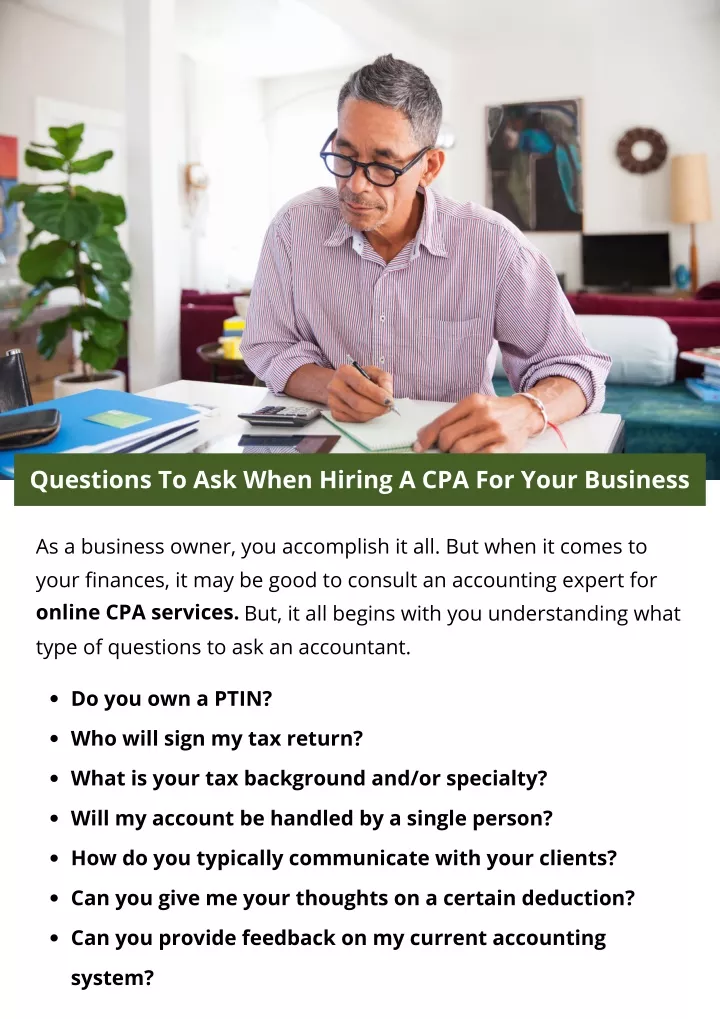

Questions To Ask A Cpa For A Small Business

For small business owners, navigating the complexities of finance and taxation can feel like traversing a minefield. Choosing the right Certified Public Accountant (CPA) is paramount to ensuring not only compliance but also strategic financial planning that fuels growth and avoids costly pitfalls. However, simply hiring any CPA isn't enough; asking the right questions upfront is critical to forging a successful and beneficial partnership.

The selection of a CPA is a critical decision that impacts a small business's financial health and future prospects. Asking pertinent questions regarding experience, services offered, communication styles, and fee structures ensures a clear understanding of the CPA's capabilities and alignment with the business's specific needs. This article delves into the essential questions small business owners should ask potential CPAs to make informed decisions and build a strong financial foundation, drawing insights from industry experts and resources.

Understanding the CPA's Expertise and Experience

One of the first areas to explore is the CPA's specific expertise and experience. Does the CPA specialize in working with small businesses, particularly those in your industry?

Industry-specific knowledge can be invaluable, as the CPA will already be familiar with relevant regulations, tax incentives, and common financial challenges.

"Look for a CPA with a proven track record in your niche," advises Jane Smith, a financial advisor specializing in small businesses.

Inquire about the number of years they have been practicing and the types of small businesses they have served. Ask for references from current or past clients to gain firsthand insights into their performance and client satisfaction.

Specific Services Offered

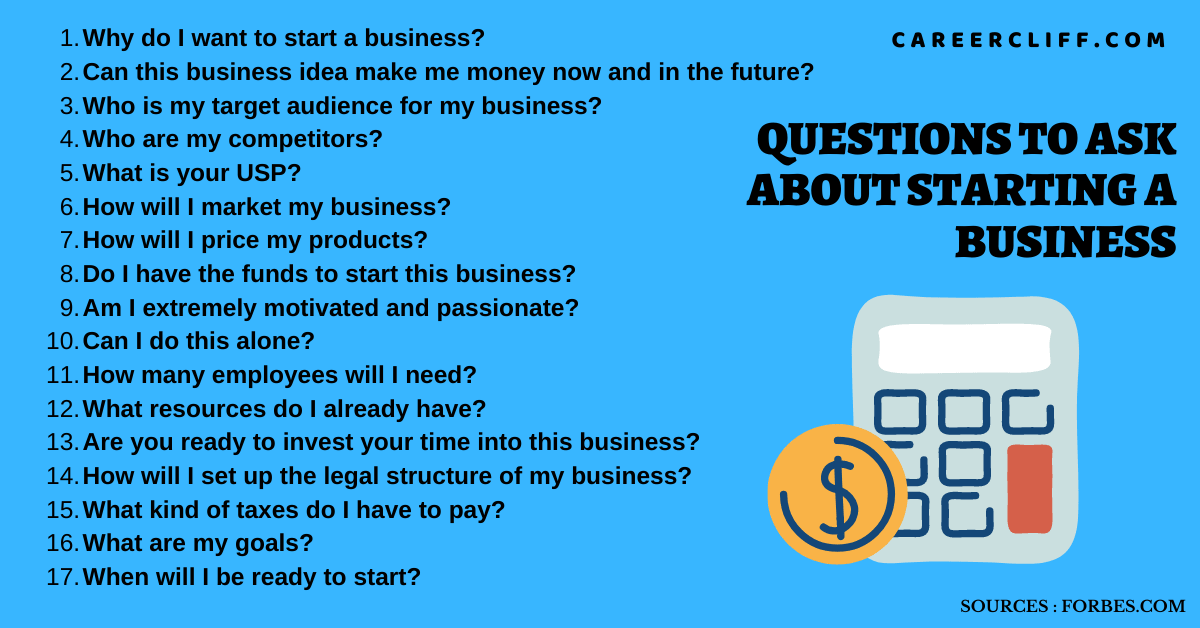

Small businesses have diverse needs, ranging from basic tax preparation to complex financial forecasting and strategic planning. It's crucial to ascertain what services the CPA offers and whether they align with your current and future requirements.

Will they handle bookkeeping, payroll processing, and tax planning in addition to tax return preparation? Do they offer advisory services, such as business valuation, budgeting, or assistance with securing financing?

"Don't assume a CPA offers all services," warns David Miller, a CPA specializing in startups. "Be explicit about your needs and confirm their capabilities."

Confirm that the CPA stays up-to-date with changes in tax laws and regulations, as these can significantly impact your business. Furthermore, understand their approach to resolving tax issues and handling audits.

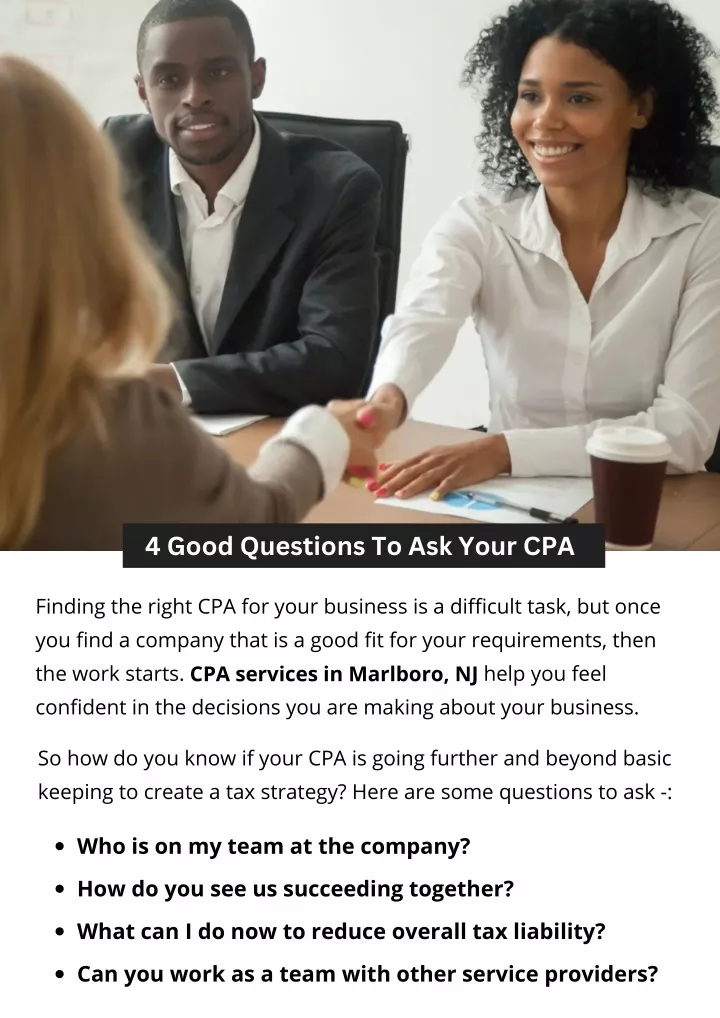

Communication and Accessibility

Effective communication is key to a successful CPA-business relationship. How often will you receive updates and how accessible will the CPA be when you have questions or concerns?

Establish clear expectations regarding communication frequency and preferred methods (e.g., email, phone, in-person meetings). Inquire about their typical response time to inquiries and their availability during peak tax season.

A good CPA should be proactive in communicating important deadlines, changes in regulations, and potential tax-saving opportunities.

"A CPA should be a trusted advisor, not just someone you contact once a year," emphasizes Sarah Jones, a small business owner.

Fee Structure and Transparency

Understanding the CPA's fee structure is essential to avoid surprises and ensure budget predictability. Do they charge hourly rates, fixed fees, or a combination of both?

Obtain a detailed breakdown of all fees, including those for specific services, consultations, and any potential out-of-pocket expenses. Ensure the agreement clearly outlines the scope of services covered under the fee and the process for handling additional work.

Transparency in billing is crucial. A reputable CPA should be willing to explain their fees in detail and answer any questions you may have.

"Don't be afraid to negotiate fees and ask for discounts, especially if you're a new or small business," advises Michael Brown, a financial consultant.

Forward-Looking Financial Planning

Beyond compliance and tax preparation, a valuable CPA should contribute to your business's long-term financial health. Inquire about their approach to financial planning and their ability to provide strategic advice.

Can they help you develop budgets, forecast future performance, and identify opportunities for cost savings and revenue growth? Will they provide insights into industry trends and benchmarks to help you make informed business decisions?

A proactive CPA can serve as a valuable partner in achieving your business goals. They can help you navigate financial challenges, identify opportunities for growth, and build a solid financial foundation for the future. It's vital to understand if they offer such services.

Conclusion

Choosing the right CPA is an investment in your small business's future. By asking the right questions upfront, you can ensure that you select a CPA who not only meets your immediate needs but also provides valuable guidance and support for long-term success. Investing the time in a thorough evaluation process will pay dividends in the form of improved financial management, reduced tax liabilities, and peace of mind.