. Areas with higher property taxes or stringent regulations often have higher closing costs.

Research local averages to get a more accurate estimate.

Who Pays What?

While the buyer typically covers the majority of closing costs, the seller may also contribute.

Negotiate with the seller to potentially reduce your expenses. This is often done with incentives like credits towards closing costs.

How to Reduce Closing Costs

Several strategies can help lower your closing costs. Shopping around for the best mortgage rates and comparing lender fees is a great start.

Consider asking the seller to cover some of the closing costs. Look into first time homebuyer programs which can reduce the overall cost.

Pay attention to lender credits. These can offset some of your expenses in exchange for a higher interest rate.

Seeking Assistance

Navigating closing costs can be complex. Consult with a real estate agent and a mortgage lender for personalized guidance.

They can provide accurate estimates and help you explore options for reducing expenses.

Remember, understanding and planning for closing costs is essential for a successful home purchase.

![How Much Are Closing Costs On A 220 000 House A Home Buyer’s Guide to Closing Costs [INFOGRAPHIC]](https://assets.site-static.com/blogphotos/1688/20696-blog-template-miscellaneous.png)

.jpg)