The Best High Yield Dividend Stocks

In an environment marked by economic uncertainty and fluctuating interest rates, investors are increasingly turning to dividend stocks as a source of stable income and potential long-term growth. High-yield dividend stocks, in particular, are attracting attention, promising above-average returns through consistent dividend payments. But navigating this landscape requires careful analysis and an understanding of the inherent risks involved.

This article examines the current landscape of high-yield dividend stocks, identifying key sectors and companies that offer attractive yields while also scrutinizing the factors that investors should consider before making investment decisions. Understanding the risks and rewards is crucial for constructing a balanced and profitable dividend portfolio.

Understanding High-Yield Dividends

High-yield dividend stocks are generally defined as those offering a dividend yield significantly higher than the average yield of the S&P 500. These stocks often belong to mature industries with stable cash flows, such as utilities, real estate investment trusts (REITs), and energy companies. The appeal is obvious: a higher yield translates to more income for each dollar invested.

However, a high yield isn't always a sign of a healthy investment. It could be a red flag, indicating financial distress or a potentially unsustainable payout ratio. Thorough due diligence is critical before investing.

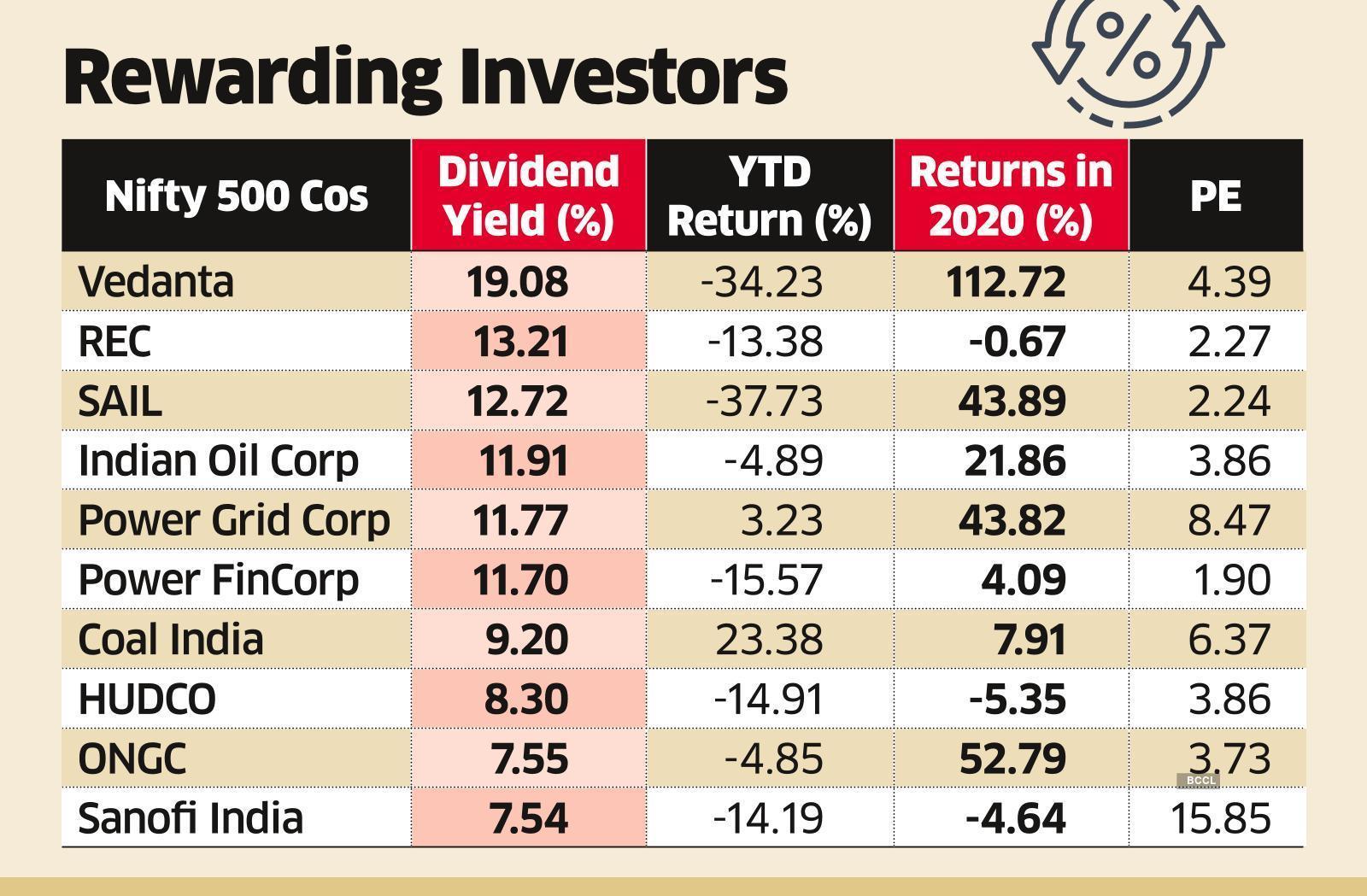

Key Sectors and Companies

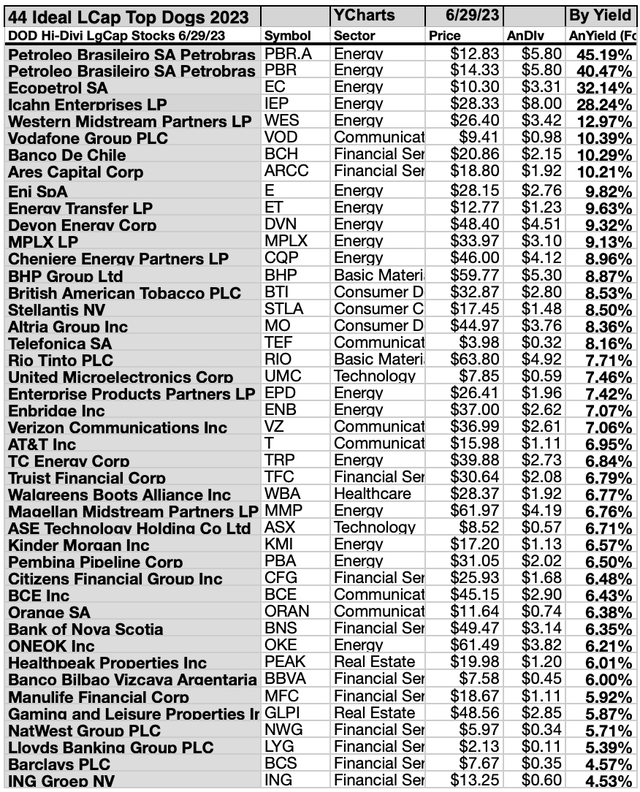

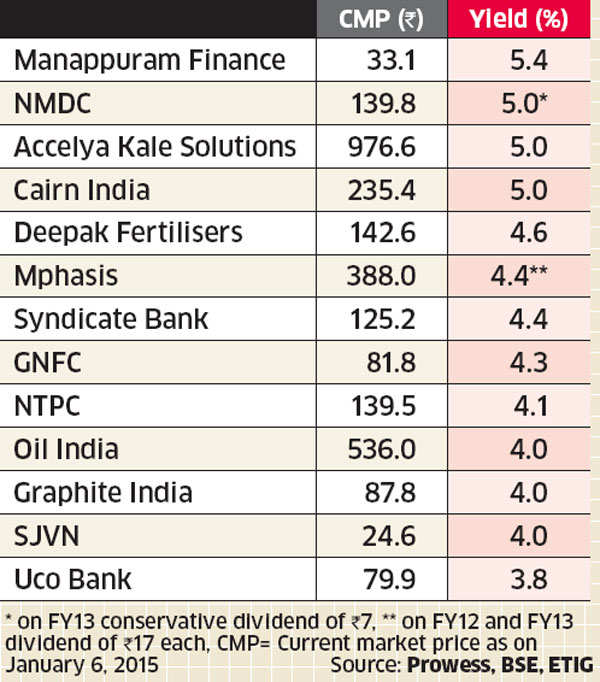

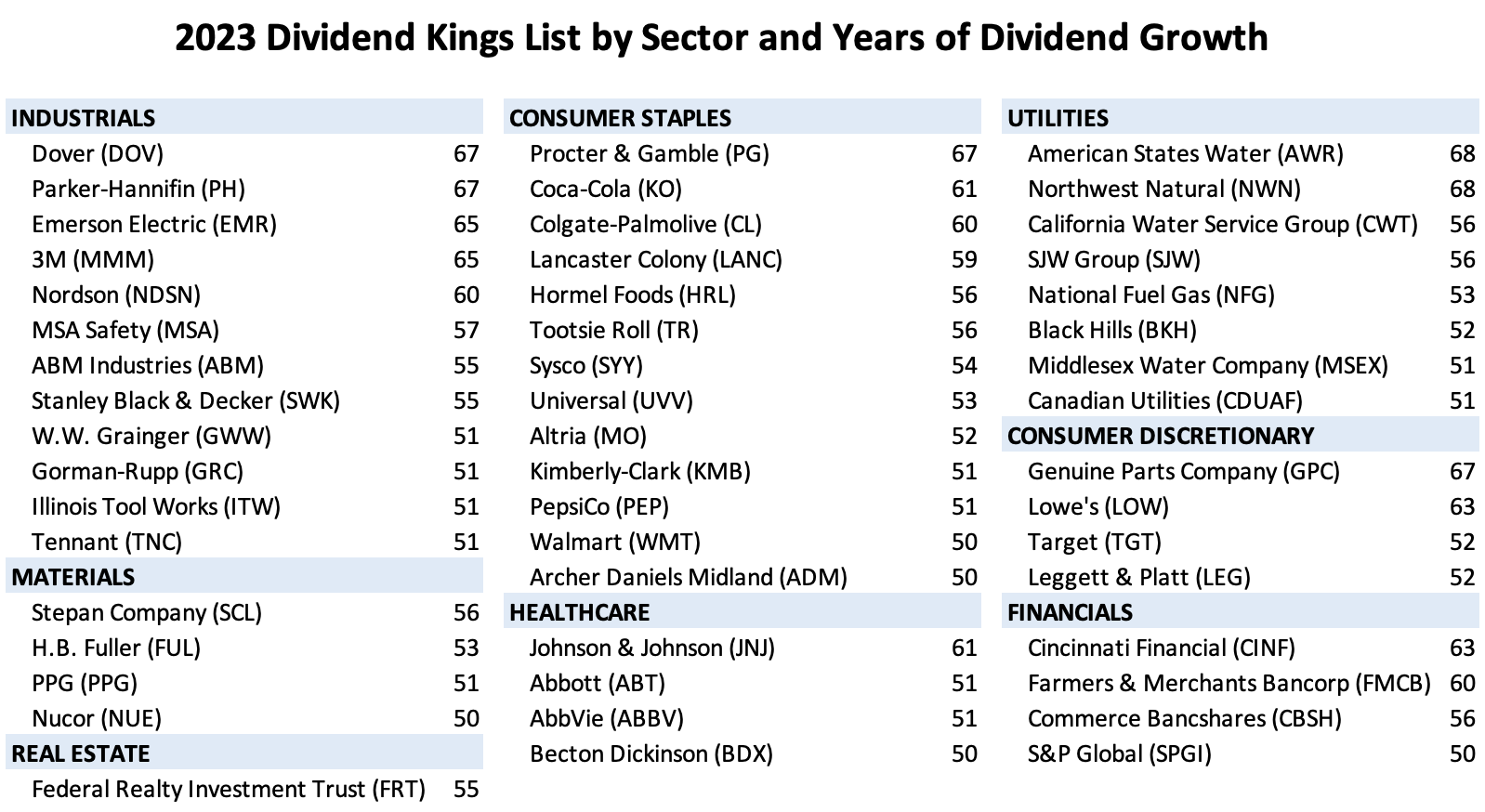

Several sectors consistently offer opportunities for high-yield dividend investing. REITs, for example, are legally required to distribute a significant portion of their taxable income to shareholders as dividends, making them a perennial favorite among income investors. Companies like Simon Property Group, one of the largest retail REITs, and Digital Realty Trust, a major data center REIT, often feature prominently in high-yield portfolios.

The energy sector, particularly master limited partnerships (MLPs), also tends to offer attractive yields. Companies involved in the transportation and storage of oil and natural gas, such as Enterprise Products Partners, generate consistent cash flows, supporting their dividend distributions. Utilities, with their regulated business models, provide another source of relatively stable dividend income.

Another sector to watch is the financial sector, specifically certain insurance companies and banks. These companies are known for returning value to shareholders through dividends. It’s important to monitor their financial health and regulatory environment, however.

The Importance of Due Diligence

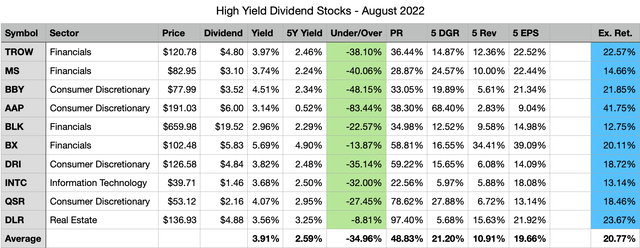

Before investing in any high-yield dividend stock, investors must conduct thorough research. This includes evaluating the company's financial health, analyzing its payout ratio (the percentage of earnings paid out as dividends), and assessing its long-term growth prospects. A high dividend yield is meaningless if the company cannot sustain its payments.

The payout ratio is a critical metric. A payout ratio consistently above 75% might be unsustainable in the long run, indicating that the company is paying out more than it can comfortably afford. Investors should also examine the company's debt levels and cash flow generation.

Consider the impact of interest rate changes on dividend stocks. As interest rates rise, the attractiveness of dividend stocks may diminish relative to bonds. Therefore, a thorough understanding of the macroeconomic environment is crucial.

Potential Risks and Challenges

High-yield dividend stocks are not without their risks. The primary concern is the sustainability of the dividend. A company facing financial difficulties may be forced to reduce or eliminate its dividend payments, leading to a sharp decline in the stock price.

Another risk is the potential for capital depreciation. A high dividend yield may mask underlying problems within the company, leading to a decline in the stock's value over time. This is why a focus solely on dividend yield can be a mistake.

"Investing in high-yield dividend stocks requires a balanced approach, combining the pursuit of income with a careful assessment of risk," says John Smith, a financial analyst at XYZ Investment Firm.

Furthermore, it's vital to consider the tax implications of dividend income. Dividends are typically taxed at a different rate than capital gains, which can affect the overall return on investment.

Building a Diversified Portfolio

The key to successful high-yield dividend investing is diversification. Spreading investments across different sectors and companies can mitigate the risk of dividend cuts or financial distress in any single holding. A well-diversified portfolio should include a mix of different industries and asset classes.

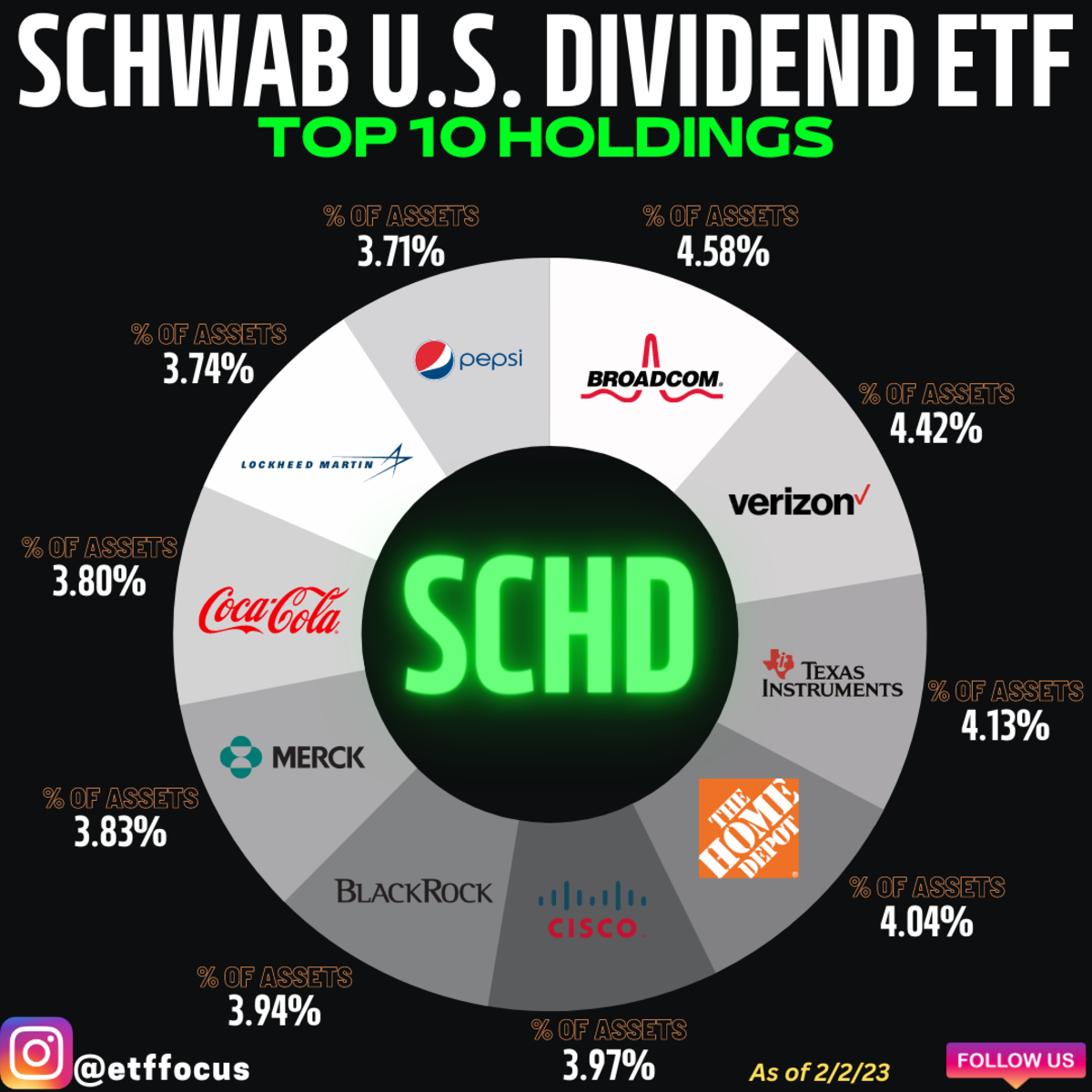

Consider investing in dividend-focused exchange-traded funds (ETFs) or mutual funds. These funds provide instant diversification and are managed by professional investors.

Regularly reviewing and rebalancing the portfolio is essential to ensure it remains aligned with your investment goals and risk tolerance. Market conditions change, and investment strategies must adapt accordingly.

Conclusion

High-yield dividend stocks can be a valuable component of a well-rounded investment portfolio, offering a steady stream of income in a volatile market. However, they are not a "set it and forget it" investment. Investors must approach this asset class with caution, conducting thorough research, understanding the risks involved, and building a diversified portfolio. By taking a disciplined and informed approach, investors can potentially reap the rewards of high-yield dividends while minimizing the potential downsides.