A Taxpayer Can Avoid A Substantial Understatement Of Tax Penalty

Imagine receiving a letter from the IRS, not with a refund check, but with a bill for penalties and interest due to an understatement of tax. This scenario can be avoided with careful planning and a clear understanding of the rules.

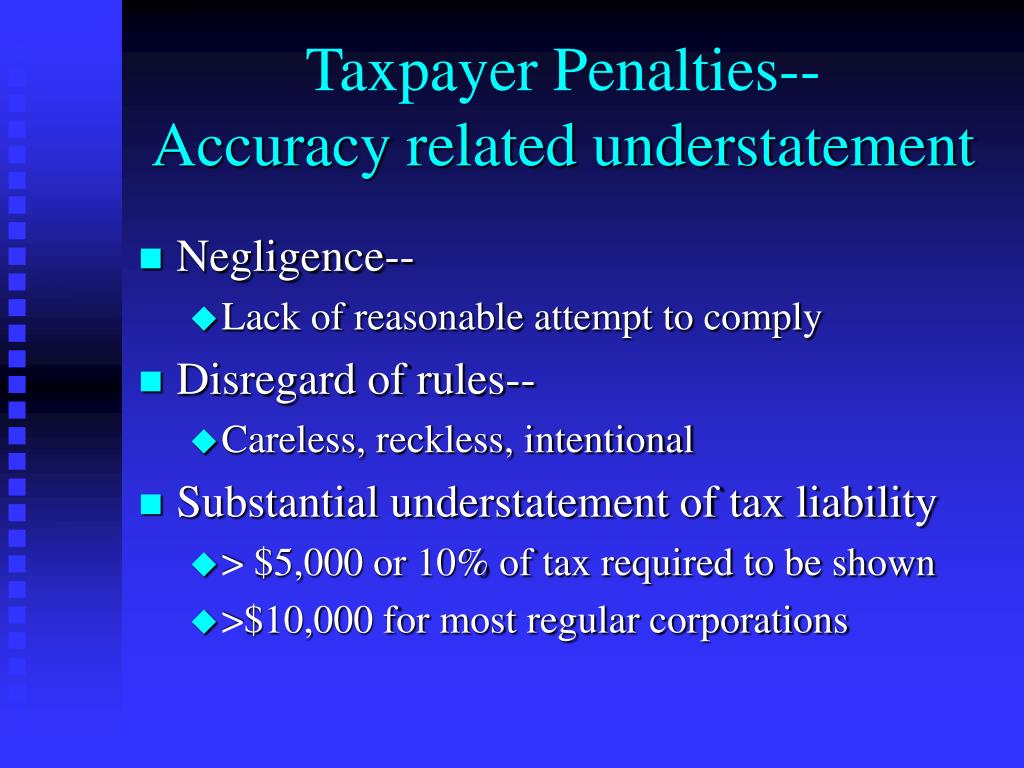

Understanding the Substantial Understatement Penalty

The IRS can impose a penalty if you substantially understate your income tax liability. A substantial understatement generally occurs when the understatement exceeds the greater of 10% of the tax required to be shown on the return or $5,000 ($10,000 for corporations, other than S corporations or personal holding companies).

Why is this important for businesses? Because these penalties can be significant and eat into your profits. Understanding the rules and taking proactive steps can save you money and headaches.

What Constitutes an "Understatement"?

An understatement is the difference between the amount of tax you reported on your return and the amount the IRS determines you should have reported. This can stem from errors in calculating income, claiming deductions, or applying tax credits.

For example, if you incorrectly classify an expense as fully deductible instead of capitalizing it, this could lead to an understatement.

Avoiding the Penalty: Adequate Disclosure

One way to avoid the substantial understatement penalty is to adequately disclose the relevant facts related to a tax position on your return. This essentially puts the IRS on notice that you've taken a position that might be questionable, but you're being transparent about it.

Adequate disclosure usually involves including Form 8275, Disclosure Statement, or Form 8275-R, Regulation Disclosure Statement, with your tax return.

Requirements for Adequate Disclosure

For disclosure to be adequate, it must be full and clear. It needs to provide the IRS with enough information to identify the potential issue.

General disclosures are not sufficient. You must clearly explain the item, amount, and the nature of the potential issue.

Avoiding the Penalty: Substantial Authority

Another defense against the substantial understatement penalty is having substantial authority for your tax treatment. This means there is a reasonable basis in the tax law to support your position.

Substantial authority is a higher standard than reasonable basis. It requires a stronger level of support for your position.

Sources of Substantial Authority

What qualifies as substantial authority? The IRS considers various sources, including the Internal Revenue Code, Treasury Regulations, court cases, revenue rulings, and revenue procedures.

Private letter rulings and technical advice memoranda issued to other taxpayers generally are not considered substantial authority.

Reasonable Basis and Good Faith

Even if you don't have substantial authority, you might avoid the penalty if you can demonstrate that you had a reasonable basis for your position and acted in good faith. This is a lower standard than substantial authority.

However, reasonable basis is generally not sufficient for tax shelters. Tax shelters require a higher standard of support.

The Role of Tax Professionals

Engaging a qualified tax professional can be invaluable in navigating complex tax rules. A tax professional can help you identify potential issues, assess your risk, and ensure you have adequate documentation to support your positions.

Tax professionals stay up-to-date on the latest changes in tax law and can provide expert guidance on complex tax matters.

Example Scenario

Let's say a business owner takes a deduction for home office expenses but doesn't meet all the requirements for the deduction. If they disclose this on Form 8275, they may avoid the substantial understatement penalty, even if the IRS ultimately disallows the deduction.

The key is to be transparent and forthcoming with the IRS.

Key Takeaways

To avoid a substantial understatement of tax penalty: adequately disclose questionable tax positions, seek substantial authority for your positions, and act in good faith with a reasonable basis. Also, consult with a qualified tax professional for guidance.

By taking these steps, you can minimize your risk and ensure you're in compliance with the tax laws.

For example, according to the IRS website, penalties for underpayment can be substantial, often including interest charges on the underpaid amount. (IRS.gov - Understanding Penalties)

Remember, proactive planning is the best defense against unexpected tax penalties.

As stated in Publication 17 (Your Federal Income Tax) by the IRS, keeping accurate records and seeking professional advice can help business owners navigate complex tax laws and avoid costly mistakes. (IRS Publication 17)